Who is Satoshi Nakamoto? British court hears "real and fake Satoshi Nakamoto" case

Wright’s lawyers countered that the Cryptocurrency Open Patent Alliance could not provide direct evidence that Wright was not Satoshi Nakamoto.

JinseFinance

JinseFinance

Written by: TechFlow

Overview

Do you know the real Chinese-speaking currency circle users?

Chinese-speaking users have always been the backbone of the crypto market. Whether it is contributing active addresses and TVL, providing liquidity in the secondary market, or providing a large number of developers for the public chain ecosystem, Chinese-speaking users have always been active in the front line of encryption. Understanding the investment preferences and scale of this group is crucial to grasping market trends, optimizing product services, and improving user experience.

Based on this, TechFlow conducted a questionnaire survey on "Chinese-speaking Users' Crypto Investment Habits" from May 22, 2024 to June 30, 2024. In this survey, the questionnaire was distributed and disseminated through social media platforms, community forums, etc., and a total of 2,107 questionnaires were collected. After data cleaning and screening, 54 invalid questionnaires were eliminated, and finally 2,053 valid questionnaires were obtained. In addition, the information collected in this survey will strictly implement privacy protection measures and will only be used for the purpose of this questionnaire research.

The data analysis of this report is based on 2,053 valid questionnaires, aiming to deeply explore the behavioral characteristics and market demand of Chinese users in crypto investment. The specific analysis content is divided into the following four parts:

Part 1: Overview of the survey population

Part 2: Market concerns of the Chinese community

Part 3: Chinese users’ preference for centralized exchanges

Part 4: Comprehensive and in-depth understanding of investors

Highlights

The interviewees showed obvious characteristics: Male-dominated, concentrated in the age of 26-35, and most of them have a bachelor's degree or above.

Among them, IN (introverted intuitive) personality occupies the majority in the MBTI personality survey. This type of personality is usually better at discovering trends, innovations and future development directions, and has a stronger strategic vision.

The track that respondents are most optimistic about and invest in is Bitcoin and its ecosystem, and most respondents are optimistic that the price of Bitcoin will exceed $100,000-150,000 and above in this cycle.

Spontaneous research and purchase are the most important factors affecting respondents' investment decisions. Twitter (X platform) has become the main way for respondents to obtain crypto market information and Alpha information, followed by various blockchain media.

In the survey of the most recognized crypto VCs by respondents, according to the nominations of respondents, a16z, Paradigm, and Binance Labs ranked in the top three.

In the competition of centralized exchanges in the Chinese community, Binance has outstanding competitive advantages: in the questions of frequently used exchanges, exchanges with the largest crypto asset positions, exchanges that make the most money, and exchanges that mainly participate in new listings, Binance ranks first with a share of over 60%. In the question of "the most frequently used centralized exchange", the respondents who chose Binance reached an astonishing 96.72%, reflecting Binance's strong influence and user base in the Chinese crypto market.

Most respondents (69.61%) said that their preference for using a certain exchange would not be affected by regulatory factors, which also means that investors are gradually becoming desensitized to the regulatory actions of various governments.

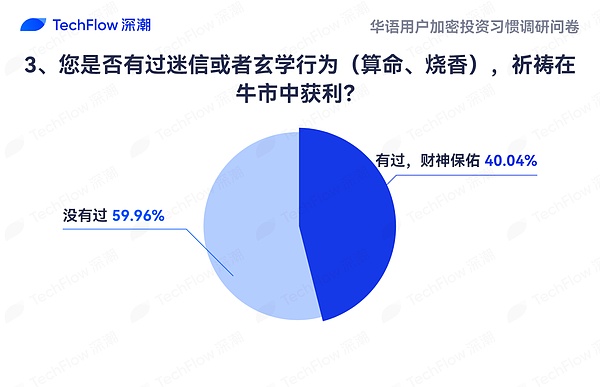

At a time when metaphysics is prevalent, 40.04% of the interviewed investors said they had prayed to the God of Wealth for blessings and other metaphysical behaviors.

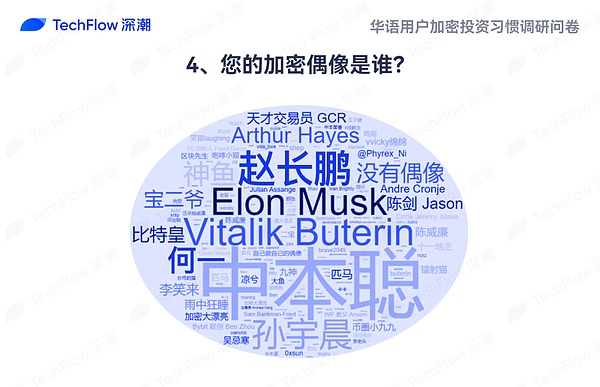

Among the interviewees’ crypto idols, Bitcoin founder Satoshi Nakamoto, Ethereum founder Vitalik Buterin, SpaceX founder Elon Musk, and Binance founder CZ became the most mentioned figures.

Exchanges are the type of Web3 companies that the interviewees most want to work for. Most people believe that exchanges gather high-quality information resources and can get in touch with some wealth codes earlier. Among all the centralized exchanges, Binance has the highest mention rate and has become the company that the interviewees most want to work for.

As for whether to "make enough money and run away", most respondents have a negative attitude and regard Web3 as a belief. As for the question of "how much money can you make to lie down", more than two-thirds of the respondents believe that the total assets need to reach more than 10 million, and A8 is a wealth watershed.

As for the crypto assets that benefited the most, Bitcoin, ETH, Solana, BNB, and PEPE became the crypto assets most mentioned by the respondents, which also seems to reflect the characteristics of this round of market cycles: only Beta, lack of Alpha, and a large number of altcoins cannot outperform mainstream coins.

Part 1: Overview of the survey population

The questions in this section mainly cover multiple aspects, including the gender, age, education, time of crypto investment, and personality characteristics of the respondents. These questions are designed to fully understand the basic information of users so that we can analyze the data more comprehensively and identify the characteristics of different groups. By collecting and analyzing this basic information, we hope to draw a comprehensive portrait of the respondents, thereby providing strong support for subsequent research and market analysis.

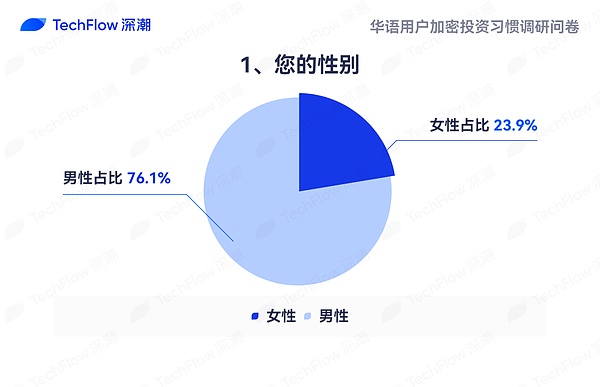

1. Gender distribution of respondents:

In this survey, we conducted a statistical analysis of the gender of the participants. The data showed that male respondents accounted for a considerable proportion, which also showed that men showed higher participation in this survey.

Specifically: there were 1,562 male respondents, accounting for 76.1%; there were 491 female respondents, accounting for 23.9%.

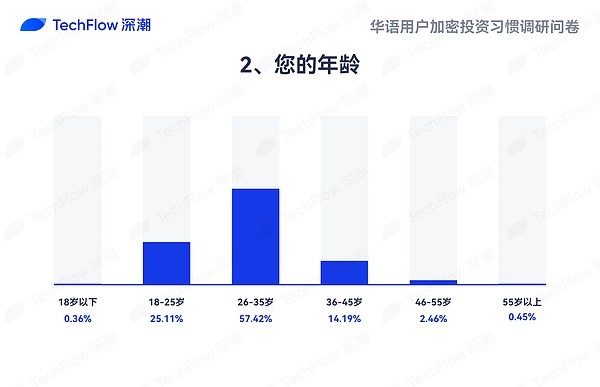

2. Age distribution of respondents:

In this questionnaire survey, we conducted a detailed statistical analysis of the age of respondents. The data showed that the age distribution of Chinese-speaking users in the field of cryptocurrency investment has a clear trend of concentration, and young groups have shown a higher degree of participation in this survey.

Specifically: Respondents aged 26-35 accounted for the highest proportion, reaching 57.42%, followed by respondents aged 18-25, accounting for 25.11%, and respondents aged 36-45 accounted for 14.19%. It is worth noting that respondents aged 18-45 accounted for 96.72%.

Respondents aged 46-55 accounted for 2.46%, while users aged 55 and above accounted for only 0.45%. This shows that as age increases, users' participation in cryptocurrency investment gradually decreases.

In addition, users under the age of 18 accounted for only 0.36%. Since these users are still minors, their economic independence and investment capabilities are limited, so their participation in the cryptocurrency market is extremely low.

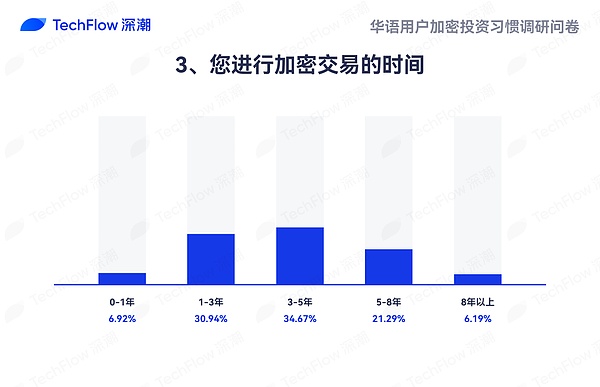

3. The time respondents spent on crypto trading:

In this questionnaire survey, we conducted a detailed statistics on the time respondents spent on crypto trading. The data showed that the experience distribution of Chinese users in the field of crypto trading experience is relatively balanced, which provides a solid and diverse user base for the crypto market and contributes to the long-term development of the market.

Specifically: respondents with 3-5 years of crypto trading experience accounted for the highest proportion, reaching 34.67%, followed by respondents with 1-3 years of crypto trading experience, accounting for 30.94%, and users with 5-8 years of crypto trading experience accounted for 21.29%. It is worth noting that respondents with 1-8 years of crypto trading experience accounted for 86.9%.

In addition, respondents with 0-1 years of crypto trading experience accounted for 6.92%, while respondents with more than 8 years of crypto trading experience accounted for 6.19%. This phenomenon of new users entering the market and old users sticking to it reflects the dynamics and vitality of the market.

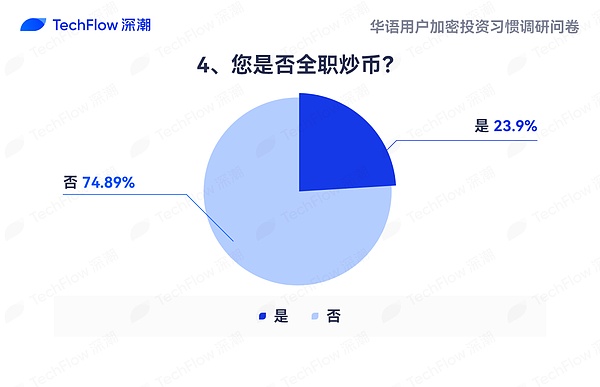

4. Whether the respondents are full-time cryptocurrency traders:

In this questionnaire survey, we conducted a detailed statistical analysis of whether the respondents are full-time cryptocurrency traders. The data showed that there are significant differences in the participation and investment of Chinese-speaking users in this field.

Specifically: 25.11% of the respondents are full-time cryptocurrency traders. That is, one-quarter of the respondents regard cryptocurrency investment as their main occupation and source of income.

In addition, the proportion of users who are not full-time cryptocurrency traders is as high as 74.89%, which means that most respondents regard cryptocurrency investment as a side job or hobby, rather than a main career direction, and most users regard it as part of asset allocation.

This difference in participation mode reflects the diversity and flexibility of the crypto trading market: full-time cryptocurrency traders can focus on market changes and adjust their strategies at any time, while part-time users can combine crypto investment with other career development and maintain a certain level of risk control.

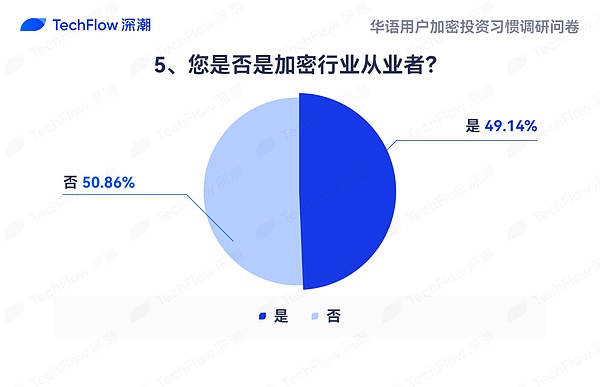

5. Whether the respondents are crypto industry practitioners:

In this questionnaire survey, we conducted a detailed statistics on whether the respondents are crypto industry practitioners. The data shows that the respondents' professional backgrounds in the crypto field present a relatively balanced trend.

Specifically: 49.14% of the respondents are crypto industry practitioners, which means that nearly half of the respondents are deeply involved in the crypto industry. In addition, 50.86% of the respondents are not practitioners in the crypto industry, but rather play the role of investors or enthusiasts, paying attention to investment opportunities and market dynamics of cryptocurrencies.

This balanced distribution of professional backgrounds reflects the diversity and inclusiveness of the crypto market: both practitioners and non-practitioners contribute to the market ecosystem in their respective roles.

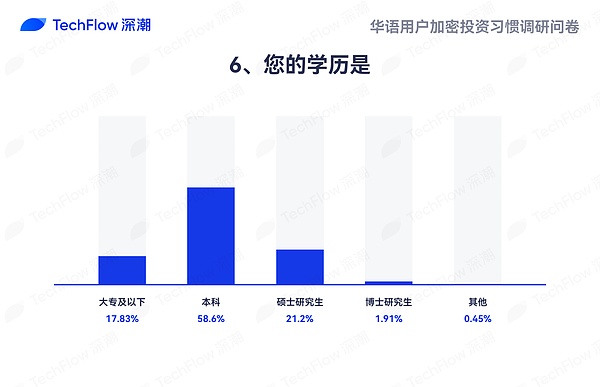

6. Education of the respondents:

In this questionnaire survey, we conducted a detailed statistical analysis of the educational background of the respondents. The data showed that the overall educational level of the respondents was high, and most of the respondents had certain professional knowledge and analytical capabilities.

Specifically: The respondents with bachelor's degrees accounted for the vast majority, accounting for 58.60%, the respondents with master's degrees accounted for 21.20%, and the respondents with doctoral degrees accounted for 1.91%, indicating that a considerable number of respondents have higher academic backgrounds and research capabilities, which provide support for rational decision-making in crypto investment.

In addition, respondents with college degrees or below accounted for 17.83%, and respondents with other degrees accounted for 0.45%, who also brought richer cognitive perspectives to the crypto industry to varying degrees.

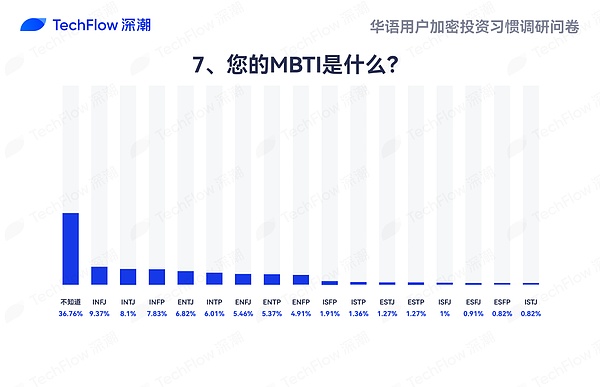

7. MBTI of respondents:

In this questionnaire survey, we conducted a detailed statistical analysis of the MBTI personality types of the respondents. MBTI is a widely used psychological testing tool that helps people understand their personality traits and behavioral tendencies.

36.76% of respondents do not know their MBTI type. This shows that although MBTI has a certain popularity in the crypto industry, a considerable number of users have not yet conducted relevant self-assessments.

Among the respondents who know their MBTI types, INFJ (9.37%), INTJ (8.10%) and INFP (7.83%) account for a relatively high proportion. All three types belong to introverted intuitive personalities, which are generally considered to have strong innovative thinking, strategic planning and empathy.

In addition, extroverted intuitive personalities such as ENTJ (6.82%), ENTP (5.37%) and ENFJ (5.46%) also account for a large proportion. These three personality types are usually good at leadership, communication and decision-making.

In contrast, the proportion of sensing and judging personalities is relatively low. For example, the proportions of ESFJ (0.91%), ESFP (0.82%), ESTJ (1.27%), ESTP (1.27%), ISFJ (1.00%) and ISTJ (0.82%) are all around 1%.

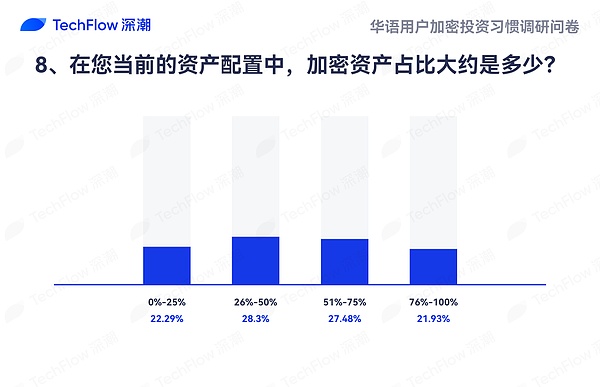

8. Proportion of respondents' crypto assets:

In this questionnaire survey, we conducted a detailed statistical analysis of the respondents' current crypto asset allocation. The data showed that the respondents' investment proportions in crypto assets showed a relatively balanced distribution, which reflects the respondents' different risk management awareness in the crypto market.

Specifically: 22.29% of the respondents have a crypto asset ratio between 0% and 25%; 28.30% of the respondents control the crypto asset ratio between 26% and 50%; 27.48% of the respondents control the crypto asset ratio between 51% and 75%; 21.93% of the respondents control the crypto asset ratio between 76% and 100%.

The proportions of the four intervals are relatively close, which reflects the different preferences and risk tolerance of different users for cryptocurrency investment. About half of the respondents (50.59%) control the allocation ratio of crypto assets below 50%, showing their cautious attitude towards risks; while the other half of the respondents (49.41%) set the allocation ratio of crypto assets above 50%, indicating their confidence in the cryptocurrency market and high risk tolerance.

Part 2: Chinese Community Market Focus

Fast pace has always been a notable feature of the crypto market. 2024 is already halfway through, and we have witnessed the rise of multiple popular narratives such as inscriptions, artificial intelligence (AI), MEME, and BTCFi in the past six months. The market environment is changing rapidly, and investors' focus is constantly shifting. In-depth understanding of multiple dimensions of information such as the tracks that users care about, the ways to obtain information, and market confidence can not only provide us with valuable market insights, but also help us make more forward-looking predictions from the user's perspective, so as to respond to user demands more efficiently.

1. Tracks that respondents are concerned about:

In this questionnaire survey, we conducted a detailed statistics on the crypto tracks that respondents are currently concerned about. This question is a multiple-choice question. Each respondent needs to select three options of interest. The proportion of each option is as follows:

In general, Bitcoin and its ecology are the most optimistic, with 65.24% of respondents choosing this option, and the popularity of the Bitcoin ecology is obvious to all. With the promotion of national inscriptions, the continuous development of Bitcoin Layer 2 solutions and the rise of BTCFi, the Bitcoin ecology is undergoing rapid and profound changes, attracting the attention of a large number of investors and developers.

The gap between the 2nd and 5th places is not big, which are Ethereum and its ecology (L2, LSD, etc.), MEME, Solana and its ecology and AI concept.

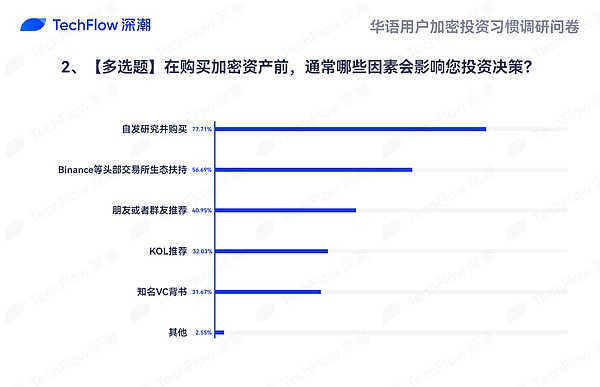

2. Factors affecting respondents' investment decisions:

In this questionnaire survey, we conducted a detailed statistics on the factors that currently affect respondents' investment decisions. This question is a multiple-choice question. Each respondent can freely choose multiple options. The proportion of each option is as follows:

In general, spontaneous research and purchase is the most important factor affecting respondents' investment decisions. 77.71% of respondents chose this option. In the context of the continuous diversification of information channels, investors can better study the fundamentals and technical details of the project, so as to make more rational investment choices.

Secondly, the ecological support of the head exchanges also accounts for a large proportion. The head exchanges usually have rich industry resources and a broad user base. Investors value the exposure opportunities and resource feedback provided by the exchanges for new projects.

In addition, the influence of friends or group members' recommendations, KOL recommendations and VC endorsements ranked third, fourth and fifth respectively.

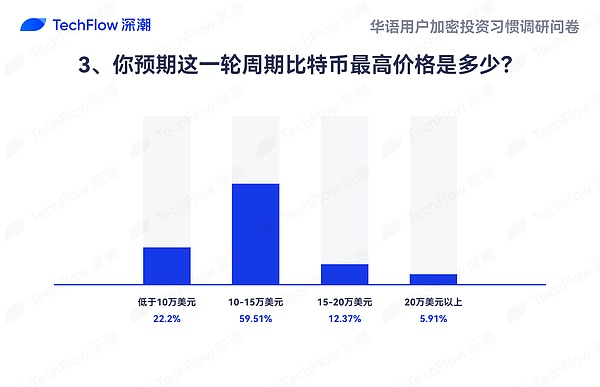

3. Respondents' predictions on the price of Bitcoin in this cycle:

In this questionnaire survey, we conducted a detailed statistics on the respondents' expectations for the highest price of Bitcoin in this cycle. The data showed that there is an obvious concentration trend in the respondents' expectations for the price of Bitcoin.

Specifically: 59.51% of the respondents believe that the highest price of Bitcoin in this cycle will be between $100,000 and $150,000, which shows that most people are relatively optimistic but cautious about the future trend of Bitcoin; 22.20% of the respondents believe that the highest price of Bitcoin will be lower than $100,000. These respondents may have a more conservative view on the risks and volatility of the market.

In addition, 12.37% of the respondents believe that the highest price of Bitcoin will be between $150,000 and $200,000, and 5.91% of the respondents believe that the highest price of Bitcoin will exceed $200,000. These respondents are more optimistic about the future increase of Bitcoin and believe that Bitcoin has the potential to reach a new historical high in this cycle.

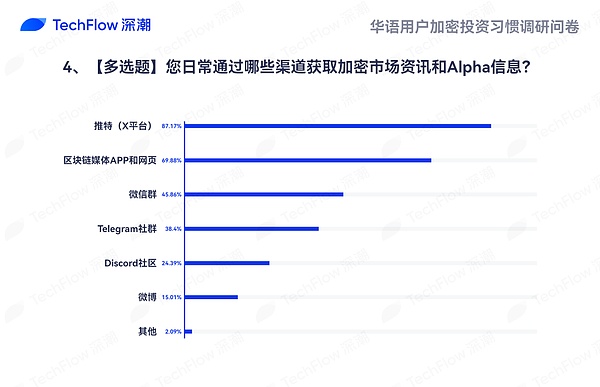

4. The ways in which respondents obtain information on the crypto market and Alpha information:

In this questionnaire survey, we conducted a detailed statistics on the ways in which current respondents obtain information on the crypto market and Alpha information. This question is a multiple-choice question, and each respondent can freely choose multiple options. The proportion of each option is as follows:

In general, Twitter (X platform) is the main way for respondents to obtain information on the crypto market and Alpha information, with 87.17% of respondents choosing this option, followed by blockchain media apps and web pages, which also account for a large proportion.

In addition, WeChat groups, Telegram communities, and Discord communities also occupy important positions, ranking third, fourth, and fifth respectively.

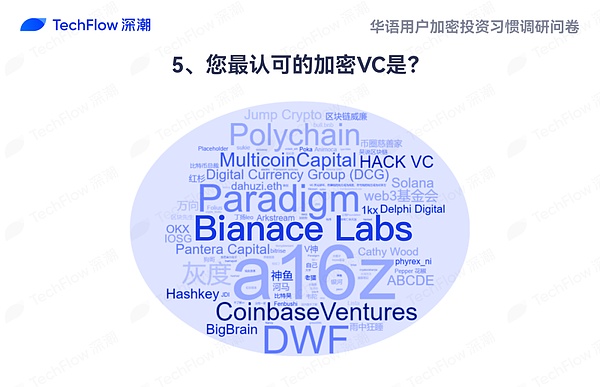

5. The most recognized crypto VC by respondents:

In this questionnaire survey, we collected data on the most recognized/least recognized crypto VCs by the current respondents. This question is optional, and interested respondents can fill it out and submit it. Based on the frequency of mentions of each VC in the feedback, we made a word cloud display.

The most recognized crypto VC by the respondents - word cloud display:

According to the word cloud display, we can observe that a16z, Paradigm, Binance Labs, Coinbase Ventures and other old-brand crypto VCs are mentioned frequently.

6. The most recognized Chinese crypto KOL by the respondents:

In this questionnaire survey, we collected data on the most recognized crypto KOL by the current respondents. This question is not mandatory. Interested respondents can fill it out and submit it. According to the frequency of mention of each KOL in the feedback, we made a word cloud display.

The most recognized crypto KOL by the respondents - word cloud display:

The respondents believe that the “anti-KOLs” mainly include:

It is undeniable that recognition/disrecognition is more of a subjective tendency, and the survey results are also affected by the communication channels. Everyone has their own standards, so just smile.

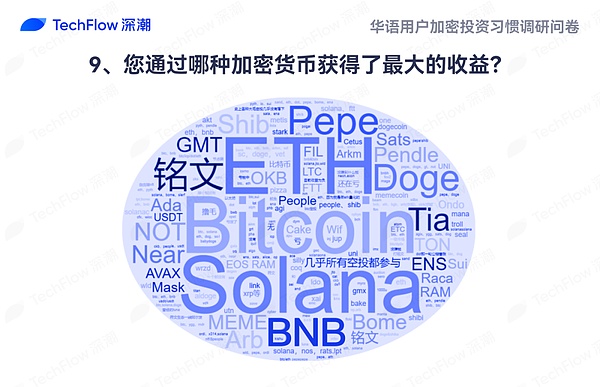

7. The cryptocurrency that the respondents have gained the most benefits from:

In this questionnaire survey, we collected data on the cryptocurrency that the current respondents have gained the most benefits from. This question is optional. Interested respondents can fill it out and submit it. According to the frequency of mention of each cryptocurrency in the feedback, we made a word cloud display.

According to the results obtained, Bitcoin, ETH, Solana, BNB, and PEPE have become the most mentioned crypto assets by respondents, which also reflects the hot spots of this round of market cycles. A large number of altcoins are not as good as mainstream currencies.

Cryptocurrencies that respondents gained the most benefits from - Word cloud display:

Part 3: Chinese users' preference for centralized exchanges

As the main battlefield for trading, exchanges have always played a vital role in the crypto market. In particular, centralized exchanges (CEXs) have become the primary entry point for most users to enter the crypto market due to their user-friendly interface and high liquidity. Understanding users' usage preferences, service feedback, and functional demands for centralized exchanges can better identify the pain points and needs encountered by users during trading, and continuously promote the construction of more comprehensive, efficient, and secure trading services.

1. Centralized exchanges used more frequently by respondents:

In this questionnaire survey, we conducted a detailed statistics on the centralized exchanges used more frequently by respondents. This question is a multiple-choice question. Each respondent needs to select three centralized exchange options. The proportion of each option is as follows:

In general, Binance is the most frequently used centralized exchange among the respondents, and the respondents who chose this option reached an astonishing 96.72%. This reflects Binance's strong influence and user base in the Chinese crypto market. As one of the world's largest digital asset trading platforms, Binance provides a rich range of trading pairs, low fees, and a variety of financial products. It is considered to be the preferred platform for investors to enter and participate in the crypto market.

Closely following is OKX. Although the number of respondents who chose OKX is 13.19% lower than Binance, it still reached 83.53%, which is also one of the exchanges that Chinese community users choose more.

In addition to the two major exchanges, Gate.io and Bitget also have good performances compared to other exchanges.

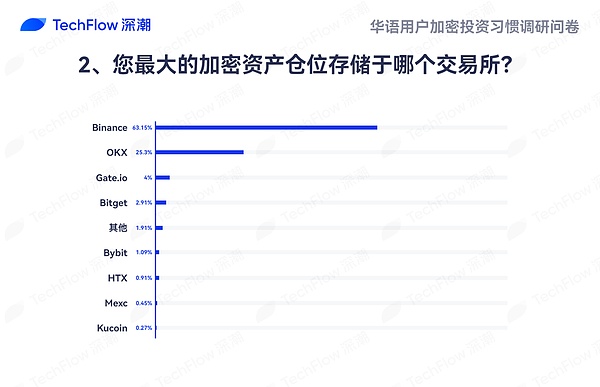

2. Which exchange does the respondent's largest crypto asset position store in:

In this questionnaire survey, we conducted a detailed statistics on which exchange the respondents' largest crypto asset position is stored in. This choice is intended to understand the respondents' trust in the security of the exchange and market recognition, and the data statistics also show an obvious concentration trend.

Specifically, Binance performed the best, with 63.15% of respondents storing their largest positions there, which shows that Binance has a very high market share and trust among users, and has accumulated a considerable number of loyal users.

Secondly, OKX is also an exchange chosen by many respondents, with 25.30% of respondents storing their largest positions there.

In addition, other exchanges such as Gate.io, Bitget, Bybit, etc. account for a relatively small proportion of users, but still have their specific user groups.

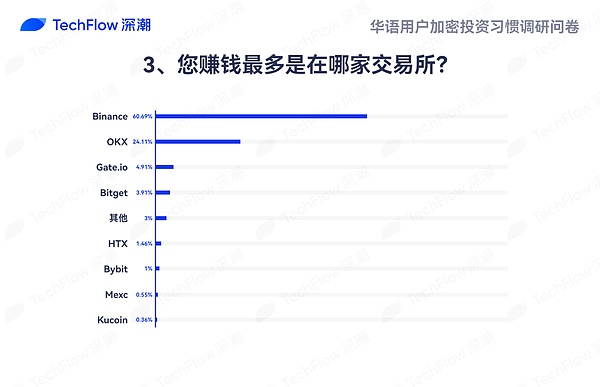

3. Exchanges where respondents made the most money:

In this questionnaire survey, we conducted a detailed statistics of the exchanges where respondents made the most money. This option aims to understand the profitability that exchanges bring to respondents. The data also shows a clear concentration trend.

Specifically, Binance is the exchange where respondents made the most money, with 60.69% of respondents making the highest profits here, which shows that Binance not only dominates the market share, but also provides users with significant profit opportunities.

OKX ranked second, with 24.11% of respondents making the highest profits here. Other exchanges performed relatively poorly in terms of user benefits: Gate.io, Bitget, Bybit, HTX, kucoin and Mexc accounted for a relatively low proportion, at 4.91%, 3.91%, 1.00%, 1.46%, 0.36% and 0.55% respectively.

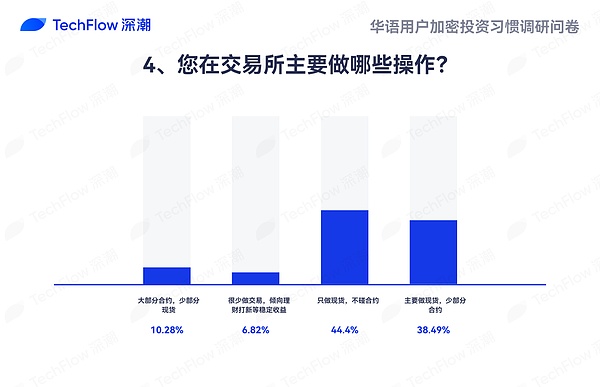

4. Respondents' main operations in exchanges:

In this questionnaire survey, we conducted a detailed statistics of the respondents' main operations in exchanges. Specifically:

The proportion of the option "only doing spot, not touching contracts" was 44.40%, which shows that nearly half of the users tend to adopt a stable investment strategy, focus on the spot market, and avoid high-risk derivatives transactions.

The option of "mainly doing spot trading, a small number of contracts" accounts for 38.49%, which shows that there are still a large number of users who hope to obtain additional income through contract trading on the basis of maintaining stable investment.

The option of "mostly contracts, a small number of spot trading" accounts for 10.28%, and they prefer high-risk and high-return trading models.

The option of "rarely doing transactions, preferring stable returns such as financial management and new listings" accounts for 6.82%, and they prefer conservative investment strategies.

Overall, spot trading is still the main operation method for most users, accounting for more than 80% (including the first two options), which shows that a considerable number of users value stable returns more and rarely participate in high-risk contract trading.

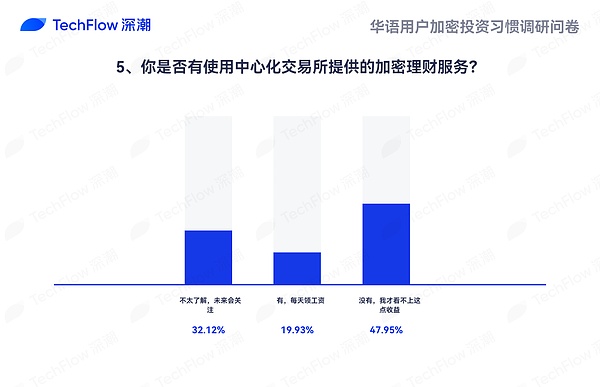

5. Do the respondents use the encrypted financial management services provided by centralized exchanges:

In this questionnaire survey, we conducted a detailed statistics on whether the respondents use the encrypted financial management services provided by centralized exchanges. Specifically:

47.95% of the respondents chose: No, I don’t care about this little bit of income. This shows that nearly half of the respondents believe that the financial management service income of the exchange is not enough to attract them to participate.

32.12% of the respondents chose: I don’t know much, and I will pay attention to it in the future. This part of users currently have little understanding of financial management services, but they may pay attention to and try to use them in the future. Exchanges can attract these users by strengthening publicity and education.

19.93% of the respondents said: Yes, they get paid every day. These users are already using the financial services of the exchange and earning passive income by receiving daily income.

6. Exchange marketing activities participated by the respondents:

In this questionnaire survey, we conducted a detailed statistics of the exchange marketing activities participated by the respondents. This question is a multiple-choice question. Each respondent can freely choose multiple options. The proportion of each option is as follows:

In general, the distribution of exchange marketing activities participated by the respondents is relatively even.

The option of listing coins/new stocks has the highest proportion, with 57.53% of the respondents choosing this option, which reflects that many users pay close attention to emerging projects, are willing to actively participate in newly listed crypto assets and investment opportunities, and hope to obtain potential benefits by participating in early projects.

Followed closely by mining activities and airdrop activities, it is worth mentioning that the data of mining activities and airdrop activities are very close, with a penetration rate difference of only 0.18%. In addition, the options of registration and referral rewards also have a high proportion, while other exchange marketing methods account for a low proportion.

Some respondents also said that they never participate in any activities, with 16.01% of the respondents choosing this option.

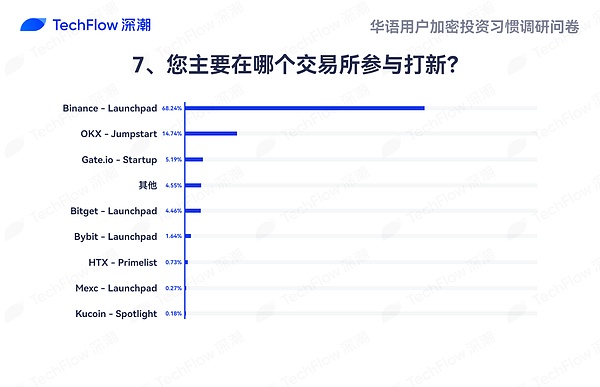

7. Participation of respondents in new IPOs on exchanges:

In this questionnaire survey, we conducted a detailed statistical analysis of respondents' participation in new IPOs on exchanges:

68.24% of respondents chose Binance's Launchpad platform. This shows that Binance's Launchpad has an absolute leading position in the issuance of new projects and has become the preferred exchange for most users to participate in new IPOs.

14.74% of respondents chose OKX's Jumpstart platform, which is far behind Binance, but still has a slight advantage over other exchanges. Other exchanges each have only a small market share.

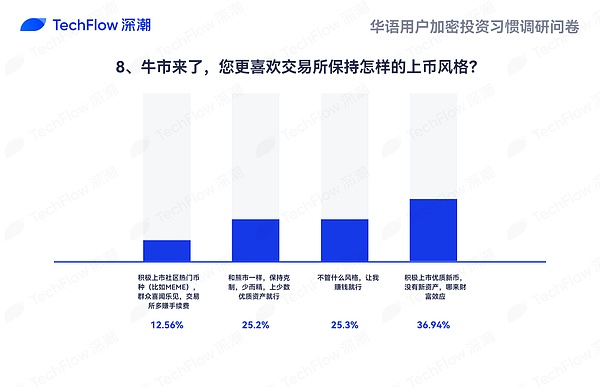

8. The style of listing on exchanges preferred by respondents:

In this questionnaire survey, we conducted a detailed statistics on the styles of listing on exchanges preferred by respondents:

36.94% of respondents like: actively listing high-quality new coins. Without new assets, there is no wealth effect. This part of users hopes that exchanges can actively discover and list high-quality new projects to meet users' investment needs for emerging assets.

25.30% of respondents like: no matter what style, as long as I make money. This part of users is more concerned about profit results, and not too concerned about specific exchange listing strategies.

25.20% of the respondents like: Just like in a bear market, keep restraint, keep it small and good, and list a few high-quality assets. This part of users pays more attention to the quality of assets rather than the growth of quantity.

12.56% of the respondents like: actively list popular community currencies (such as MEME), which are popular with the public and the exchange earns more commissions. This part of users hopes that the exchange can actively capture market hotspots and achieve a win-win situation between users and exchanges.

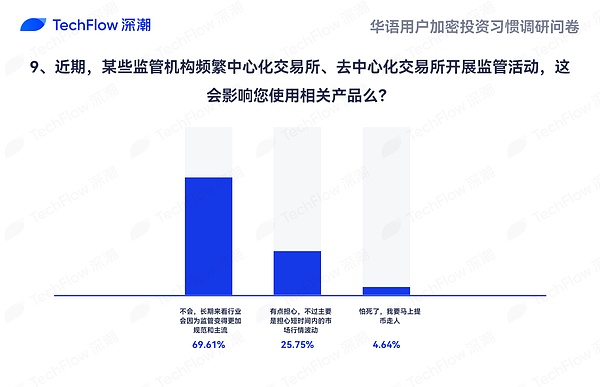

9. Respondents' sentiment towards exchange regulation:

In this questionnaire survey, we conducted a detailed statistical analysis of respondents' sentiment towards exchange regulation:

Most respondents (69.61%) said that regulatory factors would not affect their preference for using a certain exchange, which also means that investors are gradually becoming desensitized to the regulatory actions of various governments.

25.75% of respondents are cautious about regulation, mainly worried about short-term market fluctuations.

Only 4.64% of respondents have a greater fear and distrust of regulation and tend to choose to withdraw their coins immediately.

Part 4: Comprehensive and in-depth understanding of investors

In addition to basic information such as gender, age, and education, this survey aims to enter a more real and vivid Chinese-speaking crypto user community. By collecting and analyzing information on respondents' market anxiety, crypto idols, belief in Web3, and considerations of quitting, this survey provides more industry participants with a richer and more three-dimensional perspective, and more deeply presents the diversity and complexity of the Chinese-speaking community.

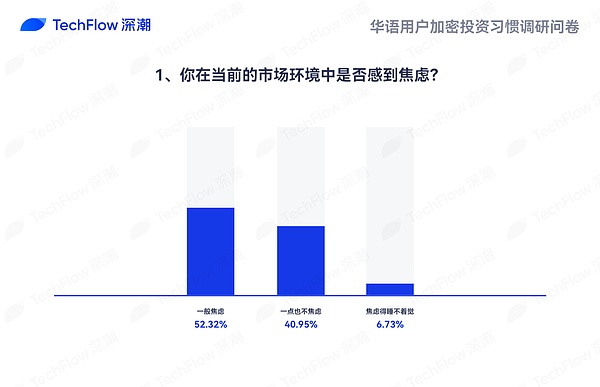

1. Respondents’ anxiety about the current market environment:

In this questionnaire survey, we conducted a detailed statistics on the respondents’ anxiety about the current market environment:

52.32% of the respondents were generally anxious, which shows that more than half of the users have a certain degree of anxiety in the current market environment, but this anxiety is still within the controllable range and has not seriously affected their daily lives.

40.95% of the respondents were not anxious at all, and these users showed strong psychological tolerance and market adaptability.

6.73% of the respondents were so anxious that they couldn’t sleep, and this proportion was relatively small.

In general, the current market environment does bring different degrees of anxiety to most users, but the anxiety is generally controllable.

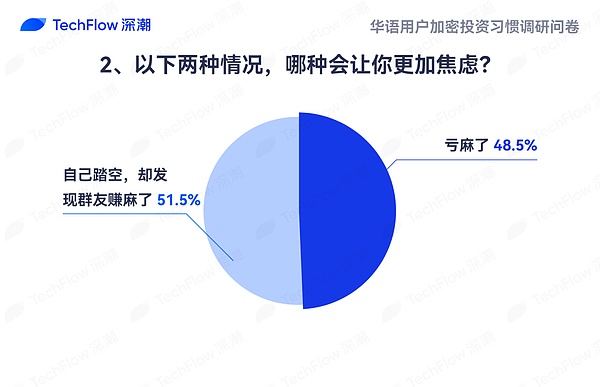

2. Anxiety factors of respondents:

In this questionnaire survey, we conducted a detailed statistics of the anxiety factors of respondents:

51.50% of respondents said that "I missed the opportunity, but found that my group friends made a lot of money" would make them more anxious. This shows that most users are more susceptible to "relative returns", and this psychological tendency of social comparison may aggravate their anxiety.

48.50% of respondents said that "losing money" would make them more anxious. This part of users is more concerned about their own "absolute returns" and is more sensitive to their own loss results.

3. Respondents’ metaphysical tendencies:

In this questionnaire survey, we conducted a detailed statistical analysis of the respondents’ metaphysical tendencies:

59.96% of the respondents had not engaged in superstitious or metaphysical behavior; 40.04% of the respondents said they had prayed for the God of Wealth to bless them.

This difference reflects the psychological and behavioral characteristics of different investors in dealing with market uncertainties. Some users prefer rational analysis and objective judgment, while others may rely on superstitious or metaphysical behavior.

4. Respondents’ Crypto Idols:

In this questionnaire survey, we collected data on the current respondents’ crypto idols. This question is not mandatory. Interested respondents can fill it out and submit it. We have made a word cloud display based on the frequency of mention.

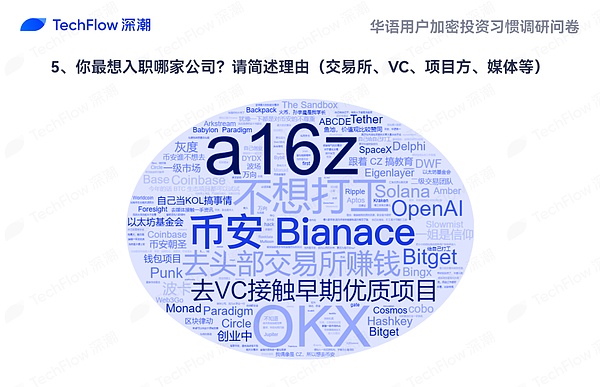

5. The Web3 companies that respondents most want to work for and their reasons:

In this questionnaire survey, we collected data on the Web3 companies that respondents most want to work for. This question is not mandatory. Interested respondents can fill it out and submit it. According to the frequency of mentions of each company in the feedback, we made a word cloud display.

In the collected feedback, exchanges are the type of companies that respondents most want to work for. Most people believe that exchanges gather high-quality information resources and can get in touch with some wealth codes earlier. Among exchanges, Binance has the highest mention rate. The reasons for the respondents to join Binance include but are not limited to: high salary in the top exchange; exposure to early opportunities to make a fortune; top Chinese influencers; want to work with a top female celebrity; the peripheral products are very good, etc. Secondly, OKX, as another mainstream Chinese exchange, was also mentioned with a high frequency. Many respondents expressed affirmation of OKX's product experience and information aggregation, and believed that OKX has more recruitment opportunities for Chinese.

In addition to exchanges, VC and crypto media are the other two types of companies that the respondents are very interested in joining. Most of the opinions believe that: VC can grasp the hot spots of the primary market and can contact a large number of excellent developers and industry innovators; and the media can contact the most cutting-edge information. Working in the media can also cultivate rigorous, scientific, and systematic project research methods and produce high-quality content.

It is worth mentioning that perhaps because of the atmosphere of distributed office in the Web3 industry and the influence that most respondents are not full-time cryptocurrency traders, many respondents also reported interesting opinions such as not wanting to work, starting their own business, and becoming a KOL to realize their knowledge.

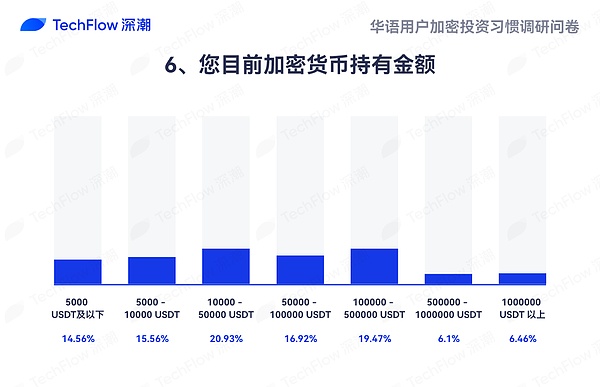

6. Amount of cryptocurrency held by respondents:

In this questionnaire survey, we conducted a detailed statistics on the amount of cryptocurrency held by respondents: the highest proportion of options is 10,000-50,000 USD, accounting for 20.93%, followed by 100,000-500,000 USD, 50,000-100,000 USD, the three cumulatively accounted for 57.32%...

The lowest proportion of options is 500,000-1 million USDT. In general, the amount of cryptocurrency held by respondents is widely distributed, ranging from small investors to large-scale fund holders.

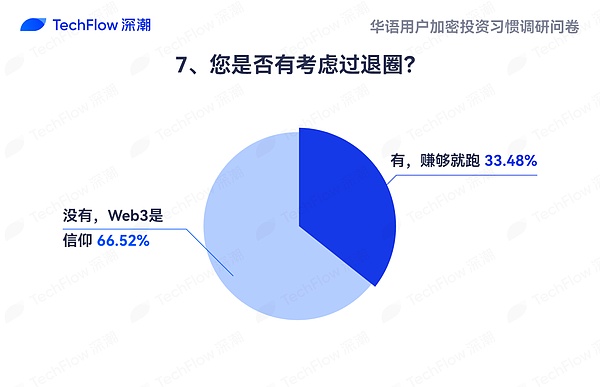

7. Respondents' Considerations of Withdrawing:

In this questionnaire survey, we conducted a detailed statistics of respondents' considerations of withdrawing:

In general, most respondents (66.52%) have not considered withdrawing. They have a strong belief and confidence in Web3 and tend to regard Web3 as a long-term investment and career development direction.

However, 33.48% of respondents said they had considered withdrawing. These users may pay more attention to returns and will consider withdrawing once the target returns are reached.

This difference reflects the psychological and behavioral characteristics of different investors when facing the uncertainty of the Web3 market. Some users are full of confidence and idealism in Web3, while others focus more on short-term gains and pragmatic considerations.

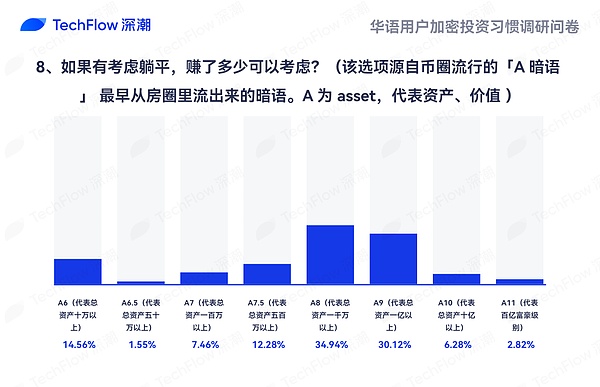

8. Respondents' expectations of lying flat:

In this questionnaire survey, we conducted a detailed statistics on how much respondents had to earn before considering lying flat:

Among all options,A8 (representing total assets of more than 10 million) accounted for the highest proportion, at 34.94%; A6.5 (representing total assets of more than 500,000) accounted for the lowest proportion, at 1.55%.

In general, respondents had large differences in the total asset target amount required for "lying flat", ranging from 100,000 to 10 billion. However, more than one-third of the respondents (39.22%) believe that the total assets need to reach more than 100 million, and more than two-thirds of the respondents (74.16%) believe that the total assets need to reach more than 10 million before considering lying flat, which reflects that most users have a high pursuit of financial freedom and quality of life.

Wright’s lawyers countered that the Cryptocurrency Open Patent Alliance could not provide direct evidence that Wright was not Satoshi Nakamoto.

JinseFinance

JinseFinanceA recent study unveils a surprising trend in Norway, where less than 1 in 10 individuals show interest in investing in cryptocurrencies. Intriguingly, men are twice as likely to consider crypto investments compared to women.

Joy

JoyThe decentralized exchange holds over $390 million in locked tokens as of Tuesday.

Coindesk

CoindeskDid a fake Satoshi infiltrate traditional finance and even find their way into an SEC meeting?

Bitcoinist

BitcoinistAs preference and use for cryptocurrency and blockchain increases, several countries are devising numeral measures to fit into the industry. ...

Bitcoinist

BitcoinistThe popularity of blockchain technology and cryptocurrencies is growing significantly every day. As more individuals become aware of this innovative ...

Bitcoinist

Bitcoinistearn it

链向资讯

链向资讯Flow announced the launch of a USD 725 million ecological fund, which will focus on games, infrastructure, DeFi, and content and creators, aiming to provide Flow ecological projects and developers with product development, product expansion, team expansion, and user acquisition. and general operational support.

链向资讯

链向资讯What is the essence of X to Earn? Does everything really need to Earn?

链向资讯

链向资讯The first PFP NFT project in Europe uses a 3D scanner to scan all NFT holders and let them enter the Metaverse.

Cointelegraph

Cointelegraph