Author: THEDEFIINVESTOR, DeFi researcher Translation: Shan Oppa, Golden Finance

Will the cryptocurrency market rise or fall in February?

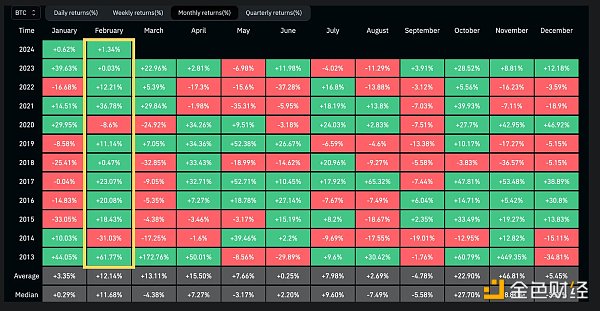

Interestingly, from a historical perspective, February has been one of the best months for Bitcoin throughout history. There were only two months in February when Bitcoin fell.

For ETH the situation is even better, as ETH has only 1 been in February in its history Downward.

But at the same time, Bitcoin has never closed higher for 6 consecutive months, and in the past 5 months, Bitcoin has Part of the time, it is in a state of only rising but not falling.

But regardless of Bitcoin’s upcoming price action, this month promises to be another month of opportunity for narrative and news traders.

The following are several major events expected to happen in February:

1. Hong Kong The first spot BTC ETF

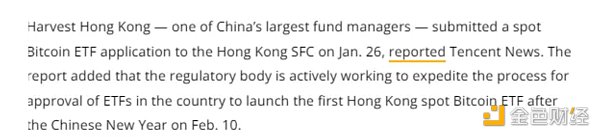

A few weeks ago, Harvest Global Investments, a large Chinese asset management company, applied for the first spot ETF in Hong Kong. BTC ETF.

Venture Smart Financial Holdings another financial giant has set the first quarter of 2024 as the year to launch BTC ETF Target.

In addition, Hong Kong regulators confirmed in December that they are considering accepting applications for spot Bitcoin ETFs.

Harvest Global Investments seems to be aiming to launch Hong Kong’s first spot Bitcoin ETF after February 10.

p>

It sounds too good to be true, but maybe Hong Kong will approve a spot BTC ETF this month.

In addition, just in case, Venture Smart Financial Holdings revealed that they plan to launch a spot ETH ETF in Hong Kong in the second quarter.

The launch of spot Bitcoin ETF in the United States has undoubtedly been a huge success, with total net flows despite significant selling pressure from Grayscale The volume still exceeds US$1.5 billion.

Hong Kong’s spot Bitcoin ETF may also attract significant funds.

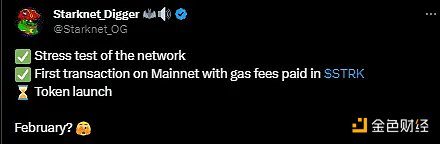

2.Starknet releases tokens

Starknet is one of the key projects in the Ethereum L2 field One, it is also one of the earliest ZK-Rollup Layer 2 networks built on Ethereum.

While there is no official confirmation, many people familiar with the Starknet ecosystem expect the STRK token to go live in February.

The project team has confirmed that they took a snapshot of the token distribution more than 60 days ago, so the token release should not be too far away.

Why is this important?

Every time a major L2 project announces the launch of its token, its ecosystem usually looks at it from then until after the token generation event to a surge in activity and TVL. For example, in the case of Arbitrum, its TVL increased by $500 million within a week of confirmation of the ARB token launch.

The prices of many Arbitrum ecosystem tokens also surged when the ARB token was first launched, and then gradually sold off after the ARB token generation event. (Because the token launch turned out to be a "sell-the-news" event.)

The same may happen with the Starknet ecosystem tokens in the coming weeks , so this is something to keep in mind especially if you trade narrative.

3.EigenLayer Deposits reopen

The largest re-pledge agreement Eigenlayer Deposits will be open again.

They removed LST 's individual cap of 200,000 ETH but now allocates it to any liquidity staking token or liquidity re- The re-staking points for pledged tokens are capped at 33% of the total future issuance.

Personally, I am participating in the EigenLayer airdrop with a relatively large percentage of my ETH holdings because I think it is One of the best profit opportunities for ETH right now.

I will be posting a topic soon about some of the reset strategies I use to maximize ETH yield + airdrop allocations.

But, in short, I'm using 4 liquidity re-staking protocols to gain EigenLayer airdrops:

Kelp DAO - Each rsETH minted using Kelp is currently rewarded with 100k Kelp points for a limited time (use my link , when you use Kelp to re-stake ETH , you can get a 10% point increase).

Eigenpie - 2 Month 12 A few days ago, Eigenpie points increased 2 fold (no recommendation reward, but if you use me I would be very grateful for the link)

EtherFi - Use EtherFi, you can get more for every 1 ETH staken ETH ;20 EigenLayer points (use my referral link to get 1k more EtherFi points for every 1 ETH you re-stake)

Renzo - Before 2 month 11 , every time you stake 1 ETH you will get 200 ezPoint points reward (+ via me The link can get a 10% point reward)

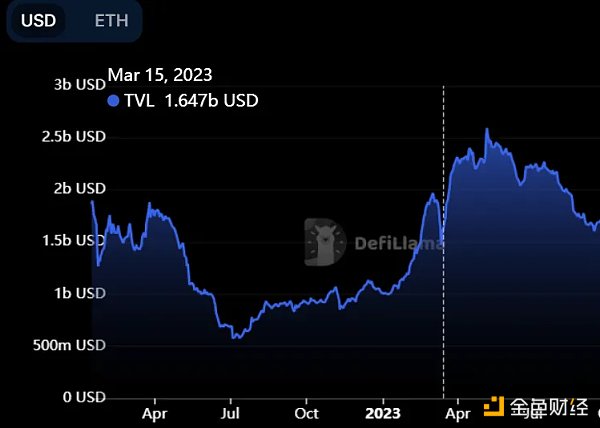

EigenLayer TVL is currently worth US$2.1 billion.

It's growing so fast this year, and with so many ecosystem airdrops being announced every week, I don't expect the hype around it to go away anytime soon.

p>

Next, the final testnet of EigenLayer Stage 2 is scheduled to be released on February 7.

Phase 2 will allow re-stakers to finally start delegating their ETH to operators running active verification services.

Here's a great overview of phase EigenLayer Phase 2 :

< img src="https://img.jinse.cn/7177188_watermarknone.png" alt="Bitcoin">

3.Frax Finance launches L2

Frax Finance is a DeFi product ecosystem built on Ethereum. Its most popular products include the stable currency $FRAX and the liquid pledge token frxETH.

The team has been working on Frax’s own L2 blockchain, which currently appears to be just days away from launch (estimated date is February 7).

Fraxtal (Frax's L2 product name) is not just a simple fork of Optimism, it will bring some interesting innovations:

Gas token flexibility: Fraxtal will use both frxETH and FRAX as Gas tokens.

Blockspace Incentives: Users, applications and developers who use the network will be rewarded with veFXS (the staking version of FXS) .

BAMM: The novel function of lending AMM (developed by the Frax team) will be launched on Fraxtal within 1-2 months Released, allowing users to leverage any token without the need for an oracle.

Curve Finance and Ra (the DEX created by the Ramses Exchange team) have been confirmed to be deployed on Fraxtal.

The Frax Finance founder also made a bold prediction, predicting that Fraxtal will attract hundreds of millions of dollars in the first month.

Whether this will happen remains to be seen. We don’t know many details about Fraxtal yet, but more information will likely be shared on launch day.

4. Ethereum Dencun upgrade: the final test network is opened

The highly anticipated Ethereum The final test network of Dencun upgrade will be launched on February 7th. If the test goes well, the upgrade is expected to be launched on the mainnet in March or April.

Dencun upgrade has attracted much attention mainly because it introduces "proto-danksharding" technology. proto-danksharding is expected to significantly reduce L2’s transaction fees by reducing the “rent” L2 pays to inherit Ethereum’s security.

L2 networks have developed rapidly in the past two years. If Dencun can live up to the community’s expectations, it could attract a large number of new users to the Ethereum L2 network as it would make them more affordable.

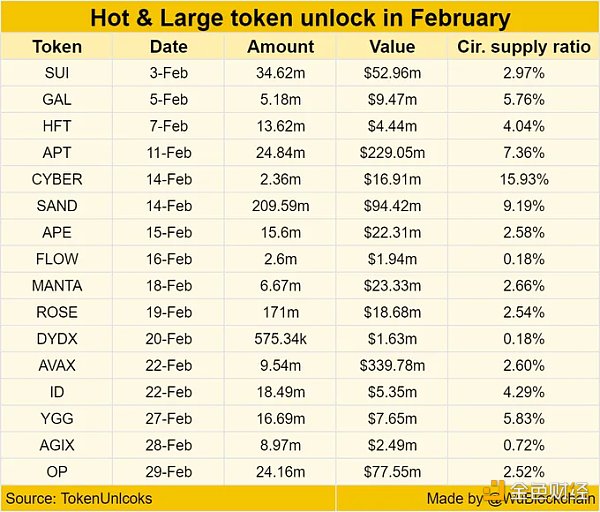

5. Major token unlocking

At the beginning of the new month, another wave of tokens is about to Unlocked.

Wu Blockchain made a great table listing the largest coins expected to be unlocked in February. Two in particular caught my attention:

In addition, $330 million worth of AVAX tokens will be unlocked on February 22. However, while this may seem large in terms of dollar value, $330 million in AVAX only represents 2.6% of its circulating supply.

6. Other noteworthy events

If you want to know what other major events will happen in the cryptocurrency space this month, Check out the cryptocurrency calendar below.

I personally think there are several key dates worthy of attention:

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Weiliang

Weiliang Miyuki

Miyuki