The dust of Bitcoin spot ETF has settled, but the market response is not satisfactory.

On the one hand, after the news was confirmed, Bitcoin did not rise but fell. On the second day of the ETF listing, it fell rapidly from above 46,000 US dollars, once falling below 42,000 US dollars. The U.S. dollar fell by more than 8.3% in a single day, and then continued to fluctuate at $42,000. The rapid decline of Bitcoin has caused a lot of discussion among industry insiders. The upcoming major correction may replace the "bull market" as a topic of market concern. Institutions that had previously shouted $50,000 changed their rhetoric and began to reveal the possible plunge of Bitcoin in March. .

But on the other hand, the 11 Bitcoin spot ETFs have been very popular since their listing, with significant capital inflows. The 11 approved ETF products completed 70 There were 10,000 separate trading operations, with a daily trading volume exceeding US$4.6 billion. It has been observed that existing crypto product funds are also rapidly pouring into ETFs.

It can be seen from this that the listing of Bitcoin spot ETF seems to have some joy and some sadness in a short period of time.

The news has landed, will Bitcoin usher in a major correction?

On January 11, with the approval of the U.S. Securities and Exchange Commission (SEC), 11 Bitcoin spot ETFs Listing and trading officially started. Among them, Grayscale and Bitwise are listed on NYSE Arca, ARK21Shares, Invesco Galaxy, VanEck, WisdomTree, Fidelity and Franklin are listed on Cboe BZX, while BlackRock and Valkyrie are listed on Nasdaq.

I thought that with the historic benefits, Bitcoin could spread its wings and reach a new high of 50,000. However, Bitcoin fell rapidly after its listing, with average prices falling within two days. in a state of severe turmoil.

On that day, Bitcoin briefly surged to $49,000, setting a new high for the year, and then quickly fell to $46,000. On the second day after the ETF was passed, it continued to fall. , once fell below $42,000, with a 24-hour drop of more than 8.3%, and is now at $42,669. CoinGlass data shows that more than 100,000 investors liquidated their positions in the cryptocurrency market across the entire network in 24 hours that day, with the total liquidation amount reaching US$342 million. Affected by this, Bitcoin ETFs suffered general declines, with DEFI, FBTC, HODL and BRRR falling by more than 6%.

100,000 people sold Bitcoin on the second day of listing. Source: CoinGlass

Regarding this plunge, the market generally believes that it is a routine operation in the financial field of "buying on rumors and selling after confirmation". Judging from the market, in the fourth quarter of last year alone, Bitcoin rose by more than 60%. This rapid rise also covered the expected positive price. Due to the end of the news game, previous profit expectations have been realized, so profit selling has ended FOMO. The flow of funds is also in line with the market's prediction. As of January 15, USDT has reduced its market value from US$1.8 billion in the first week of January to US$1.4 billion, a decrease of 23%, while USDC, which symbolizes US dollar funds, has decreased compared with January. The market value shrank by as much as 90% in the first week, and the outflow of funds also reflected the price trend.

In this context, the short-term correction of Bitcoin prices has also become a topic of market concern. In addition to Arthur Hayes's harsh words before the adoption of the Bitcoin ETF, he believed that due to macro-directional liquidity adjustments, the decline of reverse repurchases and other reasons, Bitcoin will plummet in March, and other institutions have also begun to follow suit. speak out. Analysts at Japanese cryptocurrency exchange bitBank believe that the psychological level of $40,000 is a support for Bitcoin prices in the near future, while analysts at 10x Research predict that the price will fall to $38,000.

ETF gets off to a good start, but price war reveals gimmick

< p style="text-align: left;">On the other hand, the newly approved Bitcoin spot ETF also started official trading. On the first day of trading, the ETF got off to a good start.

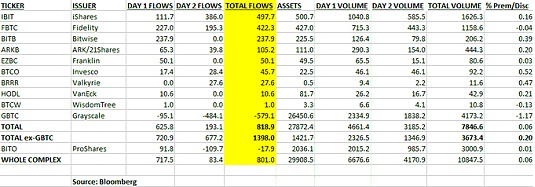

11 approved ETF products accounted for more than $4.6 billion in daily trading volume, according to data compiled by Bloomberg. Among them, Grayscale Bitcoin Trust, which has the advantage of market size and converts GBTC into ETF, ranks first with a transaction volume of approximately US$2.3 billion, followed closely by BlackRock, and iShares Bitcoin Trust (IBIT) with a transaction volume of more than 1 billion USD, Fidelity’s FBTC exceeds $680 million. Although the day's capital transactions were more from seed funds of major products, Bloomberg analyst Eric Balchunas also said that retail investors also showed enthusiasm for trading.

At the same time, the rate price war has begun to start, and high-rate funds are gradually migrating to low-rate funds.

As of the afternoon of January 13, according to statistics, the total net inflow of ETF products reached US$819 million. Among them, although Grayscale’s transaction volume is as high as 2.3 billion U.S. dollars, its net capital outflows are in a state of outflow. GBTC has an outflow of approximately 579 million U.S. dollars, while other ETFs have a net inflow of funds. BlackRock's iSharesBitcoin Trust (IBIT) topped the list with $497.7 million in total flows, followed by Fidelity, which raised $422.3 million, and Bitwise (BITB), the lowest fee at 0.2%, which saw investment inflows of $237.9 million.

ETF fund inflow statistics, source: Bloomberg

In this regard, Morgan Chase also expressed doubts about Grayscale’s fee rate of up to 1.5%. It believes that Grayscale is about to face the dual dilemma of profit settlement and capital outflow. On the one hand, investors have taken profits on the discounted GBTC purchased in the secondary market. About $3 billion may exit the Grayscale Bitcoin Trust (GBTC) and migrate to new spot ETFs; at the same time, institutional investors holding cryptocurrencies in the form of funds may move away from them due to uncompetitive fees Futures ETFs and GBTC move to cheaper spot ETFs.

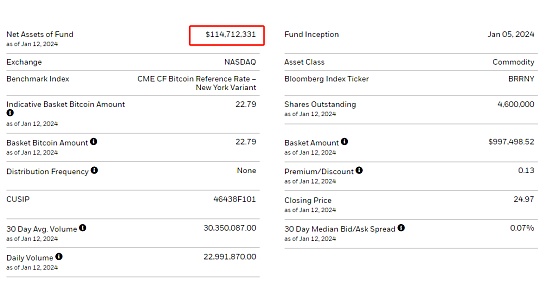

Judging from the current status, given the poor performance of the underlying price, Bitcoin spot ETFs are also in a state of decline. Among the 11 ETFs, according to Yahoo as of 1 According to data released on March 12, IBIT fell the most significantly, reaching 6.23%, and other ETFs also generally fell by 6%. From the perspective of the net asset management value of ETFs, Grayscale's GBTC still occupies an absolute dominant position with total assets of more than 26.9 billion U.S. dollars, BitWise's BITB is in second place with 242 million U.S. dollars, and BlackRock's IBIT is 114 million U.S. dollars. Franklin EZBC, Fidelity FBTC, Valkyrie BRRR, VanEck HODL, etc. currently have less than 100 million US dollars.

BlackRock IBIT ETF net assets, source: ishares official website

Although The discussion of ETFs is in full swing, but that does not mean that all institutions welcome it. Due to the sharp rise and fall in the price of Bitcoin, four Wall Street institutions have made it clear that they will not provide Bitcoin-related products to customers out of the protection of investors. Vanguard, the world's second-largest asset manager with approximately $8 trillion in assets under management, said it will not allow its customers to purchase the recently launched 11 spot Bitcoin products due to their inconsistency with long-term portfolio asset class products such as stocks, bonds and cash. any of the currency ETFs. Financial advisors Merrill Lynch, Edward Jones and Northwestern Mutual have also successively told clients that their policies do not allow investment in such assets for the time being.

It can be seen that in the long term, although the consensus that Bitcoin ETF will attract a large amount of new institutional funds is still strong, in the short term In other words, the internal digestion of funds within the encryption industry may become an important trend for ETFs. The above-mentioned JPMorgan Chase has predicted this phenomenon. It believes that even if new funds do not flow in, in the context of a large number of existing crypto products turning to newly created ETFs, new ETFs may still attract capital inflows of up to US$36 billion.

The shift in existing funds undoubtedly indicates that competition among ETFs will become increasingly fierce. In this regard, Cathie Wood, CEO of Ark Invest It is also said bluntly that it is expected that only 3-4 of the 11 spot Bitcoin ETFs may continue to operate in 5 years.

Coinbase attracts controversy, and the risks of the custody center are highlighted

In addition to ETF issuers, Coinbase, which has been silently making a fortune, has also attracted new doubts. Among the 11 ETF products, the custodian of 8 products is Coinbase, which also caused Coinbase's stock to surge by 220%. However, this high reliance on a single custodian has made the market believe that it creates a centralization risk.

8 of the 11 ETFs have chosen Coinbase as their custodian, source: X Platform

For ease of understanding, here is a brief introduction to how Bitcoin spot ETFs operate and their main roles. In the simplified ETF model, there are five main roles. One is the management company of the ETF, that is, the issuer of the ETF, such as the aforementioned BlackRock, Grayscale and other institutions; the other is the market investor. Including retail investors and institutions; the third is the custodian; the rest are market makers and authorized participants AP. Usually, the latter two are not borne by the same institution, but in reality this situation is also common.

The ETF issuer uses management fees as its only income. Its main function is to create ETF shares, correspond the ETF shares to the price of physical BTC, and at the same time, host the physical BTC in In a secure digital vault managed by a registered custodian, or more directly, in a digital wallet. After the issuer creates the ETF share, it is handed over to the authorized participant, and the AP puts it on the market. Retailers and retail investors in the market can conduct bidding transactions through brokers or exchanges.

It can be seen that AP is the most important participant in the market. In fact, although the issuer is responsible for the issuance task, the specific redemption and share creation operations But it is done by AP. The main income of AP is to sell products, provide liquidity and conduct arbitrage operations. Therefore, when selecting APs, issuers usually choose institutions with sufficient qualifications and operational capabilities as APs. Currently, 11 ETFs have chosen Jane Street, which is strong and specializes in ETFs, as the designated authorized participant. BlackRock and Invesco have additionally joined JPMorgan Chase, and GBTC has joined Virtu Americas.

Back to the custodian, as the placement and manager of assets, the custodian is mainly responsible for the obligations of the treasury. The income structure is very simple, that is, based on the proportion of the assets under custody. Hosting Fees. Publishers have nothing more than three requirements for them, one is compliance qualifications, and the other is security and stability. Due to the special needs of encryption, it is also important to have a layout in the encryption field. Under the strict supervision of the United States, there are very few custodians that meet these three conditions, so Coinbase has become a popular choice for custody.

But Coinbase has its own problems.

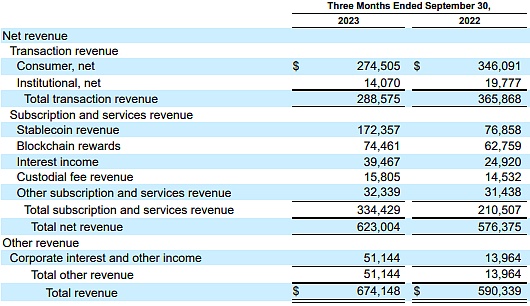

First, on the compliance level, Coinbase and the SEC’s previous accusations against unregistered exchanges and broker-dealers are still in litigation. At this point, Coinbase's compliance is questionable. Although Chief Financial Officer Alesia Haas said that the company's custody business is not involved in the ongoing SEC case, and the custody institution's funds are completely separated from other businesses in principle, the market is still concerned about this. express hesitation. The second is concentration risk. Coinbase is responsible for the custody business of 8 ETFs. If any corporate problems arise, it will cause heavy damage to the ETFs. Since trading revenue accounts for as high as 43% of Coinbase's revenue, if the unregistered securities mentioned in the lawsuit are established, Coinbase's own business will also be greatly affected, which may in turn have a chain reaction. This is the main reason why Coinbase must forcefully confront the SEC. . Mizuho Securities analyst Dan Dolev also stressed that nearly a third of Coinbase’s revenue is “at risk” as negative results from the exchange could lead to the separation of its services.

Transaction revenue is Coinbase's main revenue, source: Coinbase financial report

In addition , in the short term, the adoption of ETF is also a mixed blessing for Coinbase. On the one hand, the influx of new funds will bring about an increase in trading volume, and on the other hand, this will force Coinbase to cut transaction fees to compete with lower-cost spot ETF products.

Overall, the Bitcoin spot ETF has only been on the market for less than a week, and it has begun to bring influence to the crypto market in terms of capital flow, market price, ecological competition, etc. Although it is still unknown whether tens of billions of dollars will actually enter the market in the future, it is foreseeable that the "catfish effect" brought by ETFs will continue for a long time.

ZeZheng

ZeZheng

ZeZheng

ZeZheng ZeZheng

ZeZheng WenJun

WenJun WenJun

WenJun Xu Lin

Xu Lin Coindesk

Coindesk 链向资讯

链向资讯 Cointelegraph

Cointelegraph 链向资讯

链向资讯 Cointelegraph

Cointelegraph