Source: Sina Finance

CEIBS held the fifth "CEIBS Beijing Forum" in Beijing on July 10. Zhu Yunlai, former president and CEO of CICC and visiting professor of management practice at Tsinghua University, delivered a keynote speech. The following is the transcript of the speech.

Zhu Yunlai's latest speech

Thank you CEIBS for inviting me to attend this symposium. When communicating with Secretary Ma Lei, I mentioned that "CEIBS" means that neither China nor Europe can be removed. This is a long-term necessity. Now that geopolitics is becoming more and more complicated, the friendship between the Chinese and European people must remain. CEIBS has also been active at the forefront of education and economic development along with reform and opening up.

The school has raised the topic under the current situation: What strategies should enterprises adopt under the reconstruction of the global economic and trade pattern? I am fortunate to participate in this discussion and put forward some thinking angles. From a macro and long-term perspective, let's take a look at what factors should be considered in order to systematically understand the possibilities of future development directions.

First, let's examine the context of world development from a historical perspective.

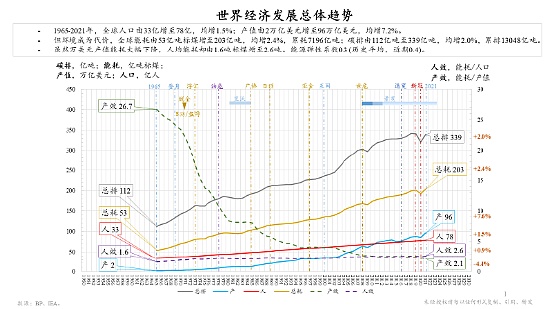

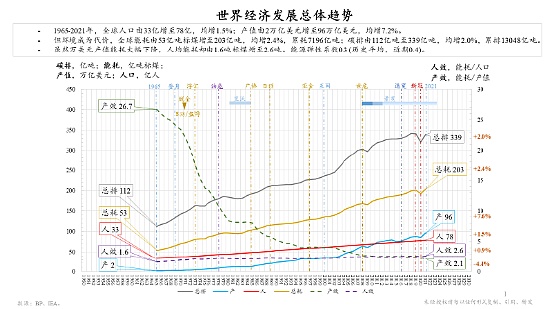

It has been 80 years since the end of World War II in 1945. Looking back, the First World War broke out in 1914, and more than 110 years have passed this year. Through this long cycle, the overall trend of global development is clearly visible: the blue line represents output value and the red line represents population. It can be found that the global population continues to grow, while the economic and production development speed is more rapid, especially in recent decades. But at the same time, energy consumption continues to rise, and the emission problem becomes more prominent-the current global annual carbon dioxide emissions are close to 40 billion tons, which is a reality we must face up to. The dimension worthy of attention is the change in energy efficiency: although the energy consumption per unit of output value has achieved a systematic decline, the per capita energy consumption is still growing. This is determined by the basic model of global development.

From historical data, the global population growth rate is about 5% per year, and the nominal GDP growth rate is 7% per year; if the inflation factor of 3%-4% is deducted, the real economy is about 3% per year. These data not only reveal long-term trends, but are also key development variables at our current stage.

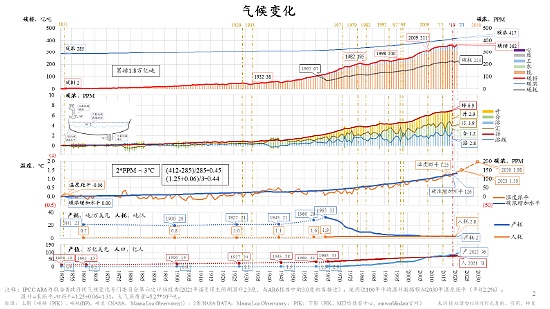

Climate Change

Another issue that needs to be focused on is climate change.

Records of climate change can be traced back to 1850. To make it easier for everyone to establish a time connection, you might as well refer to such a node: In 1851, the world's first industrial exhibition was held in London. This event marked the beginning of the modern industrial era, which is not far from the starting point of climate records.

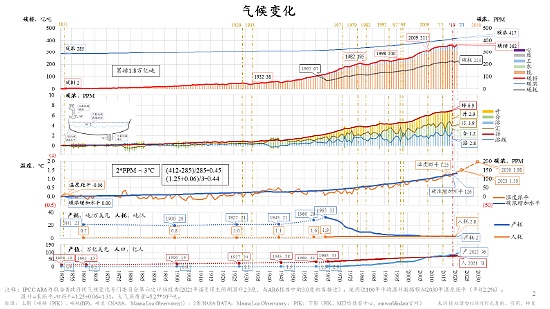

From the data, the red curve in the top figure represents the total annual carbon dioxide emissions, and the blue curve is the concentration of carbon dioxide in the atmosphere (in PPM). At the beginning of the record, the concentration of carbon dioxide was about 285PPM, and now it has exceeded 400PPM, an increase of 50% over the initial level. The direct consequence of this increase is global warming - the change in global average temperature shown by the orange curve in the third figure in the middle is almost completely synchronized with the rising trend of carbon dioxide concentration.

The scientific community has clearly concluded that if the global carbon dioxide concentration doubles compared to before the industrial revolution, the global average temperature will rise by 3℃. The current concentration has increased by 50%, which is exactly half of the "doubling", and the actual temperature has risen by about 1.5℃, which is highly consistent with the theoretical inference. The World Meteorological Organization has pointed out that if carbon dioxide emissions are not reduced, the global average temperature may rise by 3℃ by 2030, which is twice the current level; that is to say, the temperature rose by 1.5℃ in the past due to a 50% increase in concentration, and if emissions are left unchecked, it will rise by another 1.5℃ in the future.

This change is fundamentally different from the climate fluctuations in history. Although the earth has experienced alternations between ice ages and warm periods in history, and the temperature fluctuations have even exceeded 1.5℃ or 3℃, those changes were dominated by natural factors - such as the periodic deviation of the earth's orbit, and the alternation of cold and warm caused by this is often on the scale of thousands of years. The current climate warming has completely different driving factors and consequences: if the root causes of human emissions are not eliminated, the trend of rising temperatures will be difficult to reverse and there is no possibility of natural recovery.

If we develop the economy in the hope of living a better life, facing such climate problems, if we do not solve them, this earth may become an unsuitable place for survival, and even homes will be gone. This is a problem that cannot be ignored; but historically, the EU is an important participant in actively promoting climate governance and reducing carbon emissions. Unfortunately, perhaps because of the sluggish economic development, its attitude is a bit vague at present. The climate issue should still be an aspect that needs to be considered in cooperation between us and even all countries in the world.

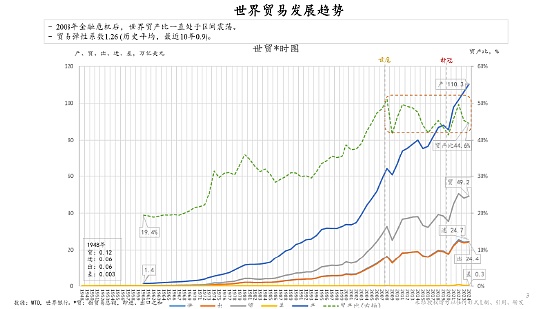

Next, let's take a look at the evolution of the global economic and trade landscape.

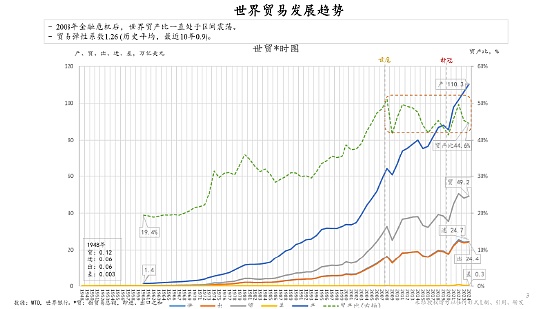

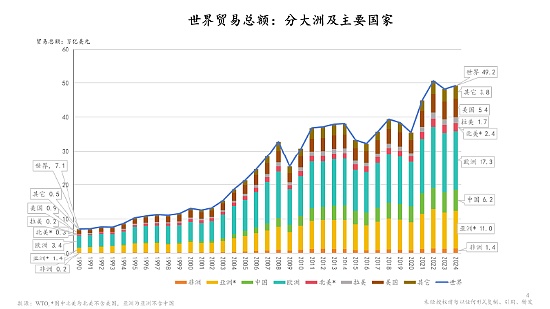

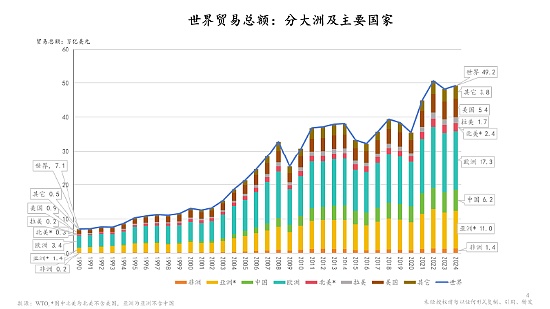

From the perspective of the total global trade volume (the sum of exports and imports), the current figure has reached 49.2 trillion US dollars, with exports and imports roughly accounting for half each. The statistical method of adding imports and exports is adopted because for countries participating in trade, exports and imports are both important components of their economic activities, which can more comprehensively reflect the degree of interaction in the global economy. Looking back to the 1960s to the present (data for this period are relatively easy to obtain), the scale of global trade has achieved substantial growth; if we look at the proportion of total trade to world economic output, it has increased from about 20% at the time to nearly 50% today, which shows that trade has always developed in tandem with the global economy.

However, global trade experienced a period of rapid growth after 2000, until the 2008 global financial crisis, when the momentum of simultaneous expansion of trade and output seemed to have encountered a bottleneck. The causes of this change are worth exploring, even when we focus on discussing the future.

From the regional composition of global trade, if it is divided into Africa, Asia (including China, that is, China and other parts of Asia together form the complete Asian plate), North America (including the United States) and Europe, observing the economic changes in the past 30 years or so may provide clues for future development. This data not only presents the current pattern, but also implies the process of its formation - its core value is to help us refine the basic characteristics and then think about the actions that can be taken.

From the perspective of relative proportion, Europe still accounts for a large share of global trade; although China's trade scale is already considerable, it is still different from Europe; at the same time, the trade volume of other parts of Asia is about twice that of China. Clarifying the proportional relationship of these values will provide an important reference for our subsequent analysis.

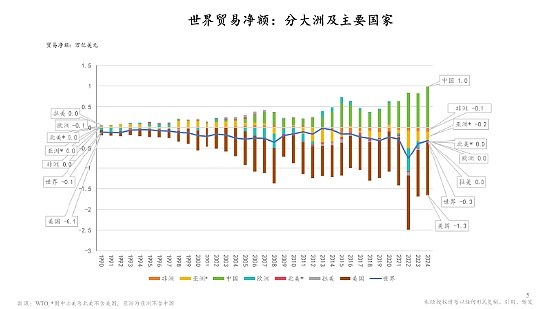

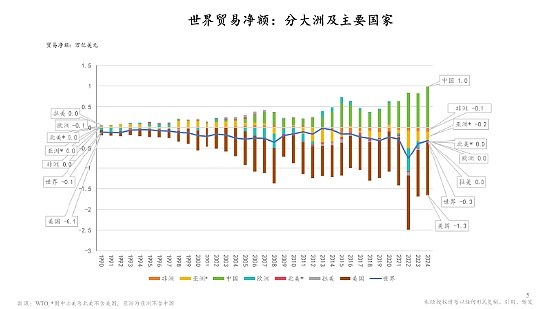

From the perspective of net trade, countries above the zero axis are net exporters (trade surpluses), and countries below the zero axis are net importers (trade deficits). Data show that since the 1990s, the trade structure between Europe, Asia and the United States has changed significantly over time, and China's trade surplus has shown a systematic growth. As of the latest statistical year, China's trade surplus reached 1 trillion US dollars, while the US trade deficit was 1.3 trillion US dollars, and the difference between the two was 0.3 trillion US dollars - this value is exactly the same as the overall global trade deficit. This means that if the trade balance between China and the United States is excluded, the trade in other parts of the world is basically in balance. The cause of this structural feature is worth exploring in depth: the US trade deficit problem has a long history, and despite repeated trade frictions and continuous discussions, the scale of the deficit is still expanding.

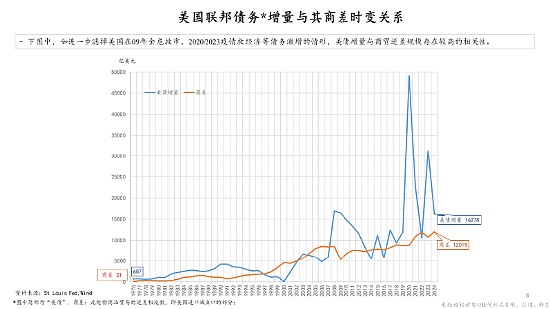

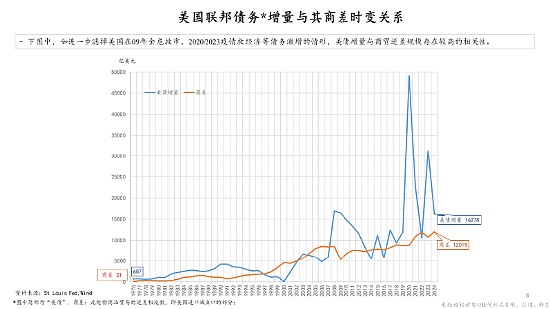

Regarding the issue of the US trade deficit, my initial analysis was that the US has maintained a long-term surplus in service trade, which is a net export state, and its overseas investment income (such as dividends, interest, etc.) has also formed a surplus. From the perspective of the balance of payments, these two items should have offset the deficit in goods trade to a certain extent. But the actual situation is that their scale is far from enough to cover the gap in goods trade. Later, I noticed a set of data that is more worthy of attention: the annual increase in the US debt balance continues to expand, which directly reflects the systematic increase in its overall debt level represented by the federal government debt. Although the fluctuation of the debt scale may be affected by many factors, the bottom line of the new debt (that is, the annual minimum increase) has been continuously raised, and this trend is far more symbolic than short-term fluctuations.

We can't help but think: Why can the US debt continue to increase? This may be closely related to its representative system of congressmen - the dispute among congressmen over the debt ceiling is essentially a discussion on whether to meet the growing payment needs, and behind this demand is the protection of the interests of their respective voters. Although this clue is not enough to fully explain the root cause of the rising debt, it at least reveals a phenomenon: public procurement (including transfer payments to residents), which accounts for a large proportion of the federal government's borrowing, may drive the debt level to continue to rise.

The demand behind this debt growth may also reflect the balance of interests of different groups in the internal economic structure of the United States. At the same time, since the reform and opening up, China has continuously upgraded its industry and manufacturing capabilities with its export-oriented strategy, and has gradually become an important supplier in the global supply chain. In fact, the United States has always played the role of the demand side, but has shifted its choice of suppliers based on the principle of purchasing the best products at a good price. From the perspective of economic logic, this choice is a trust in supply capacity. On the other hand, producers selling to the United States is a trust in its ability to pay. If the United States lacks the ability to pay, there will be no continuous import of goods. This supply and demand relationship also reflects the interdependence in geo-economics from the side.

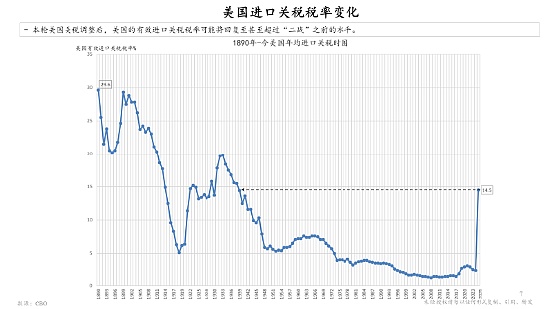

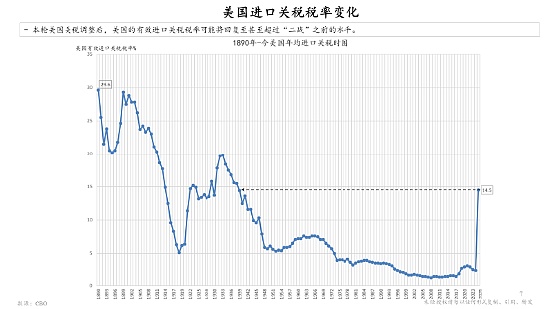

From the long-term historical trajectory of US import tariffs, the changes since 1890 are quite revealing: from 1890 to the 1980s and 1990s, the US tariff level showed a systematic downward trend, which happened to be accompanied by its vigorous economic growth and became a landmark development process. In the early days of China's reform and opening up, the United States' lower tariff barriers actually opened up its import market to the world, providing opportunities for capable suppliers, including China, to provide exports to boost the economy.

However, the current tariff policy has shown a significant reversal trend, as if it has returned to the protectionist model of sixty or seventy years ago or even earlier overnight. Can this policy shift really bring the expected benefits? In fact, the essence of trade is voluntary transactions, not compulsory behavior. If you want to attract manufacturing back to China by simply raising tariffs, it completely ignores the difficulty of rebuilding a complex supply chain system in the short term, and it is also questionable whether market players have enough willingness to respond.

In comparison, the actual effect of this tariff policy is more like a continuation of the "America First" tax reduction policy - rather than being able to achieve goals such as industrial repatriation, it is more like serving a specific policy logic and interest groups.

The demand for the expansion of the US debt scale always exists, and the tax reduction policy is inherently contradictory to this demand - although tax reduction is in the interests of business owners, the rigid pressure on public spending has not been reduced. In this context, the imposition of tariffs is more like a replacement of the source of policy funds: it is hoped that the social responsibilities that domestic enterprises should bear will be transferred to foreign importers, thereby "reducing the burden" for local enterprises.

This policy sends a signal to voters that "the cost is borne by foreign countries", but the reality is obviously not the case: the ultimate bearer of tariffs is actually American consumers. Once tariffs are raised, the price of imported goods will most likely eventually rise, and American consumers will pay for it. What is more noteworthy is that American domestic companies may also take the opportunity to follow suit and raise prices. Since profits can be maintained without technological innovation or efficiency improvement, companies naturally lack the motivation to improve, and all costs will eventually be passed on to consumers. As for whether consumers can see the chain of interests behind this policy, it may take time to give an answer.

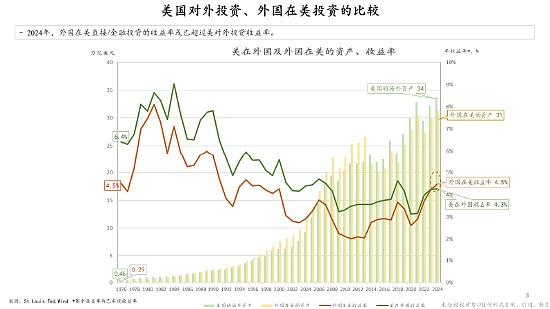

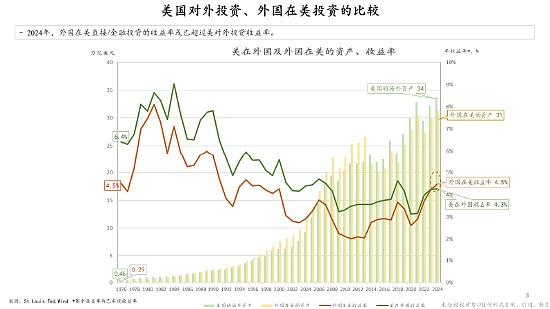

This chart shows the stock of US overseas assets and their yields from 1976 to 2024, compared with the stock and yields of foreign investments in the United States. Data shows that the United States' overseas investment has maintained a high rate of return of 5%-10% for a long time, which is consistent with the global competitiveness of US investment institutions - its extensive global layout and strength foundation do support its ability to make more complex or high-risk investments, thereby obtaining higher levels of returns. In contrast, the return on foreign investment in the United States is slightly lower, but the trend of change is highly consistent: around the 1980s, the average return on both types of investment was around 8%-9%, but now it is showing a systematic decline. This phenomenon of declining return on investment on a global scale may have given us a glimpse of future trends and also reflects a systematic historical trajectory. It is worth thinking about whether this decline is related to overly aggressive growth policies? When the scale of policy stimulus continues to expand, marginal efficiency will inevitably decline, which may be one of the important reasons for the decline in returns.

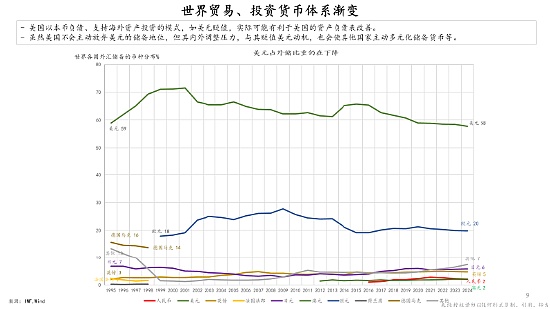

Let's talk about the currency issue again.

Combined with the growth trend of major global economies mentioned above, China's industry has undergone nearly half a century of systematic development and should have more opportunities in the currency field. From the perspective of trade practice, one of the core functions of currency is the medium of payment - it can be paper money, metal currency, or specific currencies such as the US dollar and the RMB. It is essentially an intermediate carrier in the transaction process: selling goods to collect money, and then using the money to buy consumer goods or production materials to complete the closed loop of value exchange.

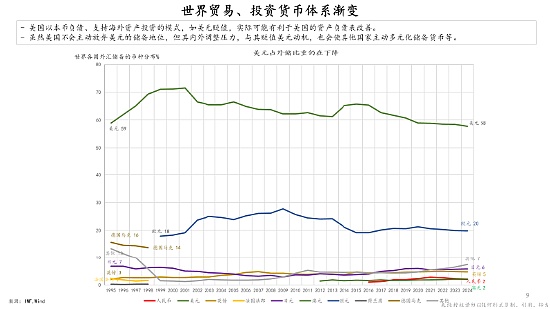

From the current currency distribution of global foreign exchange reserves, the US dollar accounts for about 50%, while currencies such as the euro, pound sterling, and yen show a "big, mostly small" echelon feature, that is, the remaining currencies except the euro account for less than 10%. This pattern triggers thinking: From the perspective of global trade, where will the future settlement currency system go? What is more noteworthy is that in recent years, currency has gradually become a geopolitical tool - the currency of any country is deeply bound to its own economic policy, and the spillover effect of the policy will be transmitted to the world through currency transactions: when you use a country's currency for cross-border transactions, its domestic policy fluctuations may directly affect your interests.

Especially during the current US government, policy uncertainty has increased significantly, and it is not ruled out that it has deliberately amplified the volatility of system expectations. The essence of currency is the credit system, and "national credit is the core of modern legal currency", which relies on certainty - if the value of currency fluctuates, it will be difficult for the transaction subject to plan, which is contrary to the credit logic of trade. For example, in the early days of reform and opening up, the Japanese yen fluctuated violently (appreciating sharply and then depreciating rapidly), which caused many production and trading companies to suffer heavy losses. This also shows that "currency stability" itself has become a systemic requirement for the normal development of trade. In this context, is the rise of stablecoins coming into being? For trade practitioners, the core demand of currency is stability - avoiding the risk of "receiving US dollars today and depreciating sharply tomorrow". Of course, Mr. Wang is an expert in this field, and I am more from the perspective of trade practice: no matter how the currency form evolves, as long as it can maintain currency stability and reduce the uncertainty caused by fluctuations, it is a choice that meets trade needs.

From a financial perspective, the stable currency I understand should be different from cryptocurrencies such as Bitcoin and traditional legal tender. It is essentially an innovatively designed token. Its core logic is to incorporate various factors that affect the currency value into a framework similar to an "investment portfolio" through a systematic and legal financial market management method, and conduct active and systematic regulation.

The core goals of stable coins are two: one is to maintain currency stability, and the other is to ensure transaction efficiency - such as achieving rapid settlement. This is in stark contrast to the traditional transaction model: in the past, when relying on the banking system, letters of credit (LC) or inter-bank transfers, there were often many frictions due to cross-regional, cross-national and cross-institutional processes, and the design of stablecoins is to break through these limitations.

In the current new era, the market demand for efficient and stable transaction media has become increasingly prominent, and the technical ideas of cryptocurrencies such as Bitcoin have also brought inspiration - people gradually realized that through the management model of combined tokens, they may be able to build a better payment tool. Specifically, a professional financial team is needed to systematically incorporate variables such as price fluctuations into the management system, and ultimately provide an efficient, low-volatility and high-security currency form. This idea has a certain echo with Hayek's monetary theory: currency may not be exclusive to the country, and private individuals may also participate in the supply. The key lies in how to establish and maintain the credit of the value of currency

However, in the current context, stablecoins are still far from "private currencies". A more realistic path may be for a large-scale, highly transparent international institution to issue it, and its operating algorithm must be publicly traceable - this is completely different from the anonymity of Bitcoin. Stablecoins need to establish credibility through "visibility", including clear disclosure of liquidation mechanisms, collateral asset composition, or specific currency value management methods. Ultimately, the value of stablecoins needs to be tested by actual application effects: if they can continue to maintain stability and efficiency, they may gradually become part of the transaction basis of global consensus by virtue of the market effect of "good money driving out bad money".

Development Opportunities

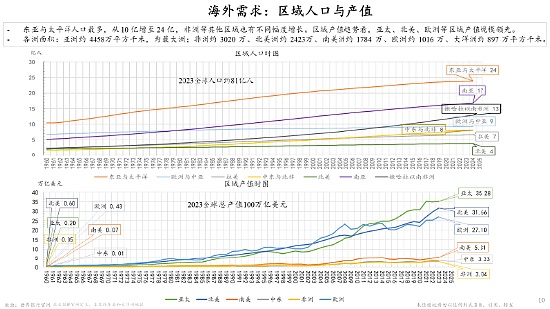

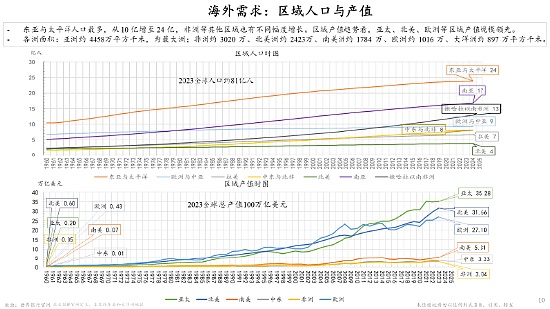

Below, I have organized the population and output data by region, hoping to use this as a yardstick to explore potential development opportunities.

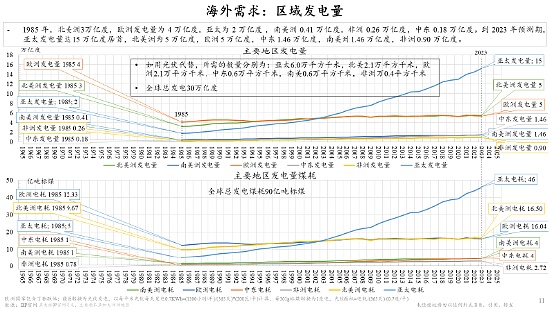

For example, Africa's population has grown from 500 million in the past to 1.5 billion, becoming a market with great potential. Take the photovoltaic industry as an example. Africa originally lacked a stable power supply. The combination of photovoltaic panels and batteries can quickly provide a stable power supply. Its electricity price is only half of that of traditional thermal power, and it achieves zero emissions, which just meets the global demand for "protecting the earth's home". In this field, China not only has rich and competitive products, but also reserves system engineers and technical workers. Facing such a large population base in Africa, we undoubtedly have a broad market space potential.

Although global trade may face bottlenecks, business opportunities still exist. If the current US government's policies force the global supply chain to restructure, China, with its strong production capacity, transportation network and human resources (hundreds of millions of workers and engineers), is still expected to gain an advantage in the restructuring. The key lies in how to systematically exert these advantages. It is worth noting that the logic of market development is similar to that of shopping: consumers are happy to discover new products, but dislike excessive sales by store clerks. Similarly, when promoting products in the global market, it is necessary to avoid rushing for quick results and focus on building long-term trust.

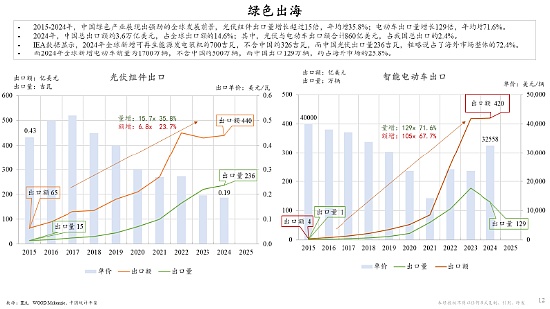

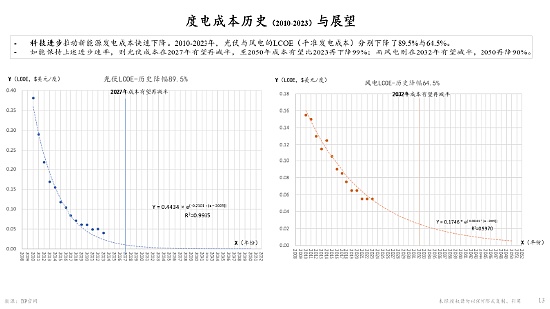

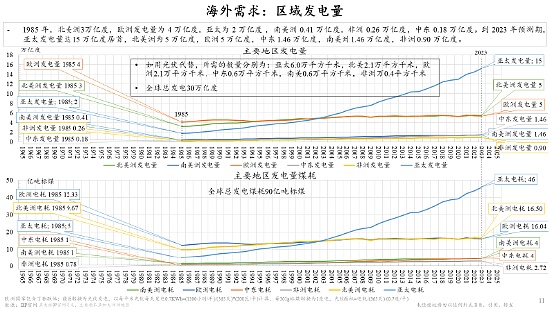

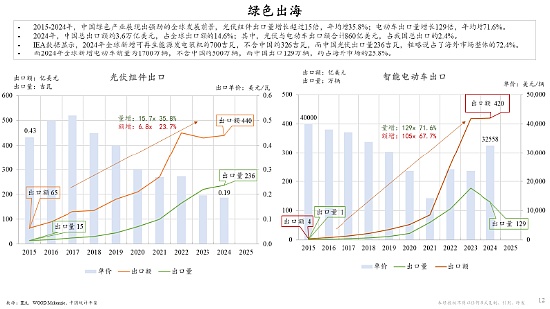

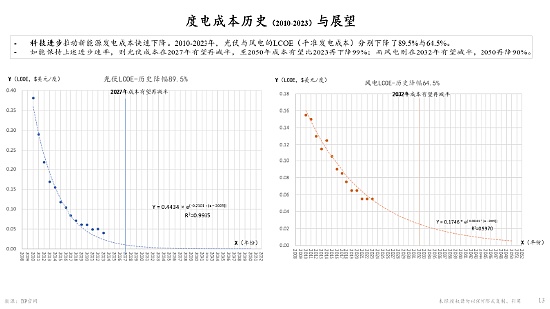

From the historical trajectory and current situation of the new energy industry, the growth potential of its market size is clearly visible. The field of "green overseas expansion" has shown a positive trend: the price of photovoltaic modules has continued to decline, and the export volume has steadily increased; products such as electric vehicles also directly hit the pain points of global development, which not only promotes green transformation, but also meets travel needs more cheaply, which is a rare opportunity. In fact, the cost of these industries has dropped by 70%-80% in the past decade. This cost advantage has laid a solid foundation for further market expansion.

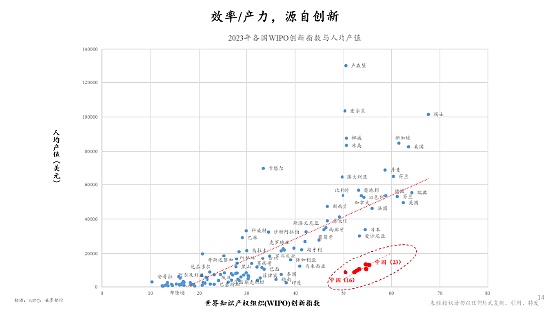

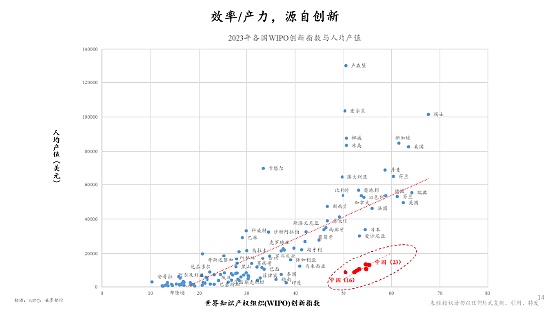

From the perspective of the distribution of global per capita output and innovation index, China's ranking has changed significantly between 2016 and 2023: its efforts in the field of innovation have made it progress far beyond most developing countries, and its per capita output has continued to increase. These achievements not only provide a solid foundation for future development, but also lay the foundation for confidence in overcoming various difficulties.

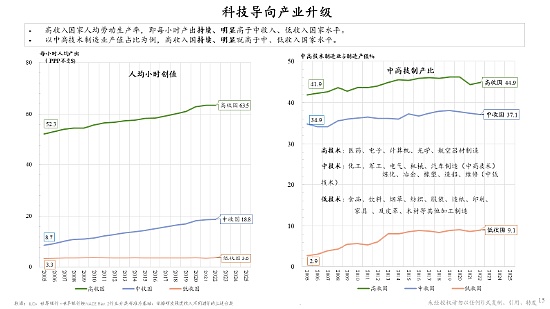

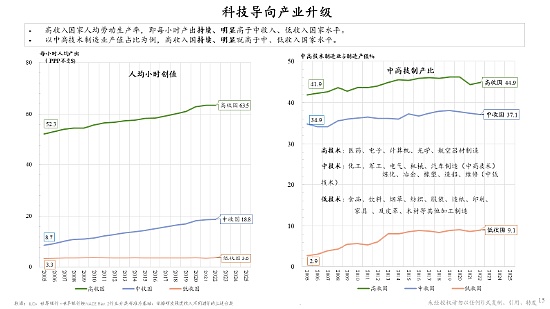

From the perspective of global economic stratification, there is a clear gap in per capita output value among high-, middle- and low-income countries, and the industrial structures of different types of economies also have different emphases. China is currently at a critical stage of moving from a middle-income country to a high-income country. Even if the threshold is no longer unattainable, the core of development still lies in achieving transformation through industry innovation and systematic improvement, achieving high-quality development, and resolving historically accumulated production capacity.

Faced with profound changes in the global landscape, the most ideal path may still be to expand development space on the world stage - of course, this requires more mature negotiation strategies and communication wisdom. As the "dual circulation" strategy emphasizes: internally, internal problems should be resolved through industrial upgrading and quality improvement, and externally, the "international card" should be played well to release systematic spillover development potential. China's superior products have practical value in improving people's livelihood and improving the economic level of developing countries. If more countries can recognize this mutual benefit, win-win results can be achieved in cooperation, and China's economy can also move towards a new stage of development in mutual benefit.

Jixu

Jixu