Last night and this morning Beijing time, the geopolitical situation in the Middle East took a 180-degree turn.

After Iran carried out "limited retaliation" against the US military base in Qatar, US President Trump posted on social media, confirming that he had received advance notice from Iran and said that the attack "did not cause any casualties on the US side." More importantly, Trump announced that Israel and Iran had reached a comprehensive ceasefire agreement.

In the early morning of June 24th, Beijing time, Trump posted on his social media platform: "Congratulations to everyone! It has been fully agreed between Israel and Iran that a complete and comprehensive ceasefire will be implemented (approximately 6 hours from now, when Israel and Iran will end and complete their final ongoing mission!) for 12 hours, when the war will be considered over! Officially, Iran will begin a ceasefire, and at the 12th hour, Israel will begin a ceasefire, and at the 24th hour, the world will pay tribute to the official end of the 12-day war. During each ceasefire, the other side will maintain peace and respect."

left;">Earlier, Iran launched a missile attack on a U.S. military base in Qatar, which caused the market to fall. Trump's statement was interpreted by the market as an important signal of easing tensions in the Middle East.

Market data showed that Bitcoin rebounded after hearing the news. As of 6:30 a.m. Beijing time on the 24th, the price of Bitcoin once exceeded $106,000, with a 24-hour increase of nearly 5%. Ethereum stood at $2,400 per coin, up 7.76% on the day. Other mainstream currencies also rose by about 5%-8%. Solana led the gains of major altcoins with a gain of about 10%. As of press time, BTC fell slightly to around $105,000.

If the sharp drop over the weekend was due to the market over-pricing geopolitical risks, Trump's latest statement clearly released a signal of easing, prompting funds to quickly flow back to risky assets.

If the sharp drop over the weekend was due to the market over-pricing geopolitical risks, Trump's latest statement clearly released a signal of easing, prompting funds to quickly flow back to risky assets.

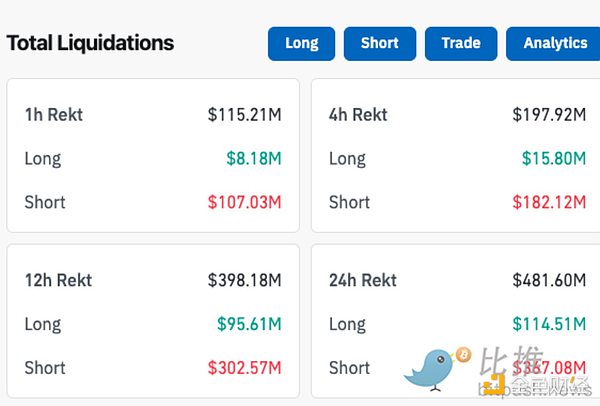

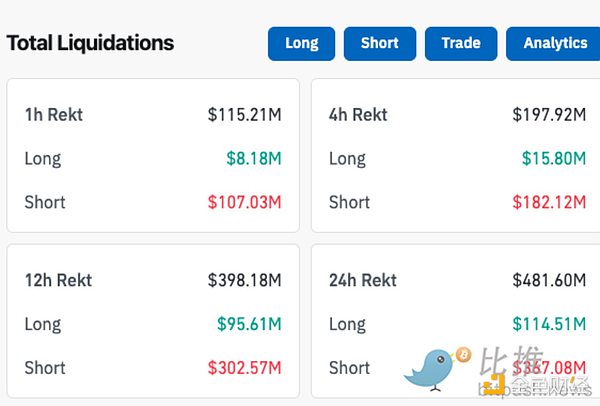

It is worth noting that during the period of sharp fluctuations in Bitcoin prices, large-scale short positions were closed in the crypto market. According to CoinGlass data, the total amount of cryptocurrency liquidations in the past 24 hours reached US$482 million, of which short orders accounted for more than 70%.

Meanwhile, derivatives market data show that optimism is heating up.

Meanwhile, derivatives market data show that optimism is heating up.

Trader QCP Capital pointed out that while the skew value of put options expiring in September is still at a high level, short-term volatility is compressing - a classic sign that traders are pricing in broader contagion risks. "U.S. stock index futures, crude oil and gold initially reacted to the headlines, but have now retreated to last Friday's levels," QCP added, suggesting that investors view the current situation as an escalation of regional conflicts rather than a full-blown global crisis. Crypto analyst Crypto Caesar said: "Bitcoin is currently remaining strong. This week's trend will be very interesting. BTC/USD is forming a clear head and shoulders reversal pattern - a bullish chart. Bitcoin is repeating the classic cycle pattern of "breaking new highs → stepping back → main rising wave". The next vertical trend may be closer than you think. History is repeating itself, don't get caught in chasing highs." Bitfinex Alpha pointed out in its June 23 report that ETF inflows are "abnormally stable" and spot ETFs have become programmatic bottom support. The report defines the $94,000-95,000 range as a key support level, and $105,000-110,000 as a near-term resistance zone. Analysts expect prices to remain volatile within this channel until weekly inflows break through $1.5 billion again or new macro catalysts emerge.

However, behind the market's optimism, one fact that cannot be ignored is that the Trump administration's policy stance remains the most unpredictable variable. From tariff policies to cryptocurrency regulation, this fickle president always brings "surprises". In such an environment, perhaps all investors can do is remain cautiously optimistic, while sincerely praying that the world will have more real peace and love and less geopolitical games.

Joy

Joy

If the sharp drop over the weekend was due to the market over-pricing geopolitical risks, Trump's latest statement clearly released a signal of easing, prompting funds to quickly flow back to risky assets.

If the sharp drop over the weekend was due to the market over-pricing geopolitical risks, Trump's latest statement clearly released a signal of easing, prompting funds to quickly flow back to risky assets.  Meanwhile, derivatives market data show that optimism is heating up.

Meanwhile, derivatives market data show that optimism is heating up.