Deng Tong, Jinse Finance

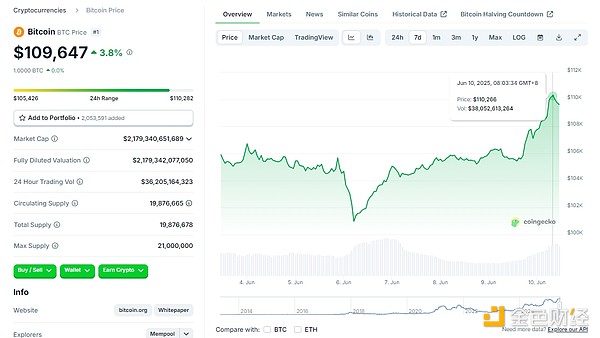

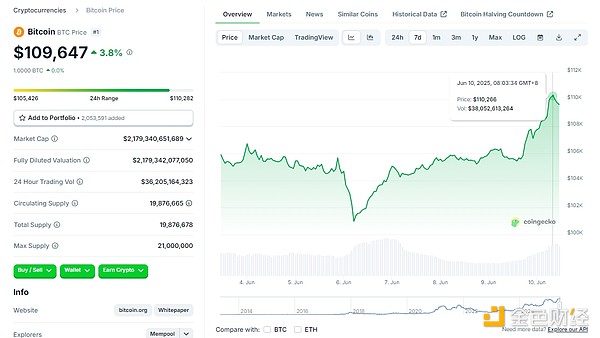

This morning, BTC and ETH rose. According to Coingecko data, the highest price of BTC reached 110,266 US dollars.

The highest price of ETH reached 2705.80 US dollars.

What makes BTC and ETH so popular? What factors are affecting the current crypto market? How much will BTC and ETH rise next?

1. New trends in Sino-US economic and trade: The United States considers lifting export controls in exchange for China's relaxation of rare earth export controls

On Monday afternoon local time, the first meeting of the US-China economic and trade consultation mechanism was held in London, UK. The US-China economic and trade negotiations kicked off in London, with the US indicating its willingness to lift export restrictions in exchange for China's commitment to relax rare earth export restrictions.

On the morning before the first meeting of the China-US economic and trade consultation mechanism, CNBC connected with Hassett, director of the White House Economic Council, for an interview. He revealed for the first time that the US government is considering canceling some export controls in exchange for China's further relaxation of rare earth export controls. Hassett said that this round of talks "will not be long, but it will be a big, strong handshake"; if China allows large-scale exports of rare earths, "all export controls from the US will be eased immediately" (any export controls from the US will be eased) and then the two sides will continue to deal with some "smaller matters" (smaller matters).

The People's Daily Zhongsheng published an article on the 10th, pointing out that the true picture of China-US economic and trade relations is complementary advantages, symbiosis and win-win. Only by removing the artificial "iron fences" and unblocking the "two-way road" of economic and trade cooperation can we promote the stable and healthy development of Sino-US economic and trade relations. As the world's top two economies, strengthening economic and trade cooperation between China and the United States will not only benefit their respective development, but will also provide important guarantees for the stability of the global industrial chain and supply chain. We believe that through equal consultation and pragmatic cooperation, China and the United States can find a mutually beneficial and win-win solution. It is hoped that both sides will work together to create favorable conditions for enterprises in the two countries to carry out normal economic and trade activities, so that the results of cooperation can better benefit the people of the two countries and make greater contributions to global economic recovery and growth.

2. The Chairman of the U.S. SEC strongly supports DeFi

On Monday, at the last meeting of the five cryptocurrency roundtables held by the U.S. Securities and Exchange Commission (SEC), agency leaders and expert panels discussed the issue of decentralized finance (DeFi) regulation.

At the beginning of the roundtable, SEC Chairman Atkins talked about how decentralized finance (DeFi) fits in with American values: "American values of economic freedom, private property rights, and innovation are the core genes of the decentralized finance (DeFi) movement." In addition, Chairman Atkins emphasized that developers of neutral tools should not be held liable for the actions of third parties: "Engineers should not be subject to federal securities laws simply for publishing such software code. As one court stated, it is irrational to hold the developer of an autonomous vehicle responsible for a third party using the car to violate regulations or rob a bank - quoting the court's decision, in this case, people will not sue the car company for accusing it of facilitating illegal behavior, but will sue the individual who committed the illegal behavior."

SEC Chairman Atkins said that The commission is developing policies to exempt decentralized finance (DeFi) platforms from regulatory hurdles.

Atkins has directed SEC staff to study modifying agency rules “to provide the necessary convenience for issuers and intermediaries seeking to manage on-chain financial systems.” Atkins called the potential exemption “an innovation exemption” that would allow entities under the SEC’s jurisdiction to “quickly” bring on-chain products and services to market.

"Many entrepreneurs are developing software applications that can run without any operator management." Although the technology that enables private peer-to-peer transactions "sounds like science fiction," he said: "Blockchain technology makes possible a whole new type of software that can perform these functions without an intermediary." "I don't think we should allow century-old regulatory frameworks to stifle innovation because these technologies have the potential to disrupt, and more importantly, improve and advance our current traditional intermediary model. We shouldn't be rightly afraid of the future."

SEC Commissioner Hester Peirce said: "The SEC may not infringe on the rights granted by the First Amendment by regulating code publishers simply because others use the code to engage in activities that the SEC has traditionally regulated," "Centralized entities cannot evade regulation simply by affixing a decentralized label."

Erik Voorhees, founder of decentralized exchange ShapeShift, pointed out: "I appreciate the change in tone and position of the Commission. I think this is absolutely a good thing for the United States."

For more information, please see the Golden Finance article: "The latest speech by the Chairman of the U.S. SEC: DeFi and the American Spirit (full text)"

3. BlackRock increases its holdings of ETH

BlackRock is quietly hoarding Ethereum, currently holding 1.5 million Ethereum (worth $2.71 billion) and tokenizing assets on the chain. The asset management company has purchased $500 million worth of Ethereum in the past 10 days, reflecting institutional investors' confidence in the altcoin, even though its price has fallen 48% from its all-time high.

Last week, Ethereum-based investment products led the inflows of funds into cryptocurrency exchange-traded products (ETPs), attracting $296 million in funds despite a market slowdown as investors waited for the Federal Reserve to introduce regulatory policies. This marks the seventh consecutive week of inflows into Ethereum ETPs, the highest since U.S. President Donald Trump won the 2024 election, and Ethereum ETPs now account for more than 10.5% of the total assets of cryptocurrency ETPs under management. CoinShares also noted a significant rebound in investor sentiment.

Fourth, what is the future of the crypto market?

BTC rises to $150,000?

Some analysts expect that the price of Bitcoin may rise to $150,000 as the U.S. government is about to raise its $4 trillion debt ceiling. However, futures market data shows that there is still hesitation in the market in the short term, which may be caused by unfavorable macroeconomic signals and misreading of Bitcoin's potential supply shock.

Bitcoin 2-month futures annualized premium. Source: laevitas.ch

Since June 6, the Bitcoin futures premium has been hovering around the 5% baseline typical of a neutral market. The recent price increase has yet to inspire significant confidence among traders. However, it would be inaccurate to say that market sentiment is completely pessimistic, especially when Bitcoin is currently trading just 3% below its all-time high of $111,965 set on May 22.

The recent price action is not driven by over-leveraged speculation, which suggests healthy market fundamentals. However, if recession fears persist, Bitcoin is unlikely to sustain levels above $110,000 given its continued correlation with traditional equity markets.

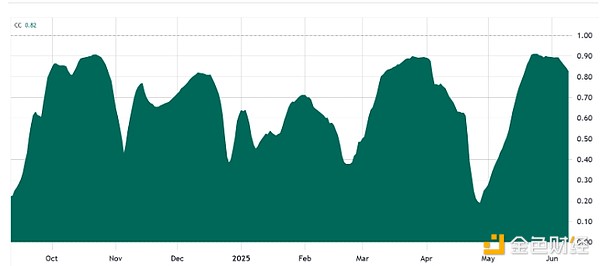

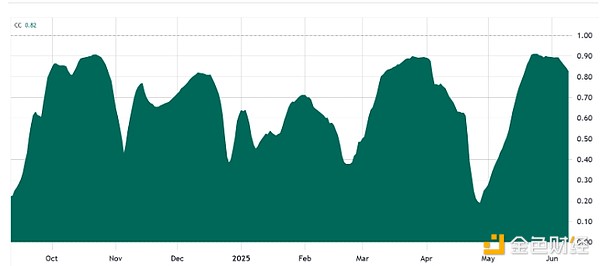

BTC/USD 50-day correlation with S&P 500 futures.

Currently, Bitcoin is 82% correlated with the S&P 500, meaning that both assets move in similar directions. This trend has held for the past four weeks. While the correlation has fluctuated over the past nine months, investors mostly still view Bitcoin as a risk-on asset rather than a reliable hedge.

If confidence in the fiscal stability of the U.S. government declines, risk perception could shift in favor of Bitcoin.

ETH above $3,600?

Currently, ETH price is back above the middle line of the Gaussian Channel, a dynamic market trend indicator. Gaussian or Normal Distribution Channels plot price movements within a dynamic range to accommodate market volatility.

Ethereum Gaussian Channel Analysis.

Historically, when Ethereum breaks through the Gaussian channel midline, a rebound occurs. For example, in 2023, ETH soared 93% to $4,000 after breaking through the Gaussian channel midline; and in 2020, ETH soared 1,820%.

With ETH stabilizing above the key $2,570 level, technical analysis predicts that ETH has the potential to rise to $3,100-$3,600 if momentum holds, thanks to the channel’s historical accuracy in predicting short-term gains.

Weatherly

Weatherly