Original: Liu Jiaolian

BTC continued to hesitate around 65k overnight. Today is the last day of the A-share market before the National Day. As soon as the market opened, it was full of momentum and rose above 3200-3300 points. Jiaolian's A-share positions built during the three-year high-retracement phase from 2021 to 2024 have also begun to turn losses into profits. This has preliminarily achieved the purpose of this experiment three years ago: to verify whether the "Eight Characters" are suitable for the A-share market.

Tomorrow is the National Day holiday. On the last day before the holiday, let's do a little summary and review. I wish all readers a happy holiday in advance.

Jiaolian's investment journey began in the stock market, but was achieved in encryption. It was the hardest when I was penniless. I had to work 996 to make a living and had no time to think about investment. I was confused when I heard the word "leverage" in the news and didn't understand it at all. The less time you have to learn, the less you can get in; the poorer you are, the less you can take risks. After stumbling and falling, I finally learned a little about investment in crypto, in fact, BTC, and figured out some practical methods, and achieved some acceptable results.

Starting from this breakthrough, I slowly expanded and gradually expanded my understanding and vision of investment. As described in "Peach Blossom Spring", "When the forest ends and the water source comes, there is a mountain. There is a small opening in the mountain, as if there is light. So I left the boat and entered through the opening. At first it was very narrow, but it was only passable. After walking a few dozen steps, it suddenly became clear."

The "Eight-Character Formula" (stick to fixed investment and increase positions when the price drops) is a methodology summarized from BTC. Although countless research will say that it is better to go all-in when the price drops, but if you practice it, you will know that the theory is far from the practice of ordinary people. Jiaolian knows this very well, because Jiaolian considers himself an ordinary person, who can't be more ordinary. What is an ordinary person? Ordinary people are those who will enter the A-share market at 3,500 points in 2021, enter the BTC market at 60,000 dollars, and even be attracted by altcoins, meme coins, and dog coins. Ordinary people are those who will sell BTC at 16,000 dollars at the end of 2022, and sell A-shares at 2,700 points in 2024, thus "falling before dawn".

Therefore, Jiaolian often looks back on himself and warns himself that when he really wants to buy, he should resist buying, and when he really wants to sell, he should resist selling - he should even increase his efforts to buy. Four words, be patient when you are anxious. Of course, the most important thing to match with the "eight-character formula" is to resist selling. If you can't resist buying, the cost will be slightly higher at most. So Jiaolian simply set a discipline: no selling at any time. In this way, he can control his hands.

There are often some people who think they are not ordinary and challenge Jiaolian. The implication is to compare and highlight the excellence of their own strategies. In fact, there is nothing clever about it. Everyone knows that the secret to getting rich in the secondary market is just four words: buy low and sell high. The secret to getting rich faster is eight words: buy low and sell high with leverage. The more you brag, the less real you are. If you really have a way to win in a zero-sum game, everyone would want to hide it like a martial arts secret book, so how could you talk about it on the table?

Remember: martial arts secret books that are sold must be fake. If you don't even charge money and give it away for free, it must be something that will kill you.

This is also one of the major differences between blockchain thinking and Internet thinking. The Internet encourages free thinking and caters to the mentality of some people who are greedy for small gains. In fact, it is a trap. Blockchain advocates paying from the beginning. There is no free lunch in the world. Not a single bit of BTC can be obtained for free. Everyone must pay the corresponding price equally to get it, so they will cherish it. From this point of view, if a project under the banner of blockchain actually uses the Internet free thinking marketing method to attract traffic through petty profits, then it must have ulterior motives and want to reap in the future.

Jiaolian believes that practice makes perfect. Therefore, in the spirit of "If I don't go to hell, who will go to hell", Jiaolian entered the "hell-level difficulty" copy in many people's mouths in 2021-Big A. However, compared with friends who stand guard at a high position with a single hand, Jiaolian is using real money to test the effect of the "eight-character formula" in the Big A market.

Jiaolian simultaneously established two positions in Big A: one, individual stocks; two, stock index funds. The logic of selecting individual stocks was discussed by Jiaolian in "8.26 Jiaolian Internal Reference: Talking about the basic logic of stock market investment". Stock index funds chose the dividend index. The reason is that the global economy is in a Kondratieff depression period, and offensive assets should not be over-bet, but the defensiveness of assets should be considered. The Kondratieff cycle of the global economy constitutes the general tone of our choice of asset allocation.

Facts have indeed proved that in the past three years when the index has been falling, the funds selected by Jiaolian have effectively resisted the macro recession and avoided falling into the mud. In terms of individual stocks, the eight-character position-building method has enabled Jiaolian to turn the lock-in caused by the decline of individual stocks into an opportunity to reduce the cost of holding positions, so that when the macro bottom rebounds rapidly, the position will quickly turn losses into profits.

It can be seen that the right strategy can help us hedge against the unfavorable macro situation, and even in the face of "hell-level difficulty", we can calmly stand in an invincible position. When the A-share market seems to have passed the historical bottom and the right entry signal appears, Jiaolian's stock and fund positions have all turned losses into profits, which is standing on a relatively good starting line.

So far, among all the positions of the teaching chain, only another experiment - the altcoin UNI (-30% and more) is still stuck in the quagmire, and the other positions are temporarily profitable, including BTC (+ over 300%), ETH (+4%, just turned a profit), large A stocks (+3%, just turned a profit), large A funds (+ over 10%), etc. Overall, the asset positions of the teaching chain are profitable, which well realizes the expectation of defending against the macro depression cycle in 2020 - of course, before this round of Kondratieff depression is completely over, it cannot be taken lightly. After all, only when you live until spring comes and laugh until the end of the world can you talk about the final victory.

These asset positions, plus cash and cash equivalents such as money funds, constitute asset allocation (teaching chain excludes physical assets). In fact, the most important thing that determines the success or failure of an investment, but also the least valued and discussed, is precisely asset allocation.

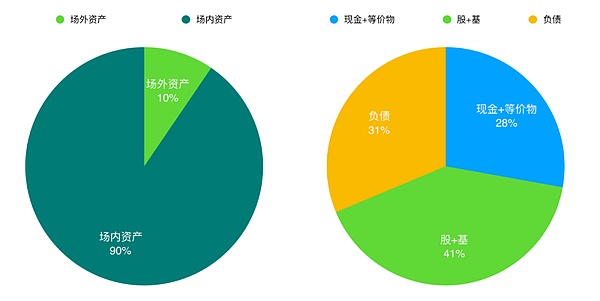

Asset allocation determines where the risk exposure of the position is, as well as the size and relative proportion of the exposure. 90% of the risk exposure of the teaching chain is in the crypto market (on-exchange), and 10% is in the non-crypto market (off-exchange). Among the crypto positions, BTC accounts for more than 90%, and the others account for less than 10%. In the off-exchange positions, the traditional low-risk assets, namely cash and cash equivalents, and the traditional high-risk assets, namely stocks and stock index funds, are about 5:5. In addition, a certain amount of low-cost long-term liabilities, roughly equivalent to the size of cash and equivalents, is maintained to hedge against inflation - inflation will cause cash and liabilities to depreciate equally.

Simply draw a pie chart to illustrate:

It is said to be risk exposure, but in fact, it is precisely the risk that needs to be controlled. Most of the teaching chain's strategies are defensive. BTC is to defend against the risk of global liquidity flooding. Cash is to defend against the risk of market volatility. Liabilities, stocks and bases are all for the purpose of defending against the risk of cash depreciation. Different purposes lead to different asset allocation methods.

BTC positions are ballast stones. Some people think that BTC is an extremely high-risk asset, but that is only because of insufficient knowledge. If you think about all angles of all assets, not just short-term volatility, you will realize what is the safest asset.

Jiaolian's views and choices on these assets are based on its own needs. Different people have different views and purposes, so they must not be copied mechanically.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund JinseFinance

JinseFinance CaptainX

CaptainX CaptainX

CaptainX CaptainX

CaptainX Nulltx

Nulltx