Author: Dynamo DeFi Translation: Shan Ouba, Golden Finance

Trends and narratives

Will 2024 be the year of the modular blockchain?

Every once in a while, a new crypto ecosystem emerges that is fundamentally different from the one that came before:

It can be considered that the infrastructure is quickly being put in place, and similar things may also happen in modular blockchains superior. Simply put, modular blockchains are custom chains that, like Lego, can choose different blockchain components to suit their needs:

Billing

Data availability

Execution environment

Due to these modular areas Blockchains are highly customizable, so they are well suited for purpose-built application chains and smart contract chains. Previously, launching a custom chain was a daunting task, but now, new instant service solutions make it as easy as clicking a few buttons.

As this infrastructure improves, dozens or even hundreds of modular blockchains may be launched this year. Celestia, the data availability layer built on Cosmos, will be one of the main beneficiaries of this expansion. Dan Smith from Blockworks Research outlines what the future of Celestia might look like:

Another important infrastructure for modular expansion is Dymension. Dymension is looking to create an IBC-enabled standard for Rollups that developers can use to deploy custom Rollups with just a few clicks. In an interview with The Rollup, the founder of Dymension talked about how Dymension fits into the modular ecosystem:

Tokenizing the world

Bitcoin ETF has been launched. Big names on Wall Street appear to be taking a deeper interest in cryptocurrencies.

In interviews this week, BlackRock CEO Larry Fink repeatedly praised cryptocurrencies and other tokenized Utilities. In an interview, he talked about how all financial assets will be tokenized in the future, and this global ledger of asset ownership could be used for things like shareholder voting:

While people in the cryptocurrency community have been talking about “hypertokenization” for years, it’s remarkable to now see the CEO of the world’s largest asset manager talking about the issue.

Note that it remains to be seen how, if at all, Wall Street’s tokenization plans will involve public blockchains. However, more tokenized assets increase cryptocurrency adoption and legitimize the asset class.

On-chain analysis

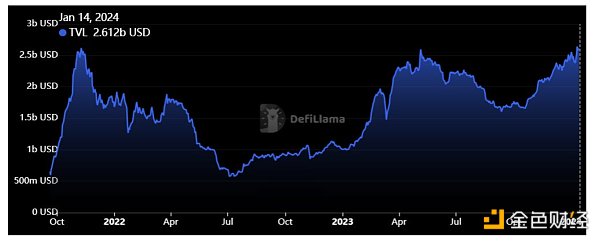

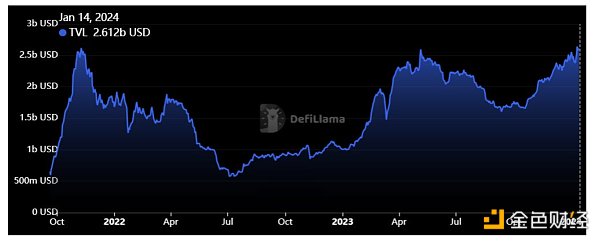

Arbitrum breaks TVL record high in 2021

This week, Arbitrum broke its long-standing TVL all-time high. Arbitrum’s previous record was in November 2021. Following the 2023 ARB airdrop, Arbitrum came close to breaking that record. Now, more than two years later, it has finally broken that record, becoming one of the only major chains to break the TVL record during the 2021 bull market.

p>

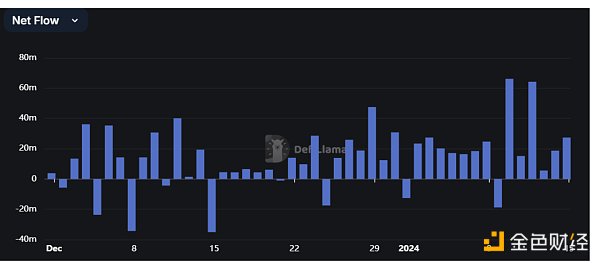

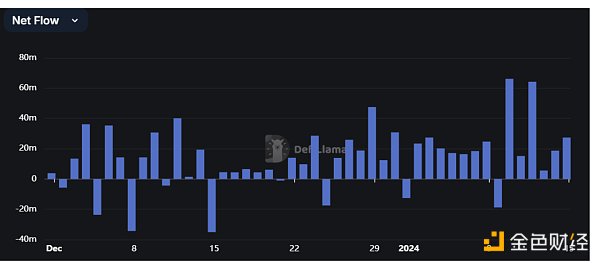

TVL’s growth has been driven in part by bridging inflows. Arbitrum has seen over $175 million in net bridge inflows over the past seven days.

p>

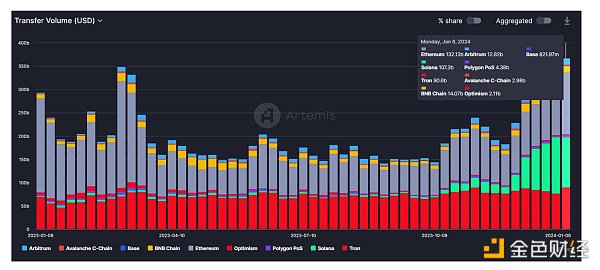

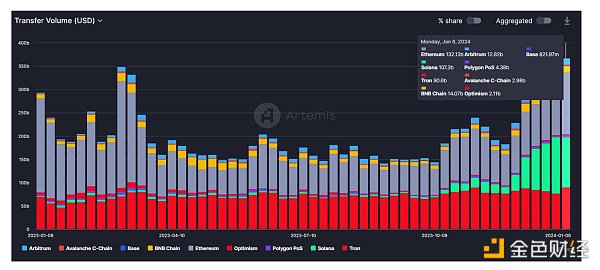

Stablecoin transfer volume hits 365-day high

Stablecoin transfers are cryptocurrencies in the real world One of the best uses and growing all the time. The overall stablecoin transfer volume hit a one-year high this week. This growth has been driven primarily by Solana, which has been on an upward trend since early December.

p>

Tool Spotlight

Use Celenium to track Celestia usage

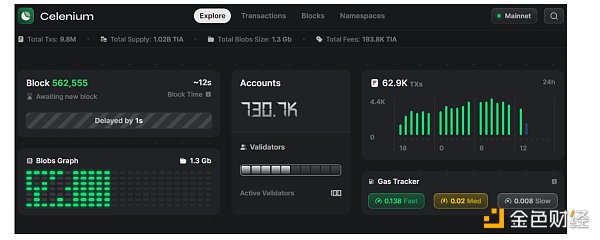

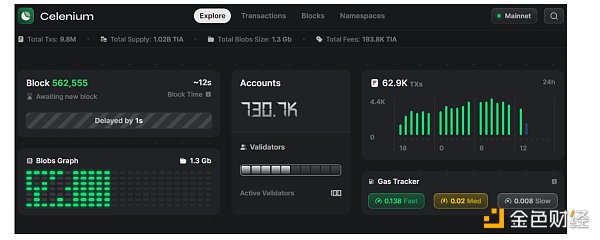

Celestia is so unique in the blockchain world that measuring it with conventional metrics can be difficult. However, its usage can still be roughly tracked through accounts, transactions, and data blocks. Celenium is a developer-focused browser for the Celestia blockchain.

p>

Important events this week

JinseFinance

JinseFinance