Author: Marco Manoppo Source: Launchy Translation: Shan Ouba, Golden Finance

Cryptocurrency is now a ten-year-old industry. To be more precise, it has been around for 15 years, but while the Bitcoin whitepaper was released in 2008, there wasn't a lot to do on the blockchain until Ethereum pioneered smart contracts.

Some would even say that the word "industry" is still too generous.

The entire crypto asset market is still smaller than Nvidia. Next time you think about selling your crypto to BlackRock, read that last sentence again. That being said, gone are the days when cryptocurrency was seen as career suicide, and gone are the days when developers and investors were seen as foolish for participating.

Still, your family may ask you if what you’re doing is real.

So, other than increased public acceptance and no more being looked at strangely for saying you work in crypto (who would believe me… that still exists) – after more than a decade of development, iteration, and experimentation, what have we achieved?

Turns out, a lot!

Stablecoin Settlement Volume Reaches $10 Trillion, Approaching Visa Levels

Over $100 Billion in Crypto Collateralized

Bitcoin ETF Reaches $10 Billion in AUM, Fastest Growing ETF in US History

Wait a minute… Why is all of our achievements tied to money flows or some kind of investment product? What about Web3, Decentralized Identity, and the Metaverse! Yes, the kids want the Metaverse!

You won’t own any land, but you will own this private digital plot of land next to Snoop Dogg’s pixelated mansion, and you’ll be happy! Next!

To understand why the above achievements are amazing even though we don’t have mainstream consumer applications yet, we need to recognize what cryptocurrency is.

Is it a new asset class?

Is it a new form of equity?

Is it a new form of money or commodity?

Is it a movement?

Is it an ideology rooted in libertarianism?

After more than 7 years in the cryptocurrency space, my definition of cryptocurrency is simple:

Crypto is a tool to increase the velocity of capital; capital is ultimately a means of coordinating energy.

Capital Velocity

I know what you’re thinking. Is this another piece of VC crap churned out to cater to a down market? Hmm… trust your gut ;)

But never mind, let’s move on…

Over the next 50 years, only two things will stay constant:

It doesn’t matter if you’re a techno-optimist or a nostalgic.

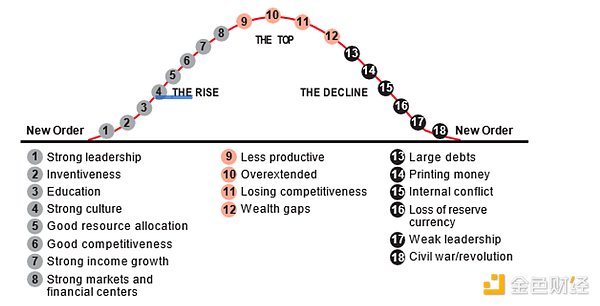

Our world is moving in an unprecedented direction. Historians, another term for macro fund managers, may seek to compare the current world to the past, looking for patterns that can be used to analyze the current state of the world.

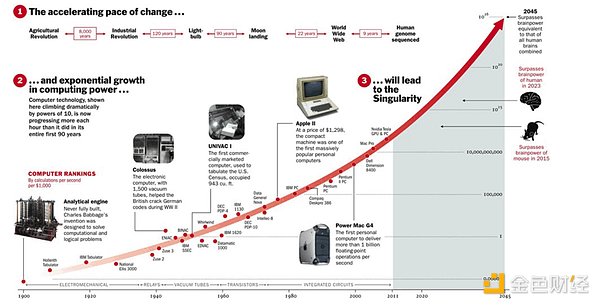

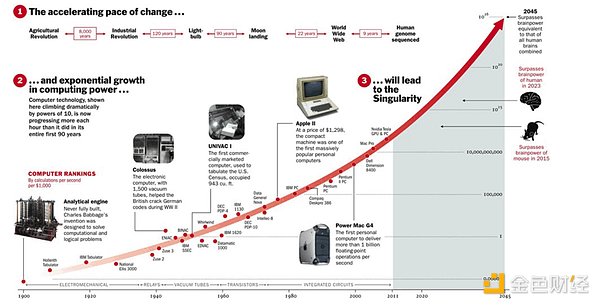

While there may be some benefits to studying the past, the world and society have never faced such a rapid pace of technological innovation. The innovations we have created in the past 100 years have resulted in exponential progress compared to the progress made between 1500-1900.

Source: Time

And we’re not slowing down.

Think about it, our parents and grandparents used to have more time to adapt with each technology cycle. There were some differences between mobile phones, but they all had more or less the same functionality until the internet came along.

Since then, everything has become more exponentially more advanced. In 2015, the term “influencer” was relatively new. In 2017, we had the first cryptocurrency ICO bubble. In 2020, we had the COVID virus and mRNA vaccines. In late 2022, we had ChatGPT. A college student graduating in 2019 has never seen such rapid technological innovation as in the past five years.

Fast forward to 2024, we are having a heated discussion around nuclear energy, biotech, and space/military technology. All of this doesn’t even take into account AI girlfriends. Yes, we shouldn’t underestimate that AI girlfriends will be the innovation with the greatest impact on human society (but that’s another topic).

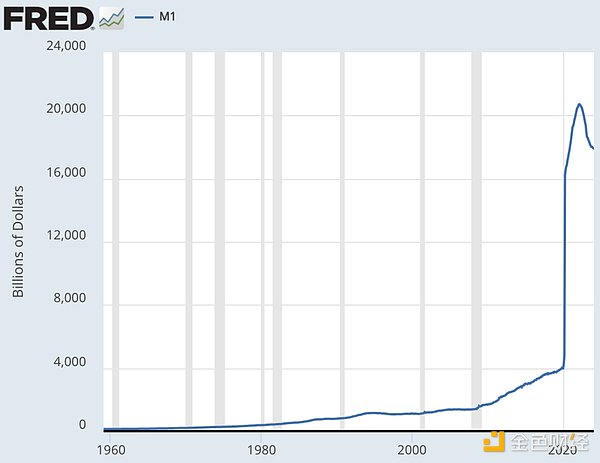

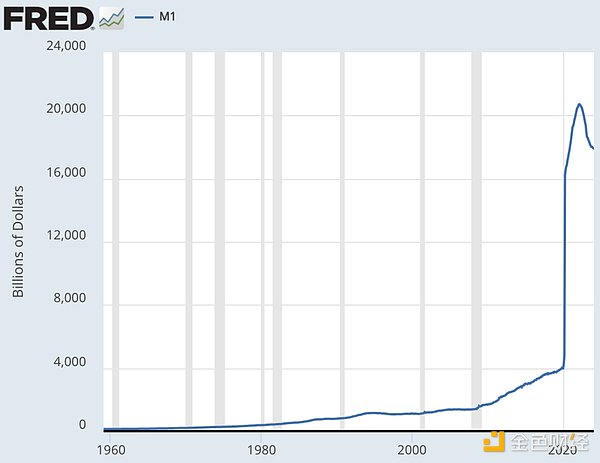

In terms of volatility, we have to admit that macro fund managers have contributed something. When 75% of the existing USD circulation has been printed in the past four years, something is bound to break sooner or later.

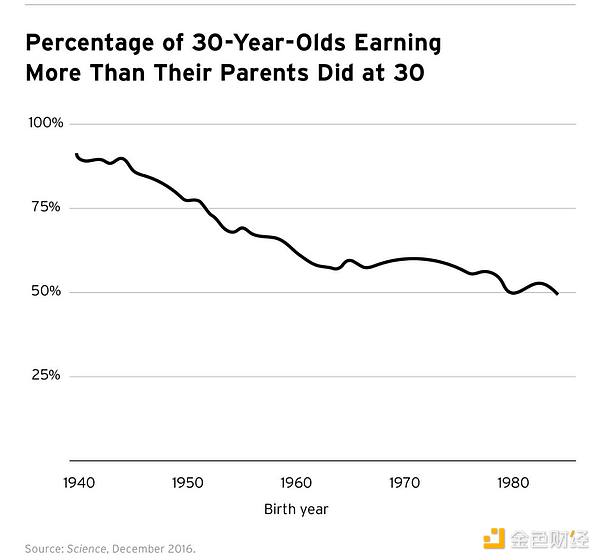

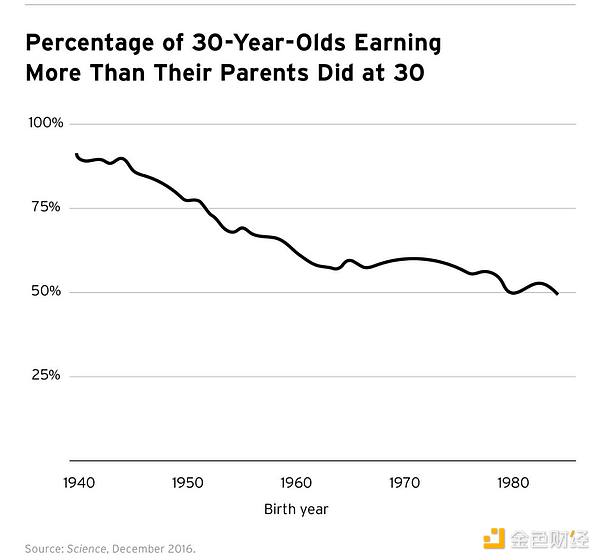

For the first time in history, we have a generation that will not be better off than their parents.

Why are the above two charts so important?

Because they symbolize the growing wealth gap in our world, which will eventually lead to instability.

Massive wealth inequality caused by wrong policy decisions and a social structure that fails to give hope to the younger generation will inevitably lead to social unrest and make our world more unstable.

So why should we get involved in cryptocurrencies?

If done right, cryptocurrencies are a tool for a decentralized system.

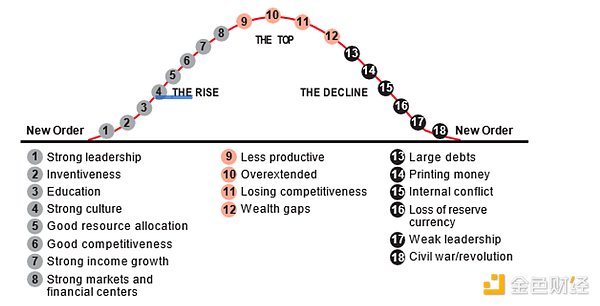

Many aspects of our world, including money, power dynamics, and other social structures, operate as systems. Currently, these systems are becoming increasingly digital and volatile. In order to prevent chaos and maintain stability, society must have a way to effectively coordinate its energies and nip the threat of collapse in the bud.

I believe that, if done right, cryptocurrencies are the right tool to achieve this goal.

This is because cryptocurrencies can increase the velocity of capital. The permissionless nature of cryptocurrencies reduces transaction friction and makes it easier for value to be traded between any entity in the world. At the end of the day, capital is simply a means of coordinating the flow of energy. From funding new projects to creating incentives, our entire world relies on how capital is allocated.

In essence, our entire world is just a mechanism design.

This is why cryptocurrency is often seen as an incredibly interesting and controversial industry. Due to its permissionless and decentralized nature, it has the potential to disrupt the existing system. It is the best tool for coordinating capital (and therefore energy) in an increasingly digital and turbulent world where power and wealth disparities are widening. It is also the means for everyone to truly own their capital, digital footprint, and ultimately their energy.

Keep thinking, act pragmatically.

Joy

Joy