だいたい OCT

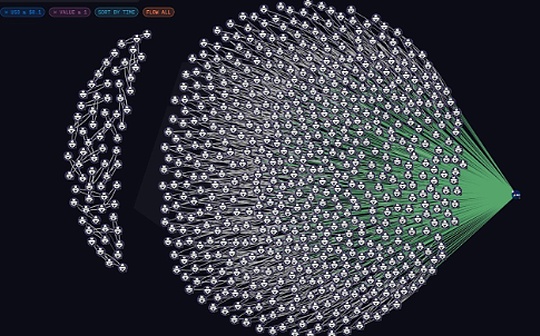

EOSエコスフィア上に構築された世界初のアプリケーションとして、OracleChainは、ブロックチェーン技術サービスをさまざまな現実のシナリオと効率的にリンクさせることによって、オラクル(オラクルマシン)エコシステムの需要を満たす必要があり、それによってこの数十億ドル規模の巨大な評価市場を掘り下げることになる。

EOSプラットフォームをベースとした分散型オラクルテクノロジープラットフォームとして、自律的なProof-of-Reputation & Depositメカニズムが採用され、他のブロックチェーンアプリケーションの基本サービスとして利用される。ブロックチェーンに実世界のデータを提供するオラクルのサービスに加え、クロスチェーンのデータを提供するオラクルのサービスも提供されている。

OracleChainは、AugurやGnosisといった複数の予測市場アプリケーションの機能を実現できることから、Robo-Advisorのような特定のシナリオで外部データへの高頻度アクセスを必要とするスマートコントラクトビジネスもサポートできる。

OracleChainは、現実世界を変えるブロックチェーンアプリケーションを育成し、提供していきます。オラクルチェーンのミッションは、"Link Data Link World "であり、現実世界とブロックチェーンの世界をつなぐインフラになることを目指しています。イントラチェーンデータとエクストラチェーンデータのコネクティビティを実現することで、将来のブロックチェーン世界において、エクストラチェーンデータに最も効率的にアクセスできるサービス提供プラットフォームを作りたいと考えています。

公式ウェブサイト

ソーシャルメディア

よくある質問

OracleChain (OCT)の史上最高価格はいくらですか?

続きを読むOCTの史上最高値は 0 米ドルで、1970-01-01 に記録されています。現在のコイン価格は最高値から 0% 下落しています。 (OCT)の史上最高価格は 0 米ドルです。現在の価格は史上最高値から 0% 下落しています。

OracleChain (OCT)の流通量はいくらですか?

続きを読む2024-08-09現在、流通中の OCT の量は 0 です。 OCT の最大供給量は 0 です。

OracleChain (OCT)の時価総額はいくらですか?

続きを読むOCTの現在の時価総額は 0 です。これは現在の OCT の供給量にそのリアルタイムの市場価格 0 を掛けて計算されます。

OracleChain (OCT)の史上最低価格はいくらですか?

続きを読むOCTの史上最低値は 0

で、1970-01-01 に記録されています。現在のコイン価格は史上最低値から 0% 上昇しています。 (OCT)の史上最低価格は 0 米ドルです。現在の価格は史上最低値から 0% 上昇しています。 OracleChain (OCT) は良い投資ですか?

続きを読むOracleChain (OCT) の時価総額は $0 で、CoinMarketCap では #8243 にランクされています。暗号通貨市場は非常に変動しやすいため、必ず自分で調査 (DYOR) を行い、リスク許容度を評価してください。さらに、OracleChain (OCT) の価格傾向とパターンを分析して、OCT を購入する最適な時期を見つけます。