Author: 1912212.eth, Foresight News

At 21:00 Beijing time on December 8th, the Stable mainnet will officially launch. As a Layer 1 blockchain supported by Bitfinex and Tether, Stable focuses on stablecoin infrastructure. Its core design is to use USDT as the native gas fee, achieving sub-second settlement and gas-free peer-to-peer transfers. As of press time, Bitget, Backpack, and Bybit have announced the listing of STABLE spot tokens. Binance, Coinbase, and Korean exchanges have not yet announced the listing of STABLE spot tokens.

Total supply 100 billion, no gas fees

The project team has released the white paper and token economics details before the mainnet launch.

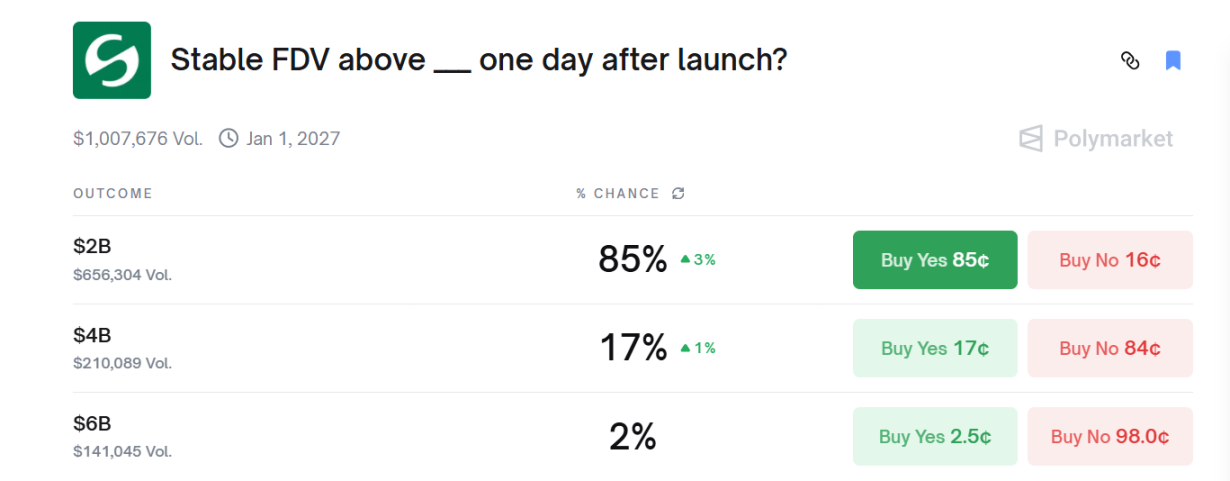

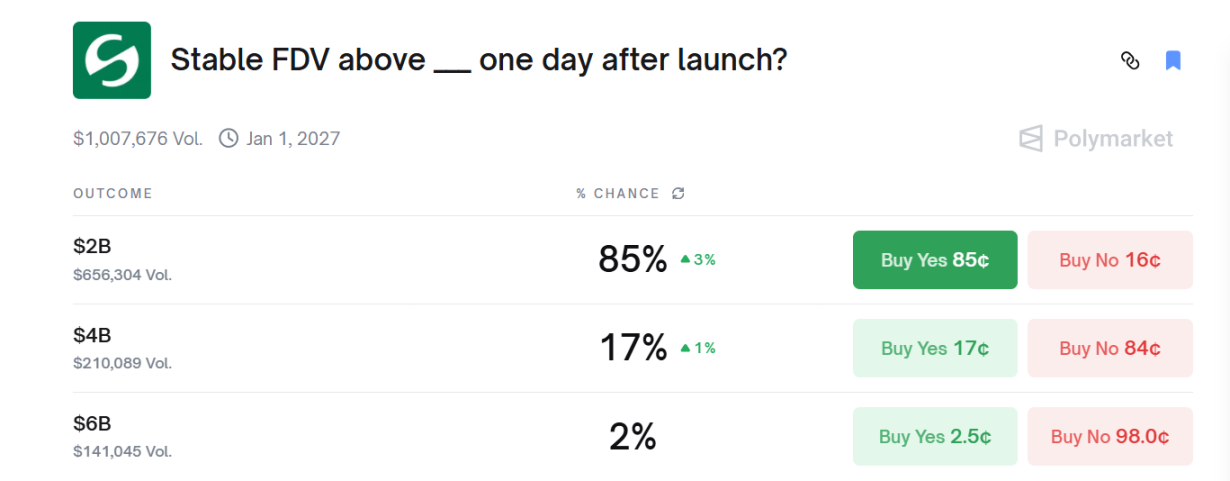

Its native token, STABLE, has a fixed total supply of 100 billion. All transfers, payments, and transactions on the Stable network are settled in USDT. STABLE does not have gas fees; instead, it serves as an incentive mechanism between developers and ecosystem participants. STABLE tokens are allocated as follows: 10% of the total supply is allocated to support liquidity, community activation, ecosystem activities, and strategic distribution during the initial launch phase. This Genesis Distribution will be fully unlocked upon mainnet launch. 40% of the total supply is allocated to the ecosystem and community for developer funding, liquidity programs, partnerships, community initiatives, and ecosystem development. 25% of the total supply is allocated to the founding team, engineers, researchers, and contributors. 25% of the total supply is allocated to investors and advisors who support network development, infrastructure construction, and promotion. The team and investor shares have a one-year cliff period, meaning zero unlocking for the first 12 months, followed by linear unlocking. The ecosystem and community fund shares unlock 8% from launch, with the remainder gradually released through linear vesting to incentivize developer, partner, and user growth. Stable employs a Delegated Proof-of-Stake (DPoS) model through its StableBFT consensus protocol. This design supports high-throughput settlement while maintaining the economic security characteristics required for global payment networks. Staking STABLE tokens is the mechanism by which validators and delegators participate in consensus and earn rewards. The primary role of the STABLE token is governance and staking: holders can stake tokens to become validators, participate in network security maintenance, and influence protocol upgrades through DAO voting, such as adjusting transaction fees or introducing new stablecoin support. Additionally, STABLE can be used for ecosystem incentives, such as liquidity mining or cross-chain bridging rewards. The project team claims that this decoupled design attracts institutional funding because USDT's stability is far higher than that of volatile governance tokens. Pre-deposit controversy: insider trading, KYC delays. Like Plasma, Stable also opened deposits twice before the mainnet launch. The first phase of pre-deposits started at the end of October, with a cap of $825 million, but it was filled within minutes of the announcement. The community questioned whether some players were engaging in insider trading. The top-ranked wallet deposited hundreds of millions of USDT 23 minutes before the deposits opened. The project team did not directly respond and launched the second phase of its pre-deposit activity on November 6th, with a cap of $500 million. However, Stable underestimated the market's enthusiasm for deposits. The massive influx of traffic the moment the second phase opened caused its website to slow down and lag. Therefore, after Stable updated its rules, users can deposit through the Hourglass frontend or directly on-chain; the deposit function will be reopened for 24 hours, with a maximum deposit of $1 million per wallet and a minimum deposit of $1,000. The final second phase saw approximately $1.8 billion in total deposits, with about 26,000 wallets participating. The review process took anywhere from a few days to a week, with some community users complaining about system glitches or repeated requests for additional materials. The probability of reaching $2 billion in FDV exceeds 85%. In late July of this year, Stable announced the completion of a $28 million seed round of financing, led by Bitfinex and Hack VC, bringing its market valuation to around $300 million. In comparison, Plasma's market capitalization is currently $330 million, and its FDV is $1.675 billion. Some optimists believe that the stablecoin narrative, Bitfinex's backing, and Plasma's initial rise followed by a fall suggest continued popularity and potential for price increases in the near term. However, pessimistic voices prevail: Gas is not a STABLE payment, limiting its utility, especially given the current bear market and tight liquidity, which could lead to a rapid price drop. Current Polymarket data shows an 85% probability that its FDV will exceed $2 billion on its first day of trading. Based on a conservative estimate of $2 billion, the corresponding STABLE coin price would be $0.02.

In the perpetual contract market, according to Bitget data, STABLE/USDT is currently priced at $0.032, meaning its estimated FDV is expected to rise to around $3 billion.

Stable's first phase of pre-deposits reached $825 million, and the second phase actually contributed over $1.1 billion, but after proportional allocation, only $500 million actually entered the pool. The total pre-deposits amount to $1.325 billion.

The token economics disclosure states that an initial allocation of 10% (for pre-deposit incentives, exchange activities, initial on-chain liquidity, etc.) is allocated. Assuming the final airdrop of 3%-7% of pre-deposits to Stable, based on a pre-market price of $0.032, the corresponding yield is approximately 7% to 16.9%, meaning that every $10,000 deposit corresponds to $700 to $1,690.

Kikyo

Kikyo