Author: Lisa & Keywolf

On March 6, 2025, Tether froze $28 million worth of USDT at the Russian sanctioned exchange Garantex, which once again aroused widespread market attention to the risk of stablecoin freezing. This article will focus on Garantex's sanction history, platform fund management strategy and countermeasures to stablecoin freezing, and explore how to avoid on-chain compliance risks and ensure fund security.

Sanction History

Garantex was founded in late 2019 and was originally registered in Estonia, mainly providing fiat currency and cryptocurrency exchange services. Due to changes in the regulatory environment, its main business soon moved to Moscow, and set up operations in the Federation Building and St. Petersburg, which are also gathering places for other sanctioned virtual currency exchanges (such as SUEX and CHATEX). Since Garantex allows anonymous transactions and has weak compliance, it has gradually become an important channel for hackers, ransomware gangs and illegal funds, which eventually triggered high-intensity scrutiny from regulators.

1. Sanctioned by OFAC and FIU

In February 2022, after the Estonian Financial Intelligence Unit (FIU) investigated Garantex, it was found that the exchange had serious violations of anti-money laundering/counter-terrorist financing (AML/CFT) and had links with criminal funds, and eventually revoked Garantex's virtual currency service provider license. Despite losing the Estonian license, Garantex still provides services to customers through other means.

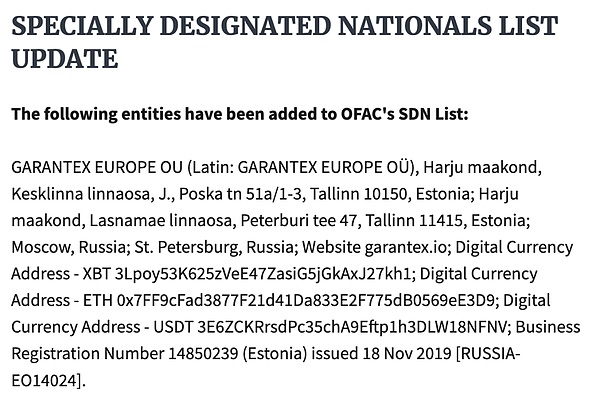

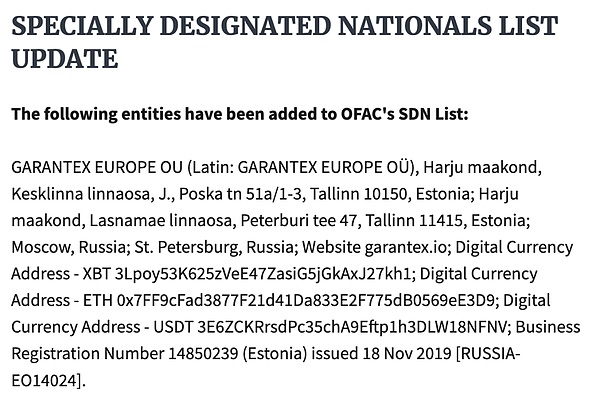

On April 6, 2022, the U.S. Treasury Department's Office of Foreign Assets Control (OFAC) announced sanctions against Garantex, accusing the exchange of facilitating illegal transactions, money laundering and other criminal activities. During this investigation, OFAC found that more than $100 million in Garantex transactions involved illegal actors and darknet markets, including nearly $6 million from the Russian ransomware-as-a-service (RaaS) gang Conti and nearly $2.6 million from the banned darknet market Hydra. OFAC also added three wallets associated with Garantex to the Specially Designated Nationals and Blocked Persons List (SDN List), prohibiting U.S. persons or institutions from transacting with them. The action was part of the U.S. government's crackdown on the Russian darknet market Hydra. On the same day, German law enforcement shut down Hydra and confiscated 543 bitcoins (worth about $25 million at the time).

(Source: https://ofac.treasury.gov/recent-actions/20220405)

2. Linked to illegal funds

Even under sanctions from the United States and Estonia, Garantex continues to operate and is linked to the funding of hackers, ransomware gangs, and criminal organizations.

On June 13, 2023, Cointelegraph reported that the North Korean hacker group Lazarus Group, believed to be behind the theft of Atomic Wallet (loss of up to $35 million), transferred part of the funds to Garantex in exchange for BTC.

On July 25, 2024, TRM Labs released a report stating that in 2023, Garantex accounted for 82% of the international sanctioned entity's crypto trading volume, far higher than other sanctioned platforms.

On February 12, 2025, it was reported that the U.S. Treasury Department OFAC, the UK FCDO and the Australian DFAT jointly sanctioned the Russian Bulletproof Hosting (BPH) service provider Zservers, accusing it of providing critical infrastructure support to the ransomware gang LockBit. On-chain data shows that Zservers participated in at least $5.2 million in crypto transactions, some of which flowed to Garantex and KYC-free exchanges.

3. Stablecoins are frozen

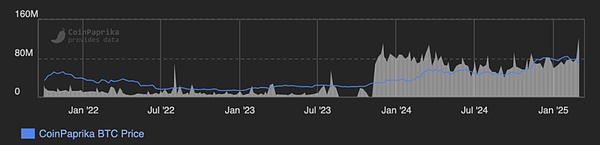

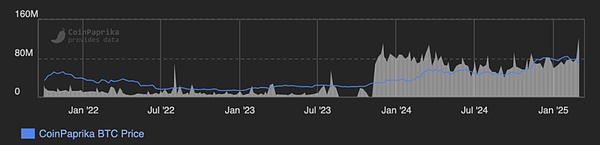

It is worth noting that Garantex's user base and transaction volume did not drop significantly due to sanctions, and even increased at one point. According to CoinPaprika, Garantex's daily trading volume has soared since 2022, and its trading volume has surged by more than 1,000% in the past three years, from about $11 million in daily trading volume on March 1, 2022 to $121.6 million on March 1, 2025.

(Source: CoinPaprika)

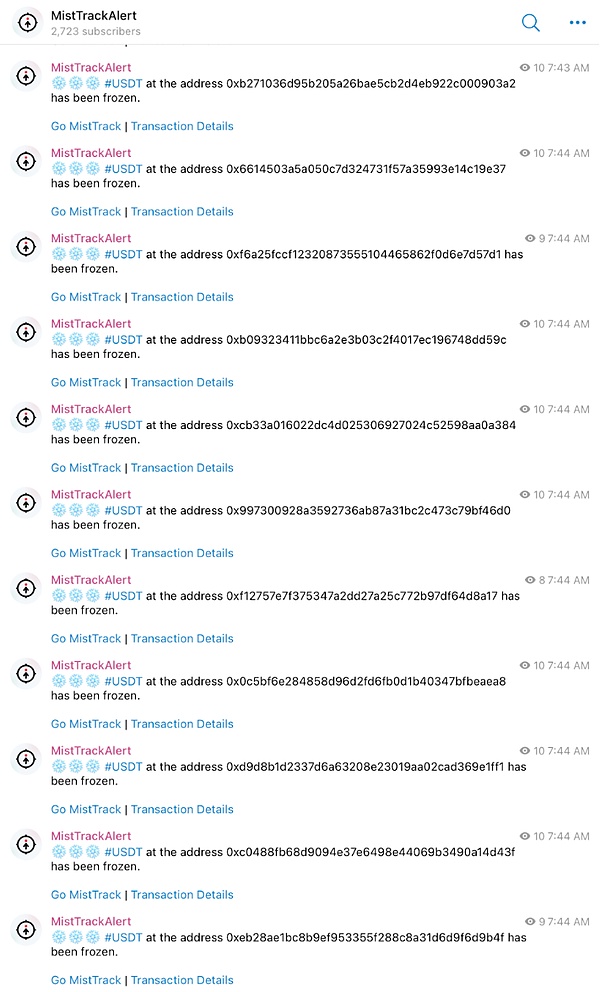

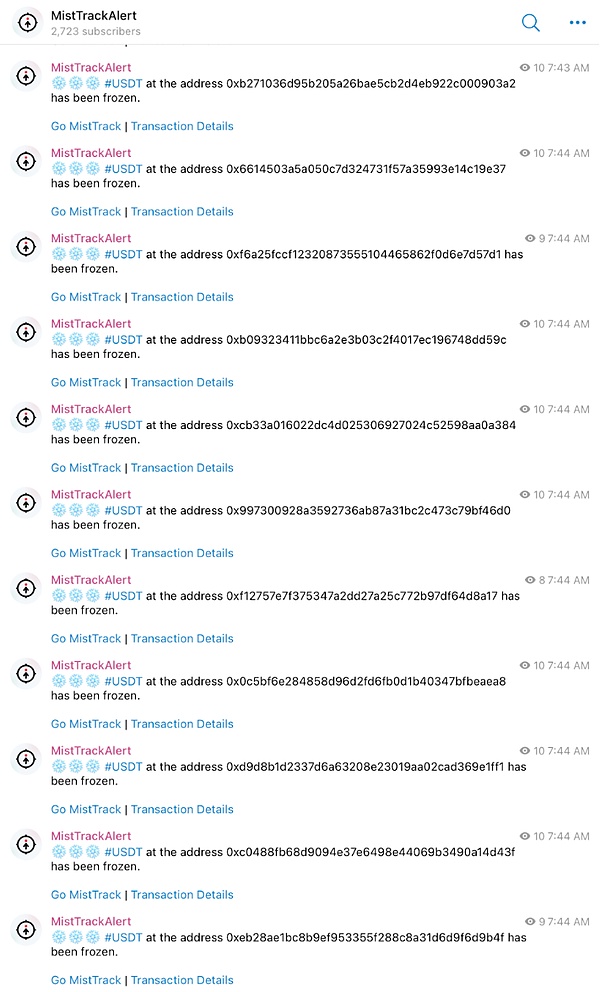

However, with the escalation of supervision, the intensity of sanctions has been further intensified. On March 6, 2025, the stablecoin issuer Tether froze about $28 million in USDT, involving multiple Garantex-related wallets. Garantex was forced to suspend all transactions and withdrawals, and issued an announcement on its official website, warning Russian users that their USDT assets were at risk. This action followed the 16th round of sanctions against Russia issued by the European Union on February 26. Garantex was directly included in the sanctions list due to its close relationship with sanctioned Russian banks.

(Source: https://t.me/misttrack_alert)

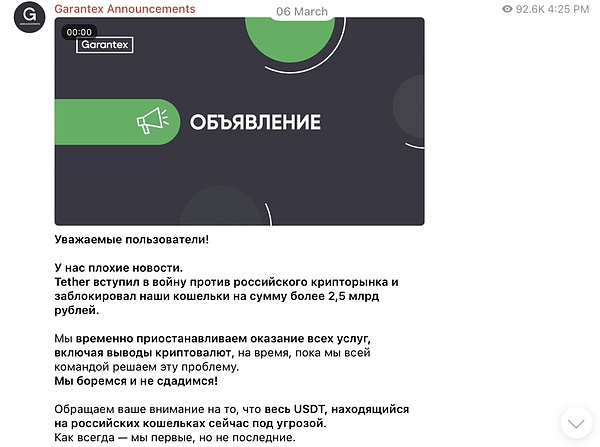

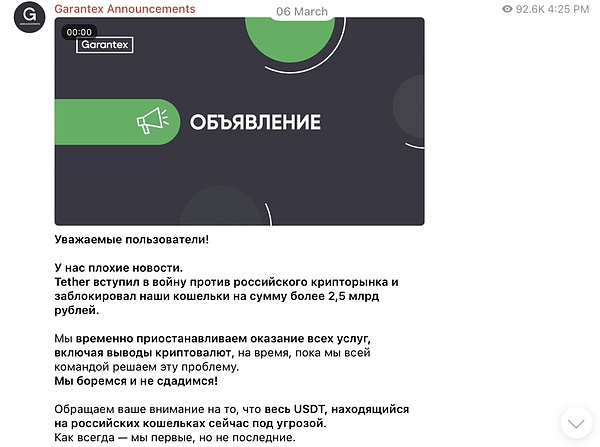

Garantex officially responded that it "will continue to fight."

(Source: Garantex Telegram)

How does Garantex manage its hot wallet after being sanctioned?

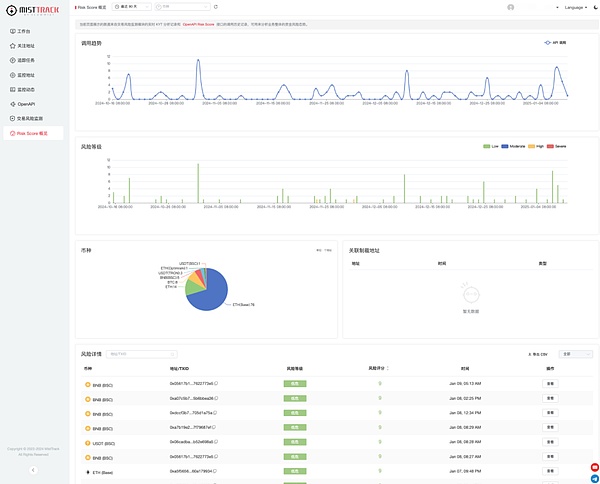

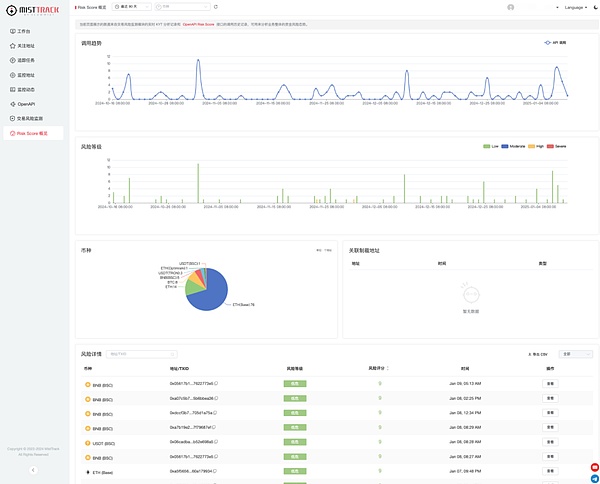

According to the address label data analysis of MistTrack, an anti-money laundering tracking and analysis system under SlowMist, after being sanctioned by OFAC in April 2022, Garantex took a series of measures to maintain operations. The most critical part of this is to continuously adjust the platform's hot wallet fund management strategy. The main change history is:

From April 2022 to December 2022, Garantex The platform changes its hot wallet approximately once a quarter;

During December 2022 - February 2023, the Garantex platform changes its hot wallet approximately once a week;

From February 2023 to date, the Garantex platform changes its hot wallet approximately every two days.

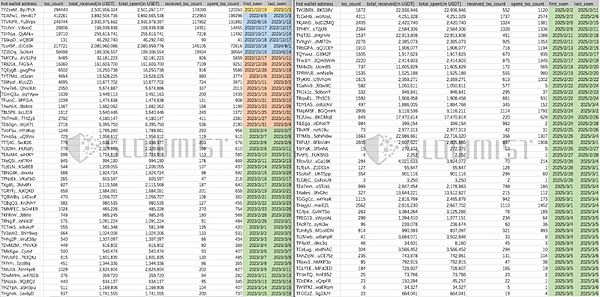

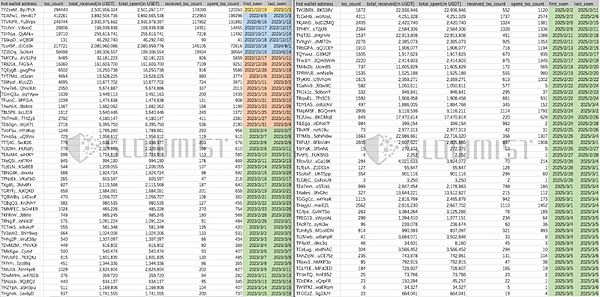

MistTrack, the anti-money laundering tracking and analysis system under SlowMist, has accumulated more than 1 million Garantex-related wallet addresses. The internally developed label data mining system will continuously identify and mark the features of Garantex's constantly changing hot wallet addresses. The statistical analysis of some hot wallet addresses is as follows:

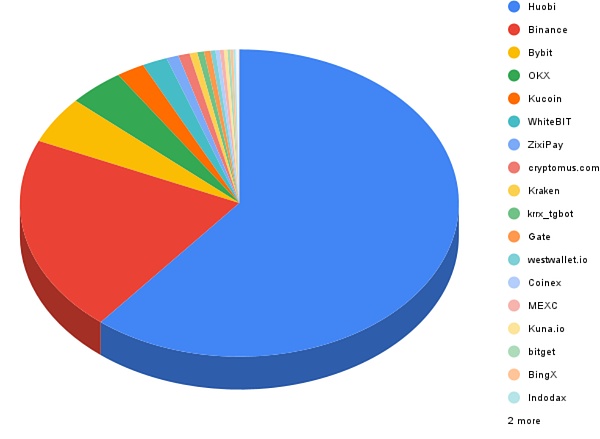

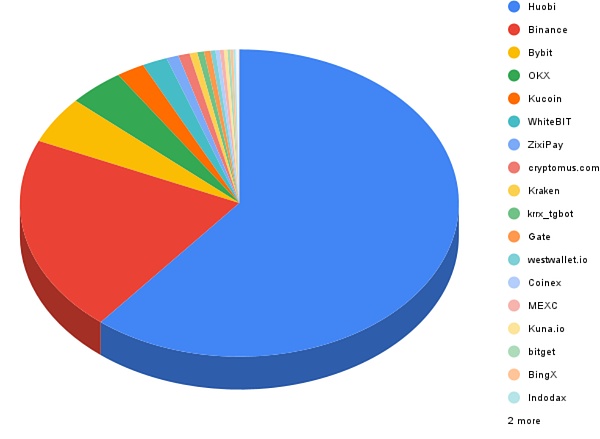

Further analysis of the counterparty addresses of the Garantex hot wallet addresses found that in addition to withdrawing USDT to non-custodial wallets (such as Ledger, MetaMask), users of the Garantex platform also withdrew USDT directly from Garantex to other exchanges, as shown in the following figure (sampled data, not necessarily completely consistent with the facts, for reference only):

How to deal with the freezing of stablecoins

According to MistTrack data statistics, Tether frozen in 2024 The amount of USDT is 540,195,442 US dollars, and the amount of USDC frozen by Circle is 13,359,597 US dollars. For exchanges, institutions, and individuals, how to reduce the risk of stablecoins being frozen and ensure the safety of funds under the compliance framework is an important challenge currently faced.

(Source: https://dune.com/misttrack/2024)

Regulators and stablecoin issuers mainly rely on on-chain data analysis tools to identify and track wallets suspected of illegal activities. If the transaction address is related to sanctioned entities or black market funds, even unintentional contact may lead to the freezing of account funds. KYT (Know Your Transaction) can analyze transaction behaviors and identify suspicious fund flows in real time, thereby reducing the risk of fund freezes due to misoperation or compliance issues.

Based on years of blockchain security research and risk control practices, SlowMist's anti-money laundering tracking and analysis system MistTrack has provided stable and reliable on-chain risk control support and powerful AML compliance solutions for many exchanges and companies, and provides accurate data analysis, real-time risk monitoring and comprehensive compliance support for individual users, corporate teams and developers. MistTrack can detect the source of funds and screen whether the funds come from sanctioned wallets or high-risk addresses to avoid receiving contaminated funds; it can also perform real-time risk control and conduct address review before transactions to avoid dealing with sanctioned addresses or suspicious funds and reduce the possibility of being frozen. MistTrack currently covers 17 public chains, including: Bitcoin, Ethereum, BNB Smart Chain, TRON, Polygon, IoTeX, Avalanche-C, Arbitrum One, OP Mainnet, Base, zkSync Era, Merlin Chain, Toncoin, Litecoin, Dogecoin, Bitcoin Cash and Solana.

From the sanction of Garantex in 2022 to the freezing of USDT by Tether in 2025, we can see the long-term impact of compliance risks on exchanges, institutions and individuals. With the tightening of the regulatory environment, KYT has become an indispensable compliance tool for the crypto industry. If necessary, please contact us to obtain a customized KYT solution to ensure the security of capital flow, avoid asset freezing, and continue to develop under the framework of legality and compliance!

Catherine

Catherine