In the United States, encryption has never been so important.

Just last week, the U.S. Congress ushered in a highly anticipated "Crypto Legislative Week". From avoiding it like a snake and scorpion to re-establishing its name and even holding an agenda on encryption in Congress, the crypto world has not been steady in the past decade, but it is definitely fast.

With the twists and turns of the encryption bills all passed, and the highly anticipated stablecoin genius bill was officially signed by Trump, the encryption industry has undoubtedly ushered in a new journey.

Milestone event! Three major encryption bills passed

Back to last Monday, July 14, the U.S. House of Representatives announced that week as "Crypto Legislative Week", attracting market attention. The core of the legislative week is the three existing crypto bills, namely the Digital Asset Market Clarity Plan (CLARITY Act), the Anti-CBDC Surveillance State Act, and the Guidance and Establishment of a United States Stablecoin National Innovation Act (GENIUS Act or Genius Act).

Of the three bills, the GENIUS Act and the CLARITY Act were both proposed this year, and the CBDC Surveillance State Act has the longest history, first proposed in 2022. Although all of them are crypto bills, the core of the three has its own emphasis. Among them, the GENIUS Act focuses on the issuance of stablecoins and has the widest recognition. The bill focuses on payment stablecoins and implements a dual-regulation management system that runs parallel between state and federal governments. It stipulates that all stablecoins must be anchored to high-quality, low-risk liquid assets in the U.S. dollar at a ratio of 1:1, including U.S. Treasury bonds due within 93 days, insured bank deposits or physical U.S. dollar cash (including Federal Reserve bills), and requires stablecoin issuers to disclose stablecoin reserve details every month. The bill was proposed in February and has been signed by Trump so far. The legislative process ranks first among the three major bills, which shows the importance of the legislature and the top leaders.

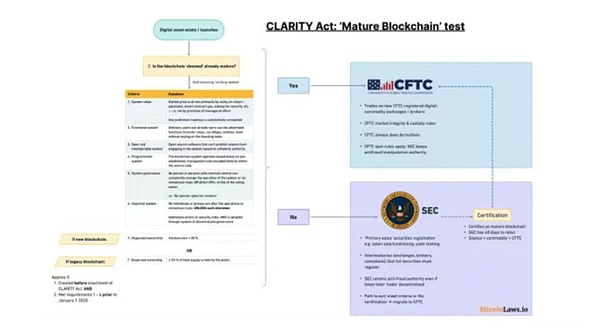

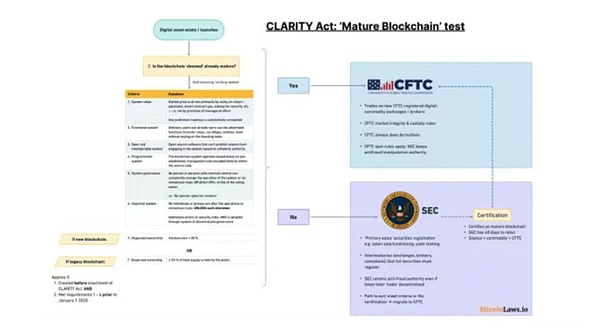

Compared with the genius bill, the CLARITY bill is much more unfamiliar to outsiders. The plan was first submitted by J. French Hill, Republican Congressman from Arkansas, Chairman of the House Financial Services Committee, on May 29, 2025, and the latest version was formed after multiple rounds of hearings and deliberations. As the name suggests, the word "clarity" reflects the most important focus of the bill - the issue of regulatory power. Because the attributes of cryptocurrencies are difficult to define, the dispute between securities theory and commodity theory has never stopped since the inception of cryptocurrencies. In addition, the crypto industry has more lucrative forfeiture capital than other industries, and the competition between the SEC and the CFTC for its jurisdiction is very fierce. Before Trump came to power, the SEC was a famous "crypto police officer", and it would go out to police various projects from time to time. The frequent Wells notices once made the industry nervous, and USDT, USDC, ETH, and SOL were all covered.

The CLARITY Act is to solve this problem. The Act establishes clear classification standards for digital assets, subdividing them into digital commodities, investment contract assets, and non-commodity collectibles, clarifies the attribute disputes of cryptocurrencies, and builds a dual-institutional regulatory structure, that is, the digital commodity spot market is under the responsibility of the CFTC, and securities issuance and anti-fraud law enforcement are under the responsibility of the SEC.

The Anti-CBDC Surveillance State Act directly writes the content in the name. The key content is to prohibit the Federal Reserve from issuing retail-oriented central bank digital currency (CBDC) without the explicit authorization of Congress. As we all know, during Biden's administration, he maintained a relatively open attitude towards CBDC and digital dollars. In 2022, he signed an executive order instructing government agencies to study and create CBDC. But in the American political arena, it is common to change orders overnight. In January 2025, Trump signed an executive order to suspend all retail CBDC research and development on the grounds that it could be used as a government surveillance tool. Since then, the Anti-CBDC Surveillance State Act, which was proposed in 2022, has been quickly put on the legislative agenda and was passed by the House Financial Services Committee on April 3 this year, becoming an issue of Crypto Legislation Week.

From the latest approval situation, the CLARITY Act and the Anti-CBDC Surveillance State Act have both passed the House of Representatives vote and both have moved to the Senate agenda. The fastest GENIUS Act has become a formal law after being signed by Trump. It will take effect 18 months after Trump signs it, or 120 days after the "major federal payment stablecoin regulators" (including the Treasury Department and the Federal Reserve) issue final regulations to implement the bill. This is the first cryptocurrency law in the United States, which is undoubtedly a major breakthrough in crypto legislation. If we look closely at the contents of the bills, it is no accident that the three bills can be included in Crypto Week. The three bills are actually mutually reinforcing. Stablecoins, as the ballast of the industry, continue to broaden the boundaries of the US dollar and attract institutions to join. CLARITY clarifies regulatory clarity and further promotes the expansion of the industry. The anti-CBDC bill directly kills the biggest opponent of cryptocurrency, the digital dollar, in the cradle, stabilizes the basic plate of encryption, and establishes ideology. It can be believed that the three bills will maximize the value of encryption, and to the greatest extent, through the integration of encryption and traditional finance, realize the reconstruction of the value of the US dollar in the field of digital currency.

It is not smooth sailing, the interest game behind the three bills

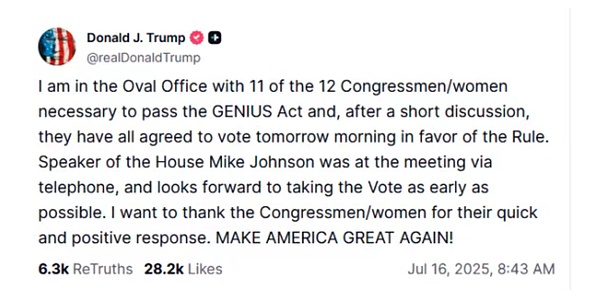

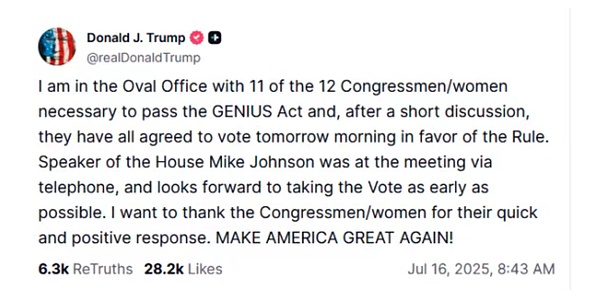

But since there are interests, there is naturally a game. The seemingly smooth approval process was not smooth sailing during the period, and the interest game behind the legislation was wonderful. On the eve of the approval of the GENIUS Act, Trump sent a message to party supporters, clearly stating that all members should immediately approve it. According to the difference in seats between the two parties in this year's election of 220:212, coupled with the background of some Democratic supporters, the passage of the bill should be a foregone conclusion. As a result, on July 15, the House of Representatives rejected the GENIUS Act by a vote of 196-223. The key was the reneging of the family members. 12 Republicans in the House of Representatives performed a rebellion on the spot.

The reason is that at that time, the two parties argued endlessly about whether the GENIUS Act should be included in the "Anti-CBDC Surveillance State Act". The Republican Party believed that if the anti-CBDC clause was not included, it might leave hidden dangers for the subsequent issuance of the US CBDC. One link after another, the integration and packaging of the "CLARITY Act" and the "Anti-CBDC Surveillance State Act" has created new problems. The bundling faction represented by industry giants such as Coinbase, the largest cryptocurrency exchange in the United States, believes that the legislation of all cryptocurrencies should be completed in one go, while the pragmatic faction of the community centered on Defi advocates small steps and fast progress, passing the GENIUS Act first, and then talking about other things. The demands are also understandable. Most industry giants have accumulated a lot in the direction of compliance and have first-mover advantages. If the cryptocurrency legislation is completed, they can obtain the most market dividends. At the same time, the giants are too big to be adjusted, so it is understandable that they prefer a more certain package of legislation. Defi has always been in the gray area of regulation. For the community, any legislation has a promoting effect, and it is obvious that the faster the efficiency, the better.

After the show of betrayal, Trump was slapped in the face and was obviously angry. That night, Trump immediately took thunderous measures and took the 12 members who voted against to his office for a talk. The content of the conversation is unknown. But judging from the results of the second vote on July 18, the arm was ultimately no match for the thigh. After nearly ten hours of tug-of-war, the longest legislative vote in history was finally passed smoothly. The U.S. House of Representatives passed the GENIUS Act with 308 votes in favor and 122 votes against.

Overall, although the three major legislations have twists and turns in the process, with the strong support of the president, it is only a matter of time before they are passed. If we add the fact that more than one-fifth of Trump's cabinet holds cryptocurrencies, the time for passing is expected to be greatly shortened. According to industry analysis, the Clarity Act is relatively more difficult to pass because it involves the transfer of ownership and has a greater impact on the market, and the Democratic Party's resistance to it is also greater. The Anti-CBDC Act is likely to take effect before the end of this year.

What impact do the three major bills have on the market?

The impact of the three major bills on the market is visible to the naked eye, and both ends of the currency and stock market cheered for this event. Bitcoin has continuously broken new highs, breaking through 120,000 three times, rising to a maximum of 123,000 US dollars, and now falling back to 119,000 US dollars, and the ETH sector rotation has also officially started, ETH soared to 3,790 US dollars, SOL came to 189 US dollars, and BNB broke through 760 US dollars again. Among the top 100 cryptocurrencies by market value, 52 of them are on the rise. Benefiting from the Stablecoin Act, Circle, the first stablecoin stock, rose by more than 1.45%, and the related Coinbase also rose to the $400 range, now at $419.78.

In addition to prices, changes in the industry are also coming quietly. First, the CLARITY Act lists seven objective and measurable standards to determine the attributes of digital assets, which greatly reduces securities risks, especially for DeFi projects that are deeply harmed by securities. DeFi systems can be exempted from federal intermediary rules. Although the secondary regulatory model is suspected of pushing up regulatory costs, it provides regulatory guarantees for the industry. In this context, it is foreseeable that the CTFC will gradually acquire law enforcement sovereignty from its original marginal law enforcement and transition to become a more important regulatory agency for cryptocurrencies. Among them, large centralized exchanges will benefit the most and can reasonably open up new institutional tracks, while DeFi and other application projects will either join the system to obtain certain dividends or face marginalization.

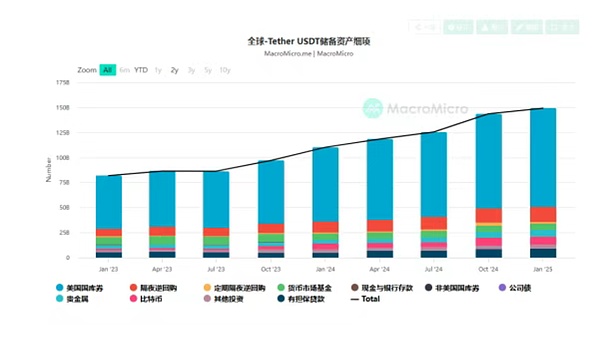

At the same time, stablecoins will be the most affected area. It has been mentioned before that the epoch-making impact of the Genius Act is to open up a new rule for private currency issuance, and the anti-CBDC bill further strengthens this point. At this point, the era of private seigniorage will begin. Traditional companies, financial institutions, and even qualified technology companies can enter this track. Take Bank of America and JPMorgan Chase as examples. Both have actively stated that they want to participate in the construction of stablecoins, and the track will soon be crowded. However, according to the prediction of Rhythm, new entrants will face an initial setup cost of $1-3 million and an ongoing compliance fee of $2-10 million per year. It can be seen that only strong companies can stand out.

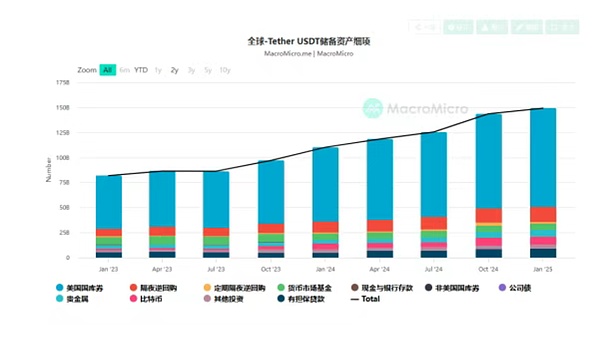

For the existing stablecoin track alone, the industry landscape is expected to be reshaped. First, the leading companies will face the dual challenges of compliance and competition. Tether, an offshore issuer, not only faces the compliance issue of collateral (about 85% of it is supported by cash and cash equivalents, not 100%), but also faces the impact from a wide range of competitors. Decentralized stablecoins are even more difficult. Both the reserve ratio and the governance structure will face a regulatory test. If they cannot comply with the regulations within the two-year transition period, they will be explicitly banned from issuance.

In addition, there is also a lot of discussion on whether stablecoins pay interest under existing regulations. In order to curb the impact of stablecoins on the existing system, the Genius Act clearly stipulates that payment-type stablecoins cannot pay interest to holders, and users need to find other DeFi protocols to obtain income. However, there is also room for maneuver, such as switching to income-type stablecoins, or purchasing U.S. debt tokens with payment-type stablecoins, and realizing the interest-bearing attribute in a roundabout way.

Whether it is interest-bearing or not, no matter how fierce the competition is, the biggest winner must be the US dollar system. Through layers of legislative nesting, the long-arm mechanism of the US dollar with stablecoins as the gripper is further strengthened. Under the influence of the anchoring of the core assets of stablecoins, the verification in stablecoins is US dollar assets, and stablecoins objectively serve as the value scale and means of circulation in the crypto market. In this context, the United States has brought encryption to the regulatory side, not only without spending a single soldier to harvest the existing encryption achievements, but also successfully promoted the reshaping of the US dollar hegemony in the field of encryption, and promoted the continuous extension of the influence of the US dollar in the digital age as the scale of encryption expands, further forming a situation of confrontation with global CBDCs. On the other hand, with the help of legislation, the development of stablecoins will promote the market demand for US debt, ease the existing US debt crisis, and form a mechanism for capital repatriation.

The finalization of legislation heralds the official arrival of the institutional era. Cryptocurrency has finally become a subsidiary of the US dollar, and the market has mixed feelings, but it still ended up rising. Perhaps for everyone, it is fortunate that cryptocurrencies have entered the table, and position is always more important than ability.

Weatherly

Weatherly