Deng Tong, Jinse Finance

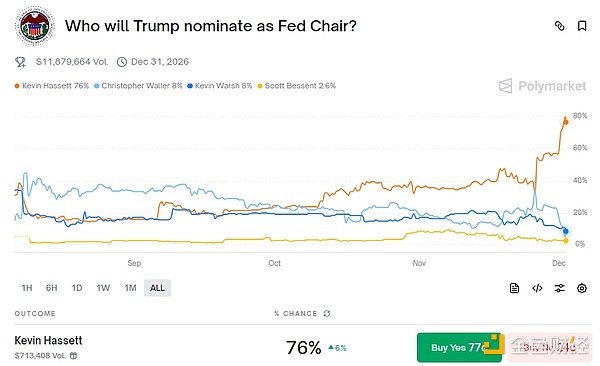

On November 30th, White House National Economic Council Director Hassett stated that if President Trump nominates him to serve as Chairman of the Federal Reserve, he "would be very happy to take the position." According to Polymarket data, Hassett's probability of being elected Chairman of the Federal Reserve has risen to 76%.

Who is Hassett? Will his appointment have a positive impact on the crypto industry? Will the independence of the Federal Reserve be affected? What impact will it have on the future economy?

I. Hassett: A Profile

Hassett is the Director of the White House National Economic Council and an American economist.

He served as Senior Advisor and Chairman of the Council of Economic Advisers from 2017 to 2019. During Trump's first term, Hassett served as the 29th Chairman of the Council of Economic Advisers from September 2017 to June 2019. Hassett joined the American Enterprise Institute (AEI) as a resident scholar in 1997. His research areas include tax policy, fiscal policy, energy issues, and stock market investment. He has collaborated with R. Glenn Hubbard on research into budget surpluses, income inequality, and tax reform. Hassett has published papers and articles on capital taxes, tax policy consistency, returns on energy-efficient investments, corporate taxes, telecommunications competition, the impact of taxes on wages, dividend taxes, and carbon taxes. In 2003, Hassett was appointed Director of Economic Policy Studies at the American Enterprise Institute (AEI). Hassett has written columns for newspapers such as *The New York Times*, *The Washington Post*, and *The Wall Street Journal*. He writes a monthly column for *National Review* and a weekly column for Bloomberg since 2005. In November 2024, after Trump won the election, Trump announced that Hassett would serve as director of the National Economic Council (NEC). Politico reported that Hassett "will assume broader responsibilities, serving as a senior advisor to the president on economic affairs and playing a key role in coordinating policies and strategies across government departments." Hassett officially assumed the position of director of the National Economic Council in January 2025, at the start of Trump's second term. In October 2025, US Treasury Secretary Scott Bessant confirmed that Hassett was one of five candidates President Trump was considering to succeed Federal Reserve Chairman Jerome Powell, whose term ends in May 2026. II. Will Hassett's appointment benefit the crypto industry? Despite a lack of explicit public statements, Hassett is widely considered a supporter of cryptocurrencies. In June, he disclosed holding at least $1 million in Coinbase shares and receiving at least $50,001 in compensation for his role on the exchange's academic and regulatory advisory committee, making his ties to the cryptocurrency industry exceptionally close—a rarity for a potential Federal Reserve chairman. He serves as director of the National Economic Council (NEC), which oversees the development of the White House Digital Assets Task Force, which earlier this year published a document outlining the government's cryptocurrency policy. The Federal Reserve does not regulate securities or commodities, so its policy changes cannot affect cryptocurrency regulation. However, a cryptocurrency-friendly Fed could still have a positive impact on the industry in several ways. First, lower interest rates generally mean better cryptocurrency prices. Juan Leon, senior investment strategist at Bitwise, stated that this has a "very positive" impact on the market. He described Hassett as an "aggressive dove" who has publicly criticized current interest rates as too high and advocated for larger and faster rate cuts. "From a marginal perspective, Hassett should be seen as good news for cryptocurrencies," said Zach Pandl, head of research at digital asset investment platform Grayscale. Caitlin Long, founder and CEO of Custodia Bank in Wyoming and a prominent advocate for cryptocurrency-friendly regulation, noted, "If this comes to fruition and Hassett does become the Fed Chair, then those anti-cryptocurrency figures still holding key positions within the Fed will eventually step down (at least most will). The Fed will undergo a major transformation." The Fed also regulates banks, particularly bank holding companies, payment system access, reserve requirements, and liquidity and risk rules. Tightening or relaxing these rules could affect cryptocurrency companies' access to several services, including: cryptocurrency custody; cryptocurrency-backed lending; access to payment channels; stablecoin issuers' requirements relative to banking regulations; and settlement rules. However, the White House has not yet formally nominated a candidate. Treasury Secretary Scott Bessant announced in late October that Hassett was one of five candidates to succeed Jerome Powell. Other candidates include former Federal Reserve Governor Kevin Warsh, current Federal Reserve Governors Christopher Waller and Michelle Bowman, and BlackRock executive Rick Reid. The final nominee is expected to be announced before Christmas. III. Will the Federal Reserve's independence be affected? 1. The Independence of the Federal Reserve The independence of the Federal Reserve is primarily based on three institutional arrangements: 1) Term Independence The terms of office for the Federal Reserve Chair and Governors are long (4 years for the Chair, 14 years for Governors), significantly longer than the presidential term. The President cannot dismiss the Federal Reserve Chair; he can only decide whether to renew the term at its end (with very few exceptions). This makes it difficult for the White House to easily exert pressure by replacing officials who "disagree with monetary policy." 2) Financial Independence The Federal Reserve operates independently, with its revenue primarily coming from interest on its holdings of U.S. Treasury bonds and profits from financial operations. It does not rely on congressional appropriations, therefore neither the executive nor legislative branches can influence its decisions through budgetary means.

3) Independence in Decision-Making

The Council on Foreign Relations has praised the Fed's independence, stating that it "protects the Fed from undue political influence, such as pressure from the White House to lower interest rates before an election, which may bring short-term political benefits but cause long-term economic damage."

The Fed's independence also "enhances the Fed's credibility," giving markets more confidence in its decisions. "Crucially, it also empowers the Fed to take difficult but necessary actions, even if those actions are unpopular."

2. Is Hassett a Political Loyalist?

But since Trump took office, he has consistently sought to strengthen control over the Fed in order to exert greater influence over his preferred monetary policies.

Earlier this year, he attempted to fire Fed Governor Lisa Cook.

Cook refused to resign, and the case was eventually appealed to the Supreme Court, which has now allowed her to remain in office. In court documents, Cook's lawyer, Abbe Lowell, called the attempt "a fierce attack on the Fed's century-old independence." Supporters see Hassett as an outstanding policymaker; as his longtime ally and former Trump advisor Stephen Moore put it, he is a "hard currency" expert who will defend the dollar. However, some former colleagues see him as a more worrying figure as a presidential advisor: a political loyalist willing to sacrifice institutional independence and objective truth to please his boss. This time, Hassett has become one of Trump's staunchest economic supporters. He stated that if he were in charge of the Fed now, he would "cut interest rates immediately" because "the data shows we should." He also predicted that Trump's reduction of domestic factory and corporate tax rates and the introduction of new industrial policies would drive "absolute breakthroughs" in GDP and job growth by 2026. He also echoed Trump's attacks on the Federal Reserve and the statistics it relies on: accusing Fed officials of "putting politics above duty"; claiming the Fed was "slow to act" on interest rate cuts; and suggesting a partisan "pattern" in the employment data released by the Bureau of Labor Statistics. When Trump fired BLS Director Erica McKentaver and accused her of "manipulating" data, a smiling Hassett described the move on television as a matter of accuracy and procedure. Hassett has become a regular on cable news, defending Trump's policy priorities, downplaying unfavorable data, and echoing the White House's position on everything from inflation to the legitimacy of federal statistics. In early November, the National Economic Council director insisted that inflation had "fallen sharply" and that prices were trending "very well," despite official data showing the Consumer Price Index had risen for five consecutive months. John Ossers, senior market editor and columnist at Bloomberg, wrote: "The choice of Hassett "appears to be a matter of loyalty; Trump believes that nominating Jerome Powell eight years ago was a huge mistake. Waller, Warsh, and Riddell could all have established their independence from the government in different ways." George Pollack, senior U.S. policy analyst at Signum Global Advisors, stated that Trump nominated Hassett "because he believes Hassett is the most likely candidate to support the current administration's priorities." If the Federal Reserve becomes another branch of the government, it might be beneficial to the cryptocurrency market in the short term, but could have disastrous consequences for other sectors. Interest rates below what is actually needed might gain cheap political capital, but will lead to increased inflation. The Center for American Progress explains, "Interest rates will be based on well-researched data, not political whims, which reassures the world that the U.S. economy will remain relatively stable and its markets will remain rational." IV. Impact on the Future Economy Jon Hilsenrath, senior advisor at StoneX and former Federal Reserve reporter for the Wall Street Journal, points out that the immediate rise in the 10-year U.S. Treasury yield is significant. He posted on LinkedIn that higher yields indicate bond traders are betting that the Hassett-led Fed might adopt a more dovish policy on inflation, thus requiring higher long-term yields to offset this risk. While a yield close to 4% may seem acceptable, it is actually "exceptionally low" considering that inflation is still above the Fed's 2% target and the budget deficit is close to $2 trillion. This disconnect could trigger a sharp market reaction and cause interest rates to surge if the bond market loses confidence in the Fed's independence.

Miyuki

Miyuki

Miyuki

Miyuki Weiliang

Weiliang Weiliang

Weiliang Anais

Anais Alex

Alex Catherine

Catherine Weatherly

Weatherly Kikyo

Kikyo Weatherly

Weatherly Catherine

Catherine