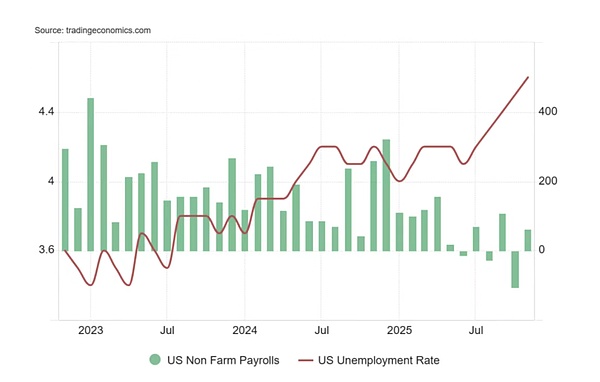

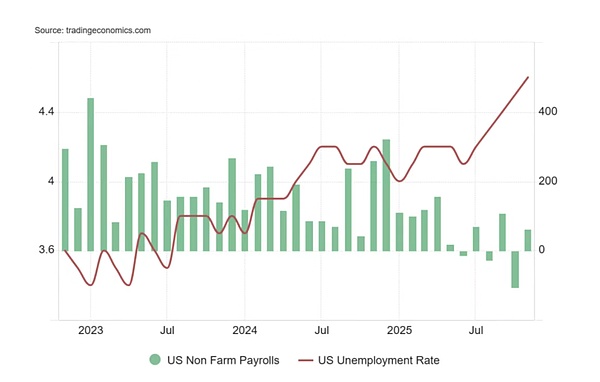

This week, the crypto market experienced a "decline followed by a rise" trend, demonstrating its increased adaptability to macroeconomic events. The key lies in understanding the deep structural impact of Japan's interest rate hike on global liquidity and crypto assets. Crypto Market Summary The market had previously predicted that cryptocurrency prices would be pressured down by the Japanese interest rate hike. In fact, this pessimistic expectation was already realized in early December, leading to a nearly 10% drop in prices. This Week's Trend: This week, cryptocurrency prices showed a "decline followed by a rise" trend. The price of cryptocurrency once fell to around 84,500 on Thursday. With the Japanese interest rate hike now a reality, market sentiment stabilized, and the price rebounded to around 89,000. The impact of the interest rate hike has subsided: Currently, the direct impact of the Japanese interest rate hike on the market should have largely diminished. Market Summary Non-Farm Payrolls (NFP): Job Growth Exceeds Expectations, But Unemployment Hits Record High The November non-farm payrolls report presented a complex picture of job growth exceeding expectations but a significant rise in the unemployment rate, making the signals from the labor market even more complicated. New Jobs (NFP): The U.S. added 64,000 non-farm jobs in November, higher than the market expectation of 50,000. However, this figure is lower than the downwardly revised 108,000 in September (August's job growth was also revised downward from -4,000 to -26,000). Unemployment Rate: The unemployment rate rose to 4.6% in November, higher than the previous reading and market expectations of 4.4%. This is the highest level since September 2021, indicating that the overall weakness in the labor market is increasing. It is noteworthy that the job market for the college-educated workforce (which accounts for over 40% of the total workforce and contributes 55% to 60% of labor income) is showing signs of weakness: University graduates aged 25 and above: As of September this year, the unemployment rate for this group was 2.8%. While the absolute value is not high, it has increased by approximately 50% compared to the low point in 2022. University graduates aged 20 to 24: The unemployment rate for this younger group has climbed to 8.5%, a significant increase of 70% compared to the low point in 2022. The accelerating rise in unemployment among this more educated group may indicate that labor market weakness is spreading to higher-income and more stable sectors of the economy, further supporting future policy adjustments by the Federal Reserve.

One Market Overview

1.1 FMG RWA, AI Index Analysis

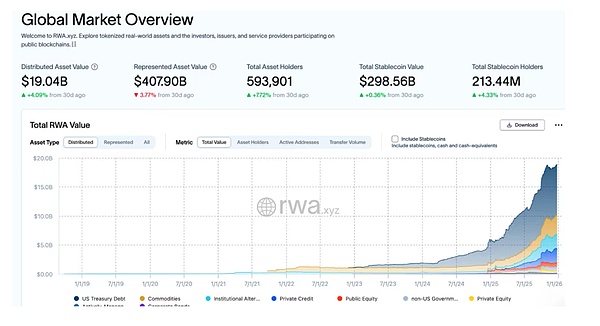

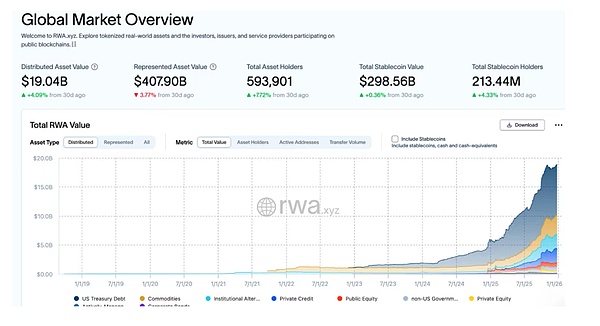

On-chain RWA market at 10 The market continued to expand in the second half of the month, reaching a total size of $18.42 billion, a 4.09% increase month-over-month. The number of asset holders reached 561,524,000, with the number of issuers remaining at 230. Structurally, private lending ($16.7 billion) and US Treasury bonds ($7.4 billion) remained the core drivers, while commodities and alternative funds gradually increased their share. Meanwhile, the total market capitalization of stablecoins reached $301.92 billion, a 0.99% increase from 30 days prior, and the number of users surpassed 191 million. Overall, RWA and stablecoins both maintained steady growth, with credit and debt assets continuing to dominate the market, indicating that the industry is evolving towards diversification and scaling.

1.2 Crypto Market Data

As of December 28, 2025, the total market capitalization of cryptocurrencies was $3.12 trillion, unchanged from $3.12 trillion in the second half of May.

As of December 28, 2025, the total market capitalization of cryptocurrencies was $3.12 trillion, unchanged from $3.12 trillion in the second half of May.

BTC Dominance Index: As of December 26, the current BTC Dominance Index is 59.4%.

II. Hot Market News

2.1Save 18% on Hotel Bookings with Stablecoins: Ctrip Overseas Version Promotes Stablecoin Payments

2.3Ethereum will see Glamsterdam and Hegota forks in 2026, with the gas limit expected to increase to 200 million

According to Cointelegraph, Ethereum will see several major upgrades in 2026, including the Glamsterdam and Heze-Bogota hard forks, with the goal of enabling L1 scaling and further application of Web3 technology.

According to Cointelegraph, Ethereum will see several major upgrades in 2026, including the Glamsterdam and Heze-Bogota hard forks, with the goal of enabling L1 scaling and further application of Web3 technology.

The Glamsterdam hard fork is expected to launch in mid-2026, with key features including a "block access list" and "built-in proposer-builder separation" (ePBS). The former will enable perfect parallel processing, allowing Ethereum to shift from a single-channel to a multi-channel model, significantly improving transaction processing speed; the latter will help improve block generation efficiency and provide more time for zero-knowledge proof verification. Furthermore, Ethereum's gas cap is expected to increase dramatically from the current 60 million to 100 million or even 200 million by 2026, while the number of blocks may increase to more than 72 per block, further supporting the L2 protocol to process hundreds of thousands of transactions per second. It is anticipated that 10% of Ethereum network validators will switch to verifying zero-knowledge proofs, paving the way for L1 scaling to 10,000 transactions per second (TPS). The Heze-Bogota hard fork at the end of the year will also focus on improving privacy protection and censorship resistance, further optimizing the Ethereum ecosystem. III. Regulatory Environment The US regulatory environment continues to improve while maintaining a cautious approach. The FOMC needs to carefully review the data from October and November, as this data may be affected by temporary disruptions such as strikes or hurricanes, leading to incomplete or distorted collection. The committee needs to obtain more data before its January meeting and analyze this information with "a degree of cautious skepticism." The current policy stance is favorable, namely, a "wait and see" approach. This means that the committee is inclined to maintain the current position and await further confirmation from economic data until clearer indications emerge.

Weatherly

Weatherly