Author: Shlok Khemani; Translator: zhouzhou, BlockBeats

Editor's Note: EigenLayer is promoting the development of trusted distributed networks in a similar way to how AWS changed the entrepreneurial economy before. By providing a reliable pool of validators (operators), EigenLayer enables new protocol developers to easily obtain technical services without staking their native tokens. This not only reduces startup costs, but also allows projects to provide security through established assets such as ETH, thereby reducing the need for token issuance. As more innovative projects emerge, EigenLayer may lead the next wave of entrepreneurial trends and inspire more experiments and development.

NFT, DAO, and DeFi have been important primitives that have gradually subverted the financial system. Shared security is another key component in this evolution. EigenLayer has become an important player in the ecosystem, and its tokens will be transferable on September 30.

We see this as Web3’s “AWS moment” - a critical node, similar to the period in the mid-2000s when server costs fell, and the cost of cryptoeconomic security will also fall accordingly. Today’s article will deeply analyze how the Active Verification Service (AVS) works and our logic behind it.

The progress of civilization lies in our ability to complete more important operations without thinking. ——Alfred North Whitehead

At the end of 2002, eight people attended a technology conference held by Amazon at the old Pacific Medical Center headquarters. Although the number of participants was very small, this conference became a turning point in the fate of Amazon, the startup economy, and even the development of capitalism. On this day, Amazon launched the first version of Amazon Web Services (AWS).

Jeff Barr was one of the eight attendees of the AWS conference and joined the AWS team soon after. Today he is the chief evangelist of AWS and often explains the new features of AWS through the Lego blog.

A non-exhaustive list of what it took to start an Internet company in the 1990s and early 2000s: physical servers, network equipment, data storage, software licenses for databases and operating systems, a secure facility to house the hardware, a team of system administrators and network engineers, and a robust disaster recovery and backup solution. All of this would cost at least $250,000 and take months or even a year to set up.

What’s surprising is that these infrastructure expenses have little to do with the company’s unique product or service. Whether you’re building a pet store or a social media platform, you have to go through the same process from scratch. It is estimated that 70% of engineering time is spent on building and maintaining data centers, and only 30% is invested in the actual business.

By introducing cloud computing, AWS fundamentally changed the economics of startups with a flexible, pay-as-you-go model that eliminates the need to invest time, energy, money, and manpower upfront. Transforming infrastructure from a capital investment to an operating expense enabled small teams with revolutionary ideas to quickly launch and validate their hypotheses. Many of these teams eventually grew into companies like Stripe and Airbnb.

Around the same time, an anonymous programmer named Satoshi Nakamoto changed the structure of capitalism in another way. He found a way for globally distributed computers to reach consensus without trusting each other, solving a problem that had plagued computer scientists for decades. This was a breakthrough innovation from zero to one in the history of technology.

While Satoshi Nakamoto's Bitcoin mainly used this trustless distributed system to maintain payment ledgers, Vitalik Buterin founded Ethereum and expanded its capabilities to support any general-purpose computing. Over time, other application scenarios for this system have gradually emerged - from decentralized storage networks like Filecoin to oracle networks like Chainlink, which can securely provide real-world data to blockchains.

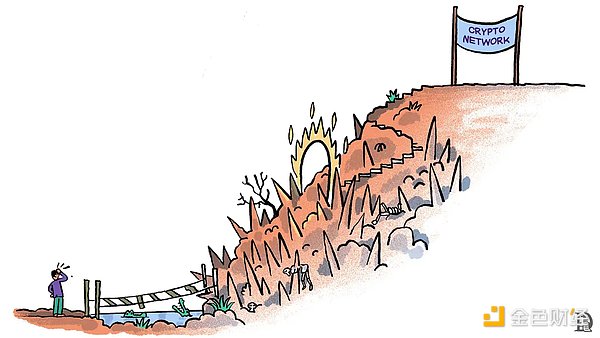

However, the process of building such a decentralized network from scratch is similar to the creation of Internet companies before AWS - costly, resource-intensive, and often unrelated to the core problem of the network. Given that many of these networks involve real money from the beginning, the consequences of any mistakes can be catastrophic.

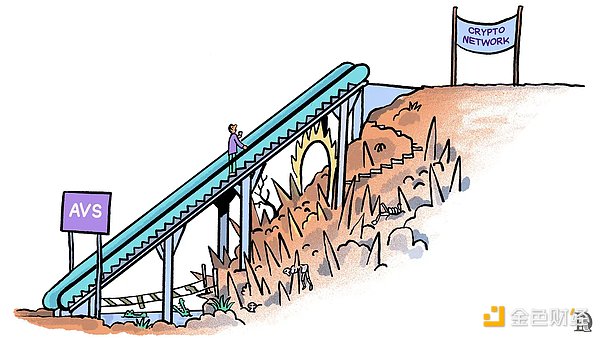

When a problem affects enough people, solutions emerge. Amazon made it easy to start an Internet company, and now the EigenLayer team is providing similar support for those who want to build trusted distributed computer networks. Each network built on EigenLayer is called an "Active Verification Service" (AVS).

Before we dive into AVS, we first need to understand why it is so difficult to start a distributed network.

Challenges

Let’s review the problem: you have a global network of computers, each operating independently, and you need to reach consensus on a common truth among these nodes that don’t trust each other. This truth could be anything—the balance of tokens in an account, the stock price of NVIDIA, the result of a complex calculation, or the availability of a file in the network.

The nodes in these networks may have an incentive to manipulate the truth, for example, falsely reporting a higher token balance than it actually is. However, as long as the majority of the nodes in the network agree on the actual truth, malicious actors are ignored. When the majority of nodes agree on a state that deviates from the truth, the situation becomes dangerous and the network is threatened.

Satoshi Nakamoto cleverly combined concepts from cryptography and game theory to create Bitcoin’s Proof of Work (PoW) system to solve this problem. Today, most networks use a variation of PoW, Proof of Stake (PoS), which contains four key elements:

Cryptography: prevents identity impersonation and ensures the integrity and authenticity of data in the network.

Reward mechanism: real participants (validators) are financially incentivized through transaction fees from users and newly minted tokens in the network.

Punishment mechanism: malicious actors face financial penalties, validators must stake the network's native tokens to participate, and if they act maliciously, the staked tokens may be destroyed (slashed).

The power of distribution: having more validators with a good distribution of stakes makes the network more resilient to attacks.

PoS networks allow ordinary users to delegate their tokens to validators and receive a portion of the validator's rewards. However, this approach also puts users at risk - if the selected validator acts maliciously, the user's stake may be slashed.

On some blockchains (such as ETH and Solana), the protocol allows stakers to exchange native tokens for liquidity tokens (for example, Lido provides stETH tokens to Ethereum stakers), and this derivative asset is called Liquid Staking Tokens (LST).

In this context, imagine that you are a team that wants to build a PoS network from scratch. You first need to find a group of validators - people who have technical expertise and hardware and are willing to join your network. You may find these people on Discord and X (formerly Twitter). However, to attract their attention among many competing projects, you need to either perform well in marketing or be backed by a lot of venture capital.

Once you have their attention, it is not easy to convince them to join your network. Remember that validators either stake their own capital as collateral or need to spend energy to attract others to stake. Since your network is still in its early stages, the value of the token may not be high. Why would a validator risk a token that could plummet at any time, especially if they are already exposed to volatility in other network assets? Your best strategy may be to increase rewards: offer validators (and stakers) higher returns to compensate for the greater risk they take, which explains why nascent networks often have higher annualized stake yields (APYs). The problem is that high issuance is actually an indirect expense to the entire network, potentially diluting the value of the token. Even if you successfully address these challenges, you may still have fewer validators than you would like in the early stages. The scarcity of validators reduces network security and makes it more vulnerable to majority attacks. Beyond that, you need to consider other factors, such as geographic distribution of validators, creating secure and audited client software, and planning infrastructure elements including data availability, transaction ordering, confirmation services, and block proposals, depending on the specifics of your project.

Similar to Internet startups before AWS, these steps are time-consuming and resource-intensive, and they are not directly related to the core problem your network is trying to solve.

Security as a Service

Recently, I explored how the Internet has spawned a new generation of businesses (platforms) that create value by efficiently connecting supply and demand. In the scenario we just discussed, there is a group of validators - the "supply side" who hope to make money by providing technical services while minimizing financial risks. The "demand side" is emerging blockchain protocols that hope to find trusted and reliable validators to protect their network security.

EigenLayer, as a platform, fills this gap, connecting validators (called "operators") with networks seeking their services (called "active verification services" or AVS).

Now, back to the perspective of new protocol developers:

First, EigenLayer provides a group of verified and trusted validators (i.e. "operators") who promise to verify multiple services, including emerging services. This solves your initial problem: how to find reliable validators?

Second, EigenLayer's most important breakthrough is to separate "rewards" from "punishments". Operators do not need to pledge your native tokens to protect your network. EigenLayer requires them to deposit (or attract pledges) existing assets such as ETH and Liquid Staking Tokens (LST). In the event of malicious behavior, these assets will be slashed.

This separation means that stakers and operators avoid the risk of holding additional new tokens, and they can earn additional returns by holding mature assets they already trust. (Saurabh's analysis of "intersubjectivity" explains how EigenLayer improves capital efficiency.)

From a protocol perspective, this model eliminates the need to compensate validators by issuing tokens (which can lead to token inflation). Instead, you benefit from the stronger security guarantees provided by ETH as collateral. In fact, this flexibility even allows you to choose not to issue tokens if you don't want to!

Finally, you can carefully select operator clusters based on the security needs of specific products. Before integrating them into your network, you can weigh the validators' technical capabilities, the size of the assets staked, the geographical location, and their security record in other networks. Compared with the arduous task of building a network from scratch, this selectivity is simply a luxury.

When one security risk is reduced, another risk follows - dependence on EigenLayer itself. However, EigenLayer is not an independent blockchain, but a set of smart contracts deployed on Ethereum. Ethereum has more than 6,000 nodes and $86 billion in funding. Although smart contract risks still exist, Ethereum itself is the safest existence in the blockchain.

You may ask: What is the "reward"? How does the economic model built on EigenLayer work?

The protocol can reward operators and delegators with any ERC-20 token. In practice, this leaves AVS with two options:

Distribute rewards in established tokens such as ETH or stablecoins. In this case, the relationship between operators and AVS is transactional - operators provide services and AVS pays them in widely accepted currencies. EigenDA, the first AVS, launched operator rewards by distributing ETH to operators and delegators.

Distribute rewards in their own tokens. This approach is closer to the economic model of traditional crypto networks, and while this model gives AVS the flexibility to pay for security through token issuance (rather than directly using the cost of ETH/stablecoins), they also have to convince operators that their tokens will maintain their value. Failing to do this, it will be difficult to attract operators, as they are likely to sell AVS tokens as soon as they receive them.

Initially, 10% of AVS rewards will be distributed to operators and the rest to stakers, but this parameter will become flexible in the future. Additionally, to “enhance incentive alignment,” EigenLayer plans to distribute rewards equal to 4% of the initial $EIGEN supply to encourage delegators and operators to participate in the network.

EigenLayer’s strong value proposition has attracted a variety of projects seeking to deploy as an AVS. The list includes some common projects — such as rolling chains, data availability services, bridges, oracle networks, and sorting layers that require operator services.

However, given that operators can theoretically support any type of computation (not limited to state transitions), we have also witnessed many innovative and experimental projects leveraging EigenLayer for development. These projects include decentralized physical infrastructure (DePin) networks, AI inference engines, zero-knowledge proof coprocessors, privacy-oriented protocols (including TEE, FHE, MPC), zkTLS networks, and even policy engines for smart contracts.

The Great Liberator

Earlier, I made a relatively bold statement that AWS had changed the nature of capitalism. Before AWS, high capital requirements to start a company meant that founders either self-funded or received investment from outside sources (friends, family, venture capital). This financial barrier effectively excluded a large portion of the global population from Internet entrepreneurship, making it an activity exclusive to the wealthy or privileged.

By dismantling these restrictions, AWS not only simplified the process for existing entrepreneurs—a relatively small group—but also unleashed the creativity and imagination of many who had previously considered entrepreneurship beyond their reach, and this democratization spawned a wave of entrepreneurial experimentation. While many projects failed, the ones that succeeded drove unprecedented increases in economic productivity and human convenience.

From the perspective of the individual entrepreneur, cloud computing opened up a range of options—from trying to build the next billion-dollar business, to making millions of dollars a year as a solo developer like Pieter Levels, or anything in between.

We are excited about EigenLayer and AVS because they unlock similar opportunities for trustless distributed networks. Do you have an idea that requires multiple computers to run without trusting each other? Now you can quickly implement it with AVS.

From governance chains to zkTLS networks, we are witnessing many experiments that may not have been feasible before. As more entrepreneurs realize the significant reduction in human and financial capital required to build such systems, we expect more experiments to emerge.

Most will fail.

But there will always be a few that will guide the future direction of this industry.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance decrypt

decrypt Future

Future Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph