Author: Digital Asset Research Source: digitalassetresearch Translation: Shan Ouba, Golden Finance

The week everyone has been waiting for is finally here. The US presidential election will be held tomorrow, and then on Thursday, we will have the FOMC interest rate meeting.

As markets tend to become volatile whenever an election is approaching, misleading people into thinking that this time it is really different, the election results are very important.

The election results will have a significant impact on asset prices.

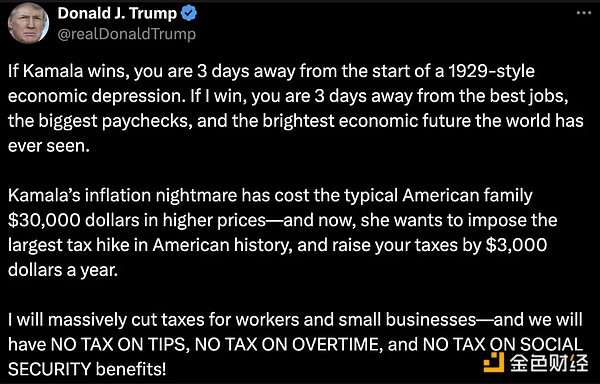

If Harris wins, it's all over and we will enter a ten-year bear market. If Trump wins, we will usher in an unprecedented rally.

Both of these statements are far from the truth. It is hilarious to see people excitedly saying on social media that Trump must win to save the market.

But people seem to ignore that Bidennomics and Harris's combination actually caused asset prices to hit all-time highs.

So please tell me again, how bad are the Democrats in the market?

This is a completely unfounded statement and shows how limited these people's understanding of the market really is.

As long as the government continues to spend money and accumulate debt, this cycle will continue to run no matter who is in power.

Whatever the outcome, the immediate impact of the election will most likely be short-lived. It is the public that buys and sells the news, and nine times out of ten they will be wrong.

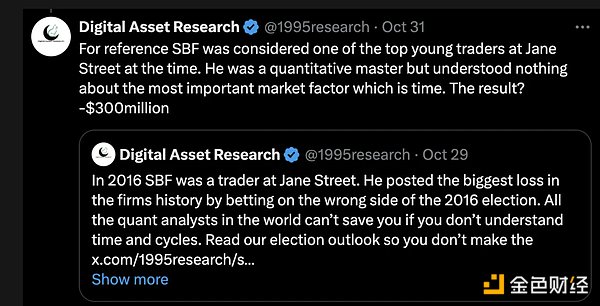

Look at the 2016 election, when Trump won, it was without a doubt one of the biggest surprises in American electoral history. The experts thought it would be the end of the world and that the market would continue to fall.

What actually happened? The market immediately fell for two or three days, then rebounded.

To emphasize this point, I shared this post on social media last week. We saw smart SBF short at the election low and lost $300 million. Of course, Wall Street thought Trump was a disaster for the market, so much so that their quantitative models were hit hard.

If Harris wins, will we see a similar situation?

I am by no means a Harris supporter, I just want to point out that the market will not immediately collapse if Harris wins.

Right now the market is enthusiastic about Trump's trades, but fearful of Harris' policies. I imagine that if she wins, Wall Street will panic again, only to find that we are in a bull market a few days later.

Still, leaving the election aside, let's focus on what is really important.

I have talked at length about the potential for slow markets like we saw in 2012 and 2016, and what we have today resembles those two cycles more than the 2020 cycle.

In short, this week we are at another critical timing point. This happens to be election week, but as you can see, the timing seems to have dictated this news.

Looking at the weekly chart, we can see that we are 30, 60, and 90 weeks away from key weekly turning points in the current cycle. 90 weeks ago, we reached a weekly high that marked the beginning of the banking panic. 60 weeks ago, we hit the low of the summer 2023 range. 30 weeks ago, we experienced a sentiment wave just before the heightened tensions in the Middle East.

Next, we see the intersection of the daily cycle and the weekly cycle. As can be seen below, the analysis based on the time perspective has been effective at the beginning of this month, with consistent major turning dates. Today is November 3rd, and we are 90 degrees away from the low in August.

Finally, these important timing factors coincide with a bullish reversal in the RSI, right on the backtest of the breakout range. The chart below shows this across multiple time frames, with the 1-day, 2-day, and 3-day charts all showing bullish signals.

The last thing I want to leave you with is an update to the fractal chart of BTC and NVDA that I have been sharing for several months. Not only does it match expectations almost exactly, but it also reminds us what true expansion of BTC looks like. Even in this fractal chart, it suggests that the last two months will be a gradual rise, followed by a larger move starting in December and lasting until 2025.

So don't get caught up in the election noise. Anyone who thinks Harris is bad for the market, ask them why we are at record market levels. Anyone who thinks Trump can save the market, ask them which market needs saving.

Time is the most important factor, and the cycle will continue to advance regardless of any man or woman. We are still in a solid bull trend making higher highs and higher lows. The current correction is expected to reverse this week following the rules of time and bullish technical indicators. The market will test your patience and faith again and again, don't get swayed by short-term noise.

Anais

Anais