Author: Aylo; Translator: Plain Language Blockchain

First of all, this cycle is indeed difficult, don't let anyone fool you into saying it is not difficult. But the reality is that each cycle is more difficult than the previous one. The number of market participants is increasing, the competition is getting more and more fierce, the old players are more savvy, and naturally more people fail in the end.

If you didn't have a large position in BTC or SOL during the bear market, you probably didn't make any money at all, and you might even have gone crazy. If I didn't use SOL to denominate myself, I would probably have a very hard time.

Yes, there are some individual big winners in this round, but I bet that if you have a large position in these assets, you will probably give back some or even most of your gains in the end. After all, most people don't stop after a wave of big profits. They always feel that "the cycle is not over yet" and want to try again, but the result is that they give back the money they made.

“Play stupid games, get stupid prizes” This principle always applies, but for traders and gamblers, this process is sometimes prolonged.

So why is this cycle so difficult?

01 Post-Traumatic Stress Disorder (PTSD)

In the past two large-scale altcoin cycles, most currencies experienced a 90-95% plunge. The collapse of Luna and FTX exacerbated the chain reaction in the industry, and the market fell more than expected. A large number of heavyweight players were liquidated, and crypto lending platforms have not yet recovered.

This "post-traumatic stress disorder (PTSD)" has deeply affected crypto native users. In this cycle, the trading pattern of the altcoin market largely reflects a mainstream view that "all projects are scams." In the past two rounds of crypto market cycles, people generally believe that "this technology represents the future." But in the current cycle, this belief has been greatly weakened or even destroyed, and many people no longer believe in the long-term prospects of the crypto industry. Instead, the view that "everything is a scam" has become one of the mainstream perceptions.

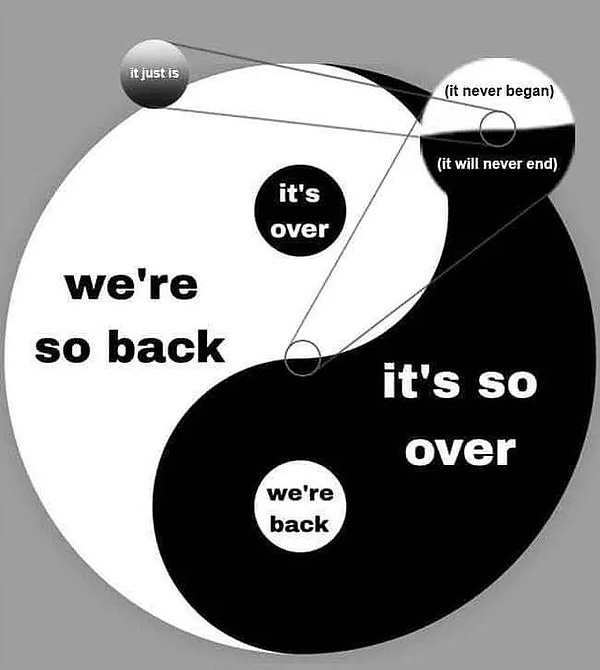

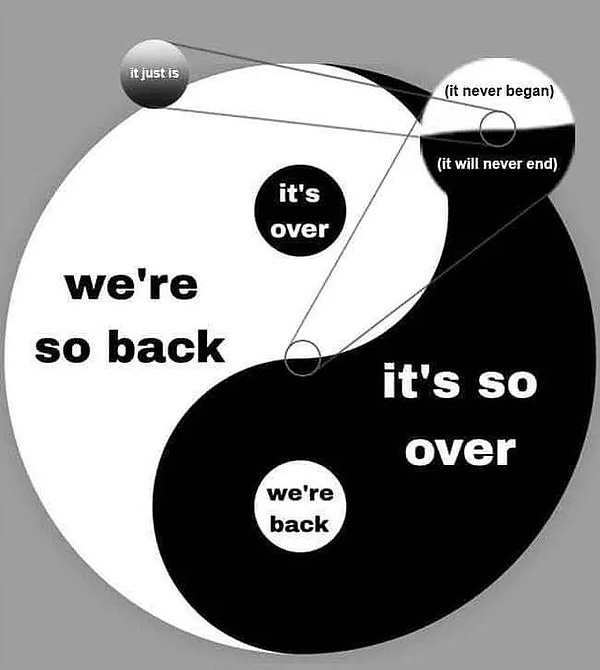

No one dares to hold any assets for a long time because they don't want to experience the pain of their assets being halved or even wiped out again. This has led to an extreme "Max Jeet Cycle" - everyone wants to get ahead and treat others as the savior.

Social media (crypto tweets on X) has exacerbated this emotional trading, and market participants are looking for the top of the cycle every day, causing market sentiment to fluctuate more violently.

This psychological impact is not only reflected in trading behavior, it also affects the construction and investment methods of the entire ecosystem. Today, projects face stricter scrutiny and the trust threshold has been greatly increased. This has a dual impact: on the one hand, it helps to screen out obvious scams; on the other hand, it makes it more difficult for truly valuable projects to gain attention and development opportunities.

This psychological impact is not only reflected in trading behavior, it also affects the construction and investment methods of the entire ecosystem. Today, projects face stricter scrutiny and the trust threshold has been greatly increased. This has a dual impact: on the one hand, it helps to screen out obvious scams; on the other hand, it makes it more difficult for truly valuable projects to gain attention and development opportunities.

02 Innovation

Current innovation is more iterative, and the infrastructure is constantly being optimized, but there is no disruptive 0→1 breakthrough like when DeFi was born, and there is also a lack of major progress that makes people shine. This makes it easier for views such as "there is no substantial progress in the crypto industry" to resonate, and it also spawns more narratives such as "the crypto industry has achieved nothing."

The entire innovation landscape has shifted from revolutionary breakthroughs to incremental improvements. Although this is in line with the natural law of any technological development, this change brings new challenges to the narrative-driven market.

In addition, we still lack real "killer applications" - those breakthrough products that can push the scale of on-chain users to hundreds of millions have not yet appeared.

03 Regulation

The previously overbearing SEC has caused great chaos in the industry and seriously hindered development. Especially DeFi, which could have attracted a wider range of users and found a market fit (PMF), was strangled and failed to grow further. In addition, the SEC also forcibly prevented all governance tokens from delivering value to holders, ultimately shaping the market narrative that "these tokens are worthless", which to some extent did become a reality.

The SEC not only forced away a large number of developers (for example, Andre Cronje publicly stated that the SEC's suppression made him completely withdraw from the industry), but also blocked the integration of traditional finance (TradFi) and the crypto industry, ultimately forcing the entire industry to rely on venture capital (VC) financing.This directly led to an imbalance in the supply and demand structure, a distorted price discovery mechanism, and a market value that was firmly controlled by a few institutions.

However, the market is now ushering in some positive changes. As more and more projects appear in the form of public sales, the crypto industry is gradually breaking the shackles imposed by the SEC.

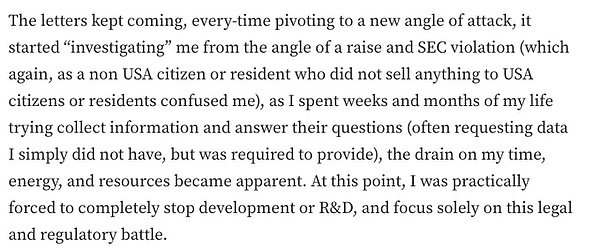

Cronje’s excerpt on his experience with the SEC

Cronje’s excerpt on his experience with the SEC

Translation: The letters kept coming, each with a new angle of attack. Initially, they were “investigating” me for financing and SEC violations, which was very confusing - after all, I was neither a US citizen nor a US resident, and I had not sold anything to US citizens or residents.

I spent weeks and even months trying to gather information and answer their questions (many of which were data they requested that I simply did not have). This ordeal took a huge toll on my time, energy, and resources. At this stage, I was almost forced to stop development and R&D completely and focus all my attention on this legal and regulatory battle.

04 Financial Nihilism

The above factors have jointly promoted the prevalence of "financial nihilism" in this cycle. The essence of financial nihilism is to lose faith in the market, but have to play. Since you have seen through everything, then speculate to the end, and make a profit. Even if it is betting on Memecoin, it is better than holding it foolishly.

The narrative of "useless governance tokens", coupled with the high FDV and low circulation supply (low float) pattern caused by the SEC, has made many crypto-native users completely abandon the fantasy of long-term holding and turn to Memecoin to find more "fair" opportunities in it.

In addition, in real society, young people can only rely on gambling-style investment to achieve class transition. Asset prices are soaring, but wages are far behind the endless depreciation of fiat currencies, making Memecoin, a "crypto-version lottery", particularly attractive. The core value of lottery has never been the odds, but the hope it carries, which is why it has always been so popular.

Because gambling culture has a natural market fit in the crypto market, and related technologies (such as Solana and Pump.fun) are becoming more and more mature, the number of new tokens issued has ushered in explosive growth. In essence, there is only one core logic to all this - there are a large number of users in the market who are eager for extreme speculation, and demand determines the market.

The crypto market has always been said to be "fighting on the front line", but in this cycle, this concept has been widely recognized.

The crypto market has always been said to be "fighting on the front line", but in this cycle, this concept has been widely recognized.

This nihilistic investment mentality is reflected in many aspects:

· The rise of the so-and-so speculation culture and its entry into the mainstream

· The investment cycle is further shortened

· strong>Trading behavior is more inclined to short-term speculation rather than long-term investment

· The prevalence of extreme leverage and high-risk operations

· An "indifferent" attitude towards fundamental analysis

05 The experience of past cycles has become an obstacle

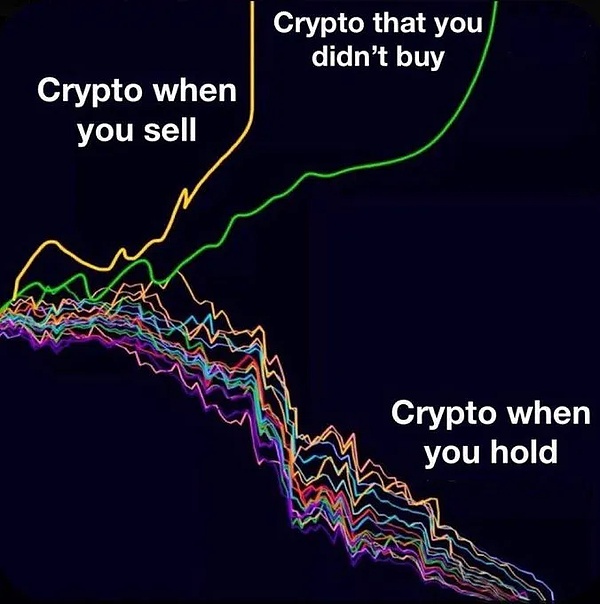

The past few cycles have taught investors that as long as they buy some altcoins in the bear market, they will eventually gain transcendence BTC's returns.

Almost no one is a naturally good trader, so in past cycles, the safest strategy for most people was to hold on - even the most depressed altcoins will eventually see a wave of increases.

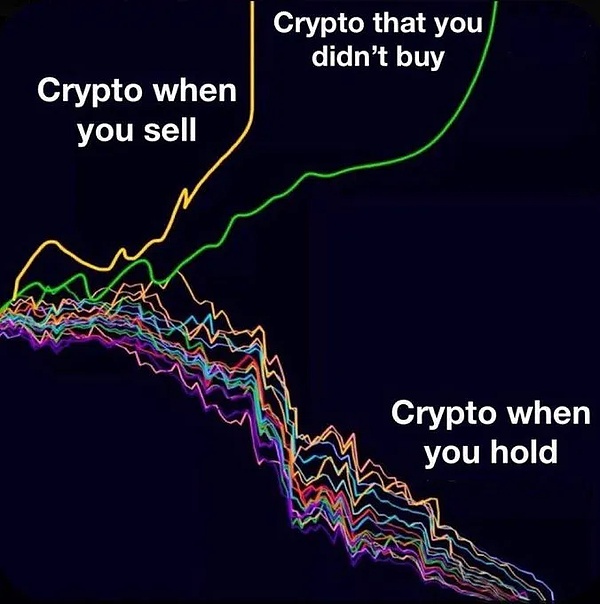

But this cycle is entirely a trader's market, which is more favorable to sellers than long-term holders. Traders even got the biggest profit opportunity in this cycle through HYPE airdrops.

The market narratives in this cycle are generally short-lived and lack sufficiently convincing themes. Market participants are more mature than before and are good at extracting value more efficiently, so the local bubble of altcoins has not been blown to the extreme as in the past.

Using AI agents (Agent) Take the first round of hype for a narrative for example - this may be the first time the market really feels "this is the new narrative we've been waiting for". However, it is still very early and the long-term winners may not have really emerged yet.

06 BTC has welcomed new buyers, while altcoins mostly have not

The differentiation between Bitcoin and other crypto assets has never been more obvious.

BTC has successfully attracted buying from traditional finance (TradFi), gaining a strong and sustained source of passive demand for the first time. Even some central banks have begun to discuss adding BTC to their balance sheets.

In contrast, altcoins are finding it harder than ever to compete with BTC. This is not difficult to understand - BTC has a clear growth goal in front of it, which is to challenge the market value of gold, while altcoins do not have a similar grand narrative.

Altcoins have almost no new buyers. Although some retail investors re-entered the market after BTC hit a record high (but they bought XRP), overall, the inflow of new retail funds is still limited, and the negative reputation problem of the crypto industry still exists.

07 The transformation of ETH's role

The decline in BTC's market capitalization share is mainly affected by the growth of ETH's market capitalization.

In past cycles, the rise of ETH was often seen as a signal for the start of the "altcoin season", but this rule of thumb did not work in this cycle. The fundamental reason is that ETH has been performing poorly and has been dragged down by fundamental factors.

Many traders and investors are confused because ETH is no longer the trigger that drives the market to take more risk. Instead, it has become a sign of the end of many mini alt-szn seasons, which is completely different from the market rhythm in the past.

Although there are already many narratives and tracks that have been independently launched and operated without ETH, many traders still firmly believe that ETH needs to rise to start a real alt season.

Of course, there are more reasons for market changes, but these are some of the key points that come to my mind first when I drink coffee and empty my mind.

So, what to do next? Either work harder or smarter.

I still believe that in the long run, fundamentals will ultimately decide everything.

But the premise is that you must really understand the projects you support and how they can actually surpass BTC. There are indeed some potential candidates in the market, but the number is still small. You can look for projects with the following characteristics: · Clear profit model · True market fit (PMF) · Sustainable Token economic model · Fundamentals supported by strong narratives (currently, AI and RWA are two areas that meet this standard) I think that with the changes in the US regulatory environment, those projects with strong fundamentals and PMF can eventually deliver value to the token, and these will be relatively more stable investment options. And those protocols that can generate stable income are now in a good development cycle. This is in sharp contrast to the token model dominated by the "greater fool theory" in the past. If your strategy is to "wait for retail investors to enter the market and then smash the market", then you may be in trouble. The market has evolved and no longer relies solely on retail investors to drive cycles, and smarter funds tend to plan ahead and rush these obvious strategies.

Possible strategy directions:

1) Become a better trader

Try to build a trading advantage and focus on short-term trading, because there are still many stable short-term opportunities in the current market.

Onchain trading has a higher return multiple, but it is also more volatile and is not suitable for people with poor stress resistance.

2) The "barbell portfolio" still applies (for most people who don't have a clear trading advantage

70-80% of funds are allocated to BTC & SOL, leaving a small portion of funds for more speculative investments.

Regularly rebalance to maintain a reasonable asset allocation.

3) Evaluate your available time and adjust your strategy

If you are just an ordinary person with a job and can't be in the market all day, then you can't compete with young traders who sit in the trenches and watch the market for 16 hours a day.

But passively holding underperforming altcoins and waiting for the market to take its turn will not be an effective strategy.

4) Explore diversified strategies (combine different fields to increase the winning rate)

Core portfolio (BTC & SOL) + low-risk arbitrage strategies (such as airdrop mining, although the difficulty has increased now, there are still opportunities).

Pre-position new ecology and occupy a position in the immature ecology, such as HyperLiquid, Movement, Berachain, etc.

Deepen a niche field and become an expert in that track.

08The altcoin market still has room for growth, but the competition is more intense

I still believe that the altcoin market still has room for growth in 2025, and the overall market environment is still affected by the global liquidity cycle. But only a few tracks and a few projects can really outperform BTC & SOL significantly. Moreover, the pace of altcoin rotation will be faster, which means that investors need to adjust their positions more sensitively.

If the market really ushers in crazy monetary easing, we may see a similar altcoin bull market in the past, but I think the probability of this happening is lower than the probability of not happening. Even if it does happen, the increase of most altcoins is only the market average, and it will not take off as it did in the past.

There are still a large number of altcoin projects to be launched this year, and market liquidity will still be diluted and dispersed, which requires special attention.

09 Summary: A little hope

I have never seen a person who has studied the crypto market seriously for several years and finally failed to make money.

There are still many opportunities in the market, and the growth of this field is still worth looking forward to. In the final analysis, I don’t know anything better than others, but I keep adjusting myself according to the actual situation in this cycle.

There are still many opportunities in the market, and the growth of this field is still worth looking forward to. In the final analysis, I don’t know anything better than others, but I keep adjusting myself according to the actual situation in this cycle.

One thing is also clear-we are no longer in the early stage of the bull market. Whether you make money or not, the bull market has lasted for a long time, and this fact will not change.

"Control the downside risk, and the rise will follow naturally." This sentence is always applicable.

Weatherly

Weatherly

This psychological impact is not only reflected in trading behavior, it also affects the construction and investment methods of the entire ecosystem. Today, projects face stricter scrutiny and the trust threshold has been greatly increased. This has a dual impact: on the one hand, it helps to screen out obvious scams; on the other hand, it makes it more difficult for truly valuable projects to gain attention and development opportunities.

This psychological impact is not only reflected in trading behavior, it also affects the construction and investment methods of the entire ecosystem. Today, projects face stricter scrutiny and the trust threshold has been greatly increased. This has a dual impact: on the one hand, it helps to screen out obvious scams; on the other hand, it makes it more difficult for truly valuable projects to gain attention and development opportunities.

The crypto market has always been said to be "fighting on the front line", but in this cycle, this concept has been widely recognized.

The crypto market has always been said to be "fighting on the front line", but in this cycle, this concept has been widely recognized.

There are still many opportunities in the market, and the growth of this field is still worth looking forward to. In the final analysis, I don’t know anything better than others, but I keep adjusting myself according to the actual situation in this cycle.

There are still many opportunities in the market, and the growth of this field is still worth looking forward to. In the final analysis, I don’t know anything better than others, but I keep adjusting myself according to the actual situation in this cycle.