Author: VKTR Compiler: TechFlow

This is not financial advice.

I have held my ETH position for almost two years and it is basically at breakeven. It is like dead money, without any movement. It is like a zombie sitting in my portfolio while other stocks in the market are running wild around me.

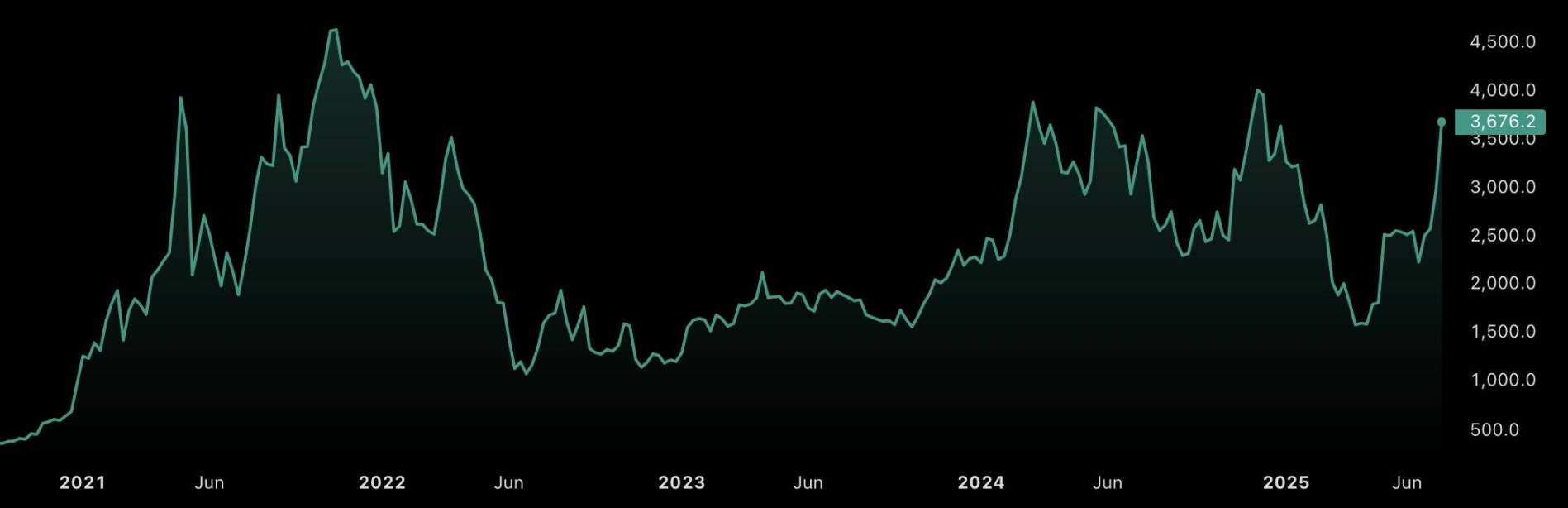

Cursed Chart

Now it is finally showing a nice profit, but that does not change the fact that it is probably one of the worst trades I have ever made. It wasn’t because of the entry point or the investment philosophy, it was because I couldn’t bring myself to walk away from the trade and redeploy the money somewhere more valuable.

This is the scarcity mentality in action. I was too afraid to “walk away” and would rather watch my money go for two years without gaining anything than admit I was wrong and look for a better opportunity.

You can see this everywhere. Traders self-destruct not because they can’t read charts or time entries, but because they can’t make clear decisions with their money.

I know a trader who made $2 million in the 2021 bull run. He lost it all in 2022. Another trader panicked and sold everything when the market first dropped 30%, only to watch the price go up 50x while continuing to hold stablecoins. Same mindset, different disaster.

Watch any trader over time and you will see the same pattern. They make tons of money and then get burned because they don’t trust their decisions. A 40% surge turns into a 20% loss because they hold on to their position too long. A 10x runner sells at breakeven because they don’t believe it will keep going up. A trader who sells a shitcoin to zero ends up panic selling the next runner because of the “a bird in the hand is worth two in the bush” philosophy.

I’ve been in both. Not the diamond hand bullshit or the poker hand panic, but I’ve seen enough good opportunities turn into regrets to recognize the true pattern. Sometimes I hold on too long, sometimes I sell too early. The commonality is not in my strategy or analysis.

It’s fear.

It’s not faith, it’s not discipline, it’s not belief in technology.

While it may sound a little daunting, it’s probably childhood trauma.

The Invisible Cage

I think most trading mistakes are actually because of scarce capital. Every “holding a position with pain” tweet, every “I sold too early” group chat message, is a sign that someone grew up thinking that such an opportunity would never come again. Every trader who can’t make clear decisions usually learned early on that money is scarce and precious, and it’s best not to waste the only opportunity you have.

Most traders I know grew up with middle-class anxiety, checking their accounts before buying anything. Parents would argue over bills. Every dollar was precious because you might never get it again.

This shit follows you into a trade like a curse.

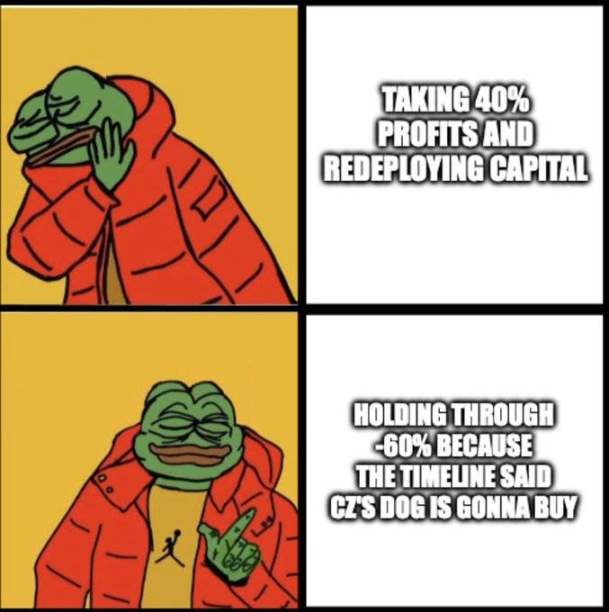

Imagine this: You make a 40% profit on a trade. Your scarcity mind starts calculating. “If I had held on a little longer, this amount of money could have changed your life.” So you hold on. And hold on. Watching your gains evaporate because you can’t accept that a 40% gain was enough.

Or the opposite: You make a 40% gain and your scarcity mind whispers, “Take it and run. You may never see green again.” So you sell it, then watch it go up 400% while you sit in cash, kicking yourself for not believing in the setup.

Scarcity Mindset Chooses Financial Trauma Over Financial Freedom

Both responses stem from the same idea: the belief that opportunity is limited and valuable.

Behavioral economists have studied this for decades. When you grow up with financial pressure, your brain instinctively thinks that every decision could lead to disaster. Your childhood experiences are running your trading account, and it's probably costing you money.

Abundance Asymmetry

Meanwhile, there's another type of trader in these markets. They usually have money from a young age, or at least a stable financial situation. They make decisions without a care in the world. They hold on to their winning positions, cut their losses, and adjust their positions appropriately. There is no emotional attachment, no vicious cycle of "what if...".

They sincerely believe that there will be more opportunities in the future, while many of us do not think so.

Abundance traders think: "I'll let this winner run and manage my risk appropriately. There will always be another trade." Scarcity traders think: "This may be my only chance at financial freedom, so I either lock it in now or let it go to zero."

One way creates wealth, the other creates anxiety.

Why Everyone Makes Wrong Decisions

The most expensive lie in the cryptocurrency space is not the "diamond hand" or "forever profitable", but the idea that there is a right answer to every trade.

Really, I think we’re just afraid. Fear of missing out. Fear of making a mistake. Fear that if we make one wrong move, we’ll never get another chance like this.

You can see this everywhere. Traders you might call “maximizers” can’t make clear decisions because every trade could change everything. They hold winners too long and they turn into losers. They sell winners too soon and watch them go bust. They keep adding to their positions without managing risk. They treat every decision as if it’s irreplaceable.

They’re trading their childhood traumas, not the markets.

The True Cost of Small-Minded Thinking

A scarcity mindset affects not only your trading, but your entire relationship with money and opportunity.

I once made 5x on a position and couldn’t bring myself to take profits. I watched it slide down over three months to breakeven because I was obsessed with the fear of “selling too early.” But I’ve also panic-sold winning stocks that were 30% up and then 10xed because my brain couldn’t believe I deserved the wealth.

Scarcity thinking creates specific types of self-sabotage:

Decision paralysis — you can’t decide when to buy, sell, or hold because every choice feels like it could ruin everything. You are paralyzed and unable to dynamically manage risk.

Binary Thinking – You think every trade is either a “diamond hand forever” or an “instant profit.” You can’t increase or decrease your position because you don’t trust yourself to make multiple correct decisions.

Risk Distortion – You either go all in on a trade or don’t take any meaningful risk. You can’t find the middle ground for truly building wealth.

The Secret to Abundance

The solution isn’t necessarily therapy or meditation, although I’ve found the latter to be helpful. The key is to convince your brain that money is a renewable resource, not a finite one.

Ask yourself, “What would someone with $10 million do in this situation?” I guarantee they wouldn’t hold onto the stock until it dropped 80% because they “believed in the technology.” But they also don’t sell in the first 20% of a bull market because they’re afraid of volatility.

Experienced, big money traders don’t get emotional about individual trades. They think about risk management and position sizing, not absolute returns. They’d rather make consistent decisions than seek perfection.

What Really Works

Here’s what I wish someone had told me five years ago, and what the truly successful traders I’ve seen do:

Consider a variety of scenarios, not absolutes. Set multiple profit targets and risk levels before trading. Don’t let scarcity thinking convince you there’s only one right way to do it.

Size your trades like you’re already rich. If you had $1 million, would you risk 100% on one altcoin? Then why would you do it with your $10,000 account?

Practice dynamic risk management. Take profits when they are big. Add to your position when you are right. Cut losses when you are wrong. Don’t treat every decision as permanent.

Calculate opportunity cost. Every dollar tied up in a bad trade is a dollar you missed out on profiting somewhere else. Every dollar you panic sell is a dollar you could have compounded.

Compounding Effect

Abundance thinking makes you more money than scarcity thinking. The mindset of desperately trying to make every trade perfect usually results in fewer good trades overall.

When you start thinking fully, you will make better decisions. You will take profits when appropriate. You will let some winners run. You will cut losses. You will wait for the right time. You will stop revenge trading. You will stop getting caught up in the high-level narrative out of fear of missing out.

All of these small decisions will add up. Instead of being stuck in the boom-and-bust cycle of scarcity trading, you’ll start to build steady, consistent wealth.

The market rewards patience, discipline, and strategic thinking, and punishes desperation, greed, and emotional decision-making. Your mindset determines which category you fall into.

Breaking the Cycle

I still struggle with this. Even now, with a larger account and more experience, I sometimes find myself making decisions out of fear, rather than rationality. Scarcity thinking is ingrained.

But I’ve learned to recognize it. And, I’ve seen the same pattern in every trader who’s gone from consistently losing to consistently profitable.

The first step is to recognize that your scarcity trap exists. It’s not your fault—it’s shaped by your childhood experiences with money. But it’s your responsibility to change it.

Heal and Win

Your relationship with money was formed before you could walk, and every trade you make has the potential to cost you money. The scarcity trap is poverty thinking dressed up as strategy.

I learned this the hard way. I have lost more money making terrible decisions than I have made logical ones. I have turned winners into losers more often because of overthinking than when I followed my plan.

I believe this pattern destroys traders more than any bad technical analysis or market crash.

Your childhood experiences are not what determined your trading destiny. But you must realize that your scarcity mindset is the real enemy. Not the market, not the whales, and not manipulation.

Your brain is broken, and it keeps you broken.

Solve this problem first. Everything else is just strategy.

Weiliang

Weiliang

Weiliang

Weiliang Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Brian

Brian Alex

Alex