Author: Matt, Castle Labs researcher; Translation: Jinse Finance xiaozou

At the ETHCC conference, Aave founder Stani announced the upcoming launch of Aave V4, the new version of DeFi's largest lending protocol.

This article will focus on analyzing the implementation of new features of Aave V4 and how these improvements may reshape the protocol ecosystem, especially the changes in new interest rate parameters and GHO upgrades.

1. Innovation of Aave V4

Aave recently broke through the total locked value (TVL) of US$25 billion for the first time, becoming the first protocol to reach this milestone. The development team is actively promoting the development of new features and promoting the continued growth of the protocol through dynamic risk control. The following are the important upgrades that were announced last year and are about to be implemented:

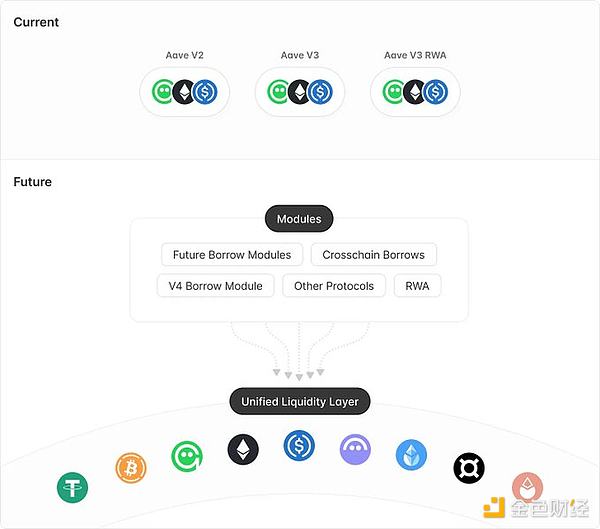

Unified liquidity layer: Eliminate liquidity migration restrictions through modular design, and add innovative features such as cross-chain lending.

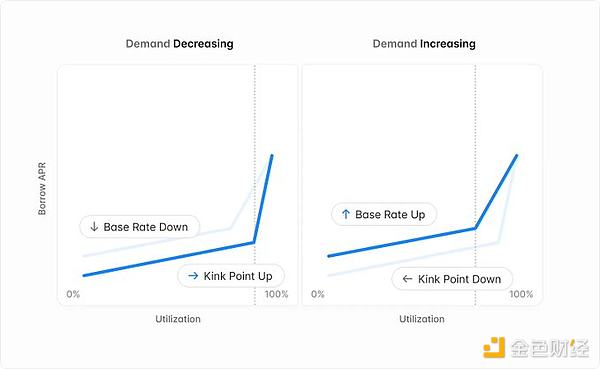

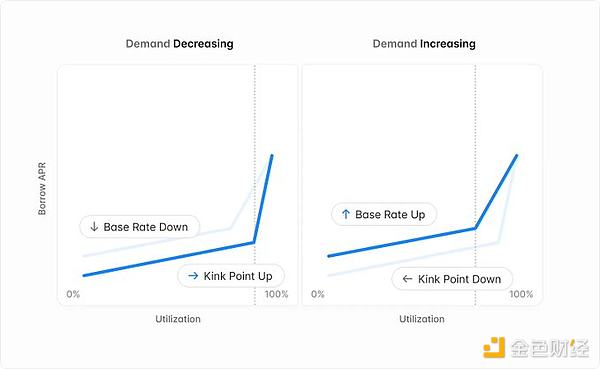

Fuzzy control interest rate: A new mechanism that automatically adjusts the interest rate curve and inflection point according to market conditions is adopted to replace the governance voting model.

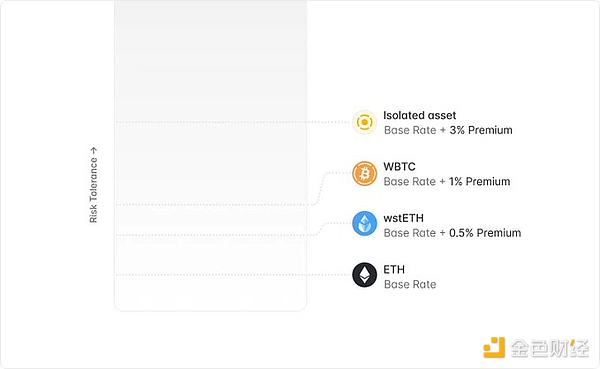

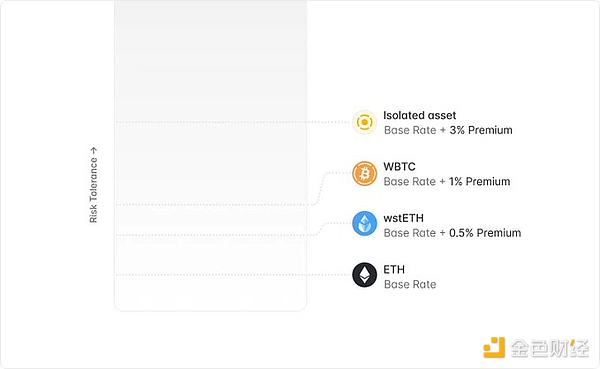

Liquidity premium: The cost of borrowing will be deeply linked to the liquidity of each token. Benchmark assets such as ETH maintain zero premium, while assets such as WBTC and wstETH will charge differentiated premiums based on liquidity conditions.

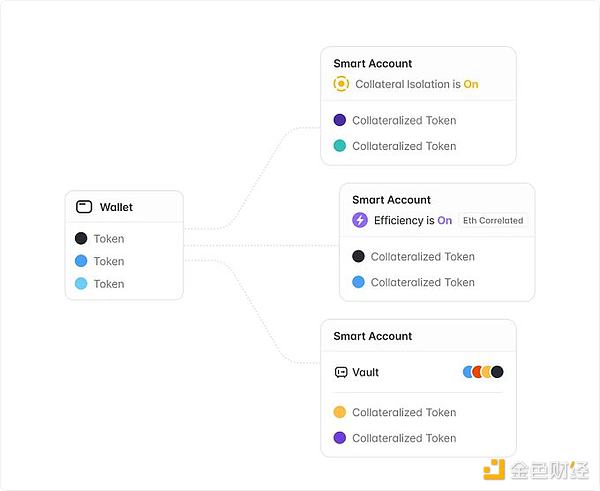

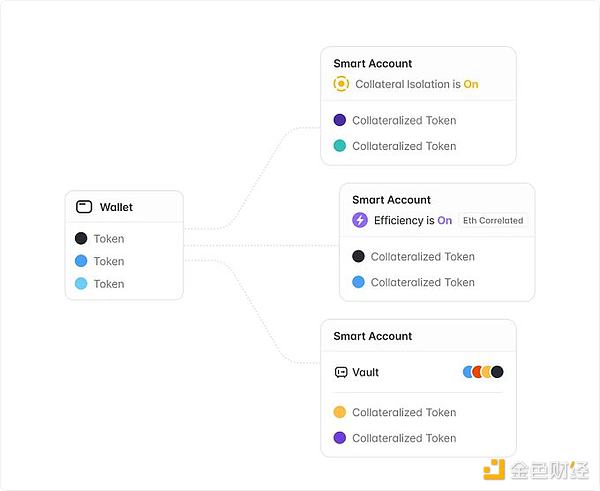

Aave V4 lending module: We are exploring innovative features through smart accounts, such as Aave vaults that can lock liquidity and disable the use of collateral.

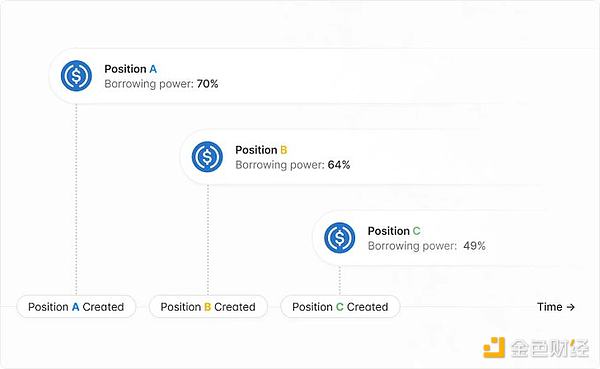

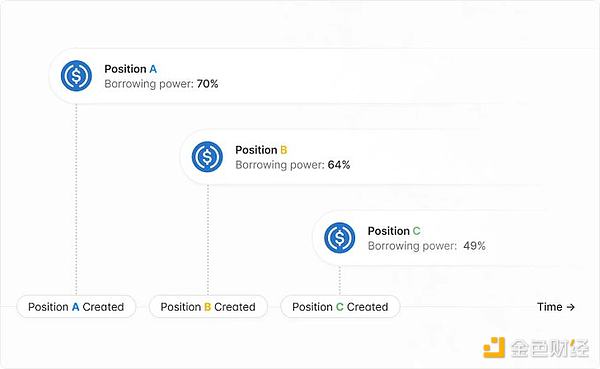

Dynamic risk configuration: The collateral ratio will be locked according to the market conditions when the position is created, and subsequent market fluctuations will not affect the established positions, providing users with higher stability.

Automated asset delisting

Automated fund management

Liquidation Engine V4: Aave’s liquidation mechanism has undergone a major upgrade, including variable liquidation coefficients and bonus mechanisms, as well as batch liquidation capabilities.

Deep GHO integration: GHO will be more deeply integrated into the Aave V4 ecosystem, adding innovative features such as soft liquidation mechanisms, stablecoin interest payments in GHO, and emergency redemption mechanisms.

Other improvements include gas fee optimization and the gradual elimination of legacy features such as tokenized positions and fixed interest rates. Next, we will focus on analyzing two core changes: a unified liquidity layer and a GHO upgrade plan.

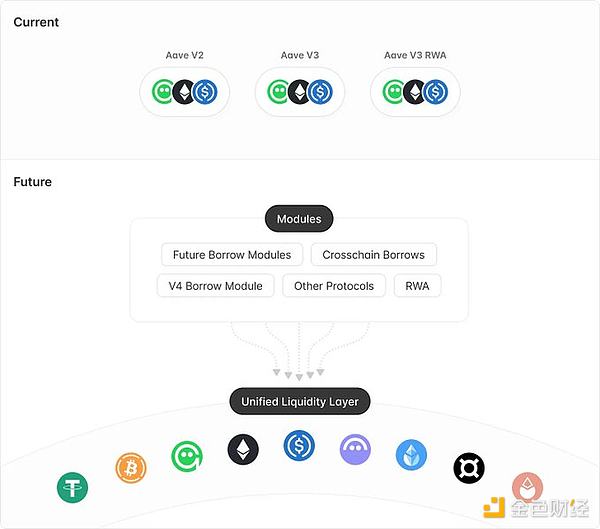

2. Unified Liquidity Layer

The unified liquidity layer introduces a new, chain-independent, independent and abstract liquidity provision infrastructure. A major improvement in this modular system is the ability to directly access new lending modules and eliminate old modules without the need for liquidity migration.

This architecture supports the flexible addition or enhancement of lending functions (such as isolated pools, RWA modules and CDPs) without changing the overall system or liquidation module. At the same time, it effectively solves the liquidity fragmentation problem that existed in the early version of the protocol.

The liquidity layer supports both external deposit assets and protocol native minting assets, significantly improving the integration with GHO and other Aave native collateral assets.

The most influential one is the cross-chain lending module, which allows users to deposit assets on one chain and borrow on another chain. This not only greatly enhances the platform's cross-chain liquidity capabilities, but also opens up new opportunities for market growth.

3. GHO Upgrade

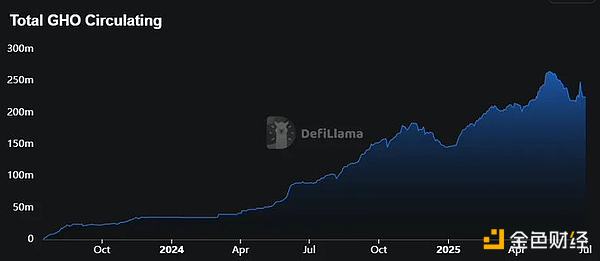

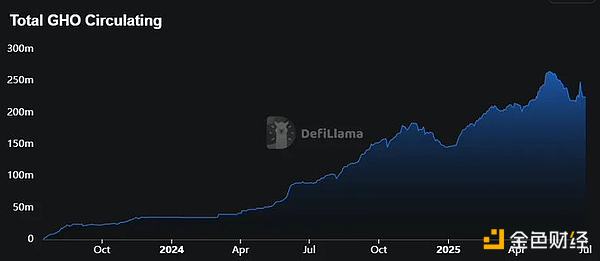

As Aave's over-collateralized stablecoin, GHO's current market value has exceeded US$220 million, an increase of 53% since the beginning of 2025.

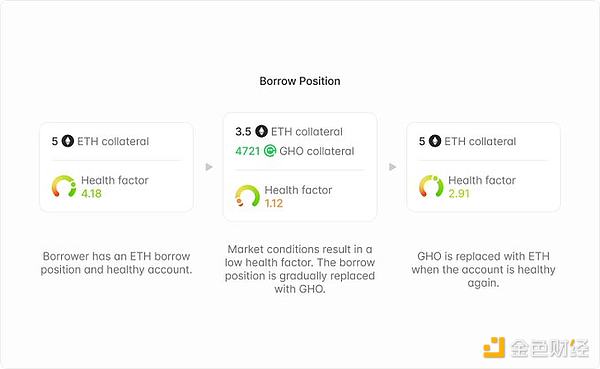

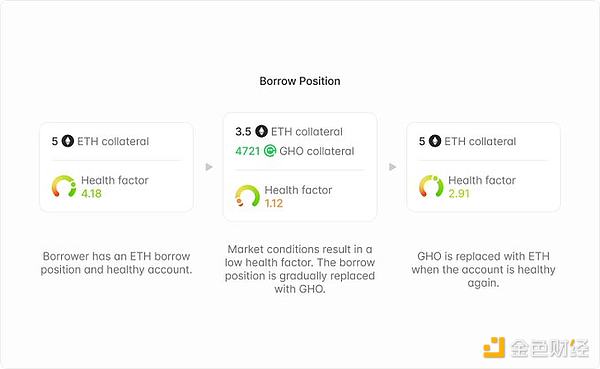

In addition to the optimization of original casting efficiency and other details, the most eye-catching is the introduction of a soft liquidation mechanism. The design draws on the innovative model of crvUSD (Curve USD) and optimizes the liquidation process through the Lending-Liquidation Automated Market Maker (LLAMM).

The liquidation operation will be performed within a customizable range: guiding assets to be converted into GHO when the market is down, and supporting collateral repurchase when the market rebounds. Compared with crvUSD, Aave V4 has three major advantages: users can independently select the collateral type for liquidation positions from the asset basket; can select the repurchase target within the range of Aave's entire platform assets (including non-initial deposit assets); GHO holders can automatically obtain interest income.

Another important change is that users in the stablecoin market can choose to receive interest in the form of GHO, and the direct tokenization of interest is expected to expand the supply of GHO.

Aave V4 also adds an emergency redemption mechanism to deal with the long-term and serious risk of GHO depegging: when triggered, the new LLAMM structure will be used to gradually redeem the collateral of the lowest health coefficient position into GHO, and automatically repay the corresponding debt.

4. Conclusion

For a protocol like Aave that combines both quantity and importance, minimizing risks is crucial - especially when launching major features such as cross-chain lending.

By automating processes such as asset delisting and interest rate model adjustments, it is possible to effectively reduce reliance on the slow decision-making process of DAO, especially when responding to market-driven changes.

Aave remains confident in the growth of its stablecoin GHO, which has now been significantly improved and deeply integrated with the protocol.

Aave will remain a cornerstone of the DeFi field for the foreseeable future. The success of the entire ecosystem depends largely on its continued leadership, as no other project has yet managed to accumulate TVL of this magnitude while maintaining comparable security.

Brian

Brian