Author: Dante&HY&Vitto, DeepSafe Research

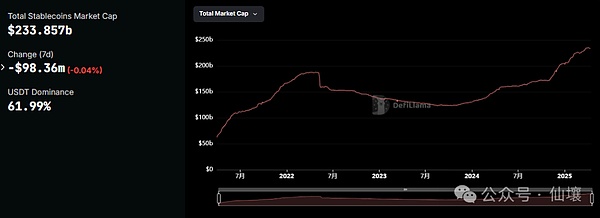

The ICO boom in the Ethereum ecosystem in 2017 gave rise to the vigorous development of ERC-20 and on-chain asset ecosystems, and also increased the market demand for stablecoins and BTC mapping assets. Since then, on-chain assets such as USDT, USDC, BUSD and WBTC have become popular and gradually become star projects in the Crypto field.

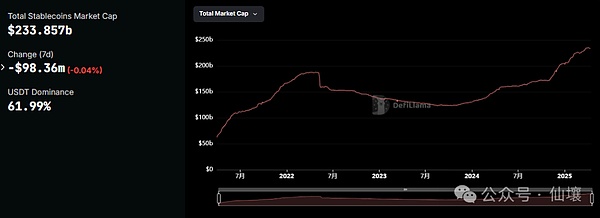

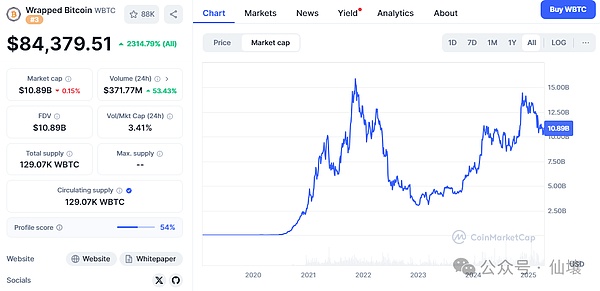

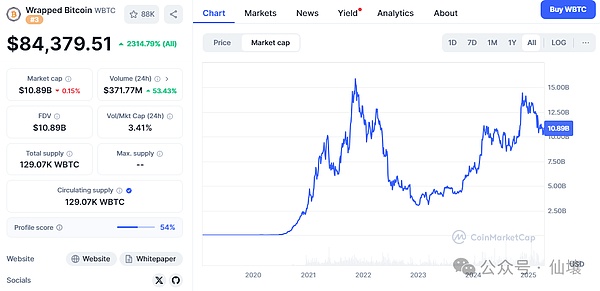

So far, the circulating market value of stablecoins has exceeded 200 billion US dollars, and BTC mapping assets such as WBTC also have a market value of more than 10 billion US dollars.It can be said that stablecoins and BTC mapping assets have become the indispensable cornerstones of the entire Web3 financial system. Without them, the entire Defi system may be wiped out.

However, these large-scale and influential on-chain assets have never gotten rid of various thorny problems. Whether it is USDT or USDC, or BUSD and HUSD, or WBTC, they have all suffered disasters due to the adoption of highly centralized management solutions. In April 2025, the incident involving Justin Sun and FDUSD even caused the latter to deviate by 12% on the same day. Although FDUSD eventually successfully returned to its anchor, these events have deepened people's suspicion of centralized on-chain assets and gradually made people lose trust in the asset management model of centralized custody, which is tainted with original sin.

Throughout history, there have been many cases of problems with centralized on-chain assets and custody platforms. In the final analysis, the management model that relies solely on credit as a source of endorsement has never been in line with the Trustless principle and has introduced overly optimistic assumptions about human nature. From FTX and LUNA to the Madoff fraud and the collapse of the Bretton Woods system, if people have excessive trust in certain platforms or institutions, or even certain countries and governments, they will eventually pay a heavy price for it. If it is not possible to construct strong restrictive measures through technical means, a crisis will sooner or later break out between centralized platforms and asset issuers.

In this article, we will list the typical centralized custodial on-chain assets that have experienced major accidents, such as BUSD and HUSD, WBTC and renBTC, to explain to you whytrust-based on-chain assets and custody methods will inevitably be abandoned by the times, and what problems trust-free decentralized custody should solve.

(Note: This article is originally created by DeepSafe Research and is authorized to be forwarded by Xianrang)

From BUSD to WBTC: Why do centralized custodial on-chain assets repeatedly encounter crises?

The representative of centralized custodial on-chain assets is the familiar USDT. Since its launch in 2014, USDT has been the leader in the stablecoin track. Today, its circulating market value has reached an astonishing $140 billion, a figure that far exceeds the US dollar foreign exchange reserves of most countries. However, since its inception, UDST’s centralized management approach has been criticized by everyone.

In 2019,the New York Attorney Generalhadinvestigated and found thatTether concealed $850 million in losses and misled the market. text="">Since then, there have been a lot of news reports pointing out that USDT is seriously over-issued and Tether has market manipulation. Wall Street institutions such as Citron Capital have said more than once that they want to short USDT. Although Tether has repeatedly escaped danger from short-selling bombardment with seemingly sufficient reserves, the negative news surrounding USDT has never disappeared. In recent months, many large companies have removed USDT from the EU regulatory area, which also illustrates the problems of this type of centralized stablecoin.

Compared to USDT, USDC, which is covered with a layer of compliance, is also not doing well. In the Silicon Valley Bank crash in 2023, USDC's $3.3 billion reserve was implicated because it was deposited in the bank, and the USDC price once decoupled from the anchor to $0.87;In February 2024, USDC stopped issuing on Tron. Although this move was under the banner of catering to supervision, it made the market question the anti-censorship of USDC.

Of course, USDT and USDC are just the tip of the iceberg of centralized on-chain assets. Projects such as BUSD, HUSD, and WBTC have more serious problems and worse impacts.

BUSD

BUSD was born in 2019, when the global crypto market was booming and the market needed an asset that could be anchored to the US dollar and circulate on the chain. At that time,

Binancecooperated with Paxos to launch BUSD, this stablecoin is similar to USDT and promises to be 100% guaranteed by highly liquid assets such as cash and US Treasury bonds. More importantly, BUSD is regulated by the New York State Department of Financial Services (NYDFS) and audited by top accounting firms. The reserve fund is kept in a bankruptcy segregated account, which is separated from the issuer's own assets to ensure that the issuer cannot misappropriate the reserve fund. Because of the endorsement of institutions such as Binance and Paxos, BUSD is given the halo of "safe and reliable". In addition, it is easy to operate and low-cost, and BUSD quickly gained market recognition. With the advent of the DeFi boom in 2020, BUSD has become one of the stars in the stablecoin track with the support of the huge ecosystem of Binance and BSC. It is not only widely used in Binance, but also penetrated into various Dapps in the Ethereum ecosystem, becoming an important asset in scenarios such as liquidity mining, lending and transfer.

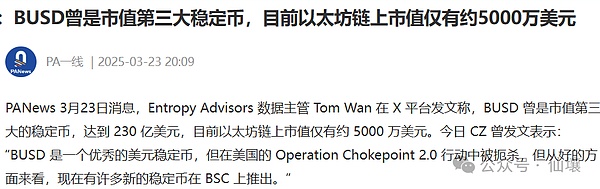

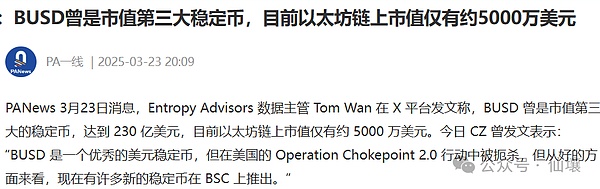

In November 2022,BUSD's market value climbed to 23.3 billion US dollars, almost becomingthe most successfulcentralized stablecoin besidesUSDTand USDC.However, in early 2023, BUSD's fate ushered in a turning point.

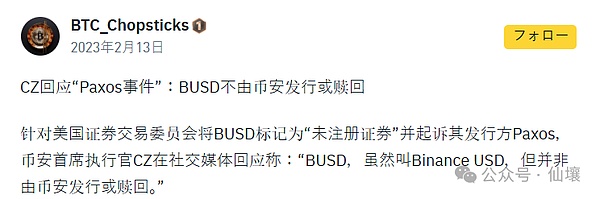

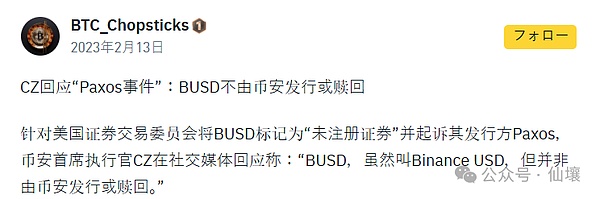

On February 3, 2023, the US SEC sent a notice to Paxos, accusing BUSD of being an unregistered security, directly pointing to the legality of BUSD. Although Paxos firmly denied this and argued that BUSD did not meet the definition of securities, the regulatory controversy surrounding BUSD has intensified since then. In response, CZ said: Although BUSD is called BinanceUSD, it is not issued or redeemed by Binance.

On February 13, the New York State Department of Financial Services (NYDFS) ordered Paxos to stop issuing new BUSD tokens to the market on the grounds that "Paxos cooperates with Binance and there are several unresolved regulatory issues." These issues may involve anti-money laundering and KYC compliance loopholes, but the specific details have not been made public.

Paxos immediately announced that it would stop the subsequent issuance of BUSD from February 21, 2023, and terminate its cooperation with Binance on BUSD matters This series of events overturned the foundation of BUSD, and the market reacted violently: According to CryptoQuant data, within 24 hours after the announcement, about 52 million US dollars of BUSD poured into the exchange and were sold, and the price of BUSD deviated from the anchor point and was temporarily decoupled. Although the price quickly stabilized, user confidence has been severely damaged. On November 29 of that year, Binance announced that it would stop supporting BUSD from December 15, and planned to automatically convert the BUSD held by users into FDUSD from January 2, 2024. At this point, the market value of BUSD has dropped from a peak of $23.3 billion in 2022 to about $1.7 billion at the end of 2023, and will eventually be replaced by FDUSD. As of March 2025, the total market value of BUSD in circulation will be less than $60 million.

Although BUSD has not experienced large-scale depegging or fund theft , in the final analysis it has not gotten rid of the inherent problems of centralized assets : Regulatory uncertainty, opaque operations, and lack of vitality for long-term survival. The fall of BUSD is a typical case: Even with the endorsement of regulators, policy changes can quickly rewrite the fate of a project. Users entrust their assets to centralized institutions, but in return they passively accept unknown risks. The final outcome of BUSD will ultimately be decided by centralized forces such as Paxos, Binance, and regulatory agencies. In the pursuit of transparency, autonomy and self-hosting in Web3, this model clearly violates the spirit of decentralization, and such things will sooner or later collapse due to the abandonment of centralized forces.

HUSD

HUSD was launched by Stable Universal in 2019, and its reserves are managed by Paxos Trust Company. Since the latter is a trust company regulated by the United States, HUSD is covered with a layer of "compliance". After its launch, HUSD was mainly circulated within Huobi, and its mechanism is similar to that of USDT. Due to Huobi's strong support, HUSD quickly became one of the core assets in Huobi's ecosystem.

In 2021,the market value of HUSD in circulation once climbed to 1 billion US dollars,becomingthe preferred stablecoin for Huobi users. By introducing market makers, preferential policies and ecological incentives, HUSD has formed a nearly closed-loop liquidity network within Huobi, and to some extent has become an extension of Huobi's power.

However, Huobi's success and failure are both due to Huobi. In 2022, as Huobi itself gradually declined, HUSD began to take a sharp turn for the worse. As the global regulatory environment tightens, in August 2022, Huobi closed the market maker accounts in some regions, and the market depth of HUSD was rapidly weakened. This adverse consequence was soon reflected in liquidity: the price of HUSD fell to US$0.92 within a few hours, and even hit a low of US$0.82. For a time, the market was in an uproar, and the fud sentiment around HUSD intensified.

Although Huobi issued a statement at the time, emphasizing that HUSD reserves were sufficient and pulled the price back to $1 within 12 hours, the trust rift between users and HUSD had already formed, and the market's doubts had not dissipated - HUSD had no independent audit, no third-party verification, and no solid technical support.

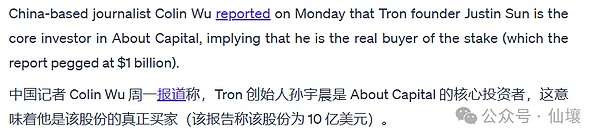

And the bad news about HUSD came soon after. In October 2022, Huobi's equity structure changed dramatically. Founder Li Lin sold $1 billion worth of shares to About Capital under Justin Sun. On October 10, Huobi announced the delisting of some HUSD trading pairs. Only 17 days later, Huobi further decided to completely delist HUSD, and planned to exchange HUSD held by users for USDT at a 1:1 ratio.

The fate of HUSD was completely rewritten. Since the trading volume of HUSD is almost entirely dependent on Huobi, its liquidity is negligible in other exchanges. After Huobi delisted it, HUSD quickly collapsed, falling to a low of US$0.28. The market value of HUSD, which was once as high as 1 billion US dollars, will only be 63 million US dollars by the end of 2022, and HUSD is basically dead. Although HUSD reserves are managed by Paxos, it theoretically meets regulatory requirements, but because it has always been a centralized on-chain asset under the control of a large exchange, it lacks the tenacious vitality of DAI that can be developed sustainably purely by a decentralized mechanism. Once the backer disappears, HUSD will directly lose its living soil. In the end, HUSD became Huobi's abandoned child and completely withdrew from the stage of history after a brief period of glory.

The ups and downs of HUSD reveal the cruel truth: when the fate of a stablecoin is tied to a single platform, the so-called "stability" is nothing more than a joke about a centralized system.Although this kind of thing can rise rapidly in the early stages with the support of centralized forces, it is destined not to last long and will ultimately be unable to escape the fate of overthrow.

flexUSD

flexUSD is a stablecoin issued by the exchange CoinFLEX. Users can mint flexUSD by depositing USDC and redeem it at a 1:1 ratio at any time without paying additional fees. CoinFLEX pays interest to flexUSD holders every 8 hours, and its income comes from CoinFLEX's repo lending market. This gameplay has attracted many investors seeking low-risk returns.

Similar to HUSD, flexUSD was born during the Defi boom, and users were attracted by its high-frequency interest payments and promises of no redemption fees. its circulation volume reached hundreds of millions of dollars at its peak. CoinFLEX's lending market is also widely praised for its flexibility and transparency, and the platform claims that its capital utilization is efficient and stable.

More importantly,flexUSD's marketing strategy cleverly caters to market sentiment-against the backdrop of volatile cryptocurrency prices, it is packaged as an "ideal asset" that can both preserve and increase value.During this period, CoinFLEX's community activity was high, and flexUSD became a popular choice in many investors' portfolios.

But the storm in June 2022 swept CoinFLEX. The cause was that CoinFLEX publicly accused well-known investor Roger Ver of defaulting on $47 million in debt, causing its capital chain to be on the verge of breaking. CoinFLEX's lending market is highly dependent on the solvency of counterparties, and this incident exposed the fragility of risk management.

On June 23, 2022, CoinFLEX announced the suspension of withdrawals for all users, including flexUSD holders, citing "extreme market conditions" and "counterparty uncertainty". This unexpected event caused flexUSD to collapse rapidly, and it once de-anchored to $0.15.

In order to save the situation, CoinFLEX tried a series of remedial measures. The platform hastily launched the rvUSD stablecoin, promising an annualized return of 20%, trying to raise $47 million to fill the hole, but this failed to win market trust. On July 14, CoinFLEX partially resumed the withdrawal function, allowing users to withdraw 10% of their account balance, but the frozen state of flexUSD remained unresolved, and the lack of liquidity made users more question CoinFLEX's solvency.

Finally, the CoinFLEX platform was unable to recover and was forced to initiate corporate restructuring, and flexUSD holders could only face the end of a significant reduction in assets. It can be said that whether it is the RWA stablecoin backed by real estate, or the flexUSD that attracts users with interest, these assets that rely on centralized custody are very likely to fall into crisis due to insufficient liquidity or poor reserve management. Since such platforms have full power to restrict users from evacuating in time, it is easy for users to suffer losses in the end.

The story of flexUSD reminds us once again that in the blockchain world, truly reliable projects or platforms must have reliable technical implementations, rather than relying on the promises of certain organizations or people.

WBTC (BitGo)

It is well known that the largest centralized stablecoin is USDT, and the largest centralized custodial BTC mapping asset is WBTC, which still has a market value of tens of billions of dollars. As a bridge connecting the Bitcoin and Ethereum ecosystems, WBTC was once highly anticipated, but it also exposed its vulnerability under the shadow of centralization.

WBTC was born from such a goal: to allow Bitcoin liquidity to flow freely in the Ethereum ecosystem. In 2019, WBTCfirst appeared in the form ofERC-20 tokens, with BitGo as the custodian to ensure that each WBTC has a 1:1 Bitcoin reserve. Users deposit Bitcoin into BitGo's custodial address, and then WBTC DAO mints an equal amount of WBTC through a multi-signature wallet, and vice versa, they can destroy WBTC and redeem Bitcoin. To enhance transparency, Chainlink regularly conducts reserve proofs to publicly verify the matching of Bitcoin held by BitGo with WBTC on the chain. This design has quickly made WBTC the mainstream mapping asset of Bitcoin on Ethereum, injecting new vitality into the DeFi ecosystem. During the subsequent DeFi boom, WBTC was widely used as collateral and trading pairs in protocols such as MakerDAO and Aave. As of April 2025, WBTC's market value exceeds US$10 billion, firmly ranking first among Bitcoin mapping assets.

But centralized custody assets are bound to have troubles that cannot be shaken off. In November 2022, FTX collapsed, and WBTC was affected. The price was 1.5% lower than Bitcoin. The market fell into panic and questioned BitGo's reserve payment ability, but Chainlink's audit results confirmed that BitGo's Bitcoin reserves were sufficient, and WBTC stabilized within a few hours. Although this storm did not cause substantial losses, it still gave people an early warning of WBTC.

In August 2024, even bigger troubles occurred. BitGo announced the implementation of a "multi-jurisdiction custody model", that is, 2/3 of the multi-signature keys are dispersed to BiT Global in the United States, Singapore and Hong Kong to reduce the regulatory risk of a single region. On the surface, it is a compliance upgrade, but the details behind it have caused an uproar.

First of all, BiT Global's strategic advisor is Sun Yuchen, a controversial figure. It didn't take long for Jupiter co-founder Meow to publicly question the risks that BiT Global may bring on Twitter.2024On August 12,,MakerDAO's risk assessment unit BA Labs launched an emergency governance discussion and proposed to restrict the use of WBTC. Only 3 Tianhou communities voted to reduce the debt ceiling of WBTC in the MakerDAO system to zero, and completely banned it from being used as collateral for new positions. This decision has greatly shaken the position of WBTC in the DeFi ecosystem. After that, Aave and Coinbase also removed WBTC, and the latter's circulation and usage scenarios are facing a significant decline. A series of events have exposed the fundamental flaw of WBTC as a centralized custodial asset: trust comes from the endorsement of centralized institutions, rather than certainty at the mechanism design or code level. BitGo's decisionandJustin Sun's intervention both remind people that the fate of WBTC is in the hands of a few people, and that these people themselves are highly risky, which is completely contrary to the decentralized spirit of Bitcoin itself.

The ending of WBTC has not yet been settled, and there may be more Defi protocols that reduce the use of WBTC in the future.

renBTC and soBTC

Similar to WBTC mentioned above, renBTC and soBTC also attempt to bring Bitcoin liquidity into the Ethereum and Solana ecosystems through centralized custody. renBTC was launched by Ren Protocol. Users can mint renBTC at a 1:1 ratio by locking BTC on RenVM. soBTC maps BTC to the Solana ecosystem through the centralized bridge protocol on Solana.

Both of them are highly dependent on centralized entities: renBTC's liquidity is closely linked to Alameda Research, while soBTC's asset reserves are controlled by an opaque bridge protocol.

In 2021, renBTC and soBTC reached their peak. The Defi craze at that time made the market eager to introduce Bitcoin into the Ethereum and Solana ecosystems, and renBTC and soBTC just filled the gap. Alameda Research acquired Ren Protocol in 2021,injecting huge amounts of capital, further boosting renBTC's operational capabilities and market confidence; at the same time, soBTC expanded rapidly with the popularity of the Solana ecosystem, and its trading volume surged.

Later, renBTC's market value climbed to about US$500 million,and soBTCalso attracted hundreds of millions of dollars in capital inflows into the Solana ecosystem. However, the good times did not last long. In November 2022, the FTX collapse swept the crypto market. The broken capital chain of Alameda Research directly impacted the repayment ability of renBTC. Since Ren Protocol's operation is highly dependent on Alameda Research, market panic spread and users rushed to redeem their assets.

After Alameda's bankruptcy, Ren Protocol naturally fell into a dilemma of capital shortage. Ren Protocol announced in November 2022 that it would gradually shut down the protocol due to the loss of financial support from Alameda Research, and planned to open source the Ren 1.0 code, hoping that the community would take over, but the community responded coldly. The update on December 7 showed that Alameda Research briefly provided transitional funds, but users were required to transfer their assets by March 2023.

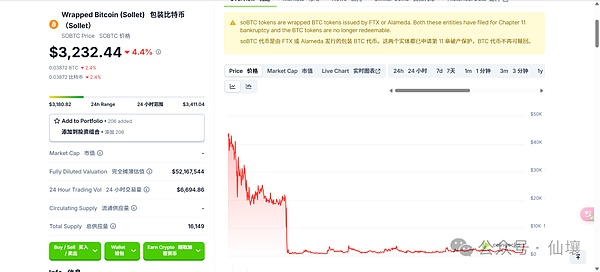

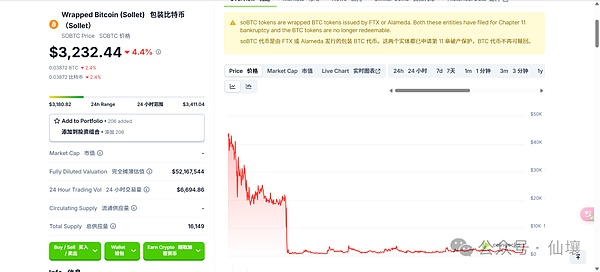

In March 2023, renBTC completely lost support, and its market value plummeted from $500 million at its peak to less than $100 million, basically declared obsolete .

soBTC's fate was equally tragic. FTX's deep binding with the Solana ecosystem caused soBTC to be affected by the FTX turmoil. After FTX went bankrupt, investors lost confidence in soBTC because its underlying asset reserves were managed by a centralized bridge protocol and the transparency was unclear, triggering a massive run. In November 2022, the price of soBTC plummeted to $1,183, while the price of Bitcoin was about $16,000 during the same period. The depletion of liquidity caused soBTC to hit the bottom, investors suffered huge losses, and the reputation of the Solana ecosystem was also hit hard.

Since FTX and Alameda filed for Chapter 11 bankruptcy protection in the United States, soBTC's custodial Bitcoin is no longer redeemable. This caused soBTC to lose its 1:1 anchor with BTC and essentially become a worthless asset. Platforms such as CoinGecko clearly marked "soBTC is no longer redeemable." So far, the stories of soBTC and renBTC have ended. They have not escaped the fate of centralized on-chain assets.

Summary

Through the above well-known cases, we believe that centralized on-chain assets will inevitably expose various problems over time due to their custody methods and excessive trust assumptions. Only by building a sufficiently trustless custody model through technical means can on-chain assets withstand the test of the long term.

Kikyo

Kikyo