Just last night, the two most popular currencies on Binance Alpha, ZKJ and KOGE, both crashed, plummeting 80% in just two hours, and the pin-shaped drop shocked the market. As the token with the largest trading volume on BSC on Binance Alpha, the holders suffered heavy losses. In the two hours of that night, ZKJ's liquidation reached 94 million US dollars, and users who had previously participated in Alpha's score-brushing also fell into panic, with an average loss of more than 800 US dollars, far greater than the average amount of their own human score-brushing airdrops.

In response to this, the market once again sounded accusations against Binance Alpha, stimulating user transactions through an arms race, but ultimately making users the liquidity receivers of LP exits. Is Binance wrong?

To talk about this incident, we have to start with Binance's new section Alpha. On December 17, 2024, Binance officially launched Binance Alpha. At the beginning of its creation, it was just an experimental function in the Binance Web3 wallet. From the perspective of functional division, users need to transfer assets to the wallet to participate in transactions and separate from Binance CEX, which also reflects the strategic positioning from the side. The function is expected to be led by the Binance team to discover, and the community and users recommend projects with development potential, and include them in the Alpha pool for display and on-chain transactions, and finally decide whether the project will be launched on Binance through user voting.

With both the words community and potential, it is enough to see that this section is undoubtedly a new channel opened by Binance for relatively small-cap tokens such as MEME. It is also easy to understand why this strategy was innovated at the time. At that time, Binance was facing rounds of accusations for listing coins. VC tokens were publicly boycotted, MEME was found to be less sensitive than other exchanges, and several attempts were questioned by insiders. Web3 wallets, which are based on drainage, could not beat OKX, an old rival. Whether it is for liquidity discovery or building a moat for the business, Binance Alpha is a good choice.

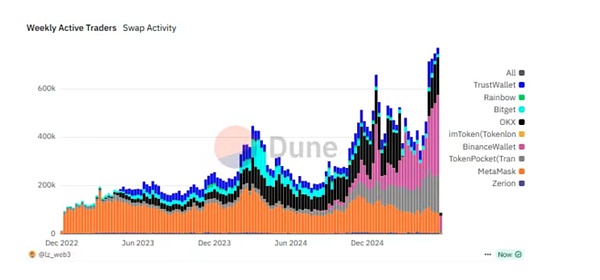

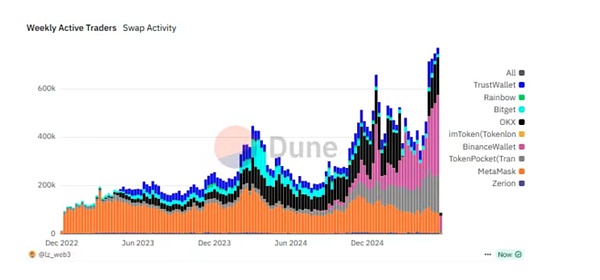

Imagination is beautiful, but ideals are full. After Binance Alpha went online, more than 80 tokens were launched in nearly 2 months. The high listing rate triggered doubts about liquidity pumping. The market did not support the trading volume as expected by Binance. The situation of tokens collapsing as soon as they were launched did not improve, and the Web3 wallets that were highly expected also performed mediocrely. In terms of data, until March 17, 2025, Binance Web3 wallets accounted for only 8.3% of the total transaction volume of all tracked Web3 wallets.

The turning point soon appeared. In March, affected by the changes in the EU regulatory environment, OKX issued a statement to suspend OKX DEX. Restricted users need to find a new entrance. For a time, major wallets competed to attract traffic, and Binance was no exception. In addition to He Yi running around to promote under major KOLs, at the same time, Binance Wallet also launched Binance Alpha2.0, integrating Binance Alpha directly into CEX, breaking through the traffic barriers between CEX and DEX, and users can directly use funds in the exchange for transactions. The benefits from both inside and outside are significant. At the end of March, the proportion of Binance Web3 wallets jumped rapidly from 8.3% to 54.1%. In May, it soared to more than 95%, which is a textbook example of overtaking on a curve.

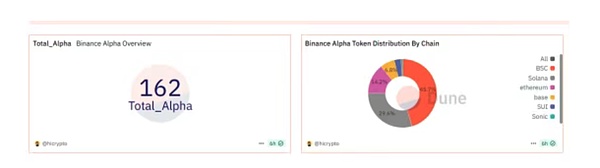

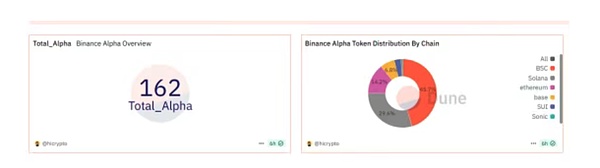

The market share has increased, and the direct benefit is undoubtedly its own ecosystem. As of now, among the 162 coins that have been launched on Alpha, projects on BSC account for 45.7%, followed by Solana, accounting for 29.6%, and Ethereum accounts for 14.2%. In terms of trading volume, 17 of the top 20 currencies in Alpha are BSC native projects. According to the @defioasis data panel, since the launch of Alpha 2.0 in mid-March, as of June 11, Binance Wallet has 39,569 addresses with a transaction volume of more than US$1 million in the BSC network, including 45 addresses with a transaction volume of more than US$10 million, and 1 address with a transaction volume of more than US$100 million.

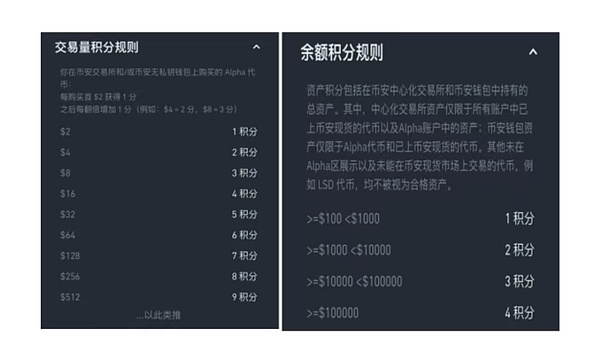

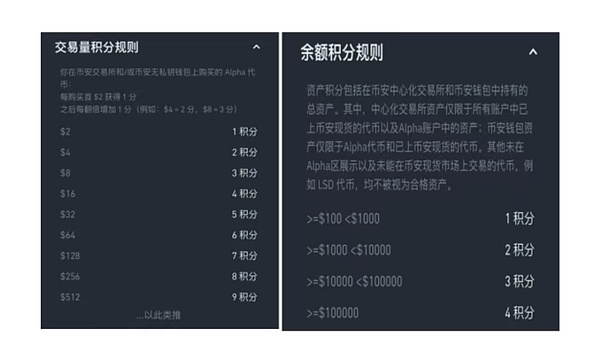

Relying solely on external old rivals to send warmth is still not enough to achieve explosive growth. Among them, the key role is played by the point system launched by Alpha later. Compared with 1.0, Alpha 2.0 adds the Alpha Points point system. This point system calculates points based on the user's asset holdings and trading activities in Binance Alpha and Binance Wallet, which serves as the participation threshold for subsequent activities such as airdrops and TGE. The point system adopts a daily snapshot mechanism with a period of 15 days, that is, the positions and trading behaviors in the past 15 days are examined.

Specifically, the mechanism is highly transparent and has formed a standardized and systematic points mechanism. The balance corresponds to fixed points, and the transaction volume is quantified into standard points. The periodicity also determines that users cannot do it once and for all, and need to continue to invest to maintain the level of points. In other words, this is more like a daily task, and points can only be accumulated after completing the task. For users, standardization means fairness. Even if the amount of funds is relatively limited, users can get points in highly quantified tasks, and thus obtain further project airdrops or TGE subscription shares. But it is worth noting that participation requires a points threshold, and claiming rewards also consumes points. It usually takes 15 points to claim once.

In terms of actual benefits, Alpha users have also experienced a complete cycle of dividends from the beginning to the end. In the beginning, only 45-75 points were needed to obtain an airdrop with a single number value of about 70-100U. If the daily points were 15 points, the points in 15 days could reach 225 points, and several rounds of airdrops could be participated in. Counting the slippage and handling fees of on-chain transactions, if the cost control is good, the return in 15 days can be around 20%-30%. Although the income is not large in the currency circle where the return is often 100 times, it is relatively stable and has the advantage of convenient participation. In this context, in addition to small-cost retail investors, major hair-pulling studios also rushed in. For a time, X began to stage a national score-brushing, and users were immersed in the calculation of wear rate, points, and points threshold all day long.

On the other hand, the project party also has its own little thoughts. Compared with the traditional listing process of Binance, which had a high threshold, Binance Alpha undoubtedly provides a listing path with lower costs, stronger narrative, and more exposure. For most project parties facing liquidity depletion, following the trend is a natural choice. Resources are tilted to the Binance system, additional airdrop shares are donated to Alpha users, higher staking returns and more competitive points competitions are launched, users are induced to increase volume, enhance project exposure and finally promote the launch of the main site. This one-stop service is not uncommon among project parties. Even due to the tilt of airdrop shares, backstabbing of the original community has occurred frequently.

It is in this context that brushing volume and group LP have become the most mainstream scoring methods. Today's protagonists, ZKJ and KOGE, are precisely the best among them. Compared with other trading pairs, this trading pair provides a relatively more substantial LP annualized return, with a daily interest rate of 0.01%-0.035, and the currency value is stable, with small fluctuations, and has the characteristics of low slippage wear and tear. Therefore, it is favored by many Alpha users. The TVL of the trading pair of the two has exceeded 30 million US dollars. In terms of daily trading volume, ZKJ and KOGE are the absolute leaders. Just one day before the crash, the daily trading volume of the two reached 703 million US dollars and 159 million US dollars respectively, accounting for 85.10% of the total trading volume.

However, on the evening of June 15, the two tokens ushered in an epic crash. ZKJ fell from 1.946 US dollars to 0.39 US dollars, and KOGE fell from 61 US dollars to 8.46 US dollars, both falling by 80%, catching the holders off guard.

According to the analysis of the on-chain analyst AI Aunt, the core of this flash crash is the withdrawal and continuous selling of large amounts of liquidity by the three major addresses. The address starting with 0x1A2 withdrew 3.76 million US dollars of KOGE and 532,000 US dollars of ZKJ bilateral liquidity twice in less than 5 minutes from 20:28 to 20:33 in the evening, and then exchanged 45,470 KOGE for ZKJ, worth 3.796 million US dollars, and sold 1.573 million ZKJ in batches. The second largest address starting with 0x078 withdrew about 2.07 million USD of KOGE and 1.38 million USD of ZKJ in bilateral liquidity, and sold 1 million ZKJ at the same time. Finally, address 0x6aD completed the liquidation after receiving 772,000 ZKJ from the second address.

Pool withdrawal + selling, the operation has obvious characteristics of harvesting from fixed-point blasting. The order of pool withdrawal is also strategic. Starting with KOGE, which has lower liquidity and better control, KOGE in hand is gradually replaced with ZKJ, and finally ZKJ is sold in a concentrated manner to complete the withdrawal of funds. From the perspective of the incident itself, Alpha users have undoubtedly become the biggest victims. According to users, due to the plunge of ZKJ, users who panic-sold lost an average of about 800 US dollars. For most users, this has exceeded the income of 10 Binance Alpha airdrops, making previous efforts completely unsuccessful.

From the core point of view, the direct trigger of the plunge is still the mechanism problem. As the number of people who brush points continues to expand, the bonus has also subsided. In June, both the threshold for obtaining airdrops and the output-input ratio have been rising infinitely. From 45 points to 100, from 100 to 200 points, on June 13, the newly launched ROAM requires users to reach 247 points before they can apply for tokens, which means that the daily points need to reach 17 points, with a cost of about 45U, and the total value of the tokens airdropped by a single number is only 60U, which means that after 15 days of hard work, the final profit is only 15U. For users who are diligent in doing tasks every day, it is like a "sweatshop". Affected by this, users have graduated from brushing points. According to Dune data, after reaching a peak of US$2 billion on June 8, Alpha's trading volume has continued to decline, and the daily trading volume is currently less than US$1 billion. In response to the above situation, on June 14, Binance also announced the adjustment of the airdrop distribution mechanism, proposing that the airdrop distribution will be divided into two stages: receiving the standard and first-come-first-served, which also indirectly stimulated the exit of large investors.

From the perspective of the entire incident, the decline in brushing scores led to a decline in trading volume, and the decline in trading volume caused a decrease in yields and a decrease in the probability of listing, which directly prompted LPs with certain backgrounds and unwilling to bear low returns to withdraw from the pool. Subsequently, the tokens were panic-sold, and then both collapsed under the brushing mechanism. In the end, LPs successfully swindled out the liquidity of ZKJ, and retail investors all became victims, especially in the context of KOGE's lack of liquidity and no hedging tools, and the losses were even more severe.

The whole set of mechanisms is not new, and the frequency of occurrence in the crypto market is not low, but it is the first malicious incident to occur on Alpha. This undoubtedly exposes the mechanism problems of Alpha itself. In addition to the lack of necessary risk control design and data verification, the arms race hidden in the mechanism, that is, the false prosperity stimulated by external means such as brushing, is more like drinking poison to quench thirst, and it does not seem to bring practical benefits to the discovery of high-quality projects. In fact, as the initiator, Binance itself may also understand this kind of competition mechanism, and even secretly fuel it. After all, whether there are objections to the project or not, Alpha has really brought active liquidity to Binance.

From a strategic perspective alone, Binance is undoubtedly the biggest winner. The launch of Binance Alpha has in disguise built a small copycat market in Binance, successfully preventing the hot spots of copycat coins from falling by the wayside, and bringing all the cold start of other exchanges and the pricing power of strong capital parties to Binance's own system, and further successfully activated on-chain transactions, once again returning funds to Binance, completing the reinforcement of traffic and capital moats.

However, the victory of the exchange does not mean the victory of the industry. It is not worthy of praise that the project parties rack their brains and the investors work diligently to fight offensive and defensive battles around fake data all day long. If there is a ZKJ, there will be the next ZKJ. The seemingly peaceful and win-win risk isolation zone will eventually become a hunting ground for large-scale fixed-point harvesting without proper control and supervision. In this regard, Binance, which is hesitating between market share, trading volume and handling fees, may have to take action.

At present, in response to the ZKJ and KOGE incidents, Binance has issued an announcement stating that from 08:00 (UTC+8) on June 17, 2025, the trading volume of trading pairs between Alpha tokens and Alpha tokens will no longer be included in the effective trading volume statistics of Alpha points.

JinseFinance

JinseFinance