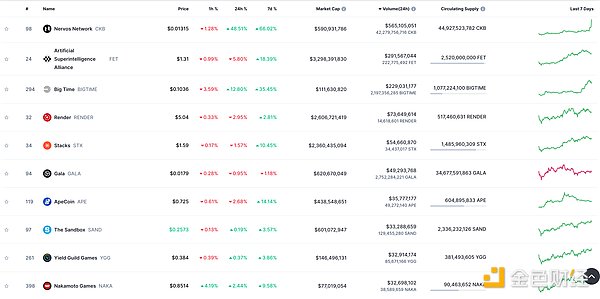

DeFi data

1. Total market value of DeFi tokens: US$68.549 billion

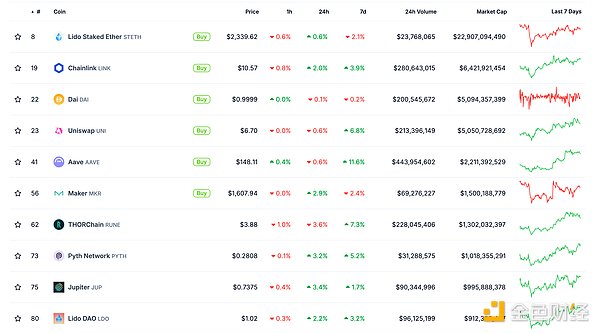

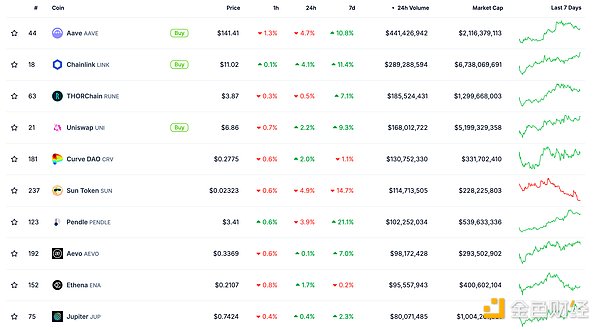

2. Transactions on decentralized exchanges in the past 24 hours 3.2 billion US dollars

Data source for decentralized exchange trading volume in the past 24 hours: coingecko

< strong>

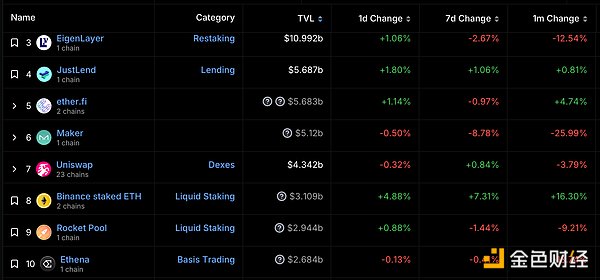

The top ten rankings of DeFi projects’ locked assets and locked-in amount data source: defillama

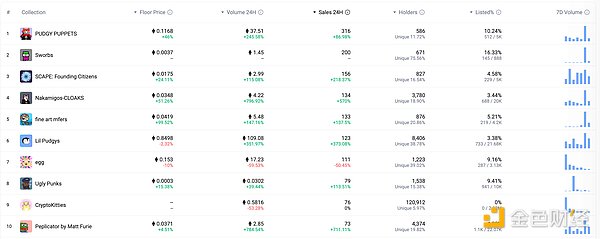

NFT data

1. NFT total market value: 25.58 billion US dollars

2.24-hour NFT trading volume: 2.204 billionUSD

NFT total market value, market value ranking of the top ten projects data source: Coinmarketcap

3. Top NFTs in 24 hours

< /p>

< /p>

The top ten NFTs with the highest sales growth in 24 hours. Data source: NFTGO

Headlines

UK High Court rules that Tether (USDT) is property

Golden Finance The UK High Court ruled that Tether (USDT) is property, the first ruling on the treatment and status of cryptocurrencies under UK law following a full trial. The day before, the UK government passed a bill aimed at clarifying the status of cryptocurrencies. Money is considered “personal property” under property law.

The legal status of Tether (USDT) is a preliminary question in a fraud case in which the plaintiff is a victim of a scam whose stolen cryptocurrencies, including Tether, were resold through various crypto exchanges after passing through a crypto obfuscator. In a ruling on September 12, Richard Farnhill, deputy judge of the High Court, said that USDT has property rights under English law. The judge added that USDT is a "rather unique form of property that is not based on underlying legal rights." The premise is that cryptocurrencies are “subject to tracing and can constitute trust property like other property,” he said, noting that there is “strong authority” that cryptocurrencies are property based on a 2019 ruling by the same court that has not yet been tried. , which is also consistent with the law in England and Wales.

NFT Hotspots

1. Hamster Kombat roadmap: launch the second season of the game and integrate external payment systems in Q3, introduce NFT and RMT mechanisms in Q4

Golden Finance reported that Binance announced the current roadmap of TON ecosystem game Hamster Kombat, as follows:

Q3 2024:

Launch the second season of Hamster game;

Expand the game library;

Work on integrating external payment systems into the game.

Q4 2024:

Release PWA to integrate payment services;

Release the first game from external developers inside Hamster;

Add NFT mechanism to the meta-game of Hamster Season 2;

Integrate ad network into store products;

Release depth of mechanism with Season 2 Integrated clans;

Launch two major games with tokens fully integrated into the game economy;

Introduce RMT (real money transactions) in games;

Q1 2025:

First competitive clan tournaments in Hamster 2.0;

Expand the number of partner games , development projects are more complex and costly;

Introduction of an internal NFT market for game items;

Q2 2025:

Phase 2 begins, tools for creating UGC (user-generated content);

Q3 2025:

Go beyond PWA and integrate with desktop games.

< strong>DeFi Hotspots

1. The market value of RWA assets on the chain has exceeded 12 billion US dollars

< According to a report released by Binance Research, the market value of on-chain real-world assets (RWAs, excluding stablecoins) has exceeded $12 billion, showing that investors are interested in There is a continued interest in blockchaining traditional assets. Among them, the tokenized U.S. Treasury market has performed particularly well, with a market value of more than $2.2 billion. BlackRock's BUILD fund has a market value of $520 million, and Franklin Templeton's FBOXX fund has a market value of $1. Market value reaches US$434 million.

The report points out that the continued high interest rates in the United States have driven the rapid growth of the tokenized Treasury market, but with the Federal Reserve expected to cut interest rates in the coming months, the attractiveness of these yield products may be affected. The tokenized commodity and real estate markets are also growing, and the on-chain private credit market is valued at $9 billion.

2. Binance completes the upgrade of Polygon (MATIC) tokens to Polygon (POL)

Golden Finance reported, According to the official announcement, Binance has now completed the upgrade of Polygon (MATIC) tokens to Polygon (POL), and opened the recharge and withdrawal services of the new POL tokens.

Binance has opened trading of POL/BNB, POL/BRL, POL/BTC, POL/ETH, POL/EUR, POL/FDUSD, POL/JPY, POL/ TRY, POL/USDC and POL/USDT spot trading pairs. Trading bots and spot copy trading will be enabled within 24 hours of the above tokens being listed on the spot market.

3. Starknet community voted to launch the STRK token staking plan proposal

Golden Finance reported that according to the community governance page, Starknet community The proposal to launch the STRK token staking program was voted in. Starting from the fourth quarter of this year, any address holding more than 20,000 STRK can stake STRK on the Starknet network.

4. Solana Co-founder Questions ZKsync’s Governance System as Not Multi-Signature According to reports, the latter has the risk of centralization.

On September 13, yesterday, Alex Gluchowski, CEO of ZKsync developer Matter Labs, announced the launch of ZKsync governance system, Alex said that the governance system is not multi-signature, "all planned upgrades are initiated directly on the chain by the community of more than 370,000 ZK token holders, rather than by a foundation or a small group of people. Initiated by trusted actors.

Solana co-founder Toly questioned under the article that although ZKsync claims not to be a multi-signature system, it is actually still based on the honest majority assumption, which means that it is essentially similar to a multi-signature system. Toly further stated that, unlike Solana, ZKsync’s governance system has potential centralization risks. In Solana, even if there are enough validators to reach consensus, a single full node of Circle (the issuer of USDC) is able to reject invalid state transitions, thus protecting the system from malicious behavior. ZKsync’s “Professional Security Committee” may Face legal risk because if enough committee members are subject to orders from a U.S. bankruptcy judge, they could be forced to place all cross-chain assets under the control of a bankruptcy trust.

5. MakerDAO rebrands Sky feature to be launched on September 18

6.IntoTheBlock: Arbitrum accounts for more than 14% of DEX trading volume

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and is not intended as actual investment advice. Please establish a correct investment philosophy and be sure to raise your risk awareness.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Davin

Davin decrypt

decrypt Others

Others Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph