Source: C Labs Crypto Observation

Stablecoin giant Circle is about to go public (Do stablecoins make money? Detailed explanation of Circle's prospectus). Recently, many Chinese stocks, such as Everbright Holdings, as an early investor in Circle, have also seen a significant increase in share prices.

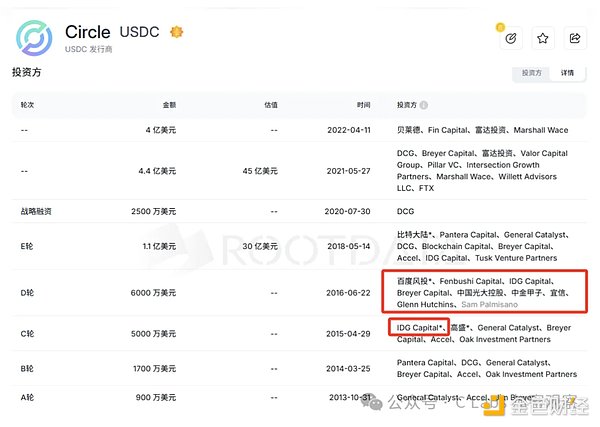

And Everbright invested very early, in 2016.

IDG, a Chinese venture capital giant, led Circle's Series C round as early as 2015.

The Series D round in which Everbright participated in 2016 was entirely led by investors with Chinese backgrounds.

It is understood that Circle's post-round D valuation in 2016 was US$480 million, so up to 20% of Circle's shares may be held by Chinese people.

And behind the investment of these Chinese giants in Circle, there is a story that no one mentions now:

Circle announced plans to expand into the Chinese mainland market in 2016 and established an independent subsidiary called "Circle China" to provide cross-border payment and digital currency services to Chinese consumers.

Later, due to the Chinese government's increasingly stringent supervision of cryptocurrencies and related financial services, Circle's business promotion in mainland China encountered challenges and eventually withdrew from the Chinese market completely.

Although Circle China's business has withdrawn from China, the shares of these Chinese-backed investors remain.

In addition to the aforementioned IDG and Everbright, other institutions are also well-known, including: (former) Internet giant Baidu, private enterprise giant Wanxiang Group (later evolved into the current Hashkey), financial technology giant CreditEase, and the famous CICC.

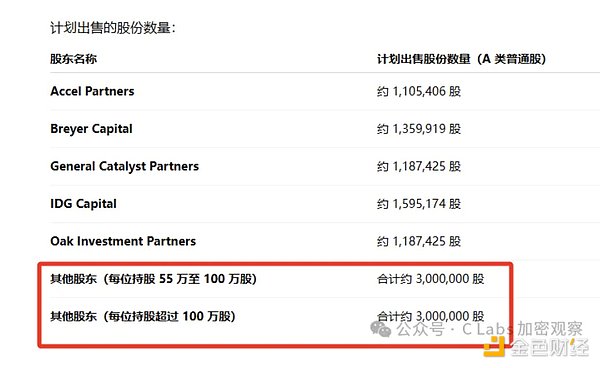

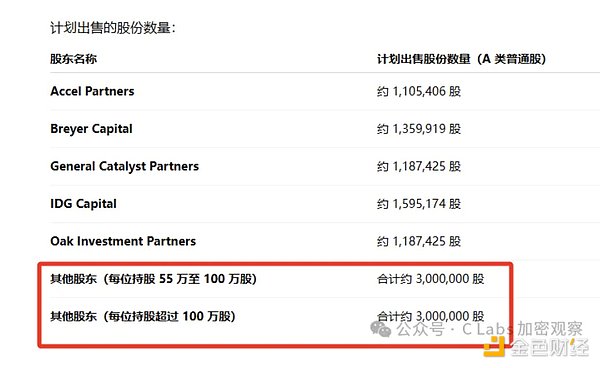

According to the latest prospectus, Circle and existing shareholders will issue a total of 32 million Class A common shares, of which 19.2 million shares (60%) will be sold by existing shareholders and the remaining 12.8 million shares (40%) will be newly issued by the company.

But what’s interesting is that many of the shares sold came from some “other” shareholders.

The proportion of shares sold by existing shareholders this time is higher than that in typical technology company IPOs, but it is still popular in the market.

BlackRock and Cathie Wood’s ARK Invest have both expressed their intention to subscribe to a large number of shares. I wonder if this means that the US investors will take over the shares of Chinese investors.

Weatherly

Weatherly