Deng Tong, Golden Finance

On August 14, 2025, Google announced it would acquire an 8% stake in Bitcoin mining company TeraWulf for $3.7 billion. On August 18, TeraWulf announced it had increased its convertible bond sales to $850 million. TeraWulf stated that net proceeds from the transaction were expected to be $828.7 million. The buyer has a 13-day option to add an additional $150 million to the transaction, which is expected to close this week. Google currently holds warrants for a 14% stake in the company.

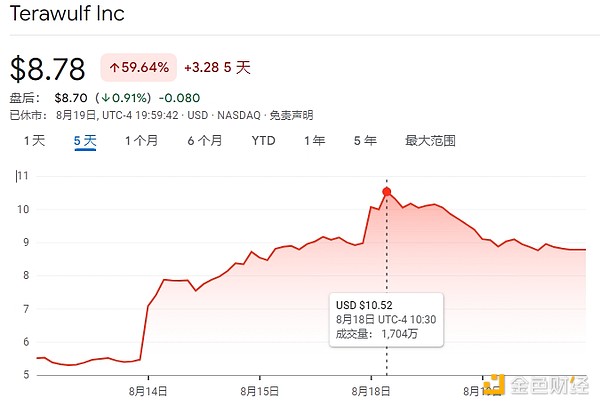

Influenced by the positive news, TeraWulf's stock price has been rising since August 14, reaching a high of $10.52 on August 18, up $5.22 from its low of $5.30 on August 13, a 98.49% increase. It subsequently declined slightly, remaining at $8.78 as of press time, but still maintaining a high level.

I. Details of the TeraWulf-Google Partnership

Last Thursday, TeraWulf announced at its shareholders' meeting that it had signed a 10-year colocation lease agreement with AI infrastructure provider Fluidstack, generating $3.7 billion in contract revenue. This figure could more than double if the agreement is renewed for another five years.

Google's participation includes supporting Fluidstack's $1.8 billion lease obligations with TeraWulf and providing debt financing. In return, Google received warrants for approximately 41 million shares of TeraWulf stock, representing approximately an 8% stake in the company. This week, Google continued to increase its stake in TeraWulf. TeraWulf Chief Strategy Officer Kerri Langlais revealed that Google's support in the agreement has now increased to $3.2 billion in exchange for warrants to purchase more than 73 million shares of TeraWulf, representing a 14% stake in the company. Google's new equity stake, making it TeraWulf's largest shareholder, "demonstrates a strong endorsement from one of the world's leading technology companies" and highlights "the strength of our zero-carbon infrastructure and the scale of the future opportunity." This collaboration will provide over 200 megawatts (MW) of critical IT loads (of a total capacity of approximately 250 MW) to TeraWulf's Lake Mariner data center in Western New York, a facility purpose-built for liquid-cooled AI workloads. Equipped with dual 345 kV transmission lines, a closed-loop water cooling system, and low-latency fiber optic connectivity, TeraWulf's Lake Mariner campus is designed to be a top-tier hyperscale data center for demanding AI workloads. The first phase of the campus, comprising 40 MW of capacity, is expected to be operational in the first half of 2026, with full capacity expected by the end of the year. TeraWulf CEO Paul Prager called this a "defining moment" for TeraWulf, while CTO Nazar Khan highlighted the facility's scalability and readiness. Fluidstack President César Maklary emphasized the parties' shared commitment to fast, scalable AI infrastructure. Second, venturing into the HPC hosting business. Founded in 2021, TeraWulf is a Bitcoin mining company focused on environmentally sustainable operations. According to TeraWulf's Q2 2025 financial results released on August 8, revenue for the second quarter of 2025 was $47.6 million, compared to $35.6 million in the second quarter of 2024. BTC mining capacity increased 45.5% year-over-year to 12.8 EH/s. In the second quarter of 2025, the company mined 485 bitcoins through Lake Mariner, compared to 699 bitcoins in the second quarter of 2024. The decrease in mining activity was primarily due to the halving in April 2024 and the strategic divestiture of the Nautilus Cryptomine facility in October 2024. The electricity cost per bitcoin in the second quarter of 2025 was $45,555, compared to $22,954 in the second quarter of 2024, reflecting the halving, increased network difficulty, and short-term electricity price fluctuations. Since the Bitcoin halving, miners have sought to diversify their revenue streams by shifting energy capacity toward AI and high-power computing (HPC) hosting services. TeraWulf faces a common challenge for Bitcoin miners, and whether to make changes is a question for TeraWulf. Asset management firm VanEck estimated in an August 2024 report that if publicly traded Bitcoin mining companies shifted 20% of their energy capacity to AI and high-performance computing (HPC) by 2027, they could generate an additional $13.9 billion in profits annually over 13 years. "In the short term, mining can generate cash flow and provide a valuable resource to the grid because its flexible load can be quickly adjusted to support stability and reliability." However, in the medium to long term, TeraWulf believes that converting the business to AI and HPC workloads "holds greater value," and that revenue from long-term contracts with blue-chip partners such as Fluidstack and Google "will drive growth and value creation." "We will begin recognizing revenue from our HPC hosting business in the third quarter of 2025, marking a key inflection point in our financial position," said Patrick Fleury, TeraWulf's Chief Financial Officer. "With the execution of our previously announced financing strategy and our disciplined approach to capital allocation, we are confident we can scale responsibly while creating meaningful value for our shareholders." "TeraWulf continues to execute on its strategy to develop scalable and sustainable digital infrastructure to support HPC hosting and proprietary Bitcoin mining," said Paul Prager, TeraWulf's CEO. "In the second quarter, we made significant progress in delivering the 72.5 megawatts of HPC capacity contracted for Core42. The Company delivered and became profitable at the WULF Den data center in July and expects to deliver and generate revenue at the CB-1 data center this month, with CB-2 to follow in the fourth quarter." The data center is generating revenue, consistent with previous expectations. Furthermore, we are in advanced discussions to expand our HPC hosting deployment at Lake Mariner and are actively seeking additional data centers to support our long-term growth plans. III. Why did Google invest in TeraWulf? 1. Profitability As previously mentioned, TeraWulf has signed a 10-year colocation lease agreement with AI infrastructure provider Fluidstack, generating $3.7 billion in total contract revenue. This figure could more than double with a five-year renewal. The agreement, under a modified master lease with annual escalations, is expected to generate a site-level net operating margin of 85%, or approximately $315 million per year. The total project cost is estimated to be $8 million to $10 million per megawatt. TeraWulf's stock price surge also demonstrates the market's recognition of the value of the partnership between TeraWulf and Google. Following Google's investment announcement, TeraWulf's stock price surged nearly 100% in the short term. With the Lake Mariner data center operational in 2026 and the expansion of its HPC hosting business, the company's revenue and profit growth will further drive up its equity value. As the largest shareholder, Google will directly share in the gains. 2. Supporting Google's AI Competition Google has made significant progress in AI competitions. For example, its Gemini series of models has achieved remarkable success, with the Gemini 2.5 Pro sweeping the LMArena rankings in categories like coding, math, and science. The development of AI is inseparable from HPC. HPC, as the computing power behind AI and big data, is the engine of AI development. During the training phase, large AI models must process billions or even trillions of parameters, a feat impossible with standard servers alone. HPC's clustered architecture and parallel computing technology can significantly shorten model training cycles. During the inference phase, real-time AI applications require low-latency responses. HPC's high-speed interconnect technology and edge computing node deployment ensure AI models complete inference decisions within milliseconds. In an interview with CNBC, TeraWulf CEO Paul Prager stated, "Our partnership with Google is a defining moment for TeraWulf. We are bringing together world-class capital and computing partners to build the next generation of AI infrastructure, powered by the industry's lowest-cost, nearly zero-carbon energy. The Lake Mariner site is unique. It features dual 345 kV power transmission lines, a closed-loop water cooling system, and an ultra-low-latency fiber optic network. These conditions are perfectly tailored for liquid-cooled, high-density AI computing." Currently, TeraWulf has transitioned from Bitcoin mining to HPC hosting, with plans to deliver capacity across multiple data centers. TeraWulf will continue to support Google's AI efforts in the future. IV. Conclusion The deep integration between Google and TeraWulf is a win-win partnership. TeraWulf leverages Google's funding and reputation to boost its stock price in the short term. In the medium and long term, it can expand beyond its single mining business into HPC hosting services and AI infrastructure development, finding new profit points. Google, through its investment in TeraWulf, can gain access to additional computing resources to meet its computing needs for large-scale model training and cloud services, while also benefiting from the appreciation of its equity through TeraWulf's profits. As competition in the AI sector intensifies, TeraWulf's development is providing a model for more crypto mining companies to transform: riding the coattails of tech giants, entering the golden age of mining, leveraging its existing businesses as a foundation while actively expanding into high-value-added businesses, becoming a bridge for the coordinated development of the traditional tech and crypto industries.

Brian

Brian

Brian

Brian Alex

Alex Brian

Brian Brian

Brian Kikyo

Kikyo Brian

Brian Kikyo

Kikyo Alex

Alex Brian

Brian Kikyo

Kikyo