Author: World Economic Forum; Source: Chakan Blockchain

"Digital Assets Regulation: Insights from Jurisdictional Approaches" was released by the World Economic Forum. It analyzes the digital asset regulation in the European Union, Gibraltar, Hong Kong, China, Japan, Singapore, Switzerland, the UAE, the United Kingdom and the United States, focusing on anti-money laundering (AML) and know your customer (KYC), regulatory and technical sandboxes, decentralized finance (DeFi), and privacy and security, providing insights and recommendations for policymakers and industry participants.

Current Status of Digital Asset Regulation

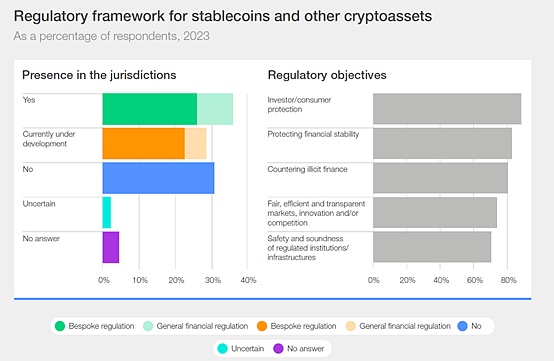

Digital assets continue to occupy an important position in the global economy, as evidenced by their considerable market value. However, the legal status of cryptocurrencies varies significantly between countries. According to an analysis by the Atlantic Council, cryptocurrencies are legal in 33 countries, partially banned in 17 countries, and generally banned in 10 countries. In its assessment of the current state of global digital asset regulation, the Bank for International Settlements (BIS) noted that more than 60% of responses indicated that jurisdictions have or are in the process of creating a regulatory framework for digital assets.

Most jurisdictions are introducing dedicated regulations (48%) because their existing regulatory frameworks do not cover digital assets. Jurisdictions that have established or are developing dedicated regulatory frameworks for stablecoins include the United Kingdom, Hong Kong and Singapore, while the European Union is developing a more general regulatory framework for digital assets. Only 9% of jurisdictions include digital assets in existing financial regulation. As of now, approximately 33% of jurisdictions lack a relevant regulatory framework and are not currently working in this regard.

Central Bank’s Response to the Survey on Digital Asset Regulation

Analysis of Nine Regulatory Models

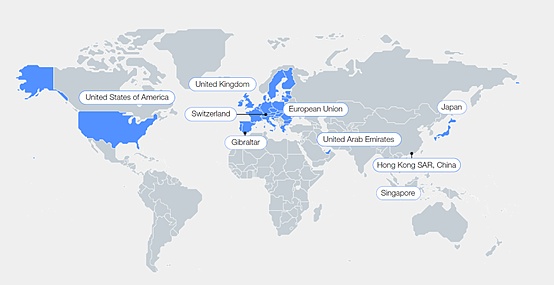

In order to examine the lessons learned in the field of digital asset regulation, a comprehensive review of current approaches is needed. The nine jurisdictions selected are the leading economies in terms of digital asset activities and regulatory implementation: the European Union, Gibraltar, Hong Kong, Japan, Singapore, Switzerland, the United Arab Emirates, the United Kingdom, and the United States. For each jurisdiction, the report examines four key industry topics: Anti-Money Laundering (AML) and Know Your Customer (KYC); Regulatory and Technology Sandboxes; Decentralized Finance (DeFi); and Privacy and Security. During the evaluation process, these topics were identified as the most pressing issues and have become the most prominent topics in the industry today.

Nine Jurisdictions Assessed

1 European Union

The European Union is one of the largest markets with an advanced digital asset regulatory system. In 2023, the EU finalized the comprehensive Crypto-Assets Market Regulation Act (MiCA). MiCA requires all issuers to create a white paper for their assets, which is subject to approval and licensing, and failure to comply will result in fines. The regulation will take effect for stablecoins from June 30, 2024 and will be fully effective by the end of 2024. MiCA focuses on investor protection and market integrity, primarily targeting crypto-asset service providers (CASPs) and certain types of tokens. The intention of MiCA is to bring about regulatory harmonization in Europe, as the law is binding and directly applicable in all EU member states.

2 Gibraltar

Gibraltar has become an important center for blockchain and digital assets. In January 2018, the region pioneered distributed ledger technology (DLT) legislation, becoming the first jurisdiction in the world to do so, with legislation emphasizing regulation, reputation, and rapid market implementation. Cryptocurrency companies operating in Gibraltar must obtain a license from the Gibraltar Financial Services Commission (GFSC) under the Financial Services Act 2019. Under the Gibraltar Companies Act 2014, dividends, capital gains and income from digital asset transactions are exempt from tax if they are derived from sources outside Gibraltar. Due to its favorable regulatory environment, an influx of companies has entered Gibraltar’s digital asset ecosystem.

3 Hong Kong, China

The Financial Services and the Treasury Bureau (FSTB) of the Hong Kong Special Administrative Region Government issued the "Policy Declaration on the Development of Virtual Assets in Hong Kong" in October 2022, clarifying the regulatory vision and policy direction for virtual/digital asset activities under the principle of "same business activities, same risks, same supervision". In June 2023, the Hong Kong SAR government further established a high-level working group to promote the development of Web3.

4 Japan

The Financial Services Agency (FSA) of Japan plays a key role in formulating policies and enforcing regulations, while the Japan Virtual Currency Exchange Association (JVCEA) and the Japan Security Token Offering Association (JSTOA) are committed to formulating rules and policies appropriate to their respective regulatory areas. The Japan FSA serves as the main liaison agency for digital asset regulation, ensuring consistency and continuity in regulatory oversight. It led the revision of the Payment Services Act (PSA), which determined the legal status of tokens based on their function and purpose.

5 Singapore

In recent years, Singapore has become a digital asset hub in Asia, building on its reputation as a leading fintech hub. The Monetary Authority of Singapore (MAS) is the main regulator for digital assets. Key legislation includes the Payment Services Act 2019 (PSAct) and the Financial Services and Markets Act 2022. The Monetary Authority of Singapore has published a proposed regulatory framework for digital payment token (DPT) service providers, such as cryptocurrency exchanges, under the Payment Services Act, which implements various operational requirements and customer protection measures. The proposal was revised in April 2024 and will take effect in phases. Under the proposal, DPT service providers will need to obtain a licence to provide services in Singapore. Platforms are prohibited from offering margin trading or any trading incentives to retail customers. As a condition of listing crypto assets, platforms must disclose potential conflicts of interest, publish standards governing listings, and establish procedures for handling customer disputes. Singapore is seen as an emerging leader in digital asset regulation due to the regulatory clarity it provides and has attracted a number of companies looking to expand their operations in the country.

6 Switzerland

Since Swiss legislation is based on principles and has nothing to do with technology, most of its existing legal provisions can also apply to virtual assets. Switzerland does not provide comprehensive, independent virtual asset regulation. As a result, regulatory tools specifically targeting virtual assets are very limited, focusing primarily on the transfer of such assets from a civil law perspective. Swiss lawmakers have introduced a specific framework for distributed ledger technology trading facilities. In addition to this, the Swiss Financial Market Supervisory Authority (FINMA) issued guidance on how to deal with virtual assets within the existing legal framework. The proactive steps taken by Switzerland, under the guidance of institutions such as FINMA and the Swiss Federal Council, highlight the country’s determination to maintain a safe and transparent financial ecosystem.

7 United Arab Emirates

The UAE has created a friendly business environment to promote the development of digital assets. The country’s central bank does not issue licenses for cryptocurrencies, and cryptocurrencies cannot be used as legal tender; however, people can hold and trade cryptocurrencies. In Dubai, the Dubai Financial Services Authority (DFSA), the long-standing regulator of the Dubai International Financial Centre (DIFC), has created a new regulator, the Virtual Assets Regulatory Authority (VARA). In 2022, UAE Law No. 4 established VARA to regulate virtual assets in the Emirate of Dubai, aiming to position the country as a pioneering force in the digital asset space. VARA’s ultimate goal is to balance growth and security to promote the sustainable growth of the digital asset ecosystem.

8 United Kingdom

The digital asset regulatory framework currently being developed in the UK focuses mainly on creating stable market conditions, enhancing investor protection and providing an environment that promotes innovation. The regulatory framework distinguishes between digital securities and non-physically backed crypto assets and stablecoins, and it is in these areas that most of the new rules take effect. The Financial Conduct Authority (FCA) regulates digital assets under wider financial services legislation. Notably, the Financial Services and Markets Act 2023 provides extensive guidance on financial matters, including provisions for the treatment of digital asset settlements.

9 United States

The United States has taken a fragmented approach to digital asset regulation, involving multiple different regulatory agencies such as the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the Federal Deposit Insurance Corporation (FDIC), and the Treasury Department. Various federal legislation has been proposed over the past few years that seeks to establish jurisdictional boundaries and provide clear guidance to regulators on how to regulate digital assets. Recent legislative cases have focused on two main aspects of digital assets: stablecoins and market structure. In the absence of regulatory guidance at the federal level, states have taken the lead in developing and implementing policies, which has helped businesses grow in these regions.

Regulatory Recommendations

1 Anti-Money Laundering (AML) and Know Your Customer (KYC) Recommendations

Technology-enhanced Solutions:Policymakers and regulators, as well as private sector stakeholders, should explore the adoption of technology-enhanced solutions to meet AML and KYC requirements within their jurisdictions. Global cooperation: For digital asset regulation, given the increasing internationalization of industry participants and the borderless nature of blockchain, global public sector leaders must strengthen international cooperation in this area. Training and compliance programs: Anti-money laundering and KYC policies that have proven to be effective typically emphasize comprehensive training and compliance programs.

2 Regulatory and Technical Sandbox Recommendations

Clear sandbox objectives and supporting mechanisms:In different jurisdictions, sandboxes that can achieve their intended objectives are designed according to specific objectives and participation criteria. This helps ensure that sandbox initiatives are focused on clear objectives and provide high value to public and private sector participants. Collaborative Ecosystem: Effective sandboxes facilitate the sharing of insights, challenges, and feedback between public sector officials and innovators. Diverse and extensive networks: Across the jurisdictions analysed, sandboxes often have mechanisms for sharing insights and feedback, leading to actual policy and regulatory outcomes.

3 Decentralized Finance (DeFi) Recommendations

Sandbox-first approach:Jurisdictions that have shown progress in addressing the rapidly evolving DeFi ecosystem have addressed its complexity through a flexible, sandbox-first approach. Risk Mitigation:DeFi policies should be tailored to the risks posed by specific DeFi applications. Parameter Definitions: Policymakers and regulators should explore ways to adjust requirements and parameter definitions for decentralized networks to achieve the key objectives of protecting consumers, maintaining market integrity, and promoting innovation.

4 Privacy and security policy recommendations

Consumer-centric:Effective security and privacy-related policies usually reflect a consumer-centric concept. Clear and Integrated:A common feature of successful security and privacy policies is the establishment of a central authority within a jurisdiction to oversee digital asset matters, which can help clarify guidelines and minimize the potential for regulatory arbitrage. Technology-driven: Forward-looking policies often use enhanced analytical tools that can provide policymakers with data when monitoring and enforcing rules.

Catherine

Catherine

Catherine

Catherine Hui Xin

Hui Xin Clement

Clement Brian

Brian Aaron

Aaron Jixu

Jixu Jasper

Jasper Clement

Clement Kikyo

Kikyo Jixu

Jixu