Crypto has successfully occupied a seat in the White House.

According to the usual rules, the president-elect of the United States will take intensive actions to hand over his allegiance to major industries and the whole nation one month before taking office, and Trump, who claims to be the president of Bitcoin, did not disappoint the industry this time.

Since his election, the crypto industry has been receiving good news in waves, including the replacement of the SEC chairman, the coming to power of a cabinet that supports crypto, the establishment of a crypto committee, and in the distance, the national reserve assets are shining brightly. Just a few days ago, the White House once again received good news about crypto.

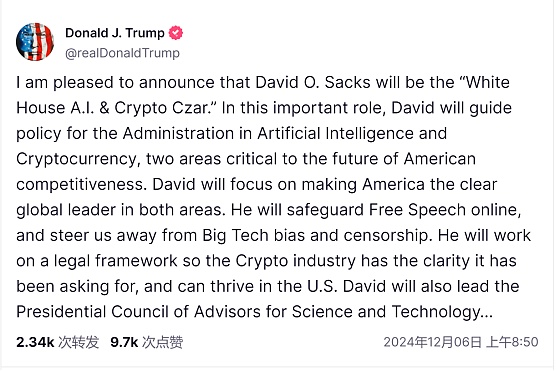

On December 6, Trump officially appointed David Sacks, co-founder of PayPal, as the "White House Director of Artificial Intelligence and Cryptocurrency Affairs". This is also the first time that cryptocurrencies have obtained an exclusive seat in the White House. Putting cryptocurrencies together with the booming artificial intelligence further highlights the president's strategic ambitions in the field of crypto.

The key responsibilities of this position can be seen from the appointment letter. Trump mentioned that David will formulate policies for the government in the fields of artificial intelligence and cryptocurrency. These two fields are crucial to the future competitiveness of the United States. His goal is to make the United States a global leader in these two fields. David will also promote the establishment of a clear legal framework to provide the cryptocurrency industry with the clarity it has long needed to ensure its prosperity in the United States.

It can be seen that the development of a regulatory framework for emerging industries and assets with blurred boundaries will be David's core goal. At this point, the crypto industry will truly stand at the starting point of a new era of regulation.

Such an important position is not appointed by an ordinary person.

David Sacks, a member of the famous "PayPal Mafia", joined Confinity, an e-commerce startup founded by Max Levchin and Peter Thiel, in 1999. After the merger and renaming of the company "PayPal", he successfully became the first product manager of PayPal and led PayPal's revenue from zero to more than 100 million US dollars in 2001, winning global acclaim.

After PayPal, Sacks founded the social enterprise software company Yammer and continued to be active as CEO until 2012, when Yammer was acquired by Microsoft for $1.2 billion.

At the end of 2017, Sacks co-founded Craft Ventures with Bill Lee, starting the transition from entrepreneur to investor, and has been operating the fund ever since.

In 2020, Sacks created the business technology review podcast "All In Podcast", which is currently the third most popular technology podcast on Apple Podcasts, according to Chartable data.

Just this year, Sacks also launched an AI work chat app called Glue. He often expresses support for the establishment of a freer ecosystem to promote the development of AI companies, and advocates that most content on the Internet should be used for AI training under fair use.

Overall, Sacks, who started in Silicon Valley, is an influential entrepreneur and mature investor with strong personal resources, close ties with Peter Thiel and Musk, and his own unique understanding of emerging technologies and freedom of speech.In Silicon Valley, where Democrats gather, David is unusually a spokesperson for conservatives, especially in the Russia-Ukraine war and opposition to the censorship of technology platforms.

From Trump's point of view, just like other bigwigs, Sachs did not stand with Trump at the beginning. During the Capitol Hill incident in 2021, he bluntly stated that Trump had "lost the qualifications to be a candidate again." At the beginning of this year's election, Sachs' choice was Republican Congressman DeSantis, and then Robert Kennedy Jr., and Trump was not prioritized.

According to Wall Street Journal, the key to Sachs's embrace of Trump lies in Peter Thiel's strong recommendation. Peter has always been a die-hard supporter of Trump. In 2021, he introduced Vance to Sachs to promote Vance's fundraising. It can be said that it was the three-way support of Sachs and Peter that made Trump choose Vance as the deputy of this government.

Against this background, in June this year, Sachs published a long article on the X platform, "Why do I support Trump? ”, which detailed the four sins of the Biden party in the economy, diplomacy, immigration and legal wars, and made it clear that it would officially become a supporter of Trump. At the time, this was also one of the powerful cases for Trump to regain the support of the business community.

Since then, Sachs has continued to use his influence to canvass for Trump, and raised up to $12 million in the first fundraising event on June 6. After that, Trump began to appear in Sachs’ blog. Sachs also made remarks to Trump such as “it is too difficult to do business” during the Biden administration. In terms of model, Sachs’ and Musk’s subsequent support models are quite similar, except that Musk invested more time and money, which may be related to the involvement of core interests.

The cost paid was rewarded after Trump came to power, and Sachs and Musk successfully entered Trump’s cabinet. Although he has not yet taken office and the actual implementation content of the department is still unknown, as the "White House artificial intelligence and cryptocurrency affairs director", Sachs does not have to go through the Senate confirmation process and can already become the core decision-maker of encryption policies in some directions, so he is called the "crypto czar" by the market.

Since he is the head of encryption, his professionalism in the field of encryption is also very important. And Sachs is himself a senior participant in encryption. As early as 2017, Sachs affirmed the value of Bitcoin in an interview, saying that Bitcoin is realizing PayPal's original vision of "new world currency", but in a decentralized form. He also took the lead in proposing that the regulatory agency SEC should divide the supervision according to the nature of tokens, and classify and supervise protocol coins and asset coins.

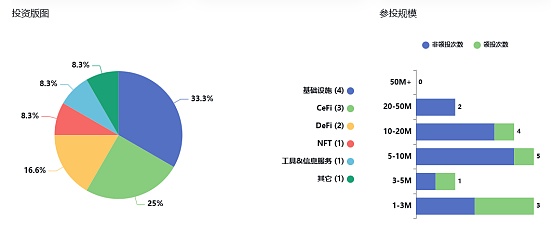

From the perspective of investment layout, Sachs is also involved in encryption. According to RootData statistics, Craft Ventures, which is responsible for it, has 12 existing crypto investments, including dYdX, Lightning Labs, River Financial, Kresus, Set Protocol, FOLD, Harbor, Handshake, Voltage, Galoy, Lumina and Rare Bits.

Interestingly, Sacks's first benefit after taking office may be SOL. In 2018, Sacks invested in Multicoin and indirectly became a major supporter of SOL. In 2022, he said that Silicon Valley elites are betting on Solana, believing that it will eventually surpass Ethereum. Just last December, Sacks also clarified that he did not sell SOL after the FTX incident.

Overall, whether as an investor or holder, Sachs has a certain degree of expertise and familiarity in the field of encryption. Considering that he once mentioned regulatory suggestions, he is worthy of the position. In terms of the encryption market, the industry has warmly welcomed the new czar with prices. As early as the end of November, when the candidate for the position appeared, Bitcoin rushed to $94,000.

In terms of performance of duties, according to Bloomberg, similar to Musk, Sachs will serve as a "special government employee", which is a part-time job that does not require the person to divest or publicly hold assets, and the maximum working hours per year are 130 days. Craft Ventures also confirmed that Sachs will not leave the venture capital company. At present, the operation mode and funding source of this position are still unclear. Some industry insiders said, "This role may be a bit awkward because the actual operation depends more on relationships and resources rather than the authority brought by formal position appointments." Suresh Venkatasubramanian, who previously served as the White House artificial intelligence adviser in the Biden administration, also said that the duties of the director of the Office of Science and Technology Policy are roughly the same as this position. The only difference is supervision. The former requires segregation of assets, while the latter is held by people who have a lot of investments in the responsible field, which is an obvious conflict of interest. No matter how the outside world questions it, the encryption industry will undoubtedly become one of the areas that benefit the most from Trump's inauguration. From the actual composition of the cabinet and Congress, from top-level design to actual implementation, encryption will usher in a clearer and more relaxed regulatory path. From the bill side, key bills in the blockchain field such as SAB121 and FIT21 are expected to be passed. In terms of supervision, after the change of leadership at the SEC, considering the SEC's contribution to the Treasury's revenue generation, whether the lawsuits against Ripple, Coinbase and other companies will stop remains to be seen, but the diversity of products will inevitably increase, and crypto assets are expected to reach more users during the term of this government.

As for how the market will go in the future? In the short term, we still need to pay close attention to changes in external news, and in the long term, liquidity remains the core of the continued bull market.

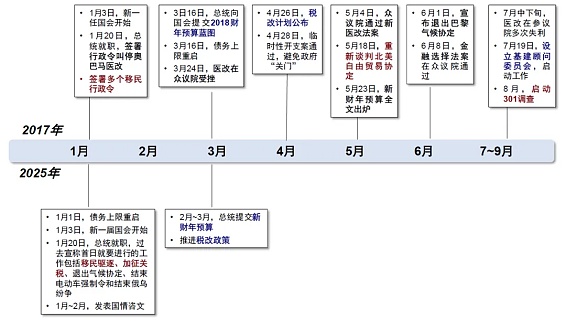

The news is still concentrated on the Trump side. According to general rules, before officially taking office, the president will tend to release more positive news to respond to voters, but after taking office, he needs to return to the origin. The implementation strength and order of various policies are crucial to the economic fundamentals and asset direction.

At this stage, Trump's commitment to encryption has been largely completed. In addition to the extremely difficult national reserve, there has been progress in personnel appointments and supervision. Therefore, before Trump officially took office, the expectations for the crypto direction were supported, the positive news will continue, and the overall market will still maintain a strong optimistic sentiment. However, considering the arrival of Christmas month, the liquidity in the US direction has decreased, and the degree of FOMO will also decrease. If the interest rate cut meeting on December 19 is not as expected by the market, Bitcoin, which has concentrated external liquidity before the New Year, will most likely usher in a correction. Citing the data of on-chain analyst @Phyrex_Ni, the core holding area of Bitcoin is concentrated around US$95,000.

On January 20 next year, Trump will give an inaugural speech and announce a series of executive orders to provide clues to the order of his policy advancement. Assets are also likely to perform in a regular manner, and will fluctuate more before taking office to choose a direction. In January and February, the president will choose a day to deliver the State of the Union address, express his views on the national situation analysis, legislative agenda, and other national priorities, and once again reflect his changing governing philosophy and attitude. Taking into account the policy support in January and the arrival of the February earnings season, the crypto market will remain active before February 2025, unless Trump changes his attitude drastically, according to the previous support.

Important policy nodes, source: CICC Research Department

However, after the first quarter of next year, as the policy benefits are gradually digested, the fundamentals led by the Federal Reserve will become the main direction.Compared with previous terms, the Trump administration in this term has the characteristics of fast cabinet formation and emphasis on loyalty. The policy direction also shows a consistent and even tougher trend. The certainty of domestic tax cuts, foreign tax increases, immigration control, and the return of old energy is already high. Since immigration and tariffs do not require congressional approval, the implementation time is faster. Tax cuts may be completed within the year. Energy is highly dependent on bipartisan cooperation, which will take a relatively long time.

It can be seen that Trump's propositions have a strong correlation with pushing up inflation, especially immigration and tariffs, which will bring inflationary pressure in the short term. The market generally believes that after Trump took office, the era of high inflation and slow growth has arrived, and interest rate cuts may enter the slow lane. From the perspective of the Federal Reserve, after a sharp interest rate cut of 75 basis points this year, Federal Reserve Chairman Powell has said that "there is no reason to rush to speed up the pace of interest rate cuts." Morgan Stanley also made a prediction on this, saying that the Federal Reserve remains cautious about the future interest rate path and will suspend interest rate cuts in the second quarter of next year. As the economy slows down, employment growth will almost stagnate in the second half of 2026, when the Federal Reserve is expected to restart interest rate cuts. Affected by this, if liquidity shrinks, the crypto bull market will also press the pause button, which will have a relatively limited impact on Bitcoin, but the more sensitive cottage market will shrink more significantly, and it is necessary to pay close attention to risks.

Of course, market forecasts are not necessarily accurate. The external environment and industry cycles cover too wide a range, and any details will trigger a butterfly effect-like wave. But what is certain is that driven by the dual forces of crypto capitalization and politicization, the crypto industry will move from being a flash in the pan to being long-lasting.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance