Ethereum open interest peaks, a crash may be imminent

Ethereum futures open interest has hit a new all-time high, but data shows that this feat is usually accompanied by a plunge in ETH price.

JinseFinance

JinseFinance

Author: A1 Research Translation: Shan Ouba, Golden Finance

Through successive market cycles, decentralized finance has undergone significant structural evolution. While centralized exchanges (CEXs) consistently lead in trading volume, decentralized exchanges (DEXs) have consistently gained market share from CEXs in each cycle, and this time, the competitive gap between the two has narrowed to an unprecedented level.

The core driver of this persistent market share disparity is clear: decentralized nature imposes fundamental limitations on infrastructure. As a new type of financial rail, blockchain has failed to match CEXs in speed, liquidity, and user experience for much of the past decade. However, with each cycle, DEXs are actively closing the gap. By 2025, it's reasonable to ask: Will DEXs eventually replace CEXs? A Cyclical Dilemma: Why Have DEXs Still Slowed to Catch Up? Analysis of multiple market cycles shows that DEX infrastructure is gradually maturing, with each cycle laying the foundation for the current landscape. 2017-2018: The Exploration and Startup Period Early DEXs (such as @EtherDelta) ran directly on Ethereum's Layer 1 network. Trade settlements took several minutes, the user interface was rudimentary, and liquidity was severely limited. In stark contrast, Binance has rapidly expanded using a Web2 application model, boasting speed, ample liquidity, and a user-friendly experience, quickly attracting both retail and institutional investors. DEX Market Share: Approximately 0% CEX Market Share: Approximately 100% This early stage reinforces a key conclusion: while decentralization is feasible, performance and usability remain key obstacles. 2020: DeFi's Summer Breakthrough Uniswap's automated market maker (AMM) model is revolutionary. This model eliminates the need for an order book and allows anyone to provide liquidity without permission, making it the first substantial architectural innovation in DEX design. However, at the time, the AMM model primarily served long-tail tokens and had yet to cover mainstream tokens with deep liquidity.

As Ethereum network congestion intensified, gas fees soared from less than 20 Gwei to over 400 Gwei, significantly increasing the cost of each transaction. Meanwhile, the user interface was sluggish, and professional traders remained loyal to centralized exchanges (CEXs) like Bybit and Binance.

DEX market share: 0.33%

CEX market share: 99.67%

To address liquidity issues, Uniswap V3 introduced centralized liquidity pools in 2021—a sophisticated solution that allows liquidity providers (LPs) to configure liquidity within custom price ranges. While the issue of impermanent loss (IL) persists, preventing many from providing liquidity for small-cap tokens, this represents a significant breakthrough for DEXs. It has since transformed DEXes from experimental protocols into viable trading venues serving specific market segments and a select group of traders. 2022: A Critical Look After the FTX Collapse The FTX collapse in November 2022 rocked the entire industry: billions of dollars in user funds evaporated overnight, and trust in centralized custodians collapsed. For weeks, the phrase "not your keys, not your coins" became a trending topic on cryptocurrency social media platforms, prompting traders to turn to self-custody. Following the crash, trading volume on DEXs like Uniswap and dYdX surged—Uniswap's trading volume exceeded $5 billion, and dYdX's trading volume soared 400%, driving a significant migration of users from centralized platforms to DEXs. However, despite this strong momentum, core challenges remain: poor wallet user experience, fragmented cross-chain liquidity, and a lack of fiat on- and off-ramps. As short-term concerns subside and user behavior gradually returns to normal, many are returning to centralized platforms.

DEX Market Share: Approximately 5%

CEX Market Share: Approximately 95%

In response, the ecosystem has further innovated, launching Uniswap's cross-chain routing functionality and optimizing the user experience through wallets like @Rabby_io and @phantom.

Even so, achieving CEX-level latency remains seemingly impossible. While each cycle brings incremental improvements, the performance gap remains significant. Blockchains are not yet capable of supporting professional-level trading, and the ultra-low latency order book architecture is inherently incompatible with the design limitations of AMMs. 2025: A Turning Point The market landscape in 2025 will undergo a fundamental shift. For the first time, infrastructure has matured enough to support true competition: high-performance blockchains, on-chain central limit order books (CLOBs), direct fiat integration, and CEX-like latency have been fully integrated into on-chain protocols. Perpetual swap DEXs like @HyperliquidX, @tradeparadex, and @Lighter_xyz are offering on-chain trading experiences approaching CEX functionality. Liquidity aggregation, faster block times, and a unified margin system will enable traders to execute a wide range of strategies, from spot to derivatives, directly on-chain, without the friction inherent in traditional on-chain transactions.

DEX market share: approximately 19% (peak of 23% in the second quarter of 2025)

CEX market share: approximately 81%

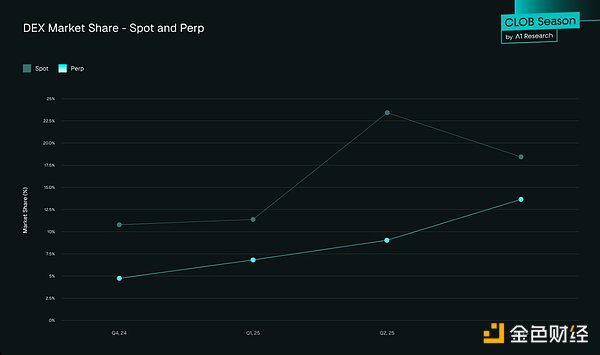

Although complete parity has not yet been achieved, DEX is no longer an alternative, but has grown into a rival that can directly compete with CEX. Figure 1: Evolution of DEX and CEX Market Share 2025 Data Insights: CEXs Remain Dominant, but DEXs Are Catching Up Rapidly The trend behind the data is clear: While CEXs still dominate global liquidity, DEXs are narrowing the gap cycle after cycle and quarter after quarter. From spot to derivatives, all segments show signs of trading activity gradually migrating on-chain. Spot market: DEX’s market share will rise to 19% by Q3 2025, up from 10.5% in Q4 2024. Futures market: DEX’s share of the futures market will rise to approximately 13% by Q3 2025, up from 4.9% in Q4 2024.

Figure 2: DEX Market Share - Spot and Perpetual Contracts

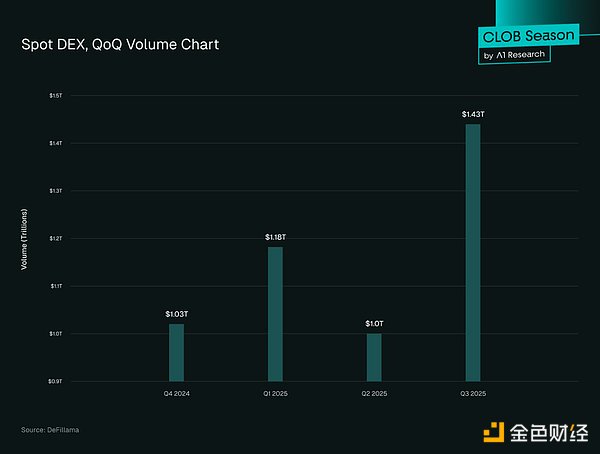

Spot DEX Trading Volume: In the third quarter of 2025, spot DEX trading volume reached US$1.43 trillion, a month-on-month increase of 43.6% from US$1 trillion in the second quarter, exceeding the historical peak of approximately US$1.2 trillion in the first quarter of 2025.

Figure 3: Quarterly trading volume changes of spot DEX

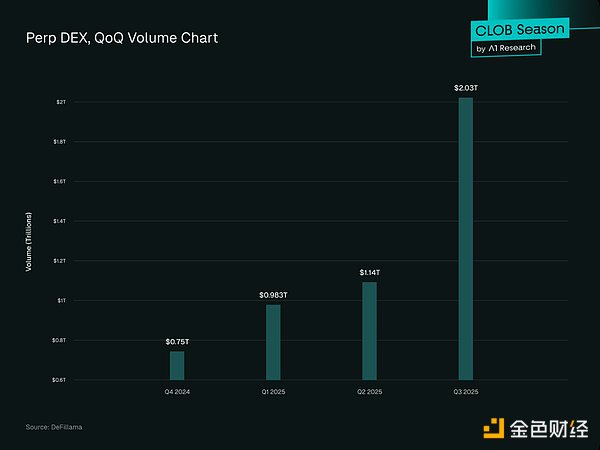

Perpetual contract DEX trading volume: In 2025, the trading volume of perpetual contract DEX increased significantly. As of the third quarter, the cumulative trading volume on the chain reached US$2.1 trillion, a year-on-year increase of 107%, and exceeded the trading volume of spot DEX.

Figure 4: Quarterly trading volume changes of perpetual contract DEX

CEX spot trading volume: In the third quarter of 2025, CEX spot trading volume is estimated to exceed US$5.4 trillion, still maintaining its dominant position, up 25% from the second quarter. Figure 5: Monthly CEX Spot Trading Volume. The overall trend shows continued acceleration: DEX spot trading volume increased by 43.6% month-over-month and 33% year-over-year. Over the past 12 months, perpetual swap trading volume has surged more than fivefold, increasing its share of total futures trading from 3.45% to 16.7%. If the current trend continues, 2025 will be a key turning point in the DEX market's positioning. Adoption Trend Analysis: While DeFi adoption has steadily increased, its growth has been uneven across regions and user groups. Diverse markets, user profiles, and institutional behaviors are shaping the evolution of decentralized finance globally. The following trends reveal where DeFi is experiencing strong growth, the differences between professional and retail participation, and the implications of these differences for the next phase of growth. 1. Global Uneven Distribution: Asia-Pacific Leads Growth: Asia-Pacific was the fastest-growing region, with on-chain activity increasing by 69% year-over-year, followed by Latin America and Sub-Saharan Africa. North America and Europe still dominate in terms of absolute transaction volume, but at a slower pace (approximately 42%-49%). Asia and Africa are experiencing significant growth, particularly in small transactions on low-fee chains, reflecting the inherent growth driven by retail investors. 2. Institutional Participation Models: Institutional adoption is showing a distinct pattern: Large trading firms are increasingly adopting cross-platform routing strategies, combining liquidity from both CEXs and DEXs to optimize execution efficiency and hedge positions. This hybrid model suggests that professional traders are no longer viewing DEXs as "high-risk alternatives" but rather as complementary trading venues. 3. Token Issuance Preferences: Token issuance trends are also revealing: most new projects now prioritize listing on DEXs, conducting initial price discovery there before seeking CEX listings. This is because DEX token issuance is permissionless and fee-free. However, well-funded projects still often choose to issue tokens on CEXs to achieve wider distribution. 4. DeFi Total Value Locked (TVL) In the third quarter of 2025, the total TVL of DeFi protocols reached $157 billion, a record high. Over 50% of this TVL was associated with DEX protocols and liquidity pools. Ethereum maintained its lead in DeFi TVL, accounting for approximately 63%. 5. Number of Active Traders CEXs still have an advantage in terms of user numbers, with over 300 million registered users worldwide. Binance alone boasts 290 million users. In comparison, DEXs have approximately 10-15 million monthly active users. While smaller in number, these users are more DeFi-native and possess greater trading experience. Breaking AMM Limitations: The Era of High-Performance CLOB DEXs Arrives Automated Market Makers (AMMs) fueled the initial wave of DeFi, enabling permissionless trading but with significant compromises in efficiency, price discovery, and capital utilization. The new generation of on-chain CLOB DEXs represents a structural breakthrough. Projects like Hyperliquid demonstrate that it is possible to achieve CEX-level performance and on-chain transparency. By reintroducing order book mechanisms into a decentralized system, these projects address many of the pain points that have kept traders hooked on CEXs—latency, execution accuracy, and capital efficiency, particularly core issues with limit orders and derivatives trading. 1. Latency: Hyperliquid leverages the HyperBFT consensus mechanism to achieve a median confirmation time of 0.07 seconds, comparable to mainstream CEXs and significantly faster than AMM DEXs (2-30 seconds). 2. Liquidity Depth: On-chain CLOBs like Hyperliquid set a new standard for decentralized liquidity: the platform can process up to 200,000 orders per second, with $6.5 billion in open interest, and boasts an order book depth sufficient to absorb large trades with minimal price volatility. For major trading pairs like Bitcoin (BTC) and Ethereum (ETH), slippage is kept below 0.1%, delivering execution comparable to CEXs. This stands in stark contrast to AMMs—even after architectural optimizations like ve(3,3), AMMs still face issues with slippage and impermanent loss. However, it's important to note that trading pairs with shallow liquidity on Hyperliquid still experience wide spreads, demonstrating the varying depth of liquidity across different markets.

3. Transaction Fees

Hyperliquid's CLOB design also reduces transaction costs: the average taker fee for futures trading is approximately 0.035%-0.045%, and for spot trading it's approximately 0.07%, with makers receiving a small commission. This fee level is comparable to that of leading CEXs and significantly lower than the typical swap fees of AMMs (0.3%-0.5%). Unlike AMMs, traders don't bear the costs of impermanent loss or routing inefficiencies, making CLOBs more capital-efficient for active and institutional traders.

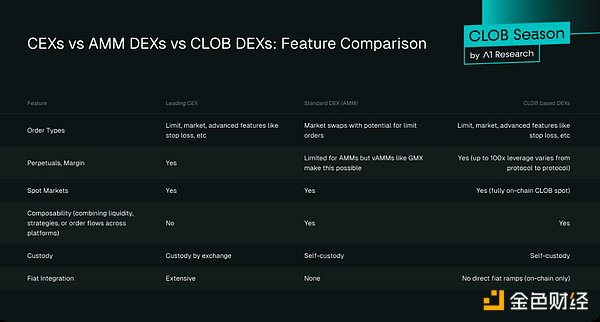

Figure 6: Functional comparison of CEX, AMM DEX and CLOB DEX

CLOB-based DEX represents the fusion of CEX and DEX: it has the high performance and deep liquidity of CEX, and the self-custody, transparency and on-chain execution advantages of DEX. Figure 7: Areas of Convergence between CEXs and DEXs Why are Traders Shifting to DEXs? From a conceptual perspective, traders may choose DEXs over custodial CEXs because they identify with the concept of decentralization. However, true migration requires DEXs to demonstrate tangible improvements in security, cost efficiency, or operational convenience. CEXs' past dominance stemmed from their smoother user experience and deeper liquidity. Today, DEXs are catching up. By 2025, DEXs will not only achieve near-parity with CEXs but also establish competitive advantages in certain dimensions. Current DEXs exhibit three structural advantages: decentralization with a CEX-level experience, extremely low (or even zero) fees, security, and access to fair markets. 1. Decentralization + a user experience comparable to CEXs DEXs inherently offer two key advantages: Transparency: On-chain settlement ensures transaction traceability and verifiable liquidity, and often supports proof of reserves, allowing users to audit protocol activity. Self-custody: Traders maintain control of their assets, completely eliminating the risk of CEX hacks. By mid-2025, CEXs had lost over $2.17 billion in funds due to hacker attacks. However, DEX execution infrastructure has historically been limited: imperfect user interfaces, highly fragmented liquidity leading to high slippage costs, and settlement delays or high fees. Traders tolerated the risks of CEXs simply because they offered greater speed and ease of use. With the launch of dYdX, these infrastructure limitations began to be addressed, and the emergence of Hyperliquid has exponentially improved the situation. By 2025, CLOB-based DEXs such as Lighter, Paradex, and Bullet emerged. These DEXs matched or even surpassed CEX speed and efficiency while retaining the advantages of decentralization. Modern improvements are primarily reflected in three areas: User interface (UX/UI) innovation: The dashboards of Hyperliquid, Paradex, and Lighter are now comparable to Binance in design and responsiveness. Liquidity transformation: AMMs are gradually being replaced by on-chain CLOBs, enabling deeper order books, tighter spreads, and lower slippage. Frictionless onboarding: Wallet integration, one-click trading, fiat deposit channels, and guided tutorials make DEX onboarding faster than CEX KYC checks. Taking Hyperliquid as an example, its trading volume reached $655.5 billion in the second quarter of 2025. The core reason DEXs can achieve such massive trading volumes is that today's DEXs can provide CEX-level user experience and ease of use without sacrificing custody and transparency. 2. Zero-Fee Model The biggest difference between the DEX and CEX business models lies in trading fees. CEXs have long profited through taker/maker commissions, rebates, and affiliate marketing revenue, but DEXs are reshaping this economic framework. Binance, for example, has a maker fee of approximately 0.020% for perpetual contracts and a taker fee of approximately 0.040%. Emerging DEXs like Paradex and Lighter have completely eliminated trading fees. They emulate the Robinhood model, refraining from charging users direct transaction fees. Instead, they profit from order flow access fees and execution priority fees charged to market makers.

For example, Paradex has pioneered structured models such as Retail Price Optimization (RPI) and Payment for Order Flow (PFOF), which improve execution quality for users while ensuring sustainable revenue for the protocol. This model replicates Robinhood's revolutionary approach to retail stock trading, but is entirely on-chain and transparent.

This transformation has far-reaching implications. Zero-fee DEXs bring three major changes:

Disrupting CEX affiliate economies: The zero-fee model disrupts the traditional CEX fee structure. While traders no longer pay taker or maker fees, protocols can still generate revenue through PFOF, RPI, and premium features, reducing reliance on affiliate commissions and reshaping the incentive structure of the trading ecosystem. Lowering the barrier to market participation: Professional traders or VIP users on CEXs can receive preferential fees through high trading volumes, but most users pay standard fees and are highly sensitive to fee rebates or zero-fee models. Zero-fee DEXs significantly reduce the cost of participation for ordinary users. Restructuring the incentive system: DEXs offer incentives such as on-chain referral programs, governance rewards, token airdrops, and liquidity rewards. While these incentives may not be as stable as CEX alliance revenue, they are more closely tied to user activity. Seemingly small differences in fees can have a significant impact on large-scale trading. For active users, especially in the perpetual contract market, even small differences in fees can accumulate into significant costs over time. The rise of zero-fee or ultra-low-fee DEXs may force CEXs to re-evaluate their pricing strategies, similar to the impact Robinhood had on pricing in the stock brokerage industry. In the long term, fee compression may shift the focus of competition from price to liquidity depth, execution quality, and comprehensive financial services. It's worth noting that leading CEXs are strategically investing in decentralized infrastructure, which could ultimately impact their market dominance. For example, Binance co-founder @cz_binance is advising @Aster_DEX, a DEX built on the BNB chain, and has publicly stated that Binance is increasing its investment in non-custodial and on-chain businesses. Other large CEXs, such as Bybit, have also begun integrating on-chain trading functionality or directly investing in emerging DEX infrastructure. For these institutions, this represents both a risk hedge and a recognition that the next phase of exchange growth will come from on-chain, interoperable, and community-driven platforms. 3. Security, Accessibility, and Market Fairness DEXs are trustless and risk-resistant: users always control their assets, funds cannot be seized, and protocol rules cannot be tampered with. Audit records are permanently stored on-chain, so even if the platform team disappears, the market can continue to operate normally. Users are protected from arbitrary rule changes or discriminatory treatment. Furthermore, DEXs offer permissionless global access: traders can operate 24/7 without undergoing KYC reviews, applying for listing permits, or being subject to geographical restrictions. Any token can be listed instantly without paying fees or undergoing centralized review. DEXs can also seamlessly integrate with other DeFi protocols and applications that support smart contracts, forming a highly composable ecosystem. Furthermore, DEX market mechanisms offer transparency: open source code, verifiable liquidity, and on-chain order books significantly reduce the risk of selective manipulation. Their architecture minimizes operational errors during periods of market volatility, giving traders confidence that markets will function reliably when they are needed most. On October 9-10, 2025, the cryptocurrency market experienced its largest liquidation event in history. Trump announced 100% tariffs on Chinese imports, resulting in over $19 billion in leveraged positions being liquidated, affecting 1.6 million traders. During this period, CEXs like Binance experienced system instability, while decentralized protocols like AAVE protected $4.5 billion in assets through highly resilient oracles. Hyperliquid maintained transparency and uptime throughout. This incident highlights the stark differences in trust and stability: centralized exchanges have suffered a loss of credibility, while on-chain platforms have maintained operational continuity. This incident clearly demonstrates the significant operational advantages of transparent settlement mechanisms during periods of market volatility and further accelerates the migration of trading activity to decentralized platforms. These characteristics demonstrate the structural superiority of DEXs. Combined with the performance and cost advantages offered by modern CLOB and AMM optimizations, DEXes further strengthen their competitiveness. Future Outlook: CEXs continue to play an indispensable role in providing fiat deposit and withdrawal channels, regulatory compliance products, insurance services, and trusted onboarding processes for new users and institutions. In contrast, DEXs excel in areas where decentralization clearly demonstrates its value: on-chain transparency, user-controlled custody, innovative financial product issuance, and privacy protections. Today, a growing number of traders, especially sophisticated traders and institutional players, are actively operating across both ecosystems: leveraging CEX liquidity to exchange fiat and cryptocurrencies (deposits and withdrawals), while simultaneously relying on DEXs to execute trades, implement DeFi strategies, and secure their own custody. This dual-platform model is rapidly evolving from the exception to the norm. However, if technological advancement and adoption continue at their current pace, DEXs are poised to ultimately dominate the market. Key Drivers to Watch: Technological advances have significantly enhanced the capabilities of DEXs. Continued breakthroughs in deepening liquidity, improving capital efficiency, enabling seamless fiat currency integration, and clarifying regulatory frameworks will further accelerate DEX adoption and narrow the gap with CEXs. 1. Scaled Development of On-Chain CLOBs Networks like Hyperliquid, or future application chains, already offer a trading environment with deep liquidity and sub-1-second latency. If these platforms can achieve similar liquidity depth for even shallower trading pairs, the remaining gap in trade execution between DEXs and CEXs will be significantly narrowed, attracting more professional day traders to DEXes. 2. Composability and New Product Categories Perpetual swaps will continue to be a core area of competitive differentiation for DEXs. Currently, on-chain options trading remains largely unfeasible. If on-chain options can achieve breakthroughs, they are expected to attract significant TVL from both retail and institutional investors. 3. Regulatory Clarity and Harmonization: As CEXs like Binance face restrictions in multiple jurisdictions, regulators are exploring frameworks that include non-custodial platforms as legitimate market venues. Singapore and Japan have already implemented or are researching compliant DeFi sandboxes, and other countries are expected to follow soon. Such regulatory clarity can alleviate compliance concerns among users and institutions, promote mainstream adoption, and ultimately strengthen the credibility of the DeFi ecosystem. 4. On-chain Private Trading with Dark Pools: On-chain dark pools provide confidential trading venues within decentralized exchanges, supporting large block trades without disclosing information to the public order book. This privacy feature prevents front-running and liquidation sniping, attracting institutional participants who seek efficient trade execution without counterparty manipulation. By enhancing confidentiality and reducing manipulation risks, dark pools will accelerate institutional adoption of DEXs. 5. Brand Building and Fiat Currency Innovation Emerging decentralized fintech startups like PayPal and Stripe may combine bank-grade service support with seamless fiat on-ramps, further weakening CEXs' advantage in fiat integration. Conclusion: The Rise of DEXs is Unstoppable Data shows a clear trend of expanding DEX market share: In the fourth quarter of 2024, DEXs accounted for 10.5% of spot trading and 4.9% of perpetual contracts; by the third quarter of 2025, these figures had soared to 19% and 13.3%, respectively. By segment, DEXs experience an average quarterly growth rate of approximately 25%-40%. Based on the current growth trajectory, the following predictions can be made:

DEX spot trading volume market share may exceed 50% by mid-2027

DEX perpetual contract trading volume market share may exceed 50% by early 2027

Even under a conservative growth scenario, DEXs will exceed the 50% market share threshold within two years, completely transforming from a "niche alternative" to a "dominant platform."

Governments are increasingly involved in the development of DeFi frameworks: Singapore and Japan have launched DeFi sandbox testing, and other regulators such as the US SEC and the EU MiCA are expected to launch similar frameworks. This trend has the potential to legitimize non-custodial platforms, allowing more individuals and institutions to participate in DeFi without worrying about legal risks. Black swan events like the October 9-10 liquidation incident have demonstrated that DEXs are structurally superior to CEXs in terms of transparent liquidation processing. When CEXs ran into difficulties, DEXs like Hyperliquid remained fully operational, demonstrating that DEXs are not only superior in concept but also superior in practice. Looking ahead, the emergence of on-chain dark pools and more composable liquidity layers is expected to attract more sophisticated traders and institutions. CLOB-based DEXs are approaching CEX-level execution, and the integration of privacy features will create a value proposition that centralized platforms will find difficult to match. The competitive trajectory suggests that 2025 will be a critical inflection point: DEXs will have evolved from experimental alternatives to fully competitive competitors, with the potential to capture a majority of market share within the next two to three years.

Ethereum futures open interest has hit a new all-time high, but data shows that this feat is usually accompanied by a plunge in ETH price.

JinseFinance

JinseFinancePavel Durov's arrest caused Toncoin to drop 14.71% and open interest to rise 32%. Market sentiment is bearish, but a rebound could occur if charges are resolved. Rumble CEO Chris Pavlovski has left Europe due to rising regulatory tensions.

Xu Lin

Xu LinInstitutional interest surges ahead of Ethereum's major upgrade in mid-March. Futures market hits all-time high, driven by confidence and anticipation.

Edmund

EdmundAltcoins, led by Solana, XRP, and Dogecoin, have surpassed Bitcoin in open interest, marking a significant shift in the derivative market. Altcoins now command 41% of the market's open interest, totaling $12.22 billion, while Bitcoin's dominance has decreased to 39%. Ethereum also trails behind, despite increased funds in its futures market. The altcoin market, with a 66% volume dominance, is reshaping investor portfolios, showcasing a paradigm shift in cryptocurrency dynamics.

Bernice

BerniceGolden Weekly is a weekly blockchain industry summary column launched by Golden Finance. The content covers key news of the week, market and contract data, mining information, project trends, technology progress and other industry trends.

JinseFinance

JinseFinanceWhile the publication of technical papers will help, OMA3 leaders say consumer adoption will be key.

Others

Others

OMA3 will focus on proposing standards and facilitating collaboration between various stakeholders of Web3 and other industries.

Cointelegraph

CointelegraphEthereum has seen more interest in recent days. Most of it has come from the price decline of the digital ...

Bitcoinist

BitcoinistBitcoin open interest has been on a downtrend recently. This is not surprising given that the price of the digital ...

Bitcoinist

Bitcoinist