Source: Kraken; Compiled by: Deng Tong, Golden Finance

Summary

A whopping 73% of U.S. cryptocurrency holders plan to continue investing in cryptocurrencies in 2025, indicating their long-term view of the market.

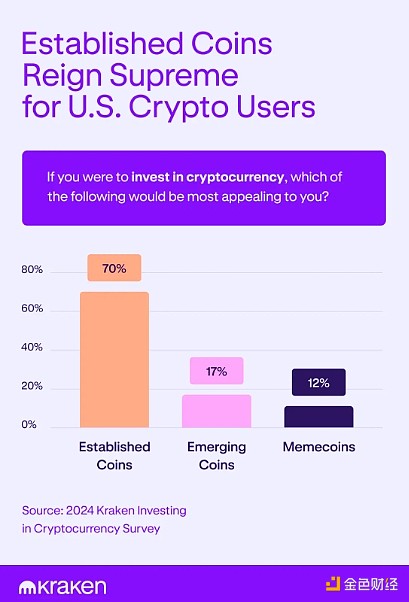

70% of U.S. cryptocurrency holders prefer to invest in established cryptocurrencies over other options such as memecoin (12%) and emerging currencies (17%).

Compared with traditional assets such as stocks (34%), bonds (13%) and real estate (17%), U.S. cryptocurrency holders believe that cryptocurrencies (36%) have greater growth potential.

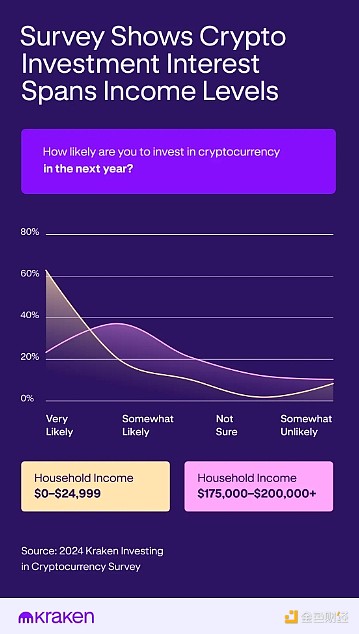

Investment interest spans all income levels. While those with higher household incomes ($175,000+) are more likely to invest in cryptocurrencies (82%), more than half (59%) of those with lower incomes ($0-24,999) also plan to invest by 2025.

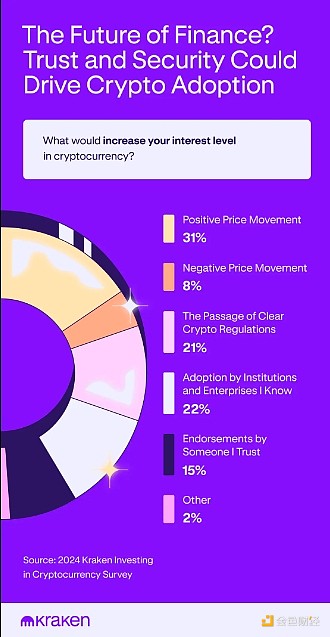

Positive price movement is the primary driver of cryptocurrency adoption (31%), followed by institutional adoption (22%), regulation (22%), personal recognition (15%), and negative price movement (8%).

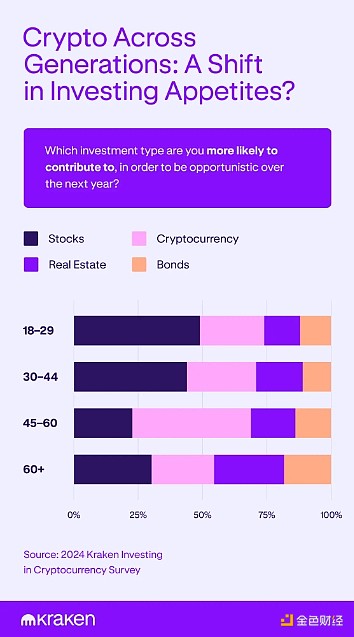

Our survey revealed an interesting trend. While cryptocurrency interest spans generations, 69% of middle-aged respondents (45-60) reported having purchased cryptocurrencies in the past, compared to only 55% of younger respondents (18-29).

Middle-aged investors (46%) clearly favor cryptocurrencies over traditional stocks (23%) in their future investment plans, dispelling the notion that cryptocurrencies are primarily for younger generations.

The dynamic nature of today’s cryptocurrency markets may have holders rethinking their investment strategies. Our new survey analyzed more than 1,000 U.S. respondents to reveal the latest cryptocurrency trends and predictions for the coming year. According to our data, 73% of U.S. cryptocurrency holders will continue to invest in crypto in 2025.

This trend highlights the evolution of the cryptocurrency investment landscape, where potential volatility matches a growing appetite for opportunity. Our new survey dives deeper into this landscape, revealing how U.S. cryptocurrency investors are navigating today’s environment — and their plans for the future.

Respondents believe that established cryptocurrencies offer greater growth potential than stocks and bonds

Our survey shows that the majority of U.S. crypto holders (36%) believe that cryptocurrencies offer greater growth potential than traditional investments such as stocks (34%), bonds (13%), and real estate (17%).

However, it is clear that the type of cryptocurrency investment is also very important when it comes to investment decisions. For example, 70% of respondents said they prefer established currencies such as Bitcoin. In contrast, only 12% said they prefer memecoins such as Dogecoin, and 17% said they prefer emerging currencies such as Solana.

This finding may indicate that investors are paying more attention to established cryptocurrencies, as investors prioritize currencies with longer histories and larger market caps. Many in the cryptocurrency market believe that these cryptocurrencies are more resilient during periods of negative sentiment.

This suggests that there is a strong comfort level with cryptocurrencies as a potential investment even compared to other mature asset classes.

It also suggests that cryptocurrency investors are maturing. While some may be chasing the next big thing, a significant number see cryptocurrencies as a viable opportunistic investment option that could go hand in hand with traditional assets like stocks.

73% of Crypto Holders Will Continue to Invest in 2025 — Regardless of Their Income Level

A significant portion of respondents who have already invested in cryptocurrencies expressed a strong interest in continuing to do so in 2025. Of these, approximately 73% of respondents said they were likely to invest in cryptocurrencies within the next year (45% said “very likely” and 29% said “somewhat likely”).

Those who reported having a higher household income were more likely to express interest in investing. 82% of respondents had a household income of $175,000-200,00 or more, indicating they were at least somewhat likely to invest in cryptocurrencies within the next year.

At the other end of the financial spectrum, more than half (59%) of those with lower incomes ($0-24,999) also plan to continue investing.

These continued investments, combined with the aforementioned higher overall interest in cryptocurrencies than other traditional investments, may indicate a steady level of comfort and confidence in the cryptocurrency market.

Both high- and low-income groups consider established currencies to be the most attractive investment option, suggesting that risk assessment is a priority regardless of income status.

Most Crypto Holders Are Motivated by Positive Price Movements and Institutional Adoption

While data shows growing interest in cryptocurrencies across income levels, barriers to widespread adoption remain. Nearly a third of respondents (31%) said positive price movements would increase their interest.

Other key factors driving cryptocurrency adoption include:

Adoption of cryptocurrency by familiar institutions and businesses (22%)

Passage of clear cryptocurrency regulations (21%)

Approval from people they trust (15%)

Negative price movement (8%)

Many respondents said that seeing established institutions adopt cryptocurrency would increase their interest and help validate the legitimacy of cryptocurrency. Likewise, the desire for increased cryptocurrency regulation highlights the importance of transparency among cryptocurrency entities and can also bolster confidence among investors who ask themselves, “Is cryptocurrency safe?” Without a clear framework, some may hesitate to enter the cryptocurrency market out of fear of potential legal consequences or unexpected changes in regulations.

Middle-aged people are more likely to invest in cryptocurrency than millennials or Gen Z

Our survey data revealed a surprising trend: Middle-aged people (45-60 years old) are the most likely (69%) to invest in cryptocurrency. While younger generations are known for their digital fluency and openness to new technologies, middle-aged people appear to be showing a keen interest in cryptocurrency.

We asked 2,191 U.S. residents aged 18+ if they had purchased cryptocurrency in the past. The percentages below show how many respondents in each age group said they had purchased cryptocurrency.

55% of the respondents were aged 18-29

49% of the respondents were aged 30-44

69% of the respondents were aged 45-60

20% of the respondents were over 60

The data may indicate that 192);">Middle-aged people represent more experienced investors who may be less afraid of potential market volatility.This ties into our first point, suggesting that cryptocurrency users are actively maturing.

This speculation isn’t to say that younger generations are completely out of the game. They still make up a large portion of cryptocurrency investors. However, this new data suggests that a broad range of demographics see cryptocurrency as an investment, and even the future of finance.

Dante

Dante

Dante

Dante JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Bitcoinist

Bitcoinist Beincrypto

Beincrypto Beincrypto

Beincrypto Catherine

Catherine Beincrypto

Beincrypto Cointelegraph

Cointelegraph