Source: Liu Jiaolian

After a sharp fall overnight, BTC stabilized at 96k on Thursday. The entire crypto market also defended tenaciously and temporarily stopped the decline.

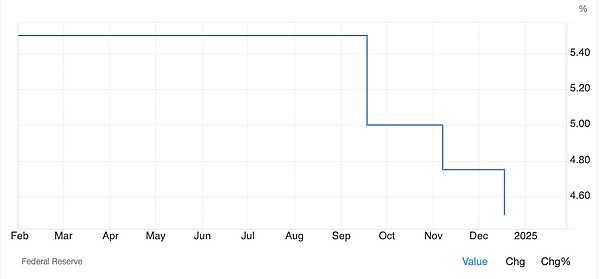

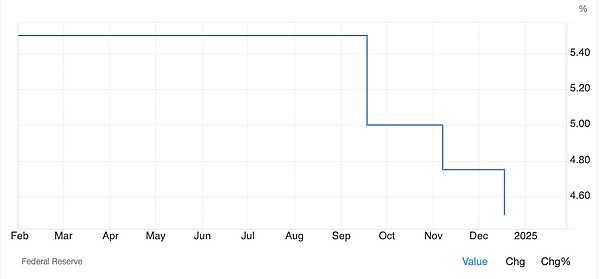

Since September this year, the Federal Reserve has cut interest rates three times, reducing the federal funds rate by 100bp from 525-550 to 425-450.

Unusually, the 10-year US Treasury yield also began to turn upward in September, and by the end of the year it had risen by nearly 100bp, from about 360 to about 460.

This was a local high in April and a historical high 17 years ago in 2007.

What happened in 2007 needs no further explanation. That year, the subprime mortgage crisis began to spread in the United States and eventually triggered a global financial crisis. In 2008, Satoshi Nakamoto suddenly got inspiration and invented Bitcoin.

Now, the Fed cuts interest rates by 100bp, and the US Treasury yield rises by 100bp. A serious deviation. The Fed's interest rate regulation seems to have gotten out of control. The more it cuts interest rates, the higher the market interest rate!

Those who understand how the Fed conducts macro interest rate regulation - in fact, to put it bluntly, it intervenes in market interest rates - should know that the Fed's interest rate hikes and cuts cannot directly change market interest rates, but rather it uses the so-called open market operation to buy and sell US Treasury bonds, and transmits interest rate adjustments to the market through the tool of US Treasury bonds.

For example, there are two items in the executive minutes of the December 2024 interest rate meeting:

* Conduct standing overnight repurchase agreement operations with a minimum bid rate of 4.5% and a total operation limit of US$500 billion.

* Conduct standing overnight reverse repurchase agreement operations with an offer rate of 4.25% and a daily limit of US$160 billion for a single counterparty. Setting this interest rate at the lower limit of the federal funds rate target range is intended to support the effective implementation of monetary policy and the smooth operation of short-term money markets.

Bond yields and bond prices are inversely proportional. This alone confuses many people.

Will the Fed be able to keep market interest rates stuck in the 425-450 range by selling US bonds at an interest rate of 4.25% and buying US bonds at an interest rate of 4.5%?

That's not necessarily true.

For example, before the interest rate cut in September 2024, the Fed's interest rate control range was still at a historical high of 525-550, but the interest rate in the U.S. Treasury market had already dropped to a local low of 360, with a spread of nearly 2 percentage points.

What does this indicate? This shows that the market is buying U.S. Treasury bonds like crazy, regardless of the Fed's "official price" being cheaper.

Of course, the Fed only trades with designated large banks, and ordinary people cannot directly participate.

Is the market irrational really optimistic about U.S. Treasury bonds, or are retail investors fooled into entering the game by investment consultants?

Jiaolian still remembers that period of time, when there were overwhelming posts on the Internet promoting U.S. Treasury bonds and persuading investors to enter the market.

Looking back at the picture, that wave of public opinion guidance should be from May to September, corresponding to the trend of falling U.S. Treasury yields. By September, it was already over.

Expectations of rate cuts, market rush, what is the logic? Or what is the sales pitch?

Jiaolian thought, it would probably be like this, saying to the boss, the Fed is about to start the interest rate cut channel, why don’t you buy some high-yield US bonds to preserve and increase value? If you miss this opportunity, you will never get it again. When the Fed lowers the interest rate, only low-interest US bonds can be bought.

Unfortunately, the iron rule of the financial market is always that if you make decisions based on other people’s investment advice, you will either suffer a loss or be fooled.

The rate cut was implemented, and US bonds plummeted. The rushers were buried.

What is the reason for being buried? The logic of being buried is also very simple, that is, the Fed cuts interest rates, the market risk is on, that is, the so-called risk appetite rises, capital sells US bonds and chases high-risk US stocks, bonds fall and stocks rise, and US bond yields rise instead of falling.

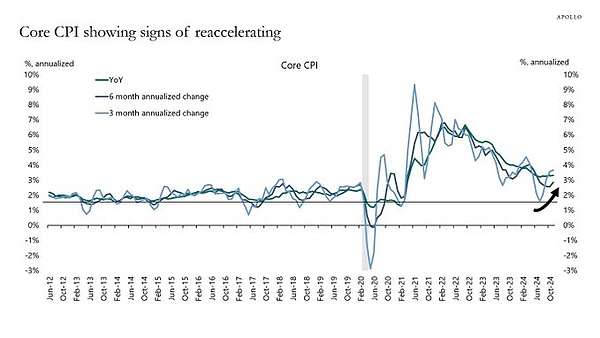

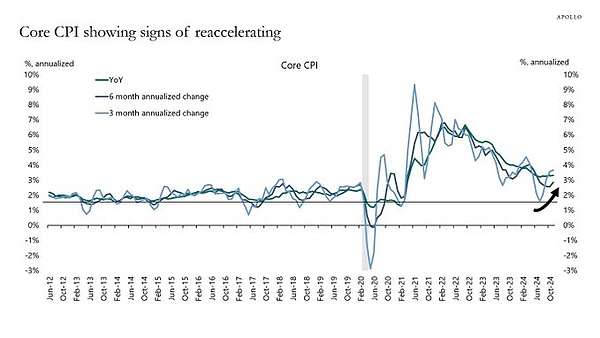

But think about it again, is capital really all excited and willing to allocate high-risk assets?

Or is it because of the expected high inflation in the future?

JinseFinance

JinseFinance