This article is reprinted from Nervos Blog, author: @radicalizedpleb, @matt_bitcoin. English original:

https://www.nervos.org/knowledge-base/web5-extra-decentralized

Twitter founder Jack Dorsey set out to build TBD[1] - a new Internet identity and trust layer, one of his first attempts in the cryptocurrency field, designed to run entirely on a peer-to-peer architecture and integrate with existing Web2 services.

Many people think TBD sounds a lot like the Web3 decentralized identity service ENS[2], but Dorsey doesn't think so. As a staunch Bitcoin believer (a term that has now become synonymous with cryptocurrency skeptics), he felt the need to distinguish himself from the mainstream and ensure that TBD would never be seen as another Web3 project.

Specifically, Dorsey realized that Web3 — a vision of a decentralized Internet built on open protocols and blockchains, with identity, financial, and social layers — was not the system he was after.

He recognized that the reality of Web3 was fundamentally at odds with his vision: it was incompatible with the existing infrastructure of the Internet and was designed to completely replace it.

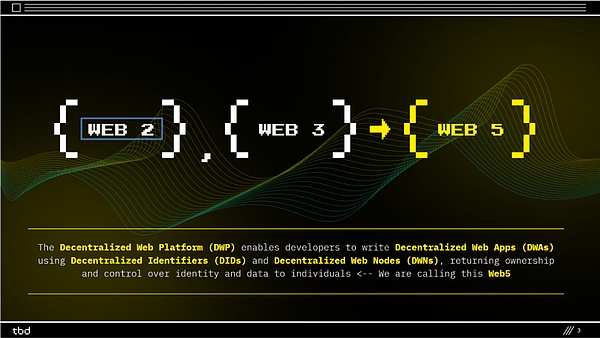

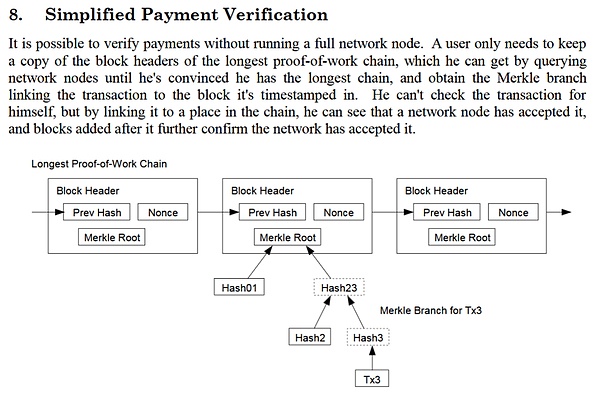

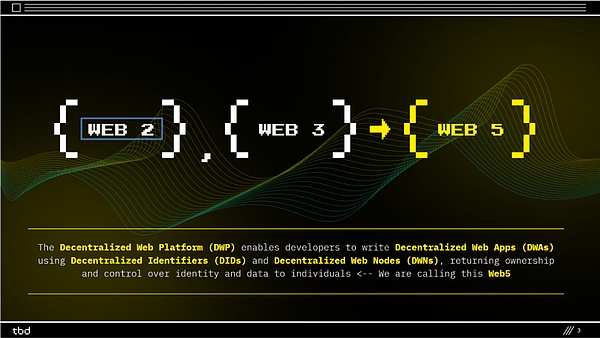

Figure: Definition of Web5 (Source: TBD PPT[3])

Because TBD’s core goal is to be “decentralized” and uncompromising, Dorsey chose to build this system on Bitcoin. In his view, this alone is enough to make TBD "not Web3", so it is necessary to create a new term for this type of system. To this end, Dorsey half-jokingly proposed the term "Web5", which is both a mockery of Web3 and a tribute to HTML5[4]. HTML5 is the foundation of today's Internet and the last major technological attempt to drive the evolution of the Internet 15 years ago.

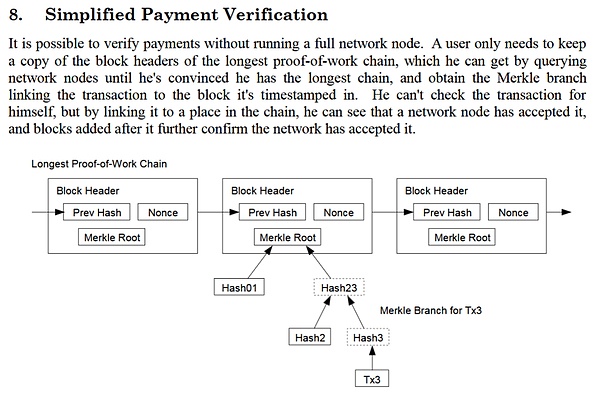

From TBD's white paper[5], Dorsey sees Web5 as a peer-to-peer network with Bitcoin as the underlying consensus layer and the Lightning Network as the payment network. It revolves around three pillars: 1) self-owned decentralized identifiers, 2) verifiable credentials, and 3) decentralized network nodes for storing data and forwarding messages.

"On the web today, identity and personal data have become third-party property. Web5 will bring decentralized identity and data storage to your applications. It allows developers to focus on building great user experiences while returning ownership of data and identity to individuals." TBD's official website reads.

Combining the Twitter documents[6] (a series of internal documents that reveal how Twitter was forced to censor sensitive content) with TBD's goals, we have reason to believe that Dorsey essentially wants to build "free technology."

His vision for this technology is typified by Nostr[7] - an open, decentralized, censorship-resistant messaging protocol designed to address the content moderation and censorship issues of current centralized social media platforms.

For starters, Nostr works similarly to a blockchain: each user generates a private key (which needs to be kept secret) and uses their public key as an identity. All messages (called "notes") are cryptographically signed by their creator and can be verified by others.

Nostr does not rely on a single platform to store user data, but instead uses independently operated servers (called "relays") to store and forward messages according to simple, open rules. Because users can choose any relay or build their own nodes, no central authority can effectively censor or delete content. The protocol itself is extremely simple, defining only the message format, signature, and publishing methods, and developers can build additional features on top of it, such as private messaging, image support, etc.

After witnessing how centralized social media companies operate, Dorsey became obsessed with another vision: giving control of network applications back to users from companies and easily manipulated nodes. His interest in and support for Nostr suggests that we have an opportunity to move beyond the “server ownership” of Web2, which has disturbingly permeated Web3.

Now, while it’s impossible to know whether Dorsey was being sarcastic when he coined the term “Web5,” it’s certainly true that he was on to something. While TBD never released a product and has ceased operations[8], Dorsey’s insights into Web3’s shortcomings were accurate and prescient.

However, his vision for Web5 doesn’t have to be limited to Bitcoin and the Lightning Network[9].

In our view, Web5 is much more than its component parts, and is much more than just a “peer-to-peer network” dedicated to Bitcoin consensus or a framework built around decentralized identifiers. Going further, Web5 is not a semantic "rebranding" or a sensational marketing strategy, but a substantive shift of the Internet industry back to its roots. Web5 in our eyes is a mesh structure composed of peer-to-peer networks, connecting various PoW (proof of work) and UTXO consensus layers, channel networks, and other systems that have not yet been conceived. More abstractly, Web5 is a thriving decentralized application (dApp) ecosystem built on this peer-to-peer mesh structure.

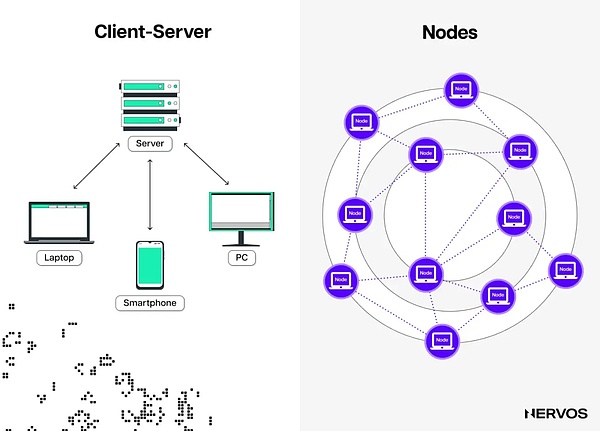

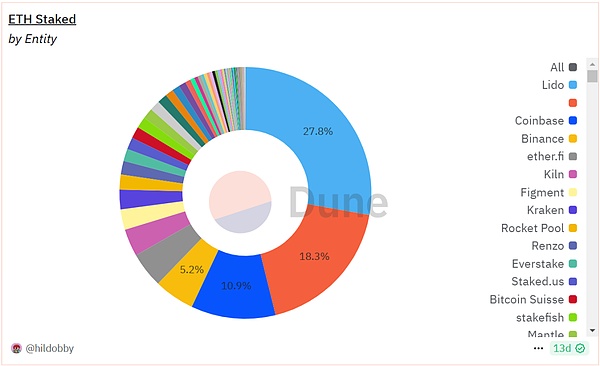

Decentralized network and peer-to-peer network topology (Source: CKB Eco Fund[10])

The underlying architecture is the core difference between Web5 and Web3.

Web5 is built on a truly decentralized, peer-to-peer topology network, which is a direct result of the adoption of PoW consensus and UTXO model. It does not regard blockchain technology as the only core, but rather envisions a series of open Internet protocols, enhanced by the latest cryptographic primitives, to jointly drive the Internet into a new era.

In contrast, Web3 has failed to deliver on its promise of decentralization, censorship resistance, permissionlessness, and self-custody of data and assets. The root cause lies in the flaws of its underlying architecture, especially the decision to choose PoS (Proof of Stake) and Account models.

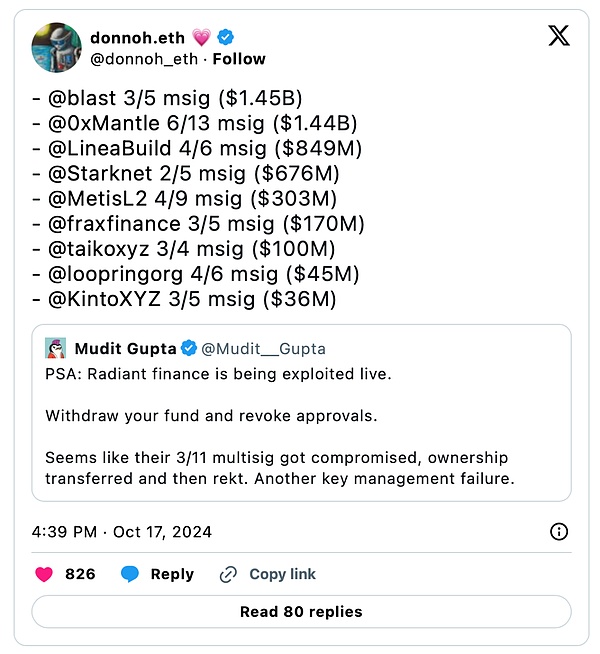

The Current State of Web3

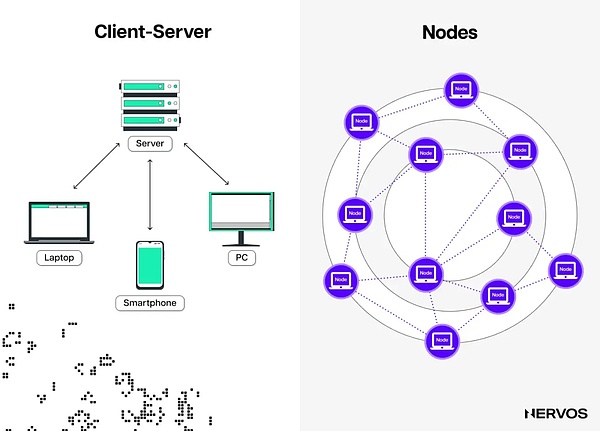

Today's Web3 is a collection of countless "nominal decentralized" networks. Since the rise of MetaMask[11] and Infura[12] in 2017, these networks have quickly moved to a "client-server[13]" topology.

Despite the arduous research and engineering efforts, we concluded that this outcome is an inevitable product of the PoS and Account models built on top.

While we respect the principled efforts of many to fight this trend, we do not believe that the flaws of the client-server topology can be fixed. Before we delve into the reasons, let us first examine the current state of Web3.

In February 2009, Satoshi Nakamoto wrote in a post[14]: "The fundamental problem with traditional currencies is all the trust required for them to work."

Looking at Ethereum today, "trust" seems to be increasing. Although staking pool operators and block builders are not strictly trusted third parties (TTPs), they have clearly become increasingly important and privileged roles.

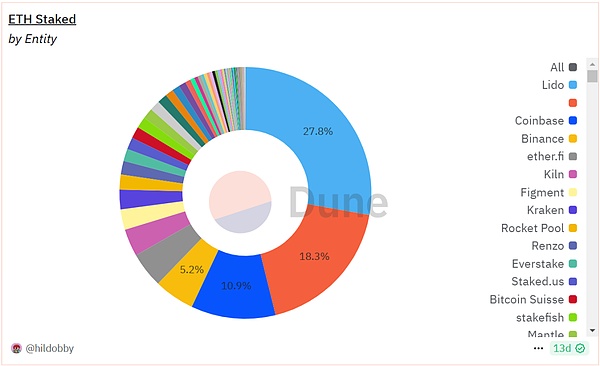

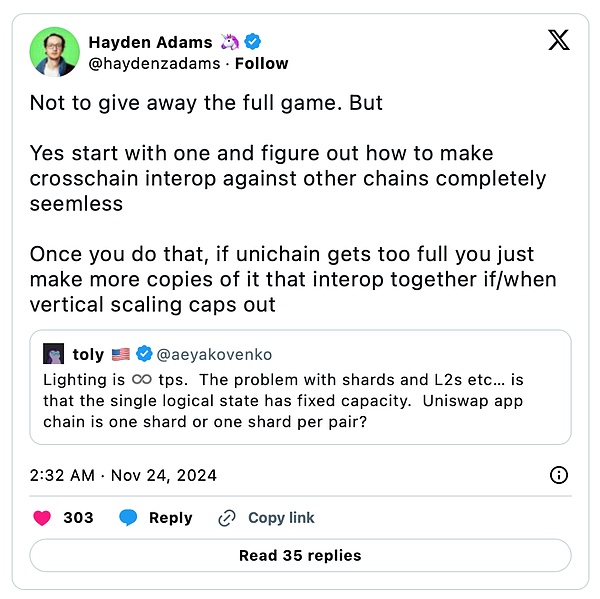

Percentage of ETH staked by each entity (Source: dune.com)

Liquidity staking protocol Lido[15] controls about 28% of total ETH staked, and Coinbase[16] controls about 11%, raising concerns about the concentration of governance and validation power in a few industry giants. Beaverbuild[17] and Titan Builder[18] produce about 89%[19] of Ethereum's blocks, further exacerbating concerns about censorship resistance and control of maximum extractable value (MEV[20]).

In addition, although the Ethereum base layer is "decentralized enough" in many indicators, especially compared to most Web3 projects, the horizontal expansion path chosen by its community has spawned systems that clearly rely on trust assumptions.

These systems rely on centralized infrastructure providers that act as "servers", and users become "clients" that rely on these servers to obtain network functions and access rights. This architecture is no different from traditional Web2, and deviates from the decentralization goal that Web3 originally pursued.

Take Rollup[21] as an example. The reliance on a centralized sorter creates a serious bottleneck. In the best case, a single entity completely controls transaction ordering and packaging, and users have to trust that it behaves honestly - which runs counter to the "trustless" purpose of cryptocurrency. In the worst case, the entity can completely stop the operation of the chain, such as the Ethereum Layer 2 project Linea, which suspended the sorter this year due to an attack on a decentralized exchange in the ecosystem[22].

To make matters worse, Linea is not an exception. Almost all Ethereum Rollups are centralized, and their operators can censor transactions or stop the operation of the chain indefinitely. If a chain can be suspended at will, then what is the point? Traditional centralized databases obviously perform better, so why run a chain?

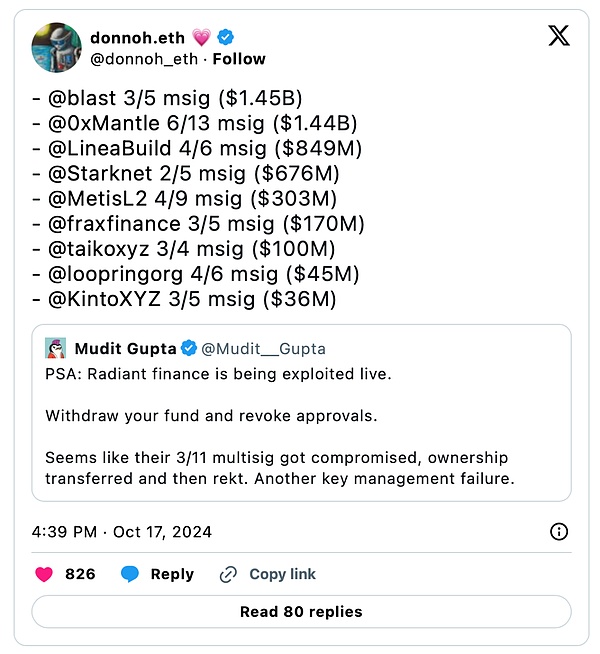

Even if we ignore these risks and naively assume that the trusted third parties of the current Web3 infrastructure are trustworthy, we still cannot avoid the fact that, as Nick Szabo pointed out many years ago, these third parties are essentially security vulnerabilities[23], and countless security incidents have repeatedly confirmed this.

For example, in July 2023, the cross-chain protocol Multichain lost more than $125 million due to suspected insider embezzlement. The root cause of the vulnerability[24] was that its CEO Zhao Jun controlled most of the platform's multi-party computing (MPC) keys, and he was arrested by the police. A year ago, a similar situation occurred with Axie Infinity's Ronin Bridge, where the North Korean hacker group Lazarus stole more than $600 million in user funds by controlling the private keys of 5/9 validators[25].

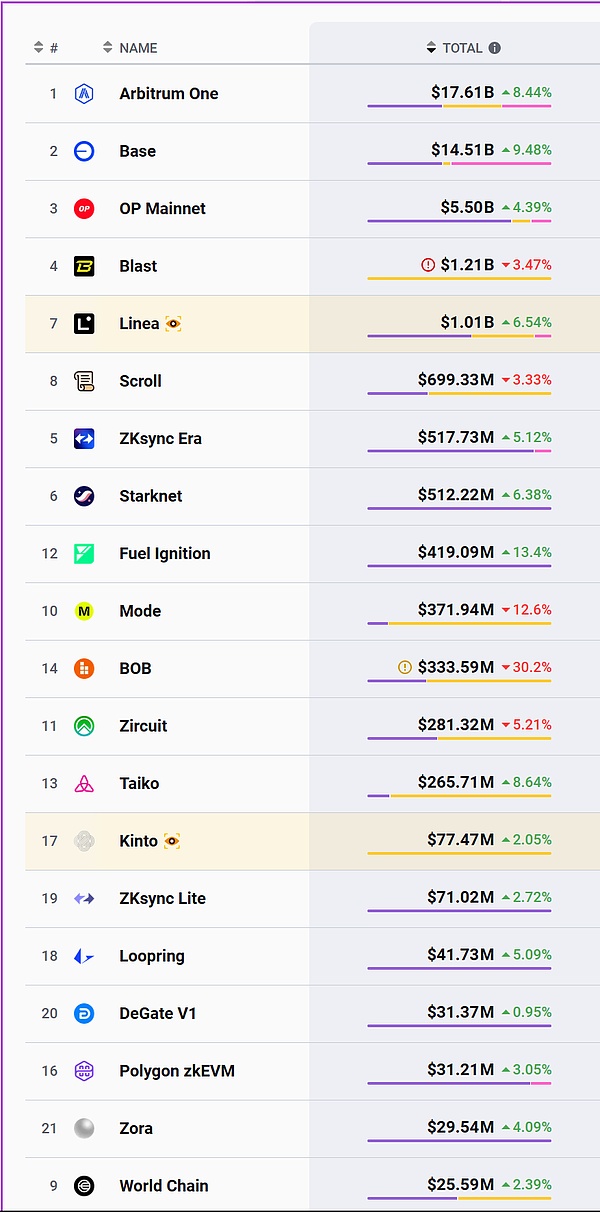

In addition to trust and security issues, horizontal expansion (i.e., offloading transaction execution through sidechains) also leads to serious liquidity fragmentation and infrastructure cost issues. There are currently dozens of Ethereum Layer 2s, most of which have become ghost chains due to their inability to attract sufficient liquidity.

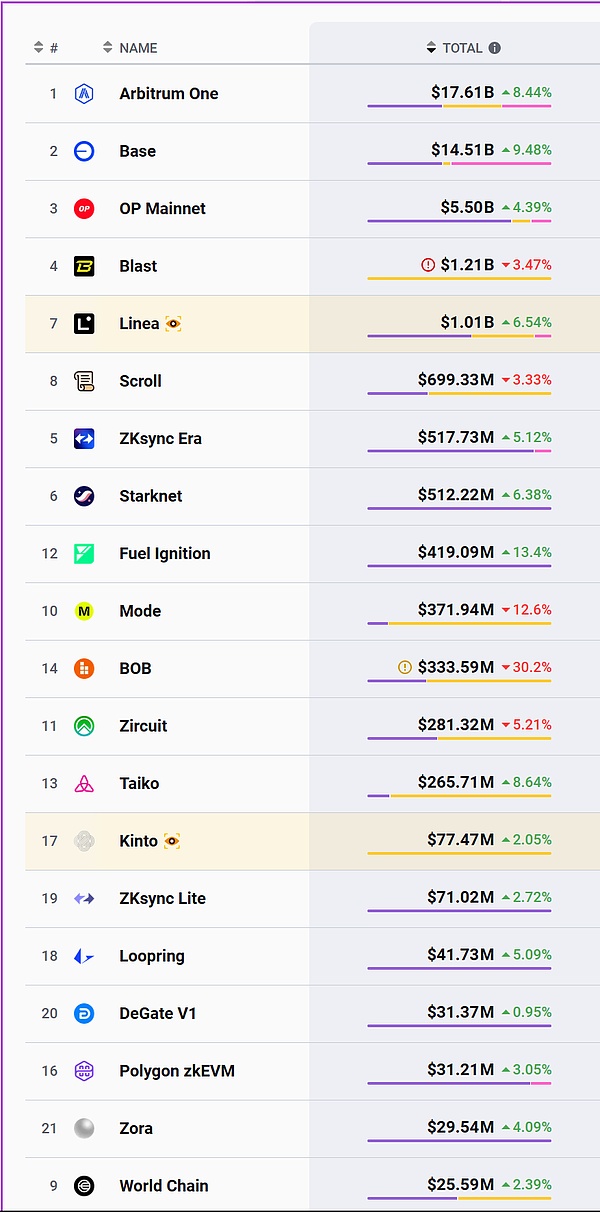

The total TVL of the top two Layer 2 projects, Arbitrum and Base ($32.12 billion), exceeds the total TVL of the remaining 18 Layer 2 projects ($11.43 billion). (Source: L2Beat.com)

Liquidity attracts traders, trading volume generates liquidity, and the combination of the two attracts dApp developers. Liquidity fragmentation has trapped Layer 2 in a network effect dilemma: the chain that first breaks the critical mass continues to grow, while the rest gradually wither, eventually leading to the concentration of liquidity and user activity in a few winners.

Although these systems are called Rollups, they are still blockchains with scarce block space. This means that successful Layer 2s will still suffer from the same scalability and fee volatility issues as the underlying chain, which in turn leads to the need for Layer 3 with more complex security assumptions.

Increasing the number of chains means higher infrastructure costs - after all, someone needs to maintain all the Rollups. Even after Ethereum’s EIP-4844[26] upgrade introduced data blocks (blobs) and reduced Layer 1 data availability (DA) costs by 100x, the average monthly cost of running a Rollup[27] is still as high as $10,000-16,000 (assuming 2 million transactions per month). Under the same assumptions, Layer 1 costs alone are $25,000, while alternative DA layers such as Celestia[28] or EigenDA[29] are orders of magnitude cheaper. Unfortunately, for many Layer 2s, the fees paid by users are not enough to cover infrastructure costs, meaning that “server” operators have to bear the costs themselves. This financial burden raises the barrier to entry for new participants, giving well-funded entities an advantage and further exacerbating centralization.

In contrast, PoW+UTXO chains achieve scalability through vertical expansion (adding payment channels or state channels on top of the base layer). Verification is kept cheap and accessible, and users can run full or light node clients on ordinary hardware, ensuring broad participation in the network. With UTXO managing state, users only need to verify transactions relevant to them, without relying on centralized middlemen.

Protocols such as the Lightning Network, Ark[30], and RGB++[31] are examples of this path. Users can directly establish payment channels, and their security is anchored in the PoW consensus of the base layer. There is no need for cross-chain bridges and no centralized sorter that can become a point of failure, which maintains the peer-to-peer topology of the network and ensures true decentralization and censorship resistance.

How did Web3 get here?

To understand why we are building Web5, we need to first understand where Web3 went wrong. The best way to do this is to examine the design choices made throughout Ethereum’s history.

First, we must clarify that we have no prejudice against Ethereum (or any other chain). Instead, we are simply using it as an example to analyze the flaws of the PoS+Account model.

In this category, Ethereum is the most decentralized chain in terms of technology, philosophy, and community, and is the birthplace and main building platform for the Web3 narrative. It is obviously unfair to criticize Web3 by using other chains as examples. In addition, we believe that the Ethereum community’s efforts to achieve the goals of Web3 are sincere, and its failures are due to decisions made ten years ago.

Ethereum’s First Mistake

Ethereum’s first mistake came from its initial attempt to turn the blockchain into a “world computer”. In this post[32], we explain in depth why this is a fundamentally bad idea, so here we’ll just give the conclusion: blockchains are for verification, not computation.

When Bitcoin developer Gregory Maxwell pointed this out more than nine years ago[33], Vitalik Buterin vehemently refuted it[34].

Looking at the current state of Ethereum, it seems that the “everything on chain” argument has been abandoned. Any and all attempts to scale the world computer are via “scaling on another chain”, the more commonly known Rollup-centric roadmap[35].

In other words, the Ethereum community has abandoned its original vision and turned to a more technically conservative “modular blockchain” path. Today, the base layer is used for verification and final settlement, while the adjacent chain or Layer 2 is responsible for transaction processing.

Ethereum’s Second Mistake

However, this shift failed to establish a peer-to-peer network, rooted in Ethereum’s second architectural mistake: abandoning Bitcoin’s UTXO model and adopting an Account model.

At the time, Vitalik put forward two arguments[36] to justify this shift: 1) “UTXO is complex in theory and even more complex in implementation”; 2) “UTXO is stateless and difficult to support complex applications that require state management (such as various smart contracts)”.

While these arguments may have been valid at the time and considered important innovations, the industry has come a long way since then. Statefulness — maintaining and updating the “state” of a blockchain, or the collection of all current data, balances, and conditions resulting from past transactions — is necessary for computation, but the Account model is not the only way to achieve statefulness.

In 2017, Cardano introduced the extended UTXO (eUTXO[37]) model; in 2019, Nervos proposed the Cell model[38] — a stateful generalized UTXO model; and more recently, BitVM developers have even implemented stateful computation on Bitcoin via Taproot.

In retrospect, choosing the Account model over the UTXO model seems to have been a short-term decision: it made it easier for developers to build dApps quickly, but it sacrificed many of the inherent advantages of the UTXO model.

Of particular importance is how the UTXO model achieves true ownership of assets and data - this happens to be the core goal jointly declared by Web3 and Web5.

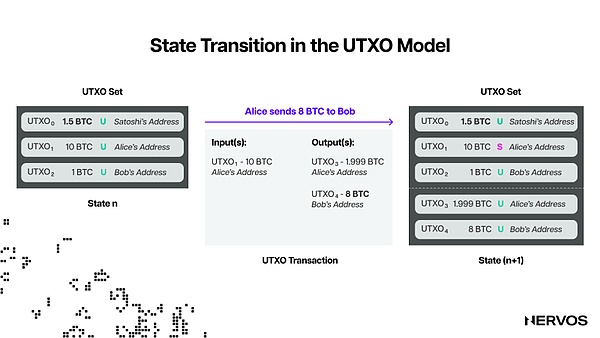

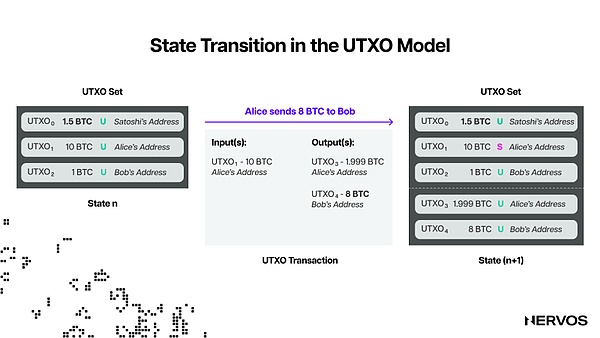

The UTXO model does not have accounts in the traditional sense, but tracks asset ownership and transfers through addresses and unspent transaction outputs (UTXO).

UTXO is a unit of cryptocurrency that has been received but not yet spent, and is associated with an address that specifies who can spend them. In this model, users manage the funds corresponding to UTXO through private keys. The sum of these UTXOs is the user's available funds, and there is no need for traditional accounts throughout the process.

In contrast, in the Account model, accounts are divided into external accounts (EOA, which are controlled by private keys and can initiate transactions) and contract accounts (CA, i.e. smart contracts, which cannot actively initiate transactions and are composed of code and data). The problem is that in the Account model, all non-native assets (tokens other than ETH in Ethereum) are managed by CA. This means that non-native assets are second-class citizens in this model. The token balance shown in the user's wallet does not represent actual ownership, and these tokens are managed by the CA controlled by the EOA that created them. Real cases best illustrate the seriousness of this problem. Brian Pellegrino, co-founder and CEO of LayerZero[39], recently pointed out in a tweet[40] that there is a serious vulnerability in the token contract of the cross-chain interoperability protocol Across[41]: a function in the token contract allows the contract owner to transfer tokens in any wallet at any time. In short, the Across team can steal tokens from any user who holds these tokens.

What's worse is that such cases are not isolated cases. Many token contracts contain similar functions, allowing contract owners to issue or destroy tokens at will, or to censor or confiscate user assets.

Centralized stablecoin issuers have such functions built in by default (as a necessary compliance measure), allowing them to confiscate tokens suspected of being illegally obtained (such as through vulnerabilities or theft).

In the UTXO model, all assets are directly controlled by the user's private key and are first-class citizens. Taking Nervos CKB, which adopts the stateful UTXO model, as an example, the token contract only defines the token logic (such as "total supply of 1 million" or "50 tokens issued per block"), while the asset data that records the user's balance (such as "Alice holds 100 tokens") is stored in the cell directly controlled by the user (which can be regarded as a stateful UTXO). This means that even if the token contract is attacked, hackers cannot steal user assets.

Ethereum’s Third Mistake

Ethereum’s third mistake was to abandon PoW in favor of PoS. Reasons cited for this decision[42] included “PoS has significant advantages in security, reduced centralization risk, and energy efficiency” and “higher security at the same cost”. But for many readers, it is now obvious that PoS cannot replace PoW. If you still have doubts, you can refer to “Why We Follow Satoshi Nakamoto[43]” or “Why the World Needs Miners[44]”.

In addition, time has provided evidence to refute these arguments. Last year, Vitalik himself wrote a long article[45] warning about the inherent centralization risks of PoS. The following excerpt summarizes its core point: "One of the biggest risks of Ethereum L1 is that PoS will become centralized due to economic pressure. If there are economies of scale in participating in the core PoS mechanism, large stakers will naturally dominate the network, and small stakers will exit and join the large pool. This will lead to an increase in the risk of crises such as 51% attacks and transaction censorship. In addition to the risk of centralization, there is also the risk of value extraction: a minority group may seize the value that should belong to Ethereum users." Although Vitalik proposed several Ethereum-specific solutions in the article, we believe that this will not help. Centralized power and reliance on trusted third parties are the natural attributes of PoS+Account blockchains. In addition, the adoption of PoS consensus and the Account model will trigger a series of chain reactions, which will eventually form a client-server topology for these networks, which is closer to a fully centralized Web2 system rather than the ideal form of Web3.

Therefore, the only way to achieve true decentralization, censorship resistance, permissionless, and self-custody of data assets (the goal of Web3) is to build a peer-to-peer network based on the PoW+UTXO system (Web5). To understand this, we need to deeply analyze the core differences between PoS+Account blockchains and PoW+UTXO blockchains.

PoS+Account vs. PoW+UTXO

There are significant differences between PoS+Account systems and PoW+UTXO systems, and the secondary effects of their implementation are even more far-reaching. Some seemingly minor design choices can ultimately lead to completely different chain forms.

We will verify the following assumptions through several dimensions: Chains that choose the PoS or Account model can never form a flat, true peer-to-peer network.

State Difference

The first dimension that supports our assumption is the difference in state assumptions between PoW+UTXO and PoS+Account chains.

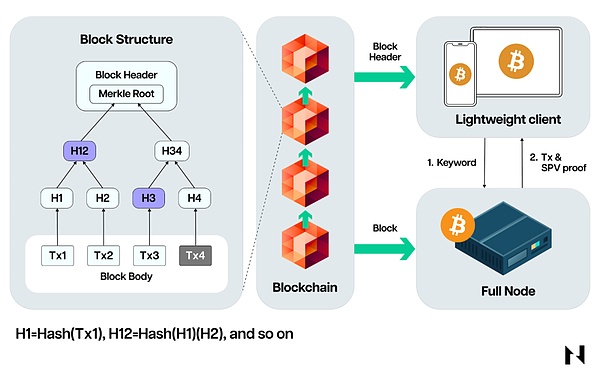

For example, in a UTXO-based system, transactions are stateful and contain two parts: input and output. Each transaction clearly specifies which UTXOs are consumed and which new UTXOs are generated, that is, it carries all the state information required to update the ledger. But the on-chain environment is inherently stateless, and transactions can only affect the UTXOs they directly reference, and cannot modify other parts of the ledger. In contrast, in an Account-based system, transactions are stateless - they only contain operational instructions (i.e., the desired actions or method calls) without explicitly stating the current state of the associated accounts. The on-chain environment is stateful, and any transaction can modify the state of any account or contract. For example, a smart contract can interact with multiple accounts and change various state variables, resulting in a highly interconnected system state. In a UTXO-based system, transactions created by users explicitly specify the ledger changes; in an Account-based system, users rely on blockchain nodes to compute these changes.

In terms of consensus mechanism, PoS consensus is stateful. Verifying consensus requires access to on-chain data, especially the current set of validators, their staking status, and random numbers. Since the set of validators changes dynamically, nodes need to keep track of these states to verify new blocks.

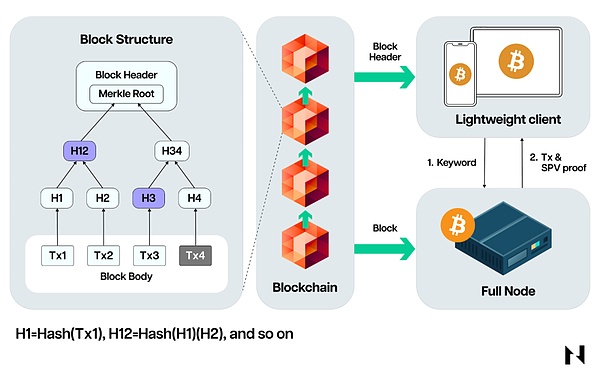

PoW consensus is inherently stateless: nodes only need to verify the proof of work in the block header to confirm the validity of the blockchain, without the need for additional on-chain state information.

These differences in state assumptions mean that in the PoS+Account model, users need to track global state to verify transactions, which requires running a full node.

However, the statefulness of the PoS+ Account model significantly increases the storage and computational burden of full nodes. Nodes need to independently execute all smart contracts to verify transactions, track changes in the validator set and their stakes, and process certifications, proposals, and other data related to block verification. This causes nodes to store and compute additional state information.

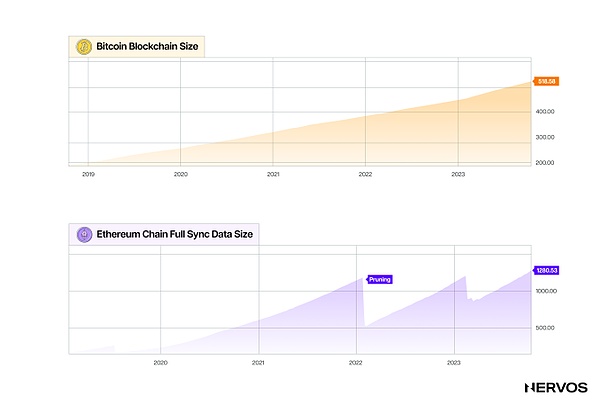

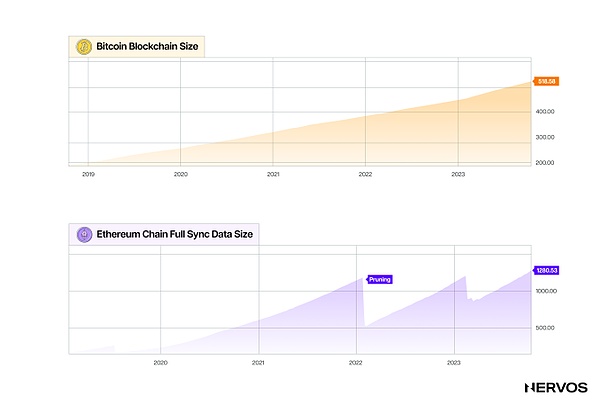

Data comparison can directly reflect the difference: the minimum requirements for running an Ethereum full node are a 2TB solid-state drive, 16GB of memory, and a seventh-generation or higher Intel processor; while running a Bitcoin full node only requires a low-end CPU, 2GB of memory, and at least 15GB of free disk space. In addition, Ethereum is facing a state explosion problem[46] - its state grows 3.5 times faster than Bitcoin, and it is impossible to prune old state data, which means that there is no upper limit to state growth.

Due to the high hardware requirements for running a PoS+Account chain full node, there are very few people who actually run it. At the same time, due to the complexity of the PoS+Account model and the security trade-offs, truly trustless light clients are almost non-existent, and users are forced to rely on centralized RPC services such as Alchemy[48] and Infura[49] to access the blockchain. In other words, the PoS consensus and Account model make it difficult to run full nodes and make trust-minimized light clients infeasible, leaving users with no choice but to read and update status through a few centralized RPCs and APIs. This dependency has given rise to a client-server network topology that is no different from the centralized model of Web2. Therefore, "Web3" reproduces the problems of Web2 that it was intended to solve: lack of security, privacy, and censorship resistance. The RPC providers that serve most Web3 users can censor transactions, as confirmed in the OFAC sanctions on TornadoCash[50].

These RPC providers also collect user data, including blockchain addresses and IP addresses. In addition, since most users rely on these providers for their traffic, if their centralized infrastructure fails or goes offline, the entire user base (especially "mass adopters") will be unable to access the blockchain, such as the service outage caused by Infura in 2018 due to congestion caused by CryptoKitties[51].

In contrast, in the PoW+UTXO system, full nodes, SPV and light clients are easy to implement, and users can verify transactions without relying on trusted third parties. This promotes direct (and therefore more private) blockchain participation and peer-to-peer network topology, achieving true decentralization.

Differentiation of Determinism

Blockchain is essentially a replicated deterministic state machine, which makes it a "single source of truth" recognized by everyone.

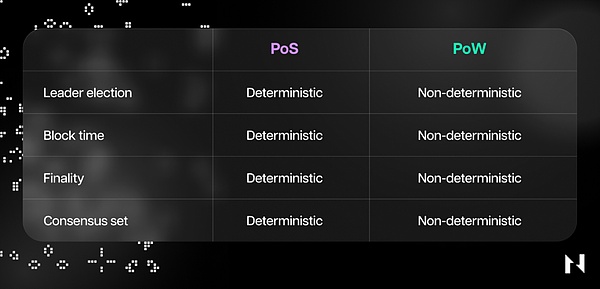

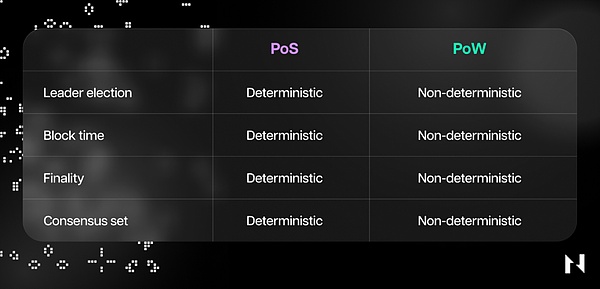

The determinism of PoW+UTXO and PoS+Account systems is different, resulting in differences in network topology, especially in validator election, block time and finality.

In the PoS system, validator election is deterministic - validators take turns to produce blocks according to preset rules. Although this approach improves efficiency, it introduces vulnerabilities: the validator IP address is public, and attackers can launch DDoS attacks against specific validators, causing the network to be paralyzed during the block period. In addition, validators must understand each other and cooperate properly, because the health of the network depends on this. More importantly, deterministic block production puts validators in a favorable position to extract economic rent from users. Specialized companies use resources and income to expand the scale of pledges, continue to obtain block rewards and MEV, and form a positive cycle of "the rich get richer". The centralization of the MEV supply chain and block builders further exacerbates this trend. In the PoW chain, validator election is non-deterministic. Before the block is mined, no one knows who will generate the next block, which promotes the equality of nodes in the peer-to-peer network. The consensus set is also non-deterministic. Miners can join or leave the network freely, and any node can generate blocks. No miner is indispensable to the continuation of the chain. This is not possible in PoS, where the consensus set is deterministic and certain validators must be present to advance the chain.

PoW networks are therefore more robust, with no node in an advantageous position or guaranteed to exploit users for personal gain.

What the Future of Web5 Might Look Like

A network composed of PoW+UTXO chains is still a fantasy to many. Web3 has become an industrial machine that continuously produces new systems to solve problems derived from Ethereum. Although some thinkers are beginning to understand the subtleties of PoW+UTXO, Web3 is still built entirely on the PoS+Account model.

While Jack Dorsey failed to lead the TBD project to the promised land, ironically, the future of Web5 is indeed TBD (to be determined).

Even Satoshi Nakamoto imagined a world of massive blockchains and industrialized nodes/miners. Today's Web3 universe includes these; however, we are always thinking about chains: which RPC does MetaMask point to? Which chain is the asset bridged to? Does the address format comply with the specification? And so on.

In this industry where every technical idea detail seems to have a token and a team, it is a new field to regard blockchain as the true commitment layer of the off-chain system. Fortunately, our vision for Web5 is already underway.

Despite its controversial beginnings (perhaps “rgbp2p” would be a better name), RGB++[52] is leading the Web5 wave by integrating Bitcoin and Nervos CKB in a trustless manner, without the need for cross-chain bridges or questionable security mechanisms. Dogecoin support[53] is in the works, and it is expected to connect to PoW+UTXO chains such as Kaspa[54] and Ergo[55] in the future.

The progress of channel networks is even more exciting. For most of 2024, the Fiber Network[56] project has been working on implementing Lightning Network-compatible channels on CKB and is now moving rapidly towards mainnet. Although the Lightning Network is known for its high difficulty, CKB provides a new computing foundation for testing various improvements to the Lightning Network without requiring consensus changes. The Polycrypt[57] team has been working on the state channel network for nearly seven years and recently released cross-account and UTXO model features, supporting 8 chains, including Ethereum, Polkadot, Dfinity, Cardano, Cosmos, Stellar, Fabric, and CKB. In the wave of BitVM[58] and Bitcoin's revival, with the maturity of Taproot Assets[59], the off-chain revival is also opening. Teams such as Ark[60] and Mercury[61] are exploring new possibilities for Bitcoin's native off-chain computing.

Conclusion

The only way to achieve the true decentralization, censorship-resistant, permissionless, and data asset self-custody that Web3 claims is to build a peer-to-peer topology network. So far, only PoW+UTXO systems are possible.

In the PoW universe, the success rate of blockchains is extremely low. They are more like fleeting shooting stars than convenience stores. These miracles or beautiful accidents are only used for consensus and final settlement, and everyone can participate in the operation. Validation is kept low-cost and easy to access, and users can run full nodes or light clients on ordinary hardware.

Increase throughput through vertical expansion (adding payment channels or state channels at the base layer). State is managed through UTXOs, allowing users to verify only transactions relevant to them without relying on centralized intermediaries.

The road to innovation is always full of uncertainty, and the future of Web5 is no exception. But as Nervos and Nostr client developer Retric said in this article[62]: "This is a vibrant community driven by values such as freedom, decentralization, and open communication. This is more than just technology - it's a movement."

After a decade of observing Web3, we rarely see surprises and are now ready to break free from these shackles. We are ready to embrace uncertainty. I hope you are too.

Catherine

Catherine