Author: Nitin, Ishita, and Pavel Source: Hazeflow Translation: Shan Ouba, Golden Finance

It's been 15 years. Trillions of dollars have poured in, and the industry has reshaped the financial, technological, and regulatory landscape. Wall Street, Silicon Valley, and global regulators have all taken notice.

But yet—not a single crypto app has truly become a part of everyday life.

No one wakes up and opens their favorite crypto app first thing. No one messages a friend through their wallet's native chat tool. No one transfers $5 to a friend on-chain like they can with Venmo or PayPal. How did we do it: build such a large, noisy, and well-funded industry, but fail to launch even a single "everyday-level" app? For much of the past 15 years, the crypto industry has focused on building core infrastructure—blockchains, consensus mechanisms, wallets, cross-chain bridges, oracles, financial primitives, and more. This decade-long "infrastructure phase" was no accident. For decentralized systems to truly take off, they must equal or even surpass centralized systems in performance, reliability, and flexibility.

This means that the first 10 to 15 years of the crypto industry were primarily about proving a series of concepts:

Bitcoin: currency without banks;

Ethereum: code is law;

DeFi: decentralized finance;

NFT: tokenized ownership.

While these concepts gave rise to dapps, they were limited by scalability, latency, and complexity of use. Today, however, a noticeable shift is underway in the ecosystem. As highly scalable blockchain technology matures, resource-intensive crypto applications are finally coming to the fore—applications that rival Web2 in ease of use and speed. The crypto "infrastructure era" is transitioning to the "utility era." We are beginning to see the first signs of real on-chain usage: Stablecoins (USDC, USDT) lead in daily trading volume, making traditional payments slow and expensive; Memecoins are no longer just speculative tools, but have become programmable, tradable social currencies; Polymarket is verifying the scalability of prediction markets with "real money" and "real data"; High-performance decentralized exchanges (such as Hyperliquid) are directly challenging the position of centralized exchanges by abstracting complexity. While it's still early days, these signals foreshadow a broader cultural shift. The Evolution of "Everyday Apps" on Mobile Early 2000s → Before smartphones, the mobile experience was fragmented and function-oriented. Mobile apps offered only basic functionality, like calendars, ringtones, and Java-based games. Opera Mini (2005) brought the "full web" to feature phones for the first time, and Google Maps Mobile offered an interactive navigation experience. However, distribution was chaotic: there was no unified App Store, only carrier-provided portals, download centers from manufacturers like Nokia, and independent websites like GetJar. With slow internet speeds (2G) and expensive data, most users relied solely on pre-installed apps—a situation strikingly similar to the current situation with encrypted apps. Late 2000s to early 2010s → The launch of the iPhone in 2007 and the App Store in 2008 completely changed everything. For the first time, a unified global mobile app marketplace emerged. Early apps like Facebook, Gmail, Google Maps, and WhatsApp quickly became part of everyday life. WhatsApp, in particular, experienced explosive growth in countries where text messaging was expensive, leveraging its practicality and network effects to ultimately become a mainstream communication tool. Mobile habits began to form: users would open the same apps multiple times a day, not just for functionality, but for connection. By 2013, smartphone penetration had reached a global critical mass, spawning a wave of truly "everyday apps": ride-hailing and food delivery services (Uber, DoorDash) went from luxuries to necessities. Uber's model particularly exemplifies the power of a strong feedback loop: more drivers mean shorter wait times, attracting more passengers, which in turn attracts more drivers. This two-sided network effect is precisely what DePIN (Decentralized Physical Infrastructure Network) promises: user participation feeds back into the infrastructure, transforming it into a "user-driven living system." Simultaneously, mobile payment systems like Apple Pay, WeChat Pay, and Alipay have made digital finance incredibly seamless. These apps are deeply integrated into mobile operating systems, such as contacts, payment, and notifications, making them irreplaceable and difficult to migrate. After 2016 → After 2016, the focus of mobile apps shifted from "utility" to "dopamine rush." Short-form video apps like TikTok transformed mobile phones into portals to endless entertainment. Starting as a niche phenomenon, they quickly became global cultural phenomena—TikTok's user base grew from 50 million in 2018 to 1 billion in 2021. These weren't just "apps"; they were entirely new experiences that captured attention and reshaped habits. They formed new "habit loops," forcing Instagram and Facebook to launch their own imitative products (Reels, Stories). Today, mobile apps are deeply embedded in global cultural and social infrastructure. Meta's product matrix (Facebook, WhatsApp, Instagram) reaches over 3 billion people daily. Regional leaders like WhatsApp in India and WeChat in China have also grown rapidly through localization. Apps that serve core human needs (communication, mobility, payment, and entertainment) are the most enduring winners. The success factors for these apps remain unchanged: Strong network effects Intuitive onboarding Platform-level integration (pre-installed, OS-level sharing) The ability to consistently create "habitual value" Today, the winners are no longer just "single apps" but entire "ecosystems." The Difference Between Crypto Applications and Traditional "Everyday Apps" In traditional tech, developers spend years searching for the so-called "killer app"—the single hit product that brings mass adoption. But in reality, this adoption has only occurred incrementally, with the gradual penetration of smartphones themselves. The crypto industry has taken a completely different approach. The longest-lasting projects—Bitcoin, Ethereum, Uniswap, Aave, ENS, The Graph—are not consumer-facing applications, but underlying infrastructure. They are protocols, not platforms. In fact, if giants like Google or Meta evolved from applications into ecosystems, leading crypto projects started as ecosystems, but are still waiting for true "everyday applications" to emerge on top of them.

This reveals a core divide: Web2 built “visible applications”, which later became platforms; Web3 built “invisible protocols” and are now waiting for their killer applications. The root of this disagreement lies in the structural and conceptual differences:

The conceptual differences have brought about structural impacts:

Wallet, as the core identity system, allows users to own assets and make direct payments, but it also brings complexity to the experience;

Retention and habit formation: users will actively open it every day/week, forming a natural usage habit;

Network effect and content freshness: the more people use it, the better it is, and the content or interaction continues to be attractive;

Adaptation to daily needs: solving clear and repetitive daily problems - such as communication, payment, travel, entertainment, and information acquisition;

Zero threshold to get started experience: users can quickly obtain value, identity authentication is optional, and the process is clear and intuitive;

Platform exposure and distribution channels: OS Integrations, app store rankings, and pre-installations can drive additional growth;

Localization and cultural adaptation: Supporting local languages, payment methods, and user habits is crucial for true global expansion.

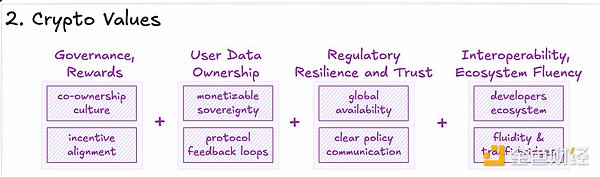

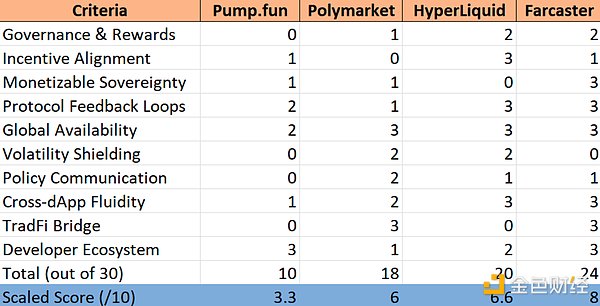

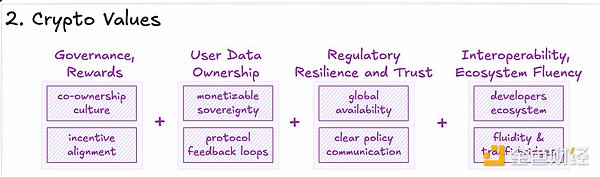

However, the evaluation criteria for Web3 applications go beyond this. They must also meet additional requirements in terms of crypto-native dimensions.

Introducing the Everyday Application Evaluation Framework

To become a true "everyday application," a crypto product must not only achieve habitual user usage and social virality but also possess a smooth user experience and incorporate the unique advantages of Web3: ownership, governance, interoperability, and data sovereignty. This evaluation framework focuses on qualitative indicators of whether the application has been integrated into users' daily lives and community culture.

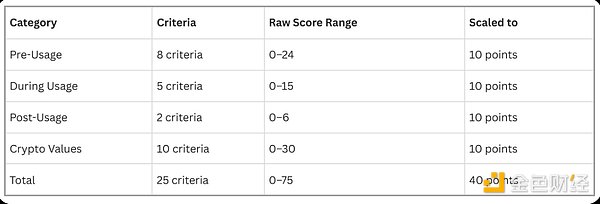

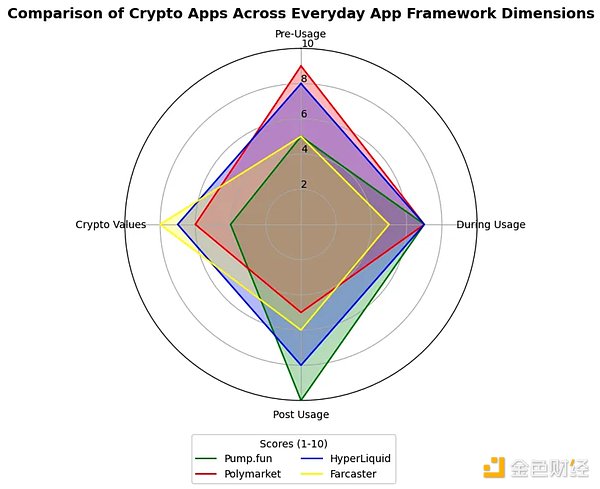

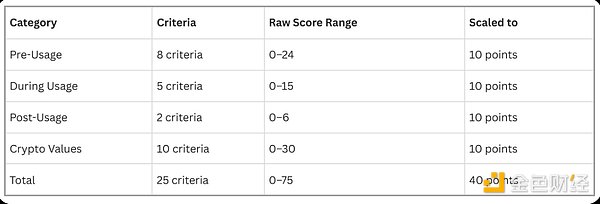

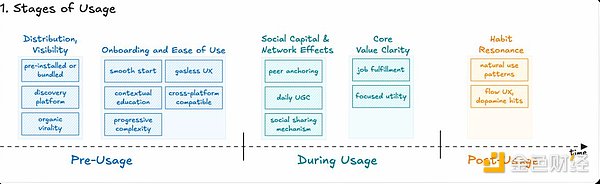

The framework is divided into four dimensions, with a total of 25 evaluation criteria:

Four dimensions:

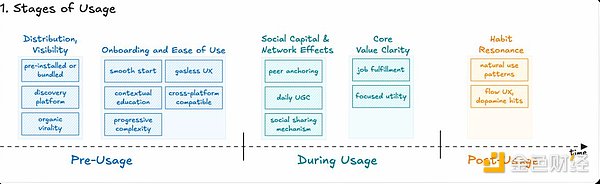

Pre-use stage: How do users access and enter the application?

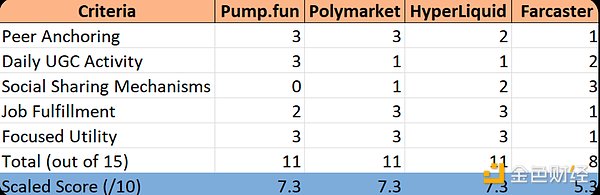

In-use stage: What feelings and behavioral habits do users form during use?

Post-use stage: Will users use it again and whether stickiness is formed?

Web3 core value: Whether the encryption native features are truly implemented?

Rating scale for each assessment item (0–3):

The total score of each section will be normalized to a 10-point scale to ensure consistent weighting across the four dimensions.

Examples of using the evaluation framework in daily applications:

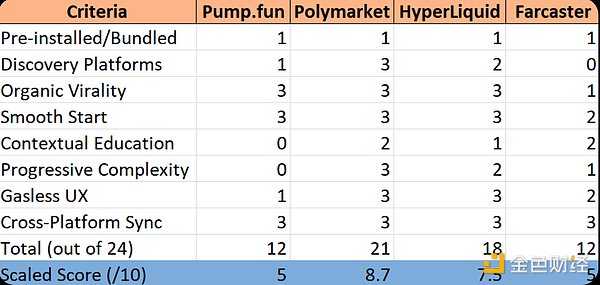

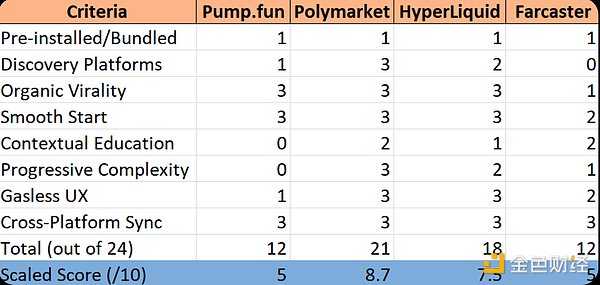

The following are four projects that are close to the standard of "everyday crypto applications", namely: Polymarket, Pumpdotfun, HyperliquidX, and Farcaster

We use the above evaluation framework to score these four projects in four stages (0–3 for each item, overall normalization):

I. Pre-use stage

How do users find the application?

Is the onboarding process smooth?

Does it have a natural social dissemination mechanism?

Is the initial experience attractive?

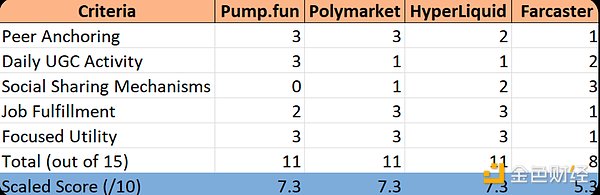

II. In-use Stage

Third, post-use phase

Kikyo

Kikyo