Original author: SAURABH DESHPANDE Translated by: LlamaC

What if everyone could have a personal banker at the click of a button? What if that banker could employ an army of analysts, compliance, and enforcement staff to trade for you? It sounds far-fetched, but that's what Saurabh explores in today's article. We are heading towards a world where robots move more money than humans. If Trump remains president, we will continue to see more assets tokenized. Saurabh's story today explores how the agency economy in cryptocurrency collides with the future of finance.

If you told someone in 1995 that, decades later, they would be able to order food, hail a cab, or transfer money to friends around the world from a device in their pocket, they would probably be skeptical. Yet here we are, at a time when smartphones have reduced these once-complex tasks to simple taps on a screen.

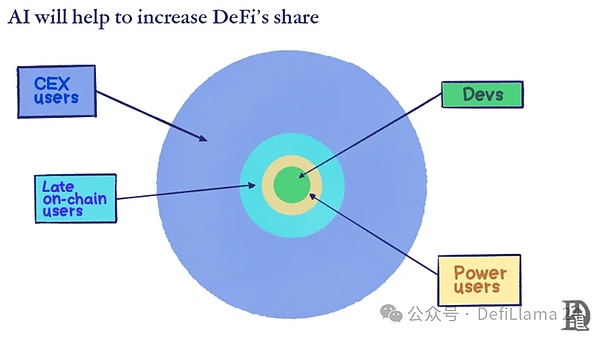

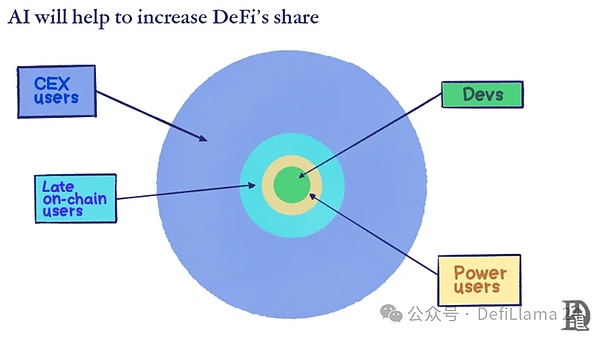

DeFi is at a similar inflection point today. DeFi offers the opportunity to earn yield and early discovery of new tokens, but it’s too complex for most people to use. Managing a wallet, navigating different blockchain networks, and understanding smart contract interactions can feel like learning a new language. Additionally, many are hesitant to participate in DeFi due to regulatory uncertainty. It’s not surprising that DeFi accounts for only 10-20% of spot trading volume on centralized exchanges (CEXs). This is because CEXs are simpler to use and have clearer regulations.

This article explores how AI can transform DeFi from a complex ecosystem serving thousands of people to an accessible financial platform serving millions. We’ll look at how AI-driven interfaces can gradually begin to bridge the gap between DeFi’s huge opportunity and the average user’s need for simplicity. While all DeFAI (DeFi and AI) applications are in their infancy, they show what DeFi could become: providing a smooth experience when interacting with financial instruments, from automated trading strategies to conversational interfaces that make complex transactions feel natural.

Let's start with how financial markets first merged with computers and algorithms. Algorithms started to become part of financial markets in a meaningful way since the 1980s. They are the cornerstone of modern markets. From stock trading to currency exchange.

Algorithms and Financial Markets

When I think of algorithms in a financial context, Jim Simons comes to mind. The word "legend" fits in front of his name with ease. He founded Renaissance Technologies, an American investment firm that changed the game in quantitative trading. Its flagship fund, Medallion, achieved an eye-popping 39% compound annual growth rate (CAGR) over a 30-year period (1988 to 2018). To understand how extraordinary this is: $100 invested in the Medallion fund would have grown to $2.1 million over 30 years, compared to $1,014 in the S&P 500. The difference is almost incomprehensible.

But what’s truly magical is how they do it. Rather than working with Wall Street veterans, Renaissance Technologies’ team is comprised of PhDs in math, physics, and other hard sciences. Their approach relies entirely on mathematical models and algorithms to trade the markets—a testament to the power of data-driven decision making.

This focus on algorithms isn’t limited to hedge funds. Across traditional financial markets, trading is becoming increasingly algorithmic. A recent article noted that more than 75% of daily foreign exchange spot trading, or $5.6 trillion of the $7.5 trillion, is now conducted through algorithms. These systems have reshaped trading desks, shifting the emphasis from human intuition to automated decision making.

In terms of automation, DeFi is still in its infancy. In contrast, algorithmic trading has existed in traditional finance for more than three decades. Since 2020, the same data-driven revolution that changed Wall Street has also begun knocking on DeFi's door.

Algorithms and DeFi

Decentralized exchanges (DEXs) and lending protocols became the foundational pillars of this new financial ecosystem in 2020.

DeFi really came alive when Compound launched its liquidity mining program, triggering an explosion of activity. Around the same time, Aave (then called EthLend) saw its TVL and price soar. Several new yield farms were launched every day. These farms offered lucrative yields, usually paid in the protocol’s native token. However, the value of these yields was directly tied to the market price of the token, adding a layer of complexity to the returns. I remember Sam Bankman-Fried saying in an interview —

Imagine a magical box that does nothing, but people throw millions into it because… why not? As more and more money piles into it, the box becomes valuable — because everyone agrees that it is valuable. At some point, sophisticated traders come in and say, wow, look at all the money in this box! It must be a great box! And the cycle continues like this — until, of course, it doesn’t.

This dynamic has created a bifurcation. Savvy traders have thrived, moving from farm to farm, profiting from tokens, and taking advantage of opportunities. Meanwhile, less experienced participants have struggled, often failing to understand the importance of consistently profiting in such a volatile market. It’s clear that this version of DeFi was not designed to scale beyond a niche audience.

As the ecosystem expands, the need for tools to simplify DeFi interactions becomes more pressing. Lending and borrowing protocols have proliferated, creating the need for aggregators.

Yearn Finance was launched in February 2020 with a total locked volume of 2.5 million ETH (about $7 billion at the time). This was a turning point in the development of DeFi.

It introduced automated vaults that optimize on-chain returns and provide users with a clear risk-reward profile. These vaults allow users to deposit assets - stablecoins, ETH, and specific tokens - while DeFi experts propose and implement yield strategies. Funds are then deployed across the DeFi ecosystem based on these strategies, with profits shared between users, platforms, and strategy creators (who essentially act as fund managers).

This model is a step forward for DeFi. For the first time, DeFi feels accessible to a wider audience. Yearn removes much of the manual work required to participate in the ecosystem while aligning incentives across stakeholders. This is a glimpse of what the next iteration of DeFi could become: efficient, user-friendly, and scalable.

While Yearn makes DeFi more accessible, its limitations become apparent as the ecosystem grows. On-chain returns began to normalize, and Yearn's strategy struggled to maintain its edge. The departure of key innovators such as Andre Cronje and severe market conditions in 2022 caused TVL to plummet from its peak to around $250 million.

Yearn is the first major attempt at automated yield optimization in the DeFi space, improving manual yield farming by allowing users to entrust funds to experienced managers. But it still relies on human decision-making. Strategy creators must constantly track market conditions to identify opportunities, evaluate new protocols, and execute strategies.

It creates two major bottlenecks. First, human managers can only process limited market data. Second, scaling to millions of users is impractical due to user experience challenges.

AI has the potential to overcome these challenges. By leveraging machine learning and automation, DeFi platforms can now analyze large amounts of on-chain data, identify patterns, and execute strategies with far greater efficiency than human managers. Using natural language to understand user needs helps increase the scale of DeFi by making it accessible to a large number of users.

Where AI is Changing the Game

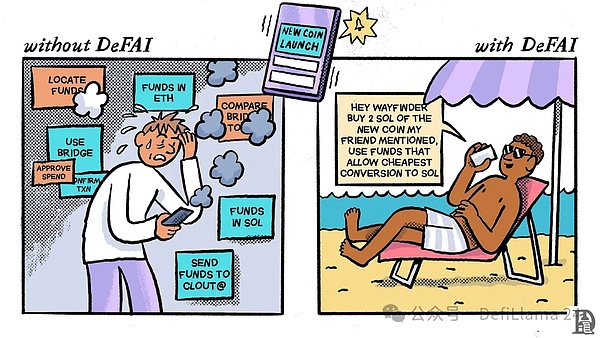

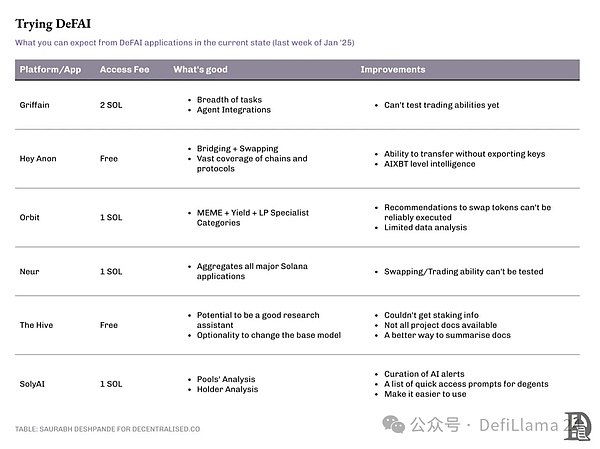

DeFi offers unparalleled selectivity, but remains difficult to use. CEXs are simple to use, but limit user control and selectivity. AI offers an opportunity to bridge this gap. By automating complex DeFi interactions and simplifying the decision-making process, AI can make DeFi as easy to use as centralized platforms without sacrificing selectivity. On the other hand, AI can help CEXs make listing decisions faster, thereby offering more choices than currently available. A practical example of this is Hey Anon, an AI-powered DeFi interface. I have personally tried out Hey Anon; it is highly efficient at swapping and cross-chain without the need to manually look up contract addresses or choose bridges. The entire interaction process is chat-based, which makes it easier for new users to use. However, it is slower than performing these transactions manually. In addition, it currently lacks support for manual transfers — an important feature that should be incorporated to provide more flexibility.

Is there a market for DeFi + AI?

Before exploring the intersection of AI and decentralized finance, let’s take a step back and look at the total addressable market (TAM).

As of the third quarter of 2024, the assets under management (AUM) of regulated open-end funds, both actively and passively managed, exceeded $80 trillion. By comparison, Bitcoin (BTC) and Ethereum (ETH) ETFs have a combined $150 billion in assets under management as of January 21, 2025.

These data highlight a key point: Trillions of dollars are managed by professionals worldwide because most people prefer not to handle their finances directly. They tend to choose products that are easy to use and provide stable growth. Cryptocurrency should not be different. We have already seen this with user preferences leaning toward centralized exchanges (CEXs).

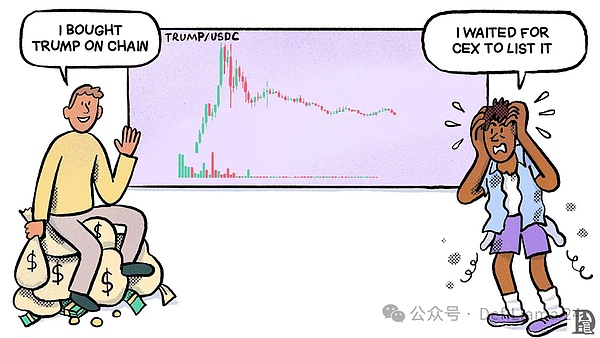

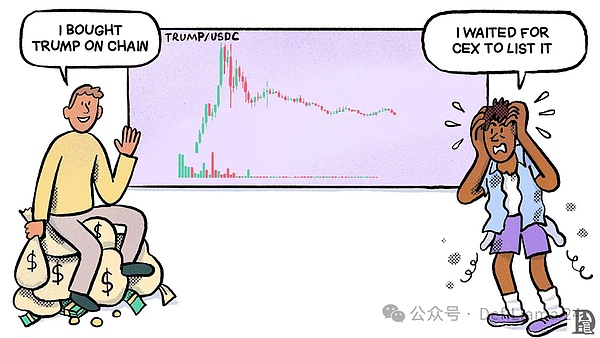

Centralized exchanges still have about five times the volume of decentralized exchanges. A big factor in this gap is usability. Managing wallets, navigating contract addresses, and understanding on-chain processes are difficult for many people. But it also brings huge benefits. Perhaps the biggest benefit is the possibility of early profit. If you found TRUMP on-chain when it had a market cap of less than $1 billion, by the time it was listed on a centralized exchange, you had already made five to ten times the profit. This is increasingly true in the player-versus-player (i.e. PvP) phase of the market, where net inflows stagnate. Assets are exchanged between existing participants.

Rotation is the name of the game. Every week there's a new hot flavor.

Even if you've been in the crypto space for a long time, it's hard to catch a chance on Jailstool or CAR. You only have one day to learn about it, do your due diligence, buy in, and sell out - nearly impossible for most people to do without prior knowledge. The only way to reliably capture this opportunity is to design a system that combines on-chain metrics like newly deployed contracts with volume and price surges and social media information like X. Both tokens are currently down more than 80% from their respective highs and have yet to be listed on any major centralized exchange.

One round of price discovery is over. A large amount of trading activity has already taken place on DEXs and/or OTC desks. Early participants such as traders, liquidity providers or arbitrageurs have already established an informal market price. By the time an asset reaches a CEX, most of the initial volatility and price exploration has already occurred.

In addition, most centralized exchanges charge higher exchange fees compared to places like Jupiter and Raydium. Jupiter charges no fees, while Raydium charges 0.25% for each exchange. The Moonshot trading app charges users 2.5% in fees, while exchanges like Binance and Coinbase charge different fees based on the user's trading volume. These fees usually range from 0.1% to 0.6%. A pattern can be seen in these fees - platforms with better user experience can charge higher fees. Coinbase has over 110 million users, far exceeding DeFi’s active user base. Given this huge gap, the potential total available market size for DeFi is huge. Even if it’s not in the billions, it’s conservatively estimated that DeFi can strive to absorb a considerable portion of the current centralized exchange users, provided that the usability aspect can be done well. This is where AI can play a transformative role.

Enter DeFAI: Simplifying DeFi with AI

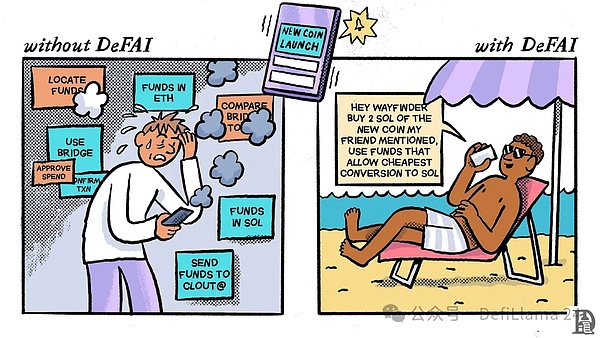

DeFAI, an emerging DeFi trend, aims to simplify the DeFi user experience. It will be as easy as talking to a broker to buy and sell stocks - only better. You will interact with an AI agent that can translate text or speech into deterministic on-chain actions and provide you with data-backed recommendations.

So when a token is released on a chain that you are not familiar with or have never bridged assets to, you can go to the chat interface and tell the AI that you want to bridge assets to this new chain to perform XYZ operations. The AI agent will complete the process for you.

We wrote in our article about chain abstraction and smart wallets that both are tools to improve the user experience of cryptocurrency. Chain abstraction removes the complexity of managing chains and bridges, while smart wallets leverage technologies such as passkeys to simplify and secure wallet management.

However, AI agents have the potential to truly expand the DeFi pie. While incremental improvements have been made in addressing user experience challenges, if executed properly, AI agents can help DeFi cross the adoption chasm.

Visualizing the Impact

Today, DeFi’s user base consists of developers, advanced users, and late-stage on-chain adopters. As AI agents lower the barrier to entry, the DeFi user base can expand significantly, attracting more CEX users who were originally happy to avoid the complexity of decentralized finance.

Abstracting the user experience is just one of the things that AI agents can help with. Intelligence is the second aspect. Think about the average centralized exchange user. It’s unlikely that they already understand what on-chain applications they can use and what assets they can consider investing in or trading. This content must be curated for them. In the early days of the internet, Yahoo was a curator that helped millions of people discover and browse the web. Today’s app stores perform a similar function, deciding which apps get exposure and which don’t.

Centralized exchanges already act as curators to some extent. They choose which tokens to list, effectively determining what most retail users can easily trade. If this curation function is removed by forcing users to move to on-chain trading, discovering opportunities and applications becomes a difficult task. Users need a trusted guide to lead them through this complexity. The question is: will AI agents democratize this curation, or simply transfer power from centralized exchanges to those who control these agents?

The combination of curation and intelligence is where the real power lies. It is not enough to simply present opportunities; users need context, analysis, and execution strategies.

With so much happening on-chain, how does a new user begin to evaluate opportunities? There are a lot of questions that need to be answered. What applications do you use for lending and trading? Where do you buy NFTs? How do you find the right contract address? AI tools/agents like AIXBT can provide information to abstract tools like Wayfinder and Hey Anon.

AIXBT is an agent that devours information on X and puts it in context. It posts hundreds or even thousands of tweets a day. Sometimes, its tweets or posts even move the market. Shlok wrote his paper on AIXBT. The paper states that the agent stands out because of its deep integration into the crypto community, sophisticated analytical capabilities, and potential for growth through intellectual property and consumer engagement. AIXBT's future could develop into a major player in the AI and crypto consumer markets, provided it continues to innovate and maintain transparency in its operations.

One of the teams we have been working closely with is GudTech, who are working to simplify the onboarding process for retail users. GudTech was built by the team associated with Zircuit, and its vision is to provide contextual information while enabling trade execution. Let me explain. Using the example of the TRUMP token above, a user may not be sure whether the President of the United States actually issued the token, or whether there are multiple well-known large wallets that are buying the token in large quantities. You may just see the token code on the DEX and buy it directly without enough context. One of the biggest problems in the current cryptocurrency space is that there are 34 million tokens (and counting) but very little contextual information about them. The crypto space is filled with unstructured and fragmented data that is often biased and unreliable.

Gud combines on-chain data with contextual information from social networks to allow the purchase of assets directly on-chain. It solves the problem of reducing the learning curve and cognitive load for new users entering the crypto space. You could have seen that the asset went up 100x in the last 24 hours, and President Trump did tweet the ticker.

In an ideal world, Gud will even verify contract addresses and execute transactions for you. Gud is building an agent economy where, through a conversational interface, users can purchase assets across all chains and get contextual information from the perspective of a crypto-native user. The Gud terminal also has critical thinking capabilities, able to reason about the positive or negative aspects of a transaction. Additionally, the Gud terminal is free to use for up to 10 queries per day, similar to Web2 platforms such as Perplexity, which focus on incentivizing adoption and usage rather than hoarding tokens.

This future may seem a bit far-fetched, but this model is based on two main aspects. First, how to capture, contextualize, and share information with newcomers to the industry. Imagine having a private wealth manager explain the latest trends in your industry. This is already happening in industries like consulting or law, where launching a ChatGPT instance can get you 80% of the insights.

The environment required for such interactions that cater to crypto-native needs does not exist yet. Gud aims to package this into a simple experience to expand the number of users currently in the crypto space. They are still a work in progress, though. As of the time of writing, the product's trading system is not yet live, and there have been several buggy interactions with agents on Twitter. But we will get there eventually.

Wayfinder is another highly anticipated application developed by the same team that built Parallel, a leading blockchain game. Here is a demo showing how the Wayfinder agent aggregates funds from multiple chains and sends them to different wallets. Hey Anon has integrated multiple chains and applications. It combines the ability to perform transactions with real-time insights from multiple platforms such as Twitter, Telegram, and Discord.

Imagine this: you open a sophisticated interface similar to ChatGPT or Claude and start a conversation with your personal AI trading agent. You share your risk tolerance, investment goals, and preferences. The agent understands your parameters and autonomously manages your portfolio—executing trades, opening positions, and adjusting strategies in real time within the boundaries you define. This isn’t science fiction; this is where we’re heading. Here’s a glimpse of what’s possible.

REALITY CHECK

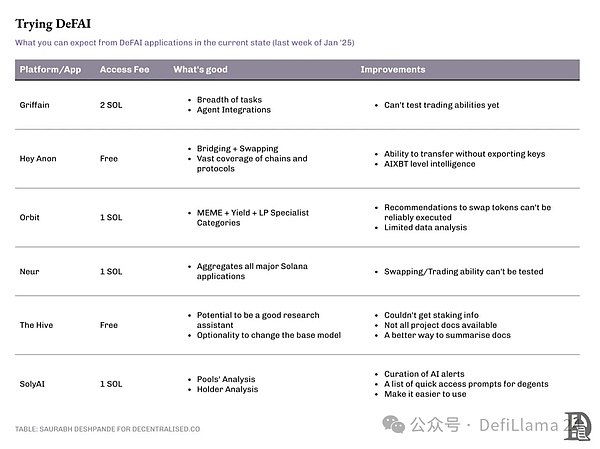

Apps like WayFinder aren’t available to everyone yet. But before getting caught up in the hype and token prices that the DeFAI narrative has generated, it’s crucial to step back and assess reality. The sobering truth is that we’re not there yet. I don’t fully understand the engineering complexity required to achieve our goals, so I can’t predict how long it will take. But what’s clear is that there are still major gaps in intelligence and abstraction in DeFi that need to be filled.

For example, take AIXBT, arguably the best intelligence or information synthesis agent in the space. It generates multiple tweets per day, making it impossible to manually evaluate every investment or trading idea. If you followed all of its recommendations in the $10 million to $100 million range, you would have earned an average return of 2%, with a win rate of 39%. This shows that while AI can process large amounts of data and spot opportunities, it still lacks the fine judgment of an experienced trader. There’s also an important caveat to this performance: a handful of tokens performed significantly better than the rest. If you missed those few winners, you would have likely lost money on AIXBT’s advice.

Given this caveat, it’s easy to overlook the value of AIXBT. But it ties into a long-standing debate in traditional finance: Is active investing really superior to passive investing? A Random Walk Down Wall Street popularized the idea that markets are largely efficient and that even professionals have trouble consistently beating index funds. In fact, studies have shown that monkeys throwing darts at a random list of stocks can produce returns comparable to those of professional investors. This highlights a broader reality — markets are unpredictable and human expertise alone doesn’t always guarantee an edge. However, The Medallion Fund’s consistent 30-year market-beating performance proves that when human intelligence is combined with algorithms, it can indeed create an edge.

I personally cannot keep up with AIXBT’s tweets to make trading decisions. However, I use a filter that distills the thousands of AIXBT tweets into the top five trading ideas. Currently, it works as a decent filter, but needs to be significantly optimized. An additional layer needs to be added to it - one that can effectively filter its output and make smarter, more strategic decisions. The challenge of intelligence is not just about quantity; it is about prioritization. What is needed is a sophisticated filtering system that can refine AIXBT's many recommendations into actionable, high-probability trades.

Where Current AI Falls Short

Returning to the intelligence side of things, I wanted to understand how the execution/abstraction side works. I tried using Orbit to buy the meme coins it thought had the most potential. I interacted with the "Meme_Radar_TK_Agent" but did not get the results I was looking for. I had to go back and forth with the agent to clarify my request. Although I selected a coin that the AI recommended, it failed to retrieve relevant information about that coin. The agent struggled with basic tasks: it would recommend a coin but then fail to provide key details about its own recommendation. Orbit ($GRIFT) traded $180 million on January 22. Yet it was unable to smoothly perform a simple task for a first-time user. This reveals a major gap between AI’s analytical capabilities and its ability to efficiently execute real-world trades. Of course, this category is still in its infancy and products will evolve over time. Our own product, SentientMarketCap, is under open development and is continually improving based on user feedback and real-world testing.

Similarly, platforms like Griffain and WayFinder may offer enhanced solutions, but they remain largely untested in real-world environments. The entire DeFAI space remains an evolving experiment, with products being actively refined through continuous iteration and real-world insights.

It is clear that a successful DeFAI platform needs to excel in three key areas:

1. A reliable, intelligent system that continuously collates contextualized data to identify profitable opportunities

2. 3. User-friendly interfaces that make complex DeFi operations easy for average users

Technology is advancing rapidly, but we are still in the early stages of this evolution. The key is to manage expectations while continuing to innovate and improve these systems based on real performance and user feedback.

The application of AI in decentralized finance is not without risks. Insufficiently trained models, reliance on historical market conditions, and the potential for manipulation are all issues that need to be addressed before AI-driven decentralized financial platforms reach mass adoption.

Learn from Feynman

Richard Feynman: Can Machines Think?

https://youtu.be/ipRvjS7q1DI

Richard Feynman's arguments about machine intelligence are highly relevant to DeFAI. He believed that machines could do better than humans at specific tasks. If we can combine these specific tasks into a superset — a new system — it can significantly help our decision-making and execution in financial markets. AI in DeFi should follow this principle: it should not replace human intuition, but rather augment our capabilities by integrating multiple layers of intelligence — automated execution, market analysis, and risk assessment — to create a seamless experience for users.

This modular approach to AI capabilities has far-reaching implications for the development of DeFi. DeFi requires not only automation, but also intelligence that can optimize execution. Take a well-managed hedge fund as an example. It has different teams, each with expertise in a specific area. Some teams focus on executing trades with minimal slippage, others analyze patterns to predict market movements, and a third ensures that funds flow efficiently between different markets.

AI agents can operate in the same way in DeFi. One agent can specialize in executing trades efficiently by reducing price impact and avoiding MEV attacks. Another can detect patterns in on-chain data to predict liquidity changes or market trends. For example, this agent can plug into tools like GMGN and Cielo to track wallets on-chain to assist with other analysis. A third can manage cross-chain transfers to ensure funds are optimally allocated across ecosystems. When these agents are combined, they go beyond simple automation. They bring intelligence to execution - from providing trade inputs to ensuring trades are made at the best price, with minimized risk, and seamlessly across multiple networks.

Towards Agent Collaboration

Most DeFAI products attempt to address the problem of intelligence (analysis, synthesis) and abstraction (execution) capabilities, and for good reason. Either component alone provides limited value, like having a map without a vehicle or vice versa. But the real power lies in specialization and integration.

The current landscape resembles a fragmented ecosystem, with different agents excelling in different areas. Some agents excel at market analysis and pattern recognition, while others excel at executing complex DeFi trades. The best solution may involve collaboration between agents, leveraging each other's strengths. Imagine Anon's expertise in DeFi integration combined with AIXBT's analytical capabilities - this collaboration could create a seamless experience that smoothly translates market insights into executed trades.

Listen is moving in this direction. The idea is to create a system where multiple AI agents with specialized capabilities collaborate to manage the complexity of DeFi. By integrating these agents, it aims to automate not just individual tasks, but end-to-end financial strategies.

This approach will allow users to issue complex commands, such as portfolio rebalancing or yield farming across multiple protocols, through a simple conversational interface (voice and text), making tasks that were once daunting for experienced DeFi users easily manageable for the average person. The partnership with Arc aims to empower these AI agents by providing a platform that allows them to interact, learn, and scale. This ensures that the execution layer and the intelligence layer are not only separate, but work together to provide a comprehensive DeFi experience.

A Familiar Evolution

The current state of DeFAI is reminiscent of the early days of banking. Initially, financial services were fragmented — users had to visit different institutions to pay bills, make investments, and transfer money. As banks came online, integrated platforms emerged to provide seamless financial management in one place.

DeFAI needs to have its own “super app” moment — a platform that seamlessly integrates a variety of specialized agents. Think of it as a coordinated system where analytics agents provide market intelligence, execution agents process trades, risk management agents monitor positions, and portfolio optimization agents balance asset allocations.

This integration will create a unified experience where users interact with just one interface while multiple specialized agents work together behind the scenes, just like a modern food delivery app handles everything from restaurant discovery to payment processing. The future of DeFAI lies in creating ways for specialized agents to collaborate seamlessly. This approach will allow each agent to focus on its core strengths while participating in a larger, more powerful ecosystem.

Lowering Barriers, Unlocking Adoption Potential

Robinhood revolutionized retail investing by making stock trading accessible to millions of people who had never considered participating in the markets. In the wake of the COVID-19 pandemic, Robinhood added over 3 million new funded accounts in the first four months of 2020 alone. 1.5 million of these were first-time investors. This unprecedented growth was driven not only by zero-commission trading and an intuitive mobile-first design, but also by external factors such as stay-at-home orders during the pandemic.

DeFAI has a similar opportunity. The complexity of DeFi has long been a major barrier to widespread adoption. Cumbersome wallet setups, confusing interfaces, and fragmented liquidity across multiple chains have deterred all but the most dedicated users. If DeFAI is to thrive, it must do what Robinhood did—eliminate friction and make DeFi as easy as opening an app, selecting an asset, and executing a trade in seconds.

Beyond usability, AI-driven curation has the potential to redefine the discovery process in the DeFi space. Just as Yahoo once curated the early web and App Stores now guide mobile discovery, I’m curious to see what new business models emerge around AI-driven DeFi curation. An open question is whether these innovations will empower users or simply shift control from centralized exchanges to those who build and manage these AI systems.

We’re still in the early days of AI applications in DeFi. The coming years will determine whether these technologies truly democratize decentralized finance or, paradoxically, introduce a new form of gatekeeping. The challenge isn’t just about automation — it’s about ensuring AI enhances accessibility, transparency, and decentralization, rather than replacing one set of gatekeepers with another.

Waiting for the new era of DeFAI.

Miyuki

Miyuki