Author: Doug Colkitt, Source: Author Twitter @0xdoug; Compiler: Wuzhu, Golden Finance

This is a great analysis and the most reasonable bullish reason for DA. But I think it is absolutely impossible for DA to get close to 50% of L2 fees.

For structural economic reasons, sorting will always generate more value than DA...

Blockchains are basically the business of selling block space. Because block space is not easily interchangeable between chains, they have almost formed a monopoly.

But not all monopolies can earn excess profits. The key lies in the ability of consumers to differentiate by price.

Without price differentiation, monopoly profits are hardly higher than commodity profits.

Think about how airlines distinguish price-insensitive business travelers from consumers seeking bargains. Or how the same SUV model is sold at very different prices under the brands of Volkswagen, Audi, and Lamborghini.

Priority fees are an incredible price discrimination mechanism in blockchains. The fees paid by the highest priority transactions are actually several orders of magnitude higher than the median.

Both L2s and Solana achieve high throughput and high revenue by using sequence priority as a form of price differentiation.

Marginal transactions pay very low fees, achieving huge TPS. But price-insensitive transactions get commissions and pay most of the network revenue.

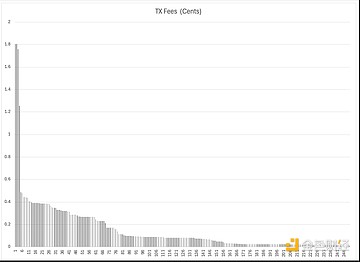

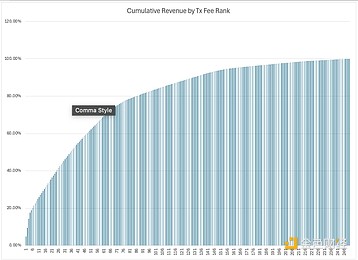

Here is the distribution of 5 blocks randomly drawn from Base L2. This is a clear Pareto distribution, which makes price differentiation very effective.

The top 10% of transactions pay 30% of the revenue. The bottom 10% of transactions pay less than 1%.

The problem is that while the sorters are making a ton of money from this, the DA layer is not participating because it doesn’t have any price differentiation.

That super high value arbitrage pays the same fee for Ethereum DA as the 1 wei spam transactions because they are settled in one batch.

Since marginal transactions are of very low value, you can only get high TPS if intermediate transactions can be on-chain at near zero cost. But with DA, essentially every transaction has the same payment.

A DA layer can have high throughput or it can have high revenue. But you can’t have both.

This makes it essentially impossible for rollups to scale without collapsing Ethereum network revenue.

The rollup-centric roadmap is fundamentally flawed because it abandons the valuable part of the network (ordering) thinking it will go back to the worthless part (DA).

I was initially optimistic about the Rollup-centric roadmap because I thought any rational person would recognize the price discrimination economics and that it would work in parallel with the scaling of L1.

High-value, price-insensitive users would use L1 because of its reliability, secure finality, and provenance. L2, on the other hand, focuses on marginal, low-revenue users that are priced out of L1 fees. As a result, Ethereum would still receive significant sorter rent.

But Ethereum leadership has repeatedly stressed that L1 as an application layer is effectively dead and will never scale. So users and developers have reacted very rationally, and the L1 application ecosystem is now dying, and Ethereum network revenue is dying with it.

If you believe that the long-term valuation proposition for ETH is as a monetary asset, then this might still be ok. Getting more people to own ETH makes it a form of money. And subsidizing L2s so that the base layer accrues zero value should help with that.

But if you believe that the long-term valuation proposition for ETH is network equity in a widely used protocol (which *I* think is more likely than ETH as money), then you need value accrual.

It’s clear that we really screwed this up with faulty economic assumptions.

YouQuan

YouQuan

YouQuan

YouQuan Hui Xin

Hui Xin Joy

Joy Hui Xin

Hui Xin Clement

Clement Joy

Joy Catherine

Catherine Kikyo

Kikyo Davin

Davin Jasper

Jasper