Author: Willy Woo Source: X, @woonomic Translation: Shan Ouba, Golden Finance

The only significant liquidation risk: convertible debt

1. If the holder ofconvertible debt Without converting into shares before maturity, MSTR would have to sell Bitcoin to repay debt holders.

2. This may happen if:

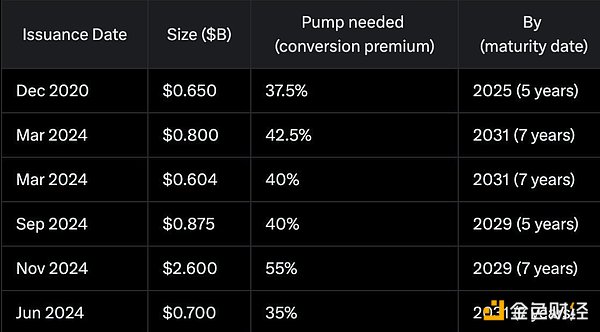

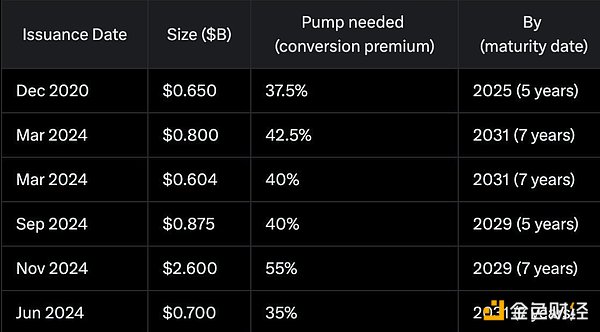

• MSTR’s stock price is Has not risen more than ~40% in 5-7 years (depending on the bond, see table below).

In other words, liquidation risk will only arise if: the correlation between MSTR stock price and Bitcoin breaks down. Or the price of Bitcoin itself falls seriously.

< /p>

< /p>

Other risks (to varying degrees)

Competition Risks:If other companies follow MSTR's strategy, it could dilute MSTR's premium (relative to net asset value, NAV).

SEC Intervention Risk: If the SEC intervenes in future Bitcoin purchases, it could reduce MSTR's NAV premium.

Custody risk: MSTR’s Bitcoin assets are hosted in Fidelity and Coinbase, and there are certain custody security risks.

U.S. government nationalization risk: The U.S. government may take action to confiscate these Bitcoin assets.

Saylor Key Person Risk: The irreplaceability of MSTR founder Michael Saylor could lead to increased uncertainty for the company.

MSTR Operational Risks: Various potential problems with the day-to-day operations of MSTR itself.

Other risks that may be missed?

Final Notes

Convertible Debt The table is for reference only. The data comes from Grok AI processing. There may be some errors. It only shows the general pattern. Details regarding MSTR’s Bitcoin custody arrangements have not yet been fully disclosed. For example, MSTR may adopt a multi-sig arrangement and retain co-signing rights. This is a smart way to manage your custody assets.

MSTU/MSTX = higher risk

These are Paper leveraged bets based on MSTR trigger liquidation levels almost immediately (and are not backed by real Bitcoin assets).

Derivatives positions dilute the value of Bitcoin.

PS: Holding derivatives positions for a long time cannot achieve 2x returns because of the impact of volatility effects (the cost of losses is higher than income).

Catherine

Catherine

< /p>

< /p>