Source: Blockworks; Compiled by: Deng Tong, Golden Finance

The following is the first part of a series of articles on the current state of the cryptocurrency liquidity market, based on multiple conversations with liquidity funds.

It is an open secret that most cryptocurrency liquidity funds are underperforming.

Liquidity funds operate similarly to traditional hedge funds: choose market directions, deploy funds, and outperform benchmarks.

However, unlike hedge funds, the metric is not a composite benchmark like the S&P 500.Cryptocurrency liquidity funds aim to outperform Bitcoin.

For example, Bitcoin appreciated by about 110% in 2024. Any liquidity fund that performs below that benchmark is underperforming, or at best, average.

Bitcoin has remained generally stable so far this year, while other altcoin markets have hit rock bottom.

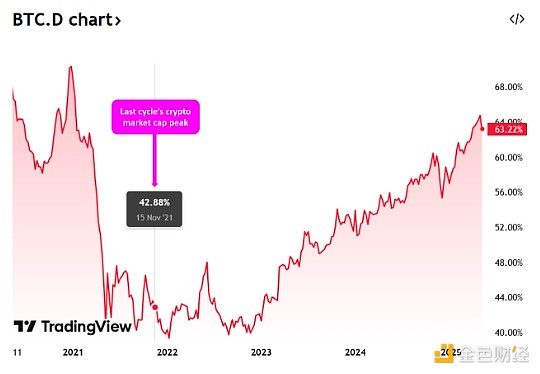

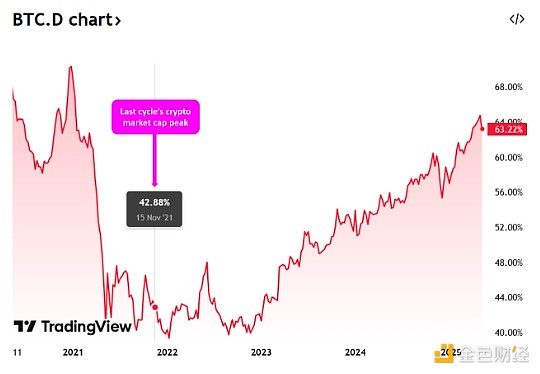

Take Bitcoin (BTC.D) as an example, its dominance has steadily climbed over the past year and now accounts for 63% of the total cryptocurrency market value of $3.3 trillion.

In comparison, the peak of the previous cycle's market value occurred in November 2021, when BTC's share hovered between 40% and 45%.

Venture capitalists like Jon Charbonneau of DBA even question the value of BTC as a benchmark. Charbonneau said in the 0xResearch podcast that a suitable benchmark might be a weighted average basket of altcoins such as ETH, SOL and BNB.

This may explain why there is a clear bearish sentiment in the crypto Twitter echo chamber despite Bitcoin hovering near its all-time high. Many investors seeking higher risk believe that altcoins will rise more than Bitcoin and are therefore "excluded" from BTC's rally.

“It’s not looking good right now,” Pantera’s Cosmo Jiang told me.Most directional liquidity funds are probably negative on BTC. For market neutral liquidity funds, the industry average is irrelevant. However, they are also underperforming this year, which means their performance is generally flat, not positive.”

Almost all liquidity funds I’ve spoken to believe that Bitcoin has established itself as an institutional/macro asset, or “digital gold.”

“We are at an interesting point in the Bitcoin adoption S-curve, where penetration is rising rapidly due to ETFs and the U.S. government’s strategic reserve. Last year, Bitcoin inflows exceeded Nasdaq’s QQQ inflows, which is crazy,” Jiang said. “Most players still don’t realize that BTC is performing very differently than the rest of the crypto market.”

This isn’t just a problem for the orange coin, which happens to be up 11% this week.

Most liquidity funds are underperforming, affected by the dark cloud hanging over the altcoin market. Arthur Cheong of Defiance Capital told me that the glut of already existing and soon-to-be-unlocked coins, such as L1/L2, DeFi, DePIN, AI, and memecoins, portends a bleak outlook.

“The unlocking schedule for all altcoins, except ETH, is expected to be $1 billion per month over the next two years. The demand for altcoins is simply not large. The total capitalization of all crypto liquidity funds is about $10 billion to $15 billion,” Cheong said.

These structural dynamics are also affecting liquidity funds that focus on market-neutral strategies.

“Even if projects try to sell their locked tokens on the over-the-counter (OTC) at a 30% to 40% discount, it is difficult to find buyers. The market generally expects altcoin prices to plummet,” said Min Jung, research analyst at Presto.

Presto wrote last year that $60 billion in buying pressure would be needed to maintain the prices of the top ten tokens launched in 2024 (STRK, ENA, JUP, ONDO, etc.).

This supply-demand mismatch means liquidity funds must work harder to pick the “right” winners.

The “rising tide lifts all boats (BTC)” phenomenon of past cycles is no longer true.

In the second part of this series, we will explore:

How can liquidity funds use fundamentals to adapt to market changes?

What cryptocurrency sectors are liquidity funds eyeing?

Has the four-year cycle ended?

Has the L1 valuation premium disappeared?

Stay tuned for part 2 of the 0xResearch newsletter later this week.

Joy

Joy