Author: Marcus Lu, Visual Capitalist; Compiler: Deng Tong, Golden Finance

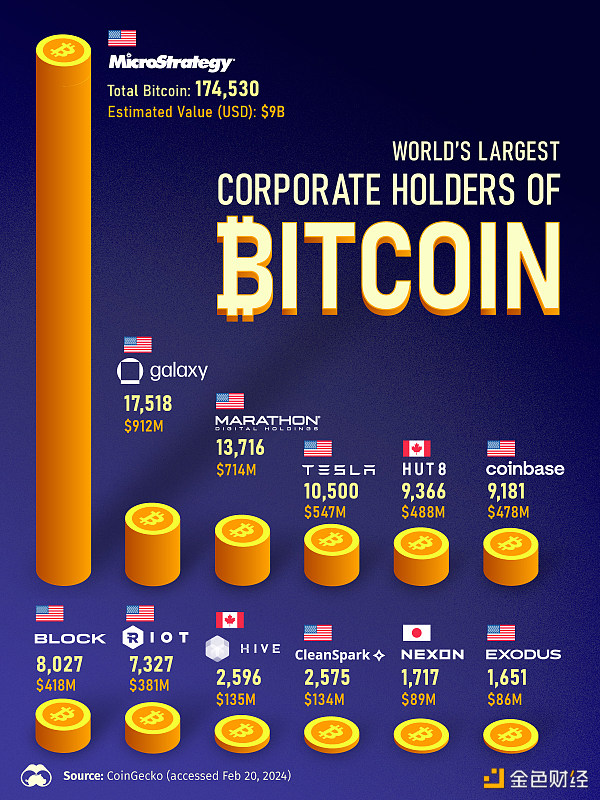

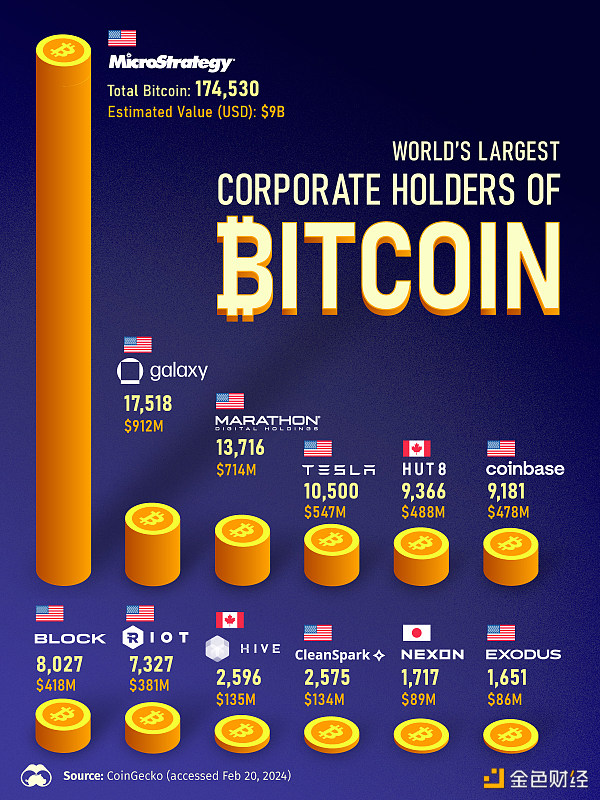

Who holds the most Bitcoins among listed companies?

While Tesla is the most familiar name among the world's largest corporate buyers, several companies have accumulated more Bitcoin, leading them to The stock price soared last year. Meanwhile, with the exception of Japanese video game publisher Nexon, the vast majority are in North America.

This chart shows the public companies with the most Bitcoin, based on data from CoinGecko.

MicroStrategy is leading the way

As the world's largest Bitcoin business owner, MicroStrategy holds 174,530 Bitcoins, worth an estimated $9.1 billion, as of February 22, 2024.

The Virginia-based intelligence software company first started buying Bitcoin in 2020 and has since grown its holdings to roughly the second-largest business owner 10 times. MicroStrategy shares surged more than 350% in 2023 thanks to the size of its Bitcoin holdings.

As of February 22, 2024, the following are the people holding the most Bitcoins among listed companies in the world:

Tesla is The fourth largest owner on the list has Bitcoin holdings worth $546.7 million.

In 2021, the company announced a purchase of $1.5 billion in Bitcoin to help boost the company's profits. It also provides liquidity to customers who can purchase its products using cryptocurrencies. The following year, however, the company sold most of its Bitcoin holdings during the cryptocurrency crash, suffering heavy losses.

Two Canadian companies, Hut 8 and Hive Blockchain, are the largest holders of Bitcoin. Shares of these cryptocurrency mining companies soared by more than 191% and 144% respectively.

Shares of Bitcoin miner CleanSpark are up more than 425% in 2023 on the back of stronger returns. This year, the company announced plans to purchase four new facilities to mine Bitcoin. Three of them are in Mississippi, costing a total of $19.8 million.

As Bitcoin climbs to new all-time highs, corporate interest in Bitcoin is likely to continue to grow along with a broader pool of buyers. Newly regulated Bitcoin spot ETFs have also spurred demand, leading to Bitcoin’s market cap reaching $1 trillion for the first time since 2021.

Anais

Anais