Author: Lawyer Liu Honglin

What happened to FTX's collapse?

Some friends may still be confused about the "FTX collapse". Don't worry, I will briefly sort out the background first. Old friends who are familiar with the incident can jump directly to the next paragraph.

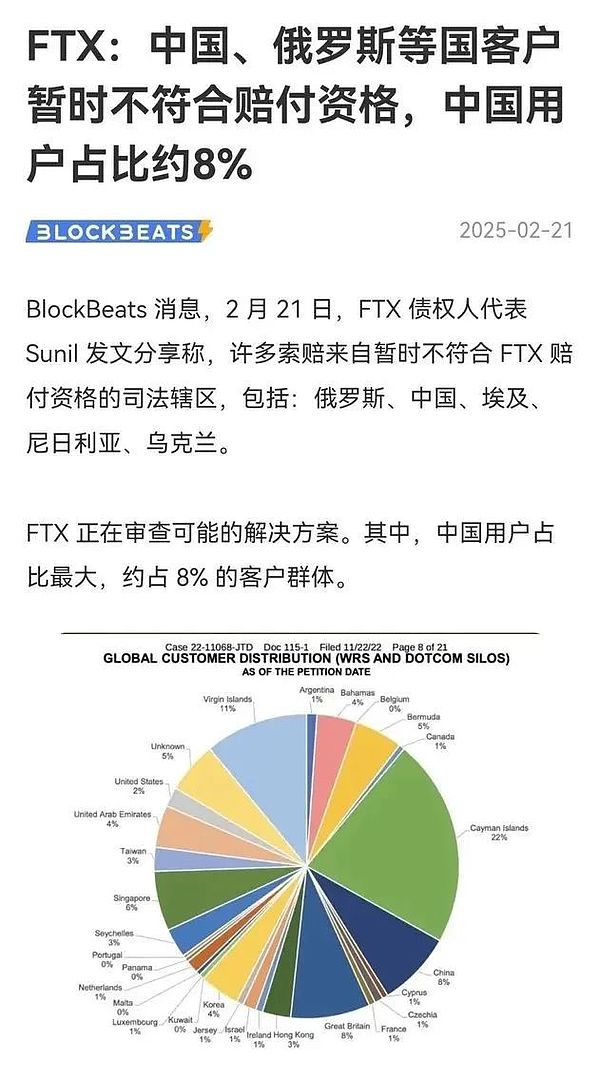

In November 2022, a shocking drama broke out in the cryptocurrency circle: FTX, the world's second largest exchange, declared bankruptcy without any warning. This platform, created by the "genius" Sam Bankman-Fried (SBF for short), was once a dazzling new star in the industry with a valuation of up to US$32 billion, but it collapsed overnight due to misappropriation of funds and chaotic management, leaving behind hundreds of thousands of users and a debt black hole of over US$10 billion. SBF was eventually sentenced to 25 years in prison by a U.S. court, but the FTX liquidation team staged a "Jedi counterattack", miraculously recovered $14.5 billion to $16.3 billion, and promised to do its best to compensate customers. This "thunderstorm" farce shocked the world and put Chinese users, who account for 8%, in a dilemma - they were blocked from the door of compensation due to regulatory restrictions.

Will Chinese creditors still get compensation?

According to PANews, Chinese customers were excluded from the compensation plan due to China's regulatory environment. China declared virtual currency transactions as illegal financial activities and not protected by law in notices in 2017 and 2021, which brought compliance risks to FTX's payment of compensation to Chinese customers. Although Chinese customers make up 8% of FTX's total users (according to the South China Morning Post), they are still considered ineligible for compensation in the current US bankruptcy proceedings.

FTX's post-bankruptcy compensation has entered the stage of small debt distribution, but due to jurisdictional barriers and compliance risks, Chinese users are currently excluded. Does this mean that Chinese creditors are completely hopeless? We think not. The situation is far more complicated than it seems, and there is still hope. The compensation issue for Chinese users may be postponed, and it is highly likely that they will not be completely excluded.

How to apply for claims?

The FTX bankruptcy case involves two parallel legal proceedings: the Chapter 11 bankruptcy proceedings in the United States and the liquidation proceedings in the Bahamas. The former is led by FTX in the Delaware court of the United States, while the latter involves its Bahamian subsidiary FTX Digital Markets Ltd. Which procedure you choose to declare your claims directly determines whether you can successfully get back your rights and interests.

For Chinese creditors, The Bahamas liquidation proceduremay be a better choice. The liquidation teams of the two countries reached a settlement in December 2023, promising to coordinate the distribution of assets and ensure that the amount and time of compensation are consistent (including principal and 9% annual interest). Compared with the US procedure, the Bahamas' legal framework provides more complete protection for foreign creditors when dealing with cross-border bankruptcies, which may better fit the actual situation of Chinese creditors and maximize the avoidance of compliance conflicts in the US procedure.

During the declaration process, there are some points that we need to pay attention to: according to the nature of your own claims, claims disputes and other situations, make the most favorable choice for yourself, and do not act rashly. At the same time, if your claims are large (for example, more than hundreds of thousands of dollars), or your English level is limited, it is strongly recommended to hire a professional lawyer. Lawyers can not only prepare the declaration materials on your behalf and save time, but also provide the best advice based on your specific situation to avoid missing opportunities due to operational errors.

Why can FTX pay?

Looking back at the history of crypto exchanges that collapsed, such as Mt. Gox, FTX was able to achieve a higher proportion of compensation after bankruptcy, which is generally considered an improvement. This involves differences in asset management, liquidation efficiency, legal framework, and market environment.

The asset addition is powerful. Although FTX founder SBF (Sam Bankman-Fried) was convicted of embezzling customer funds, the funds were not completely exhausted, and many were invested in liquid assets rather than disappearing completely. As of March 11, 2025, the liquidation team recovered $14.5 billion to $16.3 billion, enough to cover all customer principal (based on the dollar value at the time of bankruptcy in November 2022) and add 9% interest. These assets include cash, cryptocurrencies, and equity investments (such as Anthropic shares, which were sold for a profit of about $1 billion in 2024). The efficient liquidation mechanism of the U.S. Bankruptcy Code (Chapter 11) also provides strong support for asset replenishment.

Market timing is accurate. FTX collapsed in November 2022, at the bottom of the crypto market (Bitcoin was about $16,000). The liquidation team sold assets during the market recovery period of 2024-2025 (Bitcoin prices rose significantly), greatly increasing the recovery value. Mentougou missed a similar opportunity, resulting in a shortfall in compensation.

Modern supervision and technical support. When FTX went bankrupt, blockchain tracking technology (such as Chainalysis) was mature, helping the liquidation team to lock in the flow of funds. At the same time, strict US regulation and judicial supervision (11 U.S.C. §1123 principle of creditor equality) ensure that customer rights are prioritized. However, Mentougou can only compensate 15%-20% of its losses due to serious asset loss (850,000 bitcoins were stolen), nearly ten years of delayed liquidation and backward technology.

Web3 advocates decentralization, but in actual operation it still relies on centralized entities. Only a mature regulatory environment can provide investors with practical protection. FTX's ability to pay is a reflection of this logic.

Mankiw Lawyer Summary

Chinese creditors are not completely hopeless. FTX's relatively sufficient capital pool and ongoing liquidation provide a basis for compensation. Choosing the Bahamas procedure, relying on professional assistance and paying close attention to dynamics are the keys to protecting rights. Although the decentralization ideal of Web3 is beautiful, in reality, the centralized legal framework is the last line of defense for investors. If you need professional legal support in this process, you can contact Mankiw.

Alex

Alex

Alex

Alex Hui Xin

Hui Xin Brian

Brian Brian

Brian Alex

Alex Kikyo

Kikyo Hui Xin

Hui Xin Alex

Alex Alex

Alex Kikyo

Kikyo