Deng Tong, Jinse Finance

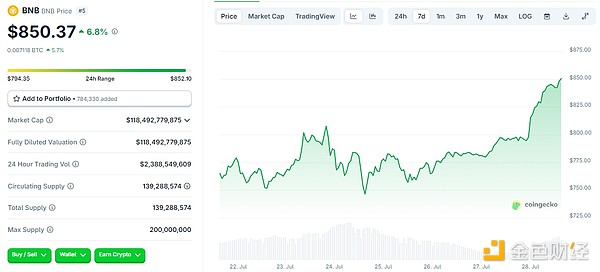

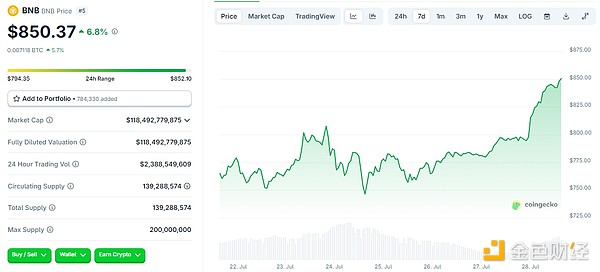

On July 28, 2025, BNB broke through $850 and was reported at $850.37 as of press time, with a daily increase of 6.8%. Since BNB broke through $700 on July 11, the price of BNB has soared. Just 12 days later, BNB broke through $800. The recent rise has made BNB's market value exceed $115 billion, making it the fourth largest cryptocurrency by market value.

What makes BNB rise again and again? How much can it rise in the future? Is a bubble in the reserve of encrypted treasury forming?

1. What makes BNB keep rising?

1. Binance Finance announces the launch of RWUSD

On July 28, 2025, according to the official announcement, Binance Finance announced the launch of RWUSD, a principal-guaranteed financial product that provides users with tokenized U.S. debt-grade returns on real-world assets (RWA). Users can get up to 4.2% annualized yield by subscribing to RWUSD. Users can use designated stablecoins (users in eligible regions can use USDT or USDC) to subscribe to RWUSD. After subscribing, users will receive the same amount of RWUSD in the spot account at a 1:1 ratio, and RWUSD does not charge a subscription fee. When redeeming, regardless of whether it was originally subscribed with USDC or USDT, RWUSD will be exchanged for USDC at a 1:1 ratio. Users can choose fast redemption or standard redemption, and corresponding fees will be charged when redeeming.

But it is worth noting that before this news was released, BNB had already shown a remarkable rise. This sharp rise before the positive announcement inevitably makes people suspect that there is information leakage in the market in advance, and some investors are rushing to buy in advance.

2. Many companies use BNB as a treasury reserve

CZ once responded on the social platform whether BNB will be included in the treasury reserve: There are more than 30 teams that want to launch BNB treasury-related listed companies.

In the current wave of cryptocurrency treasury reserves, mainstream cryptocurrencies such as BTC, ETH, and BNB have been included in the category of cryptocurrency treasury reserve assets. Recently, many companies have announced that BNB will be used as a company treasury reserve asset. This directly boosted the long-term confidence of the crypto market in BNB and quickly raised the price of BNB in the short term.

On July 25, Nasdaq-listed biotechnology company Windtree Therapeutics (WINT) announced that it had signed a common stock purchase agreement of up to $500 million to establish an equity line of credit (ELOC). In addition, the company also signed an additional stock purchase agreement worth $20 million with Build and Build Corp.

The total financing scale is up to $520 million, of which 99% of the funds will be used to purchase BNB. The company plans to officially start the capital mobilization after obtaining shareholder approval to increase the number of authorized common shares.

On July 22, Nano Labs Ltd, a US-listed company, announced that its BNB holdings have been significantly increased to 120,000 pieces, with a current total value of approximately $90 million.

Recently, Nano Labs purchased 45,684.9862 BNBs through over-the-counter transactions (OTC), with an average purchase price of approximately $764 per piece. As of now, the company holds a total of about 120,000 BNBs, with an average purchase cost of $707 per coin and a current market value of about $90 million.

On July 16, Nasdaq-listed Windtree Therapeutics (WINT) announced a $60 million securities purchase agreement with Build and Build Corp, and is expected to receive up to $140 million in additional funds in the future, with a total subscription amount of up to $200 million. The financing will be mainly used to launch the Binance Ecological Token (BNB) asset reserve strategy.

On June 23, Bloomberg reported that three former Coral Capital Holdings executives, Patrick Horsman, Joshua Kruger and Johnathan Pasch, are advancing a $100 million fundraising plan to acquire and hold BNB tokens through a Nasdaq-listed company they control.

Sources revealed that the company will be renamed Build & Build Corporation after the fundraising is completed, and will officially begin to build a company treasury with BNB as the core.

3. On-chain technical indicators

Kronos Research analyst Dominick John pointed out that BNB has risen 12% in the past seven days, due to the total locked value (TVL), stablecoin market value and decentralized cryptocurrency exchange PancakeSwap trading volumeon-chain indicators all climbing to 2025 historical highs.

The Maxwell upgrade launched on June 30 also helps the network run better by increasing block speed and better collaboration between validators. After this upgrade, the BNB Chain network block time was shortened to 0.75 seconds, and the final confirmation time of transactions was accelerated to 1.875 seconds, significantly improving network performance and user experience.

4. BNB Destruction Mechanism

The deflationary mechanism of BNB token economics remains an important reason for its price increase.Binance's ongoing token destruction program has gradually reduced the circulation of BNB, benefiting long-term investors.

On July 10, the BNB Foundation announced the completion of the 32nd quarterly destruction, destroying a total of 1,595,599.78 BNB, worth approximately US$1.024 billion. This includes 1,595,470.69 BNBs actually destroyed and 129.10 BNBs planned to be destroyed by Pioneer Burn. After this destruction, the total supply of BNB remains at 139,289,513.94 BNBs, and the destroyed tokens have been sent to the black hole address.

Komodo Platform CTO Kadan Stadelmann said these destructions are very important: "The token destruction plan will reduce the supply and try to drive the price of BNB up."

Second, how high can BNB rise?

The daily chart shows that BNB has formed a complete cup-and-handle pattern. The bottom of the cup-and-handle pattern is at $504 and the top is at $793. This pattern, coupled with a depth measurement of 37%, suggests that BNB's target price could be $1,090, about 32% higher than the current price.

Key technical indicators strongly support the bullish argument. The Average Directional Index (ADX) has risen to 47, which means strong upward momentum; the Relative Strength Index (RSI) has reached the overbought area of 84. Both the 50-day and 200-day exponential moving averages offer support, which makes the technical environment favorable for continued upward momentum.

However, investors should be cautious as the RSI indicator is overbought, which may mean that the price must go through a short period of consolidation before the next leg up. The previous resistance level of $793 has now become support, while the 50-day moving average currently provides dynamic support around $720, two important levels to watch.

III. Extension: Is there a bubble in the crypto treasury reserves?

As mentioned above, one of the reasons for BNB's recent rise is that many companies use BNB as a treasury reserve. This move not only boosted BNB's trend, but also benefited the financial status of these issuing companies.

However, once a business case has a group effect, it will easily form a bubble. The current trend of crypto treasury reserves may learn from the initial coin financing trend of that year. In 2017, countless new projects issued tokens on Ethereum, and the price of Ethereum rose by leaps and bounds, and the prices of various emerging altcoins soared and plummeted; in 2025, companies often announced crypto treasury reserve plans, and the prices of popular cryptocurrencies such as BTC, ETH, and BNB continued to reach new highs, and the company's stock prices soared accordingly.

Unlike the initial coin offering in 2017, many of the crypto treasury reserve waves involved in this wave are traditional companies. This is also an attempt by traditional finance to transform into the crypto field, and the compliance is much higher than the initial coin financing. But there is also a bubble crisis that cannot be ignored.

1. Historical similarities

On July 14, 2025, BTC broke through the historical high of $120,000, and ETH also broke through the $3,000 mark and is heading towards a high of $4,000.

The Bitcoin mining difficulty index fell 18% year-on-year in Q2 2025, while computing power increased by only 5%, reflecting the weakening of network security margins; although the Ethereum DeFi protocol locked volume (TVL) reached $127 billion, the actual number of users only increased by 3%, and most of the trading volume came from market maker arbitrage.

Be Water’s July 2025 analysis found that today’s bitcoin treasury firms and 1920s investment trusts “reveal a recurring speculative pathology” — a “blueprint for reflexive bubbles” that transcend eras and asset classes.

In mid-1929, when Goldman Sachs Trading was founded, it was called “the micro-strategy of its time,” with investors paying “two or three times” the value of the underlying assets. Yale economist Irving Fisher asserted on the eve of the 1929 crash that stocks would be at “permanent highs.” Today’s bitcoin bulls are touting higher targets, a claim similar to that of the day.

Fisher’s statement was made in defense of the trusts of the 1920s as a market support. This is exactly the same as Thaler’s current advocacy of Bitcoin Treasury as a superior investment vehicle. In the 1920s, American trusts were popular for selling speculative bonds with warrants attached, similar to Thaler’s practice of selling convertible bonds and stock options. This created an “endless supply of speculative securities” to meet insatiable demand.

2. Risk of stock crash

According to a July 2025 survey, more than half of this year’s BTC Treasury company stocks are trading at least 50% lower than their year-to-date highs. (The median decline relative to the peak is about -52%).

Wall Street analysts warn that stocks that have risen 10 or even 20 times may also collapse quickly. It is very easy for traders to watch Bitcoin Treasury company stock prices “fall” in panic, but no institutional buyers or bankers support them.

Extreme premiums bring huge risks: If the price of Bitcoin or investor sentiment reverses, the collapse of these stocks may be more severe than the decline of Bitcoin itself.

3. Investors are paying for the future

Investors are paying for the promise of future gains in Bitcoin, but this can only continue if market sentiment remains hot. If the sentiment in the crypto market changes and the prices of various cryptocurrencies no longer convince investors to continue to enter the market, then the crypto market may be at risk of collapse.

When some very small companies get the opportunity to soar in stock prices because they hoard cryptocurrencies, it means that the market is already overheated. Investors are generally blindly optimistic about the future prospects of these companies. Whether the value of these companies' stocks is supported by real industries has long been ignored. In fact, there are hidden risks under the hot hype.

The crypto market bubble brought about by the trend of crypto treasury enterprises is forming. Before the bubble bursts, the market will continue to revel, but when the music stops, we can see whether this new trend is a brand new financial revolution or a short-lived capital game.

Weatherly

Weatherly