Why do the US President and the Federal Reserve Chairman always clash over the issue of interest rate cuts?

In the political and economic arena of American power, there is a pair of "roommates" who can never get along harmoniously—the President of the White House and the Chairman of the Federal Reserve.

One focuses on votes, the other focuses on inflation;

One pursues short-term prosperity, the other sticks to long-term stability;

One is keen on "loosening the money supply", the other tightly tightens the monetary valve.

This tension was pushed to the extreme in the confrontation between Trump and Powell:

First, Trump has been shouting since the day he took office: "Cutting interest rates! Cutting interest rates! Cutting interest rates! It would be best to cut it from 4.25% all the way down to 1%!"

Second, Powell was almost determined to withstand the pressure and was unwilling to become "the second Burns" again. Why are the president and the Fed chairman always at odds, especially on the issue of "interest rate cuts"? To understand this issue, we need to explore it from three levels: history, reality, and institutional logic.

1. The President's Political Logic: Short-Term Prosperity and the Election Cycle

The US President has only a four-year term. This means:

First: If the economy is in recession, unemployment rises, and the stock market is sluggish during his term, voter dissatisfaction will quickly ferment.

Second: In order to win re-election or help his party maintain its majority in Congress, the president must demonstrate "economic management ability", even if it is just to create an "illusion of prosperity".

1. The political dividends of interest rate cuts

Interest rate cuts can bring about a series of immediate effects:

Reduction in corporate financing costs Acceleration of investment and expansion;

Cheaper household loansRecovery of consumption and real estate demand;

Recovery of consumption and real estate demand;

Reduction in corporate financing costs Acceleration of investment and expansion;

Cheaper household loansRecovery of consumption and real estate demand;

The stock market benefits → The capital market rises, 401(k) accounts look better, and voters are in a better mood.

Under this logic, the president is naturally inclined to push for an interest rate cut because it is the simplest, fastest, and most intuitive "economic stimulant."

2. Data support

Looking back at history, the approval rating of American presidents is often highly correlated with economic data:

Reagan:When he was re-elected in 1984, the U.S. GDP growth rate was as high as 7.2%, the unemployment rate declined rapidly, and voters voted overwhelmingly for him to continue in power.

Bush Jr.:After the 2008 financial crisis, his approval rating plummeted to 28%, and the Republicans lost the White House.

Biden:Before the 2022 midterm elections, he faced tremendous public pressure due to high inflation (CPI once exceeded 9%).

Therefore,the president's call for an interest rate cut is essentially an investment in his chances of re-election.

II. The institutional logic of the Federal Reserve: Central bank independence and historical lessons

Unlike the president's "quick success and instant benefits" logic, the Federal Reserve chairman must consider

long-term economic stability

1. Responsibilities of the Federal Reserve

According to the Federal Reserve Act, the Federal Reserve has a "dual mission":

to maintain price stability (to prevent runaway inflation); and to achieve full employment.

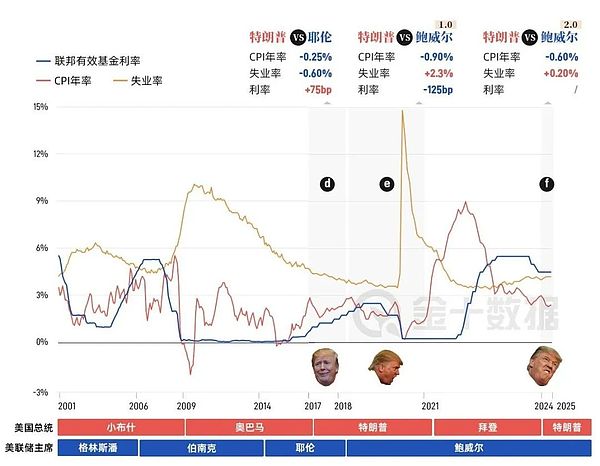

This means that the Federal Reserve needs to make calm judgments in the "inflation-employment" balance, rather than serving the election of a particular government. 2. Nixon and Burns: A Painful Lesson in Central Bank Independence The most famous example occurred in the 1970s. At the time, the United States was mired in stagflation: unemployment was 6.1% and inflation was 5.8%. To secure re-election, Nixon frequently pressured Federal Reserve Chairman Arthur Burns. The data speaks for itself: In 1971, the Federal Reserve slashed interest rates from 5% to 3.5%; the growth rate of M1 money supply soared to 8.4%, the highest since World War II; Nixon was successfully re-elected, creating a short period of prosperity; but in 1973, the oil crisis and excessive money issuance caused the inflation rate to soar to more than 11%, the US dollar collapsed, and the price of gold soared.

Burns was nailed to the pillar of historical shame, his name becoming synonymous with the "loss of central bank independence."

3. Powell's Persistence

Precisely for this reason, Powell remained restrained in the face of Trump's "fierce attacks."

He is well aware that a rash and drastic interest rate cut could not only trigger an asset bubble but also plunge the United States into a second "stagflation trap." History tells him:The presidential term is four years, and the inflation legacy may be ten years.

Third, the real confrontation: Trump vs. Powell

During Trump's first term (2017-2021), this confrontation was particularly intense.

During his second term [2025-2029], this confrontation will be even more open and aboveboard!

1. Trump's appeal

The trade war broke out in 2018, and the US economy faced uncertainty. The impact of the epidemic in 2020 caused the US unemployment rate to soar to 14.7%, the highest level since the Great Depression. Trump urgently needs monetary easing to stabilize the stock market, support the economy, and thus support his re-election.

Therefore, he frequently criticized Powell publicly on Twitter and even hinted at firing him.

2. Powell's response

Faced with an interest rate of 4.25%, Trump demanded a reduction to 1%; Powell withstood the pressure and insisted on a gradual rate cut rather than a "one-size-fits-all" approach;

This made Trump indignant. He believed that:

Powell directly affected the US economic recession and allowed the US to continue in an era of high interest rates! 3. Data Verification Conflict 3. Data Verification Conflict Data 1: In 2019, after the Federal Reserve cut interest rates three times, the S&P 500 index rose by 28.9% throughout the year, and the US GDP growth rate remained at 2.3%; Data 2: However, the impact of the epidemic in 2020 caused the economy to shrink by -3.4% throughout the year, the worst record since World War II; Data 3: High interest rates are accompanied by high unemployment rates, and the non-farm payroll data is not ideal. It can be seen that the president's political pressure is in direct conflict with the Federal Reserve's "prudent pace."

Four. The Institutional Roots of the Contradiction: Central Bank Independence and Fiscal Expansion

Why is this conflict always inevitable? The reason lies in the institutional design itself. 1. "Monetary and fiscal misalignment" The president is in charge of fiscal policy and likes to stimulate the economy through tax cuts and increased government spending; the Federal Reserve is in charge of monetary policy and must curb inflation by raising interest rates or shrinking its balance sheet. This results in fiscal policy stepping on the accelerator while monetary policy is stepping on the brakes. 2. “Short-term political cycles vs. long-term economic cycles” The president’s timeline is based on a four-year election cycle; the Federal Reserve’s focus is on macroeconomic stability over ten or even twenty years. The inherent misalignment between these two timelines makes it difficult for both sides to align their interests.

3. “Debt Burden and Inflation Control”

The current U.S. federal debt has exceeded

36.2 trillion U.S. dollars, and the fiscal deficit accounts for nearly 6% of GDP. If interest rates remain high, debt interest costs will rise sharply (US Treasury interest payments reached $1.1 trillion in 2024). Therefore, the President and the Treasury Department would prefer to cut interest rates to ease debt pressure. However, from the Federal Reserve's perspective, this may amplify inflation risks.

5. Trump's "rogue tactics" and Powell's bottom line

With less than 10 months left until the end of Powell's term [May 23, 2022 - May 15, 2026], Trump has begun to shift his focus from policies to individuals. This means: First, if Powell insists on not cutting interest rates, Trump may increase pressure, even using his political resources to force him to compromise. Second, if Powell compromises, the United States could once again fall into the "Burns Trap," where short-term prosperity is exchanged for long-term inflation. Third, if the two sides remain deadlocked until after the election, Powell's historical legacy may be determined by this final year. Powell knows that after his departure, Trump can do whatever he wants; while in office, he must uphold the independence of the central bank, otherwise he will be forever infamous.

Sixth, the inevitable conflict of power play

From Nixon and Burns to Trump and Powell, and even between any future president and Federal Reserve chairman, the debate over interest rate cuts is unlikely to disappear.

This is because it is not a simple policy disagreement but an inevitable conflict between institutional design and interests:

The president seeks short-term political benefits; the Federal Reserve seeks long-term economic stability. History has repeatedly proven that when central banks succumb to political pressure, inflation often spirals out of control, and the public ultimately bears the cost. Therefore, Powell today would rather be called "iron-headed" than become "the next Burns." This tug-of-war over "interest rate cuts" is destined to continue throughout the entire cycle of American politics and the economy. To sum it up: The president seeks votes, while the Federal Reserve maintains its credibility. The incompatibility of the two is a true reflection of the functioning of the American system.

Kikyo

Kikyo

Kikyo

Kikyo Jasper

Jasper Hui Xin

Hui Xin Brian

Brian Jasper

Jasper Catherine

Catherine Clement

Clement Joy

Joy Aaron

Aaron Jasper

Jasper