Author: Tom Mitchelhill, CoinTelegraph; Compiler: Baishui, Golden Finance

An analyst said that the large outflows from Grayscale's recently converted Ethereum ETF, Grayscale Ethereum Trust (ETHE), should subside before the end of this week, leading to a rise in ETH prices.

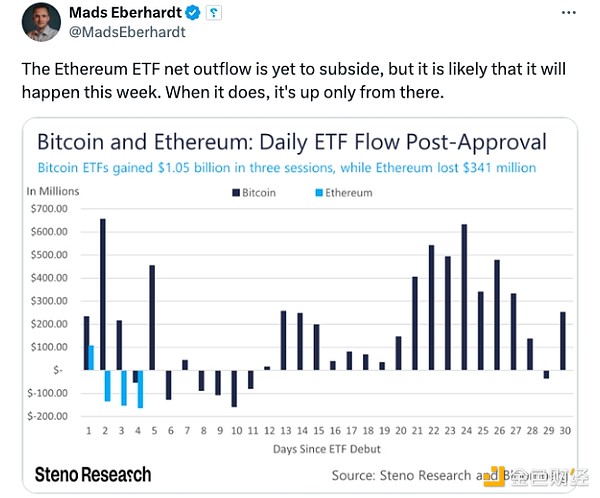

In a post to X on July 30, Mads Eberhardt, senior analyst at Steno Research, said that the large outflows from Grayscale ETHE "will most likely" subside this week. His remarks came as the Ethereum ETF had outflows for the fourth consecutive day, with outflows reaching $98 million.

Source: Mads Eberhardt

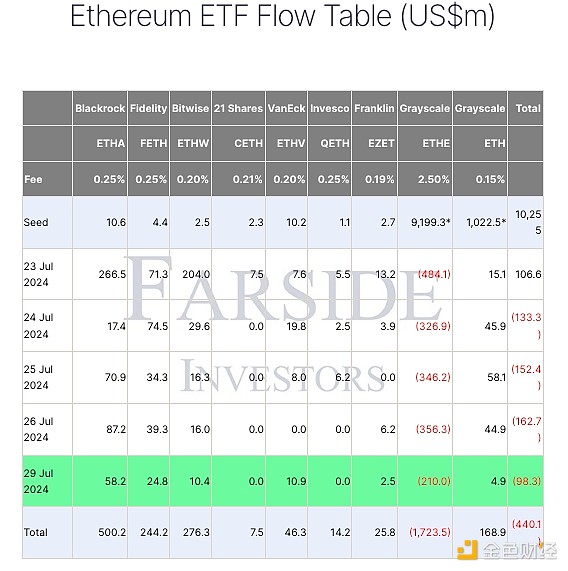

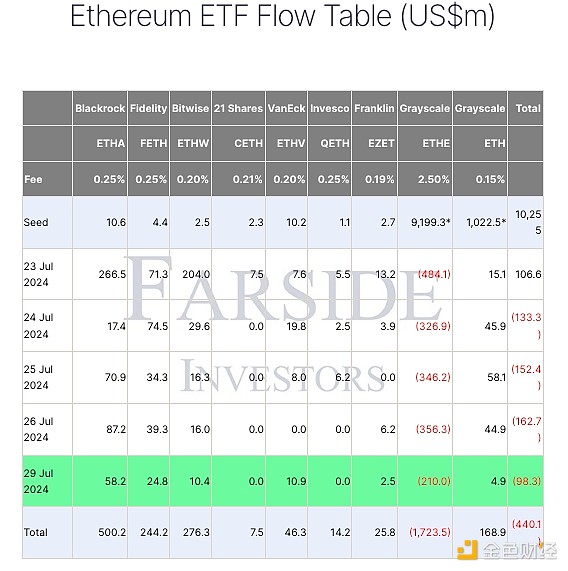

ETHE has seen outflows of more than $1.7 billion since the conversion. This figure represents nearly 18% of the $9 billion that ETHE originally contained before it converted to an ETF on July 24.

While the other eight ETH ETFs have seen continued positive inflows, this figure has resulted in the Ethereum ETF failing to achieve net inflows for four consecutive days.

BlackRock's spot ETH fund had the largest cumulative inflow of $500 million, Bitwise's fund inflow was $276 million, and Fidelity ranked third with a net inflow of $244 million.

Ethereum ETF has seen outflows for four consecutive days. Source: FarSide Investors

However, Eberhardt believes that the strong early outflows are reason for short-term bullishness.

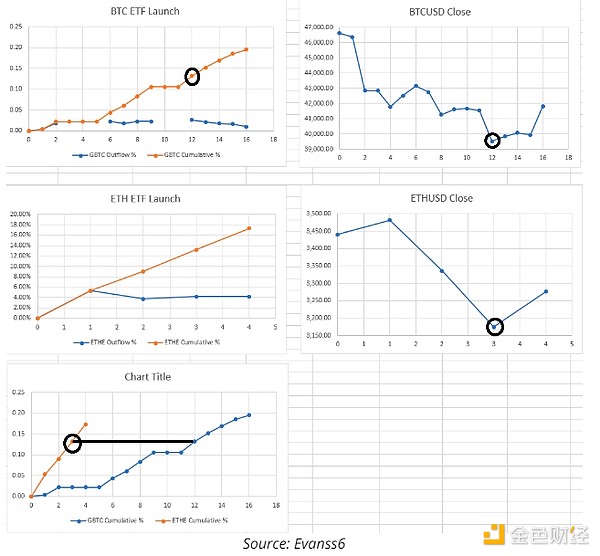

“Outflows from the Grayscale Bitcoin ETF have dropped significantly after the 11th trading day,” he said.

“Since outflows from the Grayscale Ethereum ETF are so much higher relative to AUM, we think peak outflows will occur sometime this week.”

“So what happens once we get past the peak of these Grayscale outflows? Take a guess,” Eberhardt wrote in a follow-up post on X.

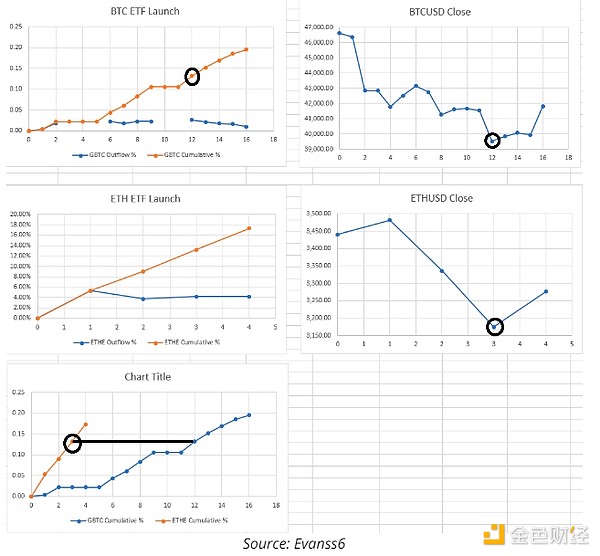

Anonymous trader Evanss6 echoed Eberhardt’s sentiments in a July 30 X post comparing the launch of the Bitcoin ETF and Ethereum ETF side by side.

Evan wrote that Bitcoin ETF outflows bottomed on the seventh trading day, and the bottom occurred when Grayscale Bitcoin Trust (GBTC) cumulative outflows reached 13.2% of the original fund.

He added that after GBTC outflows bottomed, Bitcoin went on to "plunge [about] 92% in 50 days."

In contrast, he noted that Grayscale's Ether ETF "sold much faster than GBTC," reaching 17.3% in just four days, when the overall correction in ETH prices relative to BTC was smaller.

Meanwhile, Samara Cohen, head of ETFs and index investing at BlackRock, said there is strong demand for ETH from institutional investors, adding that ETFs based on cryptocurrencies will start to find their way into “model portfolios” by the end of the year.

“Investors really want to get exposure to ETH, especially if they’re going to use it in their overall portfolio in an ecosystem that they have confidence in,” she said.

Edmund

Edmund