Ethereum News: Ether Mega Whales Accumulate $300M During Weekend Dip as ETF Inflows Surge

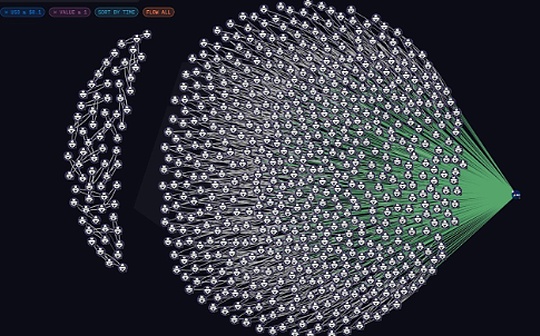

Key Takeaways:Ether (ETH) “mega whales” continued aggressive accumulation during the weekend price dip.A single address reportedly bought $300 million worth of ETH via Galaxy Digital OTC.BlackRock’s Ethereum ETF has seen 10 consecutive days of inflows, totaling $1.7 billion.Ether whale address count has increased by over 200 since July, per Glassnode.ETH dipped below $3,400 but recovered to $3,560 by Monday.Ether (ETH) continues to attract major institutional and whale interest, with blockchain data showing substantial accumulation through the weekend market dip. According to Arkham Intelligence, one whale address alone acquired $300 million in ETH via over-the-counter (OTC) trades at Galaxy Digital, and now holds 79,461 ETH worth approximately $282.5 million.The aggressive buying comes amid sustained inflows into Ether-based exchange-traded products (ETPs), led by BlackRock’s iShares Ethereum Trust, which has seen $1.7 billion in inflows over the past 10 trading days. Data from Dune Analytics shows a 40% surge in on-chain ETH holdings by ETFs over the last 30 days.Whale Addresses on the RiseOn-chain analytics firm Glassnode reports that the number of “mega whale” addresses — wallets holding over 10,000 ETH — has increased by more than 200 since early July. This includes wallets associated with custodians, exchanges, and ETPs, indicating growing institutional demand.The increase in whale accumulation reflects a broader trend of confidence in ETH ahead of potential regulatory clarity and further inflows from traditional finance.ETH Price Rebounds After Weekend DipEther’s price briefly dropped below $3,400 over the weekend before rebounding to $3,560 on Monday. Market sentiment was initially rattled by soft U.S. labor data, which sparked fears of a broader risk-off trend. However, expectations of monetary easing could shift momentum back in favor of crypto.“The cooling labor market initially spooked investors, but rising odds of rate cuts could reverse the sell-off,” said Monika Mlodzianowska, Director of Strategic Partnerships at CoinW Exchange. “Liquidity tailwinds may return to crypto markets in the coming weeks.”August Historically Bearish for ETH, but Bullish Setups EmergingEther has posted losses in each of the last three Augusts, with double-digit drops in 2023 and 2024, per CoinGlass. However, during the 2021 bull market, ETH surged 35.6% in August, offering a reminder that macro conditions and sentiment can dramatically shift monthly patterns.Meanwhile, Eric Trump, son of U.S. President Donald Trump, urged his followers on X (formerly Twitter) to “buy the ETH dip” over the weekend — adding a political twist to the narrative. CNBC also spotlighted Ethereum, calling it “Wall Street’s invisible backbone” in a Saturday article, underscoring rising institutional recognition.Will Institutional Demand Offset Historical Seasonality?As Ether enters a historically weak month, the market is watching whether whale accumulation and ETF inflows can sustain momentum. With over $3.7 trillion in digital asset market cap still intact, institutional conviction appears strong — even as price action remains volatile, according to Cointelegraph.