In recent years, the global bond market has experienced significant fluctuations, especially the rise in long-term bond yields, which has attracted widespread attention. However, this rise does not herald a major shift in inflation expectations, fiscal deficits or Treasury market liquidity, as market rumors have suggested. This article analyzes the bond markets of the United States, Canada, and Germany, and explores the phenomenon of rising long-term interest rates and stable short-term interest rates based on specific data, revealing the driving factors of the steepening of the yield curve and its reflection on macroeconomic fundamentals.

1. The rise in long-term bond yields: market misunderstanding and reality

Recently, long-term yields in major global bond markets have risen significantly. Taking the United States as an example, the 10-year Treasury bond yield climbed from 4.38% on March 27, 2025 to 4.59%-4.60% on May 23, an increase of about 21-22 basis points. The change may seem significant, but it is not unusually drastic. However, the market generally attributes this phenomenon to concerns about the US fiscal deficit, inflation expectations or liquidity in the Treasury market. Although this explanation is common, it lacks sufficient basis. Similar arguments have appeared many times in history, but rarely have they been confirmed by data. For example, in December 2023 and 2024, the market similarly attributed the rise in the 10-year Treasury yield to deficits or inflation, but those concerns ultimately proved to be exaggerated.

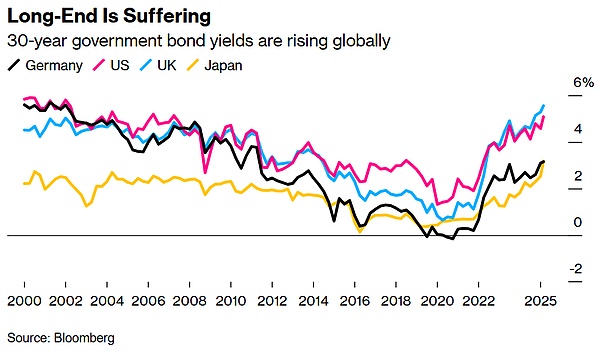

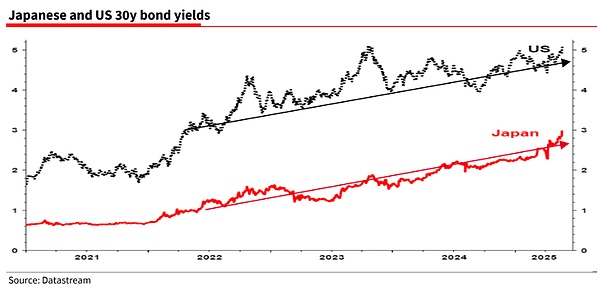

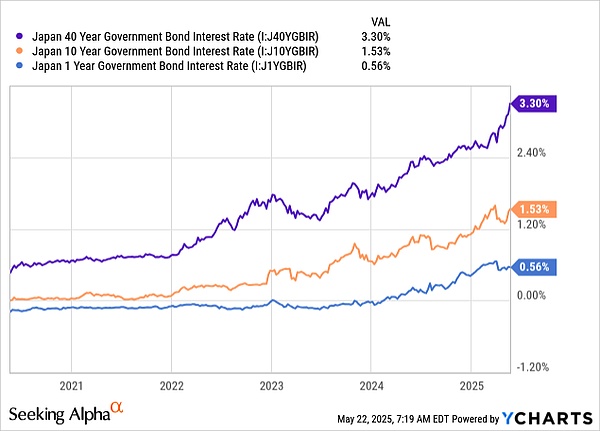

Short-term interest rates have not risen in tandem with long-term interest rates. The 2-year U.S. Treasury yield has only risen slightly from 3.97% to around 4.00% during the same period, remaining almost stable. This divergence between long-term and short-term interest rates is not limited to the U.S. Treasury market; it is also evident in the bond markets of Canada and Germany. Canada’s 10-year bond yield is at its highest level since mid-January 2025, around 3.65%, while the 2-year yield rose only slightly to 3.20%. Germany's 10-year government bond (Bunds) yield rose back to 2.60%, while the 2-year yield (Schatz) remained below 2.00%. This global bull steepening suggests that rising long-term interest rates are not a problem for a single market or country, but a common dynamic facing global bond markets.

2. Driving factors of the steepening yield curve

The steepening yield curve is an important feature of the current global bond market. The so-called "bull steepening" refers to the fact that long-term interest rates rise faster than short-term interest rates, causing the slope of the yield curve to increase. This phenomenon is generally associated with the market's reassessment of future economic growth and inflation expectations, but is also significantly affected by central bank policy uncertainty.

1. The institutional inflation bias of the central bank

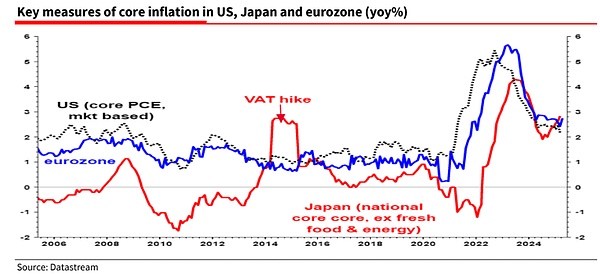

The policy behavior of the central bank is an important factor affecting the bond market. The Federal Reserve, the Bank of Canada and the European Central Bank (ECB) generally display an institutional bias towards inflation when formulating monetary policy. This bias can be traced back to the 1970s, particularly to the theory of inflation expectations developed under former Federal Reserve Chairman Arthur Burns. This theory holds that inflation is partly due to the psychological expectations of consumers and markets, so central banks tend to prioritize preventing inflation risks when data does not clearly show economic weakness.

Take the Federal Reserve as an example. Market analysis on March 28, 2025 showed that the Federal Reserve’s concerns about inflation caused it to be "hesitant" on the short-term interest rate path. The uncertainty stems from the Federal Reserve's concerns that tariffs could push up prices. Although Federal Reserve officials have publicly stated that the impact of tariffs on consumer prices may be temporary, the experience of "temporary inflation" in 2021 has made them lack confidence in such judgments. Recent data has further exacerbated this uncertainty. For example, in May 2025, Canada's core CPI rose 2.9% year-on-year, higher than the market expectation of 2.7%; the UK CPI rose 2.3% year-on-year, exceeding the expected 2.1%. The data reinforced central banks' vigilance against inflation and pushed up the uncertainty premium on long-term bond yields.

2. Stability of short-term interest rates and fundamentals

Compared with the volatility of long-term interest rates, the stability of short-term interest rates reflects the market's pricing of macroeconomic fundamentals. The 2-year Treasury yield is more sensitive to economic fundamentals, especially as the bull market steepens. The market expects that if economic weakness intensifies, short-term interest rates will have more room to fall than long-term interest rates, so 2-year bonds have become the focus of investors' attention.

For example, in the first quarter of 2025, although US retail sales data performed strongly in March (up 4.0% year-on-year), the benchmark revisions of the US Census Bureau showed that consumer spending in the past few years was overestimated by about 2%. In addition, Target's financial report released in May 2025 showed that the number of shoppers in its physical stores and online decreased, and the amount of per capita spending decreased. This is consistent with signs of weakness in the labor market. Data from the Business Employment Dynamics (BDM) of the U.S. Bureau of Labor Statistics (BLS) showed that the U.S. labor market has shown signs of stagnation in 2024, and the revised data on new jobs has continued to decline. The revision range of the non-farm employment report in the first quarter of 2025 averaged -65,000 per month. These data suggest that economic fundamentals are weaker than market expectations, and the stability of the 2-year Treasury yield reflects the market's pricing of an economic slowdown.

3. Synchronicity of global bond markets

The phenomenon of rising long-term interest rates and stable short-term interest rates is not unique to the United States. In Canada, the rise in 10-year bond yields contrasted with the relative stability of 2-year yields, with the yield curve slope increasing from 0.35 in March 2025 to 0.45 in May. The same is true in the German market, where the yield spread between 10-year Bunds and 2-year Schatz widened from 0.50 in February to 0.60 in May. This global synchronicity suggests that the drivers go beyond fiscal or monetary policy in a single country and are closely related to the collective behavior of global macroeconomics and central banks.

3. Historical perspective: Why the market misreads long-term interest rates

Historically, rising long-term bond yields have often been interpreted as market concerns about deficits or inflation, but these interpretations have often proved to be wrong. For example:

1994-1995: The Federal Reserve raised interest rates due to non-existent inflation risks, causing the 10-year Treasury yield to briefly surge to 8.0%, but the economy did not subsequently experience significant inflation.

1999-2000: Greenspan raised interest rates due to inflation concerns during the Internet bubble, and the 10-year yield rose to 6.5%, but then the economy entered a recession caused by the bursting of the Internet bubble.

2008: Soaring oil prices (Brent crude oil prices rose from $70/barrel in 2007 to $140/barrel in 2008) caused the Federal Reserve to worry about inflation and pause interest rate cuts. However, the collapse of Lehman Brothers and AIG forced the Fed to resume drastic rate cuts in September 2008, with the federal funds rate falling from 2.0% to 0.25%.

The situation in December 2023 and 2024 is similar. The 10-year Treasury yields rose to 4.70% and 4.50%, respectively, which the market attributed to deficit concerns and the Fed's "higher and longer" policy. However, the stability of the 2-year yield (about 4.8% in July 2023 and about 4.3% in November 2024) suggests that the market's judgment on economic fundamentals has not changed fundamentally. The current data for 2025 further confirms this: the rise in long-term interest rates is more a reflection of central bank policy uncertainty than a direct result of deficits or inflation.

4. Bull market steepening and market strategy

Against the backdrop of a steepening bull market, two-year bonds have become the focus of market investment due to their sensitivity to economic fundamentals and potential downward space for yields. In contrast, 10-year bonds have become an outlet for uncertainty, with yield fluctuations more reflecting the central bank's policy hesitation. For example, from March to May 2025, the rise in the 10-year Treasury yield was accompanied by stock market volatility (the S&P 500 fell 2.5% in April), while the stability of the 2-year yield indicated that the market's expectations for an economic slowdown remained unchanged.

In terms of market strategy, investors prefer to hold 2-year bonds because short-term bonds have greater capital gains potential amid expectations of a weak economy. Historical data shows that during the steepening of a bull market, the downward range of the yield on the 2-year Treasury bond is usually 2-3 times that of the long-term bond. For example, during the 2008 financial crisis, the 2-year Treasury yield fell from 4.5% in 2007 to 0.8% in 2009, while the 10-year yield only fell from 4.0% to 3.2%.

V. Conclusion

Current dynamics in global bond markets suggest that the rise in long-term bond yields is not a direct result of deficits or inflation expectations, but a combined effect of central bank policy uncertainty and a steepening bull market. The inflation bias of the Federal Reserve, the Bank of Canada and the European Central Bank has led to blurred market expectations about the path of short-term interest rates, pushing up the uncertainty premium on long-term bond yields. At the same time, the stability of the 2-year bond yield reflects the market's rational pricing of economic fundamentals, including signs of a weak labor market and a downward adjustment in consumer spending.

Investors should pay attention to the developments of 2-year bonds as they more accurately reflect macroeconomic and monetary fundamentals. While the volatility in long-term bond yields is eye-catching, it is more the result of central bank "indecision" rather than fundamental changes in economic fundamentals. In the future, we need to pay close attention to employment, retail sales and inflation data to determine whether the economy slows down further and whether the central bank will adjust its policy direction accordingly.

Jasper

Jasper

Jasper

Jasper Hui Xin

Hui Xin Alex

Alex Aaron

Aaron Jasper

Jasper Joy

Joy Kikyo

Kikyo Clement

Clement Joy

Joy Hui Xin

Hui Xin