Author: crv.mktcap.eth, crypto KOL; Translation: 0xxz@黄金财经

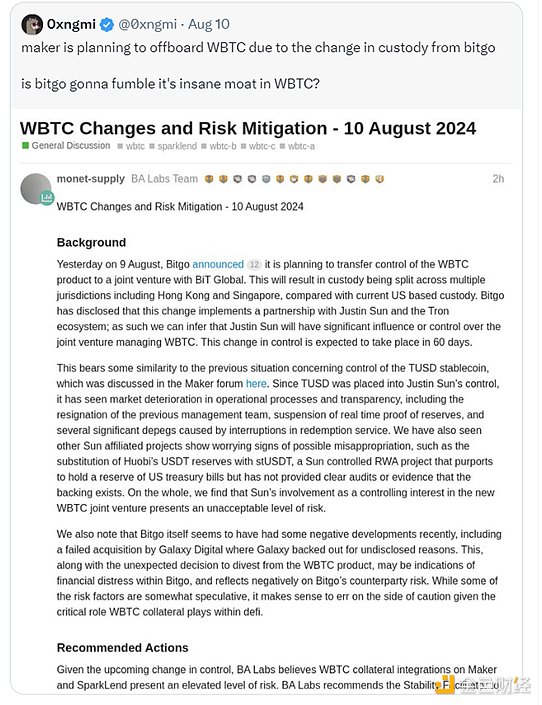

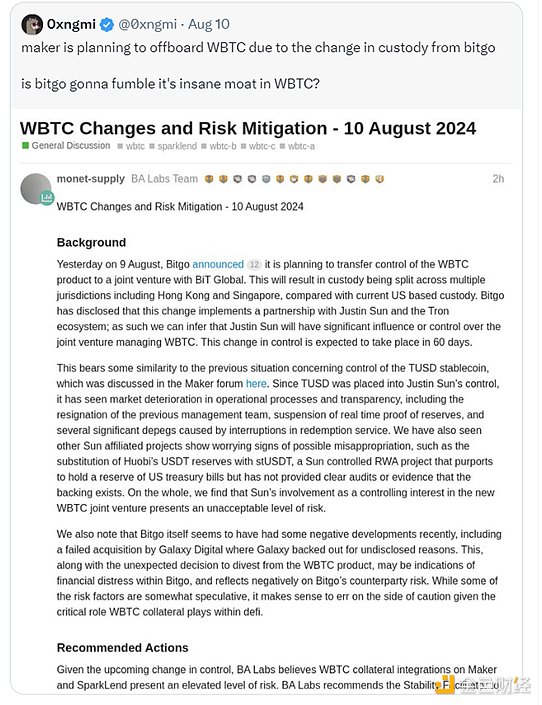

Last week, BitGo announced that it would hand over control of WBTC, sparking concerns about the health of wrapped BTC over the following weekend.

Why are some people worried about Justin Sun having greater strategic power over WBTC?

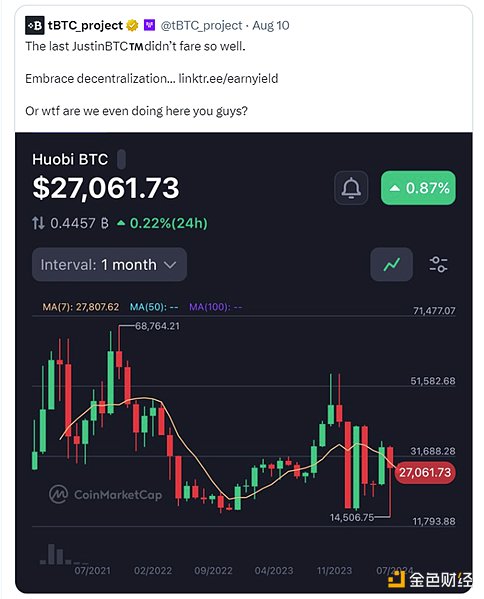

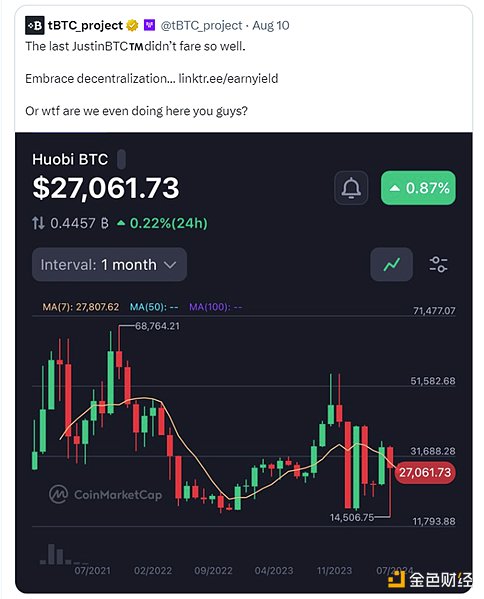

The DeFi generation may remember Sun’s previous Bitcoin wrapper product HBTC, but it performed poorly. Currently, its trading price is closer to USDT than BTC.

This time it will be different.

The shrewd Sun Chenyu quickly clarified his exact role in the ecosystem. Despite this, DeFi users have launched a serious discussion about what role WBTC plays in the ecosystem.

WBTC has been criticized for its relative centralization, however, the largest BTC wrapper product stands out from the competition. Last cycle,

CurveFinance notably brought WBTC together with Ren’s renBTC and Synthetix’s sBTC, both of which are now defunct.

Are there any other options besides WBTC? So far, there is no perfect solution.

One tempting option is frxBTC, which is rumored to be ready soon. Although tempting, degens' requirements are "now, immediately, right away."

Avax also has a custody solution BTC.B.

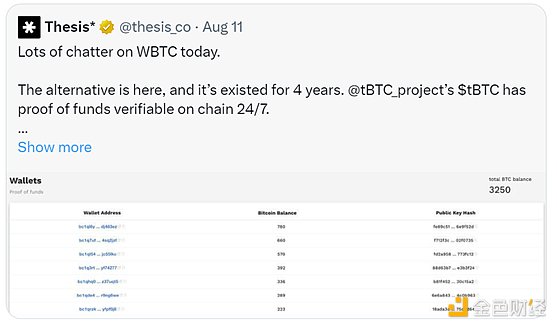

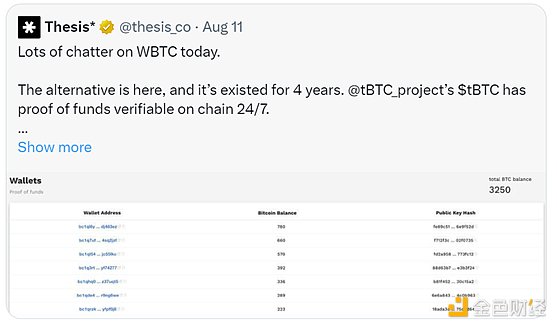

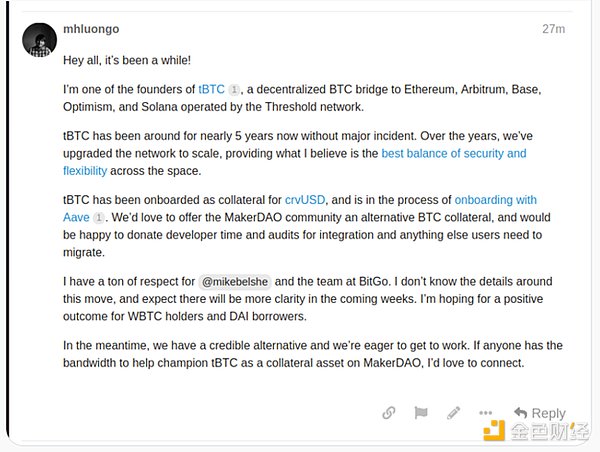

The most obvious alternative to WBTC is Threshold Network’s tBTC. In addition to being more decentralized, tBTC also exhibits a Lindy effect in terms of scale:

•v1: 4 years

•v2: 1.5 years

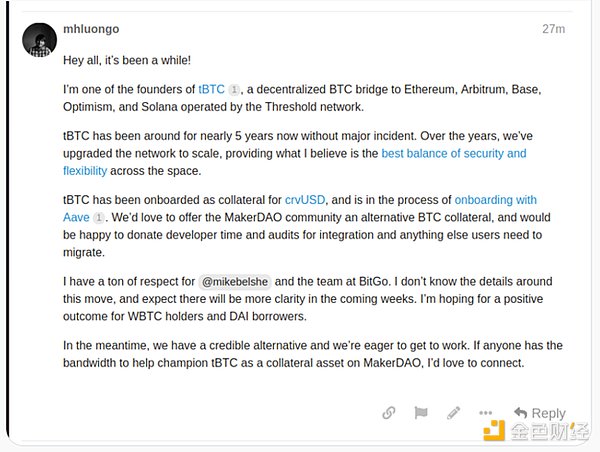

After BitGo’s announcement, MakerDAO debated hard about closing all WBTC debt. Then, constituting about 10% of DAI backing, abandoning WBTC would require a strong replacement. It’s no surprise that tBTC has come into people’s attention:

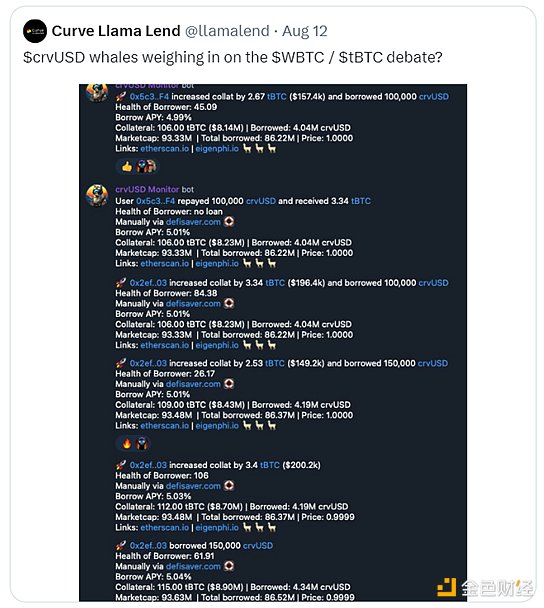

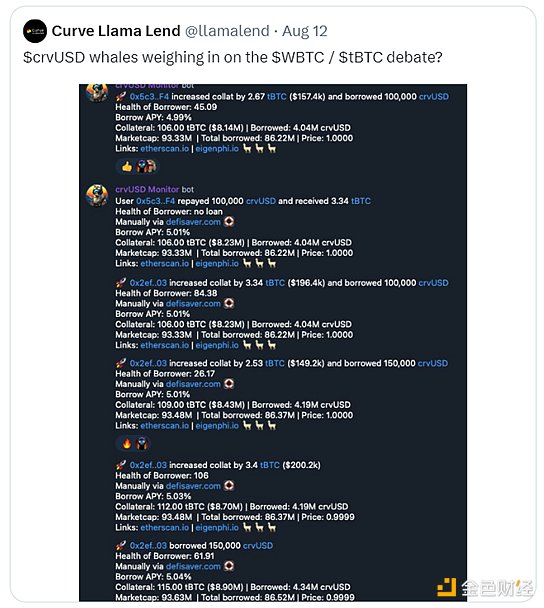

tBTC has a good DeFi adoption rate. It is widely used on Curve Finance. In addition to being actively traded in major stable and volatility pools, tBTC also supports the crvUSD stablecoin.

Some traders have already started rotating trades:

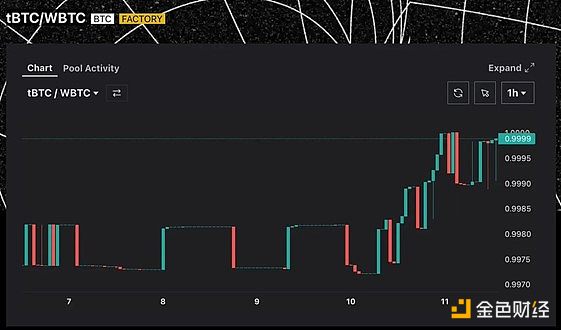

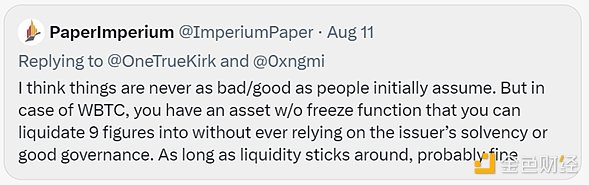

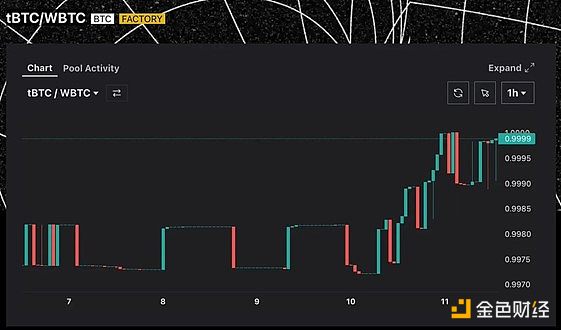

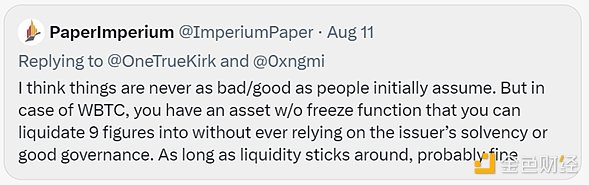

Will this storm really cause tBTC/WBTC to plummet? Shortly after the announcement, the hourly chart showed some price movements. But we don't expect the plunge to happen immediately.

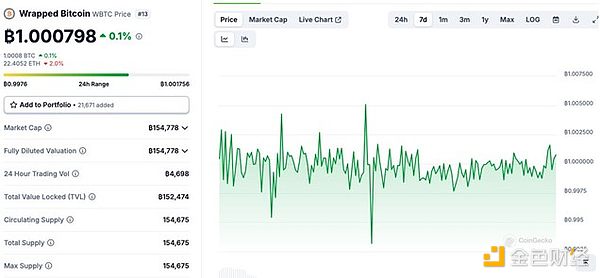

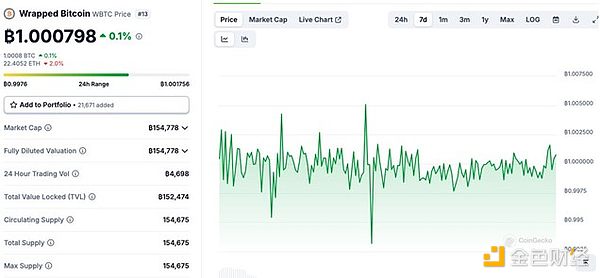

The market capitalization of both wrapped BTC tokens has been quite stable over the past week. Even though they are much discussed, neither shows a large inflow or outflow.

The market capitalization of the two is very different:

WBTC: 155,000 BTC

tBTC: 3,000 BTC

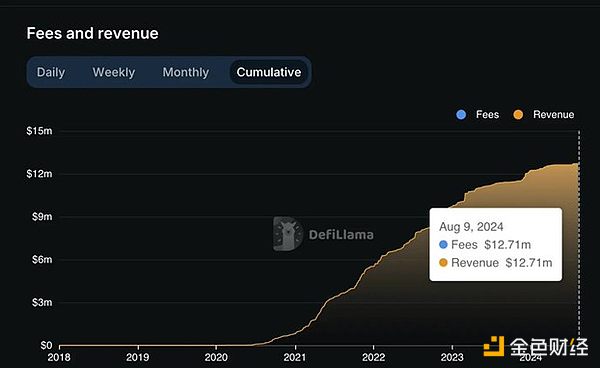

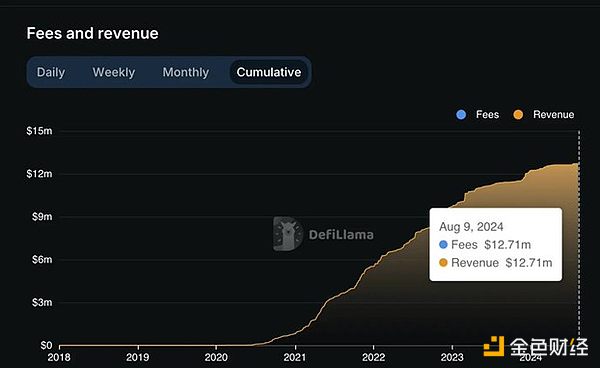

This is indeed a “crazy moat!” WBTC operates with the thinnest profit. $9 billion worth of BTC netted only $12.7 million in fees.

Therefore, WBTC is unlikely to disappear anytime soon. The liquidity and integration it has accumulated over so many cycles will not be replaced anytime soon, especially if the representative continues to run and maintain the peg.

Nevertheless, if you want to promote a more decentralized future, you might consider minting tBTC the next time you want to bridge BTC to ETH.

For more information on how to use tBTC, please refer to:

Xu Lin

Xu Lin