Author: Cai Pengcheng

At the HashKey bell-ringing ceremony, Xiao Feng is fifth from the right

In 1998, Xiao Feng, the 37-year-old deputy director of the Shenzhen Securities Regulatory Office (now the Shenzhen Regulatory Bureau), chose to resign from his official post and enter the business world. When he received the appointment letter as general manager of Bosera Funds, he held one of the first ten public fund licenses in China's capital market.

That year, Bosera, along with ten other peers including Southern Asset Management, Guotai Asset Management, and China Asset Management, jointly ushered in the era of China's public fund industry. 26 years later, when this veteran of finance stood before the Hong Kong Stock Exchange, this time he held a stack of compliance permits to the new world of crypto finance—from License No. 1 (securities trading), License No. 7 (automated trading services) to VATP (virtual asset trading platform) licenses. The protagonist became HashKey, a financial group dedicated to global digital asset services that attempts to bring crypto finance into a compliant cage. In the history of Chinese finance, few people possess both a regulatory background and have fully witnessed the chaotic era of traditional capital markets and the wild growth of crypto digital assets, like Xiao Feng. After submitting its prospectus, Dr. Xiao Feng, Chairman and CEO of HashKey Group, known as the "Godfather of Chinese Blockchain," gave an exclusive interview to Barron's Chinese website. According to Xiao Feng, "The era of unbridled growth in the jungle is over." As regulations are implemented more rapidly in various countries, the offshore model will gradually decline, and compliance will be the only viable option. Based on this assessment of the ultimate outcome, HashKey firmly chose the "narrow gate" of compliance as early as 2018—when Hong Kong lacked clear regulatory frameworks. This meant it had to proactively forgo the "light asset, quick profit" traffic dividends of offshore exchanges, instead shouldering heavy regulatory costs and compliance obligations. The prospectus reveals that compliance costs are estimated at approximately HK$130 million for the first six months of 2025, averaging over HK$20 million per month. But this is not all. In Xiao Feng's grand strategy, compliance is merely the bottom line for survival. His true ambition lies in restructuring the business model—he is not content with simply being a matching exchange; instead, he aims to utilize distributed ledger technology to construct a "crypto financial infrastructure" similar to the digital cash transaction clearing and settlement model. Xiao Feng recalls that before founding HashKey, he conducted in-depth research on several major stock exchanges worldwide, concluding that for almost every large exchange, transaction matching business accounted for less than half of its revenue. The prospectus outlines the digital asset group's overall business: a composite system encompassing transaction facilitation, on-chain services, and asset management. Transaction business remains its core, holding approximately 75% market share among the 11 licensed markets in Hong Kong. The other two fronts—on-chain services managing HK$29 billion in pledged assets; and asset management, with assets under management reaching HK$7.8 billion since its inception. However, its revenue performance over the past three years shows that it has not completely escaped the drastic cyclical nature of the crypto market, with its growth curve exhibiting a certain high beta characteristic. Another slightly unusual sign is that while the company's revenue has multiplied, it has still not escaped losses. Besides high compliance costs, the massive R&D investment is also a significant reason. In 2024, HashKey's R&D expenditure reached HK$556 million, accounting for a staggering 77.1% of its revenue. This proportion far exceeds that of internet platforms and even surpasses that of many hard-tech listed companies. The reason behind this move remains the same: Xiao Feng did not view HashKey merely as a transaction platform, but rather as an attempt to build a new financial infrastructure based on distributed ledger technology. A significant amount of capital was thus invested in the R&D of blockchain underlying infrastructure (such as the L2 network HashKey Chain) and related system capabilities. Xiao Feng denied that the decision to go public stemmed from losses or cash flow problems. Regarding the latter, the prospectus states: As of October 31, 2025, the company held approximately HK$1.48 billion in cash and approximately HK$567 million in digital assets. Even excluding digital assets and IPO proceeds, the existing cash is sufficient to support the company's continued operation at an average monthly cash burn rate of HK$40 million for 36.2 months. The phrase "the second half of next year" is a key point repeatedly mentioned by Xiao Feng in the interview, and is also seen as the biggest driving force behind HashKey's IPO. This timeframe stems from the fact that both Coinbase and Nasdaq have announced plans to launch tokenized stock trading services in the US in the second half of next year. Here, Xiao Feng demonstrates his macro-level vision as the "godfather of blockchain." In his view, the second half of 2026 is the "singularity" of the transition between the old and new financial orders. The underlying logic is that when the tokenization of funds (stablecoins, deposits, CBDC) and the tokenization of assets (stocks, funds, bonds) converge on the blockchain, a closed-loop business model of an "on-chain financial market system" will be officially established. HashKey is a key infrastructure builder in this closed loop. "Driven by fear and retaliation, he mentioned that Coinbase is attempting to disrupt Wall Street's back-office operations by offering stock tokenization trading services, a move that has forced established giants like Nasdaq to also launch stock tokenization schemes to save themselves. US legislation has almost cleared the way, and the giants' timelines all point to the second half of 2026. The crypto world is changing rapidly, and Xiao Feng's judgment hasn't changed with the cyclical fluctuations. In his view, one side is the revolutionaries (Coinbase), and the other is the reformists (Nasdaq). But regardless of which side you're on, you have to admit: new financial market infrastructure is an irreversible trend." The following is a dialogue between Barron's China and Dr. Xiao Feng, Chairman and CEO of HashKey Group. Stablecoins need to overcome cognitive biases. Q: Recent news about the mainland's crackdown on "illegal stablecoins" has sparked much discussion. Will this affect Hong Kong's situation? Xiao Feng: These are completely different things. Everyone must distinguish clearly: the mainland is cracking down on pyramid schemes and fraud using the concept of "stablecoins"; while Hong Kong is dealing with compliant stablecoins within the legal framework. Even a friend of mine asked me before, "Mr. Xiao, I also want to invest in stablecoins." I asked him why, and he said, "Don't stablecoins offer fixed returns?" "This is a misconception. Genuine stablecoins (like USDT) do not generate interest, but in the mouths of pyramid schemes, they are presented as investment products with stable returns. In fact, since the Hong Kong Monetary Authority began drafting the stablecoin bill two years ago, the entire tokenization market landscape has undergone tremendous changes. We can no longer view things with the perspective of two years ago."

Q: What changes have occurred in the tokenization market landscape?

Xiao Feng: Looking at the global "currency tokenization" now, there are actually three clear approaches, or three models:

The first type: compliant commercial stablecoins. This is the stablecoin definition in Hong Kong law and discussed in the US stablecoin bill, where commercial institutions (such as Circle and Tether) tokenize fiat currency. This is currently the most mainstream model. The second type: central bank digital currencies (CBDCs). This involves central banks directly tokenizing currency. The People's Bank of China is already working on the digital yuan, and the European Central Bank is also considering it. Although the Federal Reserve's attitude is currently unclear, it is undoubtedly an important force. The third type: bank deposit tokenization. This is a new force that has emerged in recent months. For example, the Hong Kong Monetary Authority's sandbox program has already attracted seven banks, including HSBC, Standard Chartered, and Bank of China (Hong Kong). The core of this sandbox is to explore how to directly tokenize bank deposits. alt="24GdwXQ9MFQnXvaAOvRz0zXJpc3kRDm5rl29rBbb.png">

A tokenized deposit sandbox involving seven Hong Kong banks; Source: Hong Kong Monetary Authority website

Q: Why are banks so positive about tokenizing funds?

Xiao Feng: Banks have been cornered and have to fight back. Stablecoins issued by commercial institutions (such as USDT) have taken away business from banks. Banks thought: Since the market needs tokenized currency, I have a larger fund size, more customers, and richer application scenarios than you. Moreover, my tokenized deposits can even calculate interest for users. Why don't I do it myself?

Q: Regarding RWA, the first default case occurred in the US in November. What are your thoughts on the authenticity and future prospects of RWA?

Xiao Feng: Actually, people are overcomplicating RWA. Its essence is asset tokenization. The saying "everything can be tokenized" is an unstoppable trend. I believe its development can be clearly divided into three stages:

The first stage: currency tokenization. This history is very early, dating back to the birth of USDT in 2014, which was the tokenization of the US dollar. Later, USDC emerged in 2016. This is RWA version 1.0.

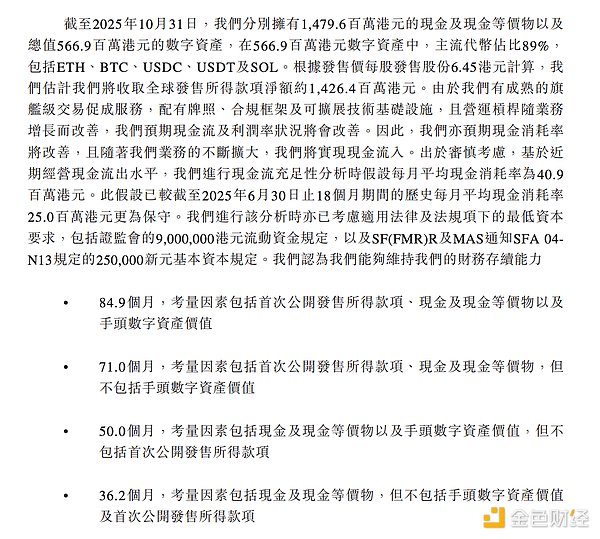

Q: The market is very concerned about HashKey's profitability. The prospectus shows that the company's cash flow is currently relatively healthy, but it is still in a loss-making state. When do you expect HashKey to reach the inflection point of full profitability?

Xiao Feng: We do have ample cash on hand, with approximately HK$2.05 billion in reserves (approximately HK$1.48 billion in cash and nearly HK$567 million in digital assets). But this is not only for maintaining operations, but also for strategic opportunities next year.

HashKey's cash flow consumption assumptions; Source: HashKey Prospectus

Regarding profitability, I do not agree with the statement that "compliance means you can't make money." Compliance certainly prevents you from making quick profits through exploitative practices, but once you reach a certain scale and amortize the compliance costs, it remains a very good business. As for the specific break-even point, we certainly have internal expectations, but as a company planning to go public, it's not convenient to publicly predict it at this time.

Q: The prospectus shows that HashKey's institutional clients contribute the vast majority of trading volume. How do you view the weak position of the retail side?

Xiao Feng: The Hong Kong retail market is indeed small, but HashKey already has the largest retail share among licensed exchanges. Moreover, our user quality is extremely high.

A retail investor has to go through such a cumbersome and strict KYC process; if they weren't truly committed, they would have left long ago. Although the number of remaining customers is only a few hundred thousand, their value is very high. The value shared by a single user for the exchange is approximately ten times that of an offshore exchange.

Besides retail and institutional investors, we have a third unique type of client: licensed brokers. This is a phenomenon unique to Hong Kong. You don't see Coinbase providing this service to brokers in the US; it's difficult for brokers to connect to Coinbase as intermediaries. Why can't Coinbase do this? Because Coinbase doesn't hold a securities license, but rather a state-specific "Money Transmission License" (MTL). In Hong Kong, HashKey holds two sets of licenses: one is a Type 1 license and the other a Type 7 license under the Securities and Futures Ordinance, which establishes our legal status as a licensed trading system. With a securities license, we can connect to all brokers in Hong Kong (provided they upgrade to a Type 1 license). Meanwhile, we also hold a VATP (Virtual Asset Trading Platform) license under the Anti-Money Laundering Ordinance. This dual license allows us to operate like a stock exchange while legally trading non-securities virtual assets (tokens). This is our competitive advantage. This is a unique phenomenon in Hong Kong: currently, about 40 licensed securities firms have upgraded their licenses to allow them to buy and sell virtual assets on behalf of clients. 90% of these securities firms use HashKey's trading system in their backend. Of course, in this model, I can't see who the clients are. Therefore, including the "hidden clients" behind these dozens of securities firms, our client structure is approximately 80% institutional (including Omni-bus) and 20% retail investors. This is consistent with the data disclosed in our prospectus. Q: In terms of future strategy, which side will you focus on more? Xiao Feng: We will develop on both sides. We will continue to expand our retail investor base and also vigorously develop brokerage firm businesses like Omnibus. As for the final ratio, we will not deliberately pursue a specific number. We will serve whatever structure the market develops into, letting nature take its course. Question: What about your international strategy? The prospectus shows that the company has already started operations in places like Bermuda? Xiao Feng: Our global site is licensed in Bermuda. Although Bermuda is considered offshore, it has a sound regulatory framework; Coinbase also holds a license there. Of course, the Bermuda model is indeed different from Hong Kong's "onshore model." Hong Kong has a local market, but Bermuda only has tens of thousands of people, so there's practically no local market to speak of. Therefore, it's essentially 100% internationally oriented. We started operating our Bermuda site last April, and encountered a major problem during the process: no banks were willing to provide deposit and withdrawal services. But this year we solved this problem, securing support from two banks. With the banking services secured, we have three major advantages in Bermuda that other offshore exchanges don't have: 1. Compliant fiat currency deposit and withdrawal channels; 2. Ability to accept Omnibus brokerage business (compliant brokerages can only accept compliant exchanges); 3. Ability to trade RWA tokenized assets (requires regulatory approval). alt="NXWeVxzfr7JVvmGklF7ZrR7u9mQw76FfPzt03JQa.png">

The Bermuda sector contracted significantly in the first half of this year; Source: HashKey Prospectus

Therefore, next year, we will leverage these three advantages to develop our "compliant offshore" business in Bermuda.

Q: With traditional financial institutions such as banks entering the tokenization market, how can they maintain a competitive advantage in the B2B institutional market?

Xiao Feng: Cooperation definitely outweighs competition.

Alex

Alex