Author: Momir Translator: Shan Ouba, Jinse Finance

The crypto market gave back its previous gains in November, with underlying reasons intertwined with technical, fundamental, and purely psychological factors. Traders who follow the four-year cycle of cryptocurrencies know that the fourth quarter of 2013, 2017, and 2021 all marked the top of the cycle. Many traders still firmly believe in this pattern, and when enough people act on it, this belief itself is enough to influence market trends.

More specifically, throughout November, the fluctuations in the probability chart of a Fed rate cut were comparable to the price movements of the MEME cryptocurrency. At one point, the probability of no rate cut in December soared to 76%, triggering widespread panic across various risk assets. However, after key Fed officials released dovish signals, this probability plummeted to about 6%.

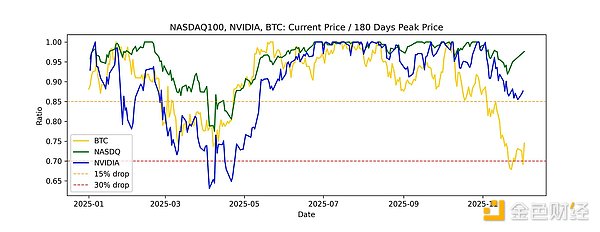

But the real core variable is the AI bubble. Today, concerns about an AI bubble have become a mainstream consensus. As these concerns spread, market participants have become more conservative, with risk-averse assets like cryptocurrencies typically bearing the brunt. The AI Bubble: Where Are We? Concerns about an AI bubble have evolved from initial skepticism into a consensus among "smart money." Recently, smart money has been expressing pessimism about a bubble bursting to demonstrate their foresight, but this raises the question: are we perhaps closer to the beginning of a bubble than its end? Looking back at the history of the dot-com bubble, smart money began sounding the alarm 3 to 4 years before it burst. Warren Buffett, whose fund didn't allocate any technology stocks at the time, significantly underperformed the market for a long period before 2000, enduring years of pressure. Ironically, Peter Thiel is currently reducing his AI-related holdings, while Berkshire Hathaway is increasing its stake in AI giant Google—perhaps Berkshire has a deeper understanding of bubble theory. Looking at the data, the dot-com bubble roughly began in 1995 and ended in March 2000, lasting about five years, experiencing nine corrections of 10% or more before finally bursting. To date, the AI bubble has only seen three similar corrections. If history repeats itself, a large-scale liquidation may still be two to three years away. More importantly, the market has become cautious – this is reflected not only in Nvidia's 15% stock price decline, but also in the negative price impact of recent capital expenditures and cyclical trading on related stocks. During this period, Bitcoin's price movement has become a leveraged version of Nvidia's, with its bottom and top occurring roughly in sync. When Nvidia's stock price corrects, the cryptocurrency market also comes under pressure. Coupled with continued selling by traders following cyclical patterns, this explains Bitcoin's 30% drop.

Crypto Industry-Specific Turmoil

Tether Rating Downgrade

Besides macroeconomic headwinds, the crypto industry itself is facing numerous troubles. S&P Global downgraded Tether's stablecoin rating to the lowest level, escalating the situation. Market speculation suggests that Tether may need to liquidate gold, Bitcoin, and other non-Treasury bond assets to meet listing and compliance requirements. While we have long criticized Tether for taking unnecessary risks, the fact remains that Tether is still an over-capitalized company. MicroStrategy: No Longer a Firm Hold on Bitcoin MicroStrategy's actions have also drawn attention: the company announced it will consider selling Bitcoin if its adjusted net asset value (mNAV) falls below 1.0x. Furthermore, MicroStrategy is raising funds to pay dividends by selling its own shares—a move that superficially bears unsettling Ponzi scheme characteristics. Adding insult to injury, MSCI announced plans to remove MicroStrategy from its indices. Once a model of corporate Bitcoin adoption, MicroStrategy has now become a potential risk factor for Bitcoin.

Vanguard Embraces Crypto

The only truly bullish news comes from Vanguard's shift in stance. The world's second-largest asset manager has decided to allow exchange-traded funds (ETFs) and mutual funds that primarily hold cryptocurrencies to trade on its platform, completely reversing its long-standing anti-crypto stance. This low-key institutional milestone is far more significant than commonly perceived.

Fed Dynamics: A Dovish Shift

In December, the Federal Reserve's policy signals underwent a significant shift, providing much-needed support for risk assets. In mid-November, market concerns about the Fed not cutting interest rates intensified, with the probability soaring to 76%. However, these concerns almost vanished after key Fed officials released dovish comments—currently, market pricing shows a 94% probability of a 25 basis point rate cut in December. In just a few weeks, market expectations have completely reversed.

Meanwhile, political factors have further reinforced dovish expectations: on the Polymarket platform, the probability of Kevin Hassett becoming the next Federal Reserve Chairman has surged to 85%. Hassett is widely considered more market-friendly and dovish than other candidates, which, if true, would mean that the Fed is likely to maintain its accommodative policy, except for immediate rate cuts. Coupled with the stabilization of the Fed's balance sheet, the central bank appears to be shifting back to a supportive stance. Despite ongoing concerns, the economy has not slowed down. More than 80% of the companies in the S&P 500 reported better-than-expected third-quarter earnings. Liquidity has returned to the market after the government shutdown ended. Government spending remains one of the core drivers of this economic cycle, and coupled with investment in AI, the US economy remains vibrant even with high interest rates. Key findings include: (1) clear signs of a genuine slowdown in fiscal spending – which would remove a major support for the economy; (2) Nvidia’s performance – as a leading indicator of AI sentiment and cryptocurrencies, its movements are highly correlated with the crypto market; and (3) whether the lagged effects of quantitative tightening (QT) will trigger liquidity problems, even if the Federal Reserve adopts a more dovish stance. For the cryptocurrency market, Vanguard’s shift in stance is more significant than most people realize. Institutional adoption is like a slow-moving freight train; once it starts, it’s hard to stop easily. Concerns raised by Tether and MicroStrategies are worth noting, but may be overstated in terms of immediate risks.

Jasper

Jasper

Jasper

Jasper Hui Xin

Hui Xin Alex

Alex Aaron

Aaron Jasper

Jasper Joy

Joy Kikyo

Kikyo Clement

Clement Joy

Joy Hui Xin

Hui Xin