Author of the article: Token Dispatch and Thejaswini M A Article compilation: Block unicorn

Foreword

The creator of a financial ecosystem worth 314 billion US dollars, wearing a plain T-shirt, pondering the future of mankind.

Vitalik Buterin, or V God, is the Russian-born genius who created Ethereum and transformed the concepts of finance, art, governance, and digital ownership.

Entire ecosystems exist in the shadow of his architecture.

His influence stretches from the boardrooms of Wall Street to developer hackathons on six continents. Central banks build central bank digital currencies (CBDCs) based on his designs. The Ethereum Virtual Machine (EVM) powers thousands of projects that process billions of daily transactions.

When he speaks, markets move. When he writes code, industries transform. When he donated $1.14 billion to charity, he didn’t even announce it publicly.

As Ethereum as an ecosystem struggles to move forward in the crypto world, Vitalik appears to be planning his most ambitious vision yet: rebuilding Ethereum from the ground up while it continues to run.

The genius who once cried because video games were nerfed is now the most influential technologist in the most important financial revolution of our time.

From Russia to Canada: The Early Years

Born on January 31, 1994 in the city of Kolomna, about 113 kilometers southeast of Moscow, Vitalik's childhood coincided with the turbulent post-Soviet era in Russia.

His father, Dmitry Buterin, was a computer scientist, which laid the foundation for Vitalik's connection to technology.

When Vitalik was six, his family immigrated to Canada in search of better economic opportunities. The move marked the beginning of a new chapter, and Vitalik's intellectual gifts gradually emerged.

In elementary school in Canada, teachers quickly discovered his mathematical talent. He could add and subtract three-digit numbers in his head twice as fast as his peers. This led to him being placed in a gifted children's program, where Vitalik began to realize that he was different - particularly attracted to mathematics, programming, and economics.

“I was never particularly inspired by the traditional education system,” Vitalik later wrote. But his perspective changed dramatically when he enrolled at the Abelard School, a private high school in Toronto. The school’s environment, which encouraged intellectual inquiry and critical thinking, transformed Vitalik’s relationship with learning.

His academic abilities continued to shine. In 2012, he won a bronze medal at the International Olympiad in Informatics, proving his programming prowess on the global stage. Perhaps the most pivotal moment in his intellectual development, however, occurred not in the classroom but through a video game.

From 2007 to 2010, Vitalik was obsessed with World of Warcraft. When the game’s developers decided to remove the damage component of his beloved warlock ability, Siphon Life, he was devastated—he reportedly cried himself to sleep that night. The event gave him a profound understanding of centralized control.

The experience motivated him to search for an alternative system, one that was free from a single authority that could change the rules at will.

The Awakening of Bitcoin

At age 17, Vitalik’s father introduced him to Bitcoin. The concept piqued his interest and prompted him to research it more deeply.

Wanting to participate in this emerging economy but lacking the computing power to mine or the funds to buy Bitcoin, Vitalik chose an unconventional path: He began writing articles about the cryptocurrency for a blog, earning 5 Bitcoins (worth about $3.50 at the time) for each article.

These early articles attracted the attention of Romanian Bitcoin enthusiast Mihaly Arici. Together, they founded Bitcoin Magazine in September 2011, establishing one of the first serious publications focused on cryptocurrency. Despite his youth, Vitalik’s articles displayed a technical depth and thinking beyond his years.

For two and a half years, Vitalik immersed himself in the Bitcoin ecosystem, gaining a deep understanding of both the potential of blockchain technology and its limitations.

By 2013, Vitalik decided to go full-time with cryptocurrency, dropping out of his computer science program at the University of Waterloo.

“I do remember the day he came home from college. His mom was visiting us at the house, so when he walked in the door, there were three of us there, me, Maya, and Natalia. And he said, ‘Hey, guys, I’m actually thinking about dropping out of school,’ ” says his father, Dmitry.

He spent six months traveling the world, talking to developers and examining various blockchain projects. What he found revealed the truth: Most projects were too narrowly focused on specific applications.

This observation sparked a key insight: What if blockchains could be programmed to do almost any task, not just process financial transactions? What if developers could build applications directly on top of the blockchain?

In late 2013, at the age of 19, Vitalik wrote a white paper outlining his vision for Ethereum—a platform that would go beyond the limited capabilities of Bitcoin to become a fully programmable blockchain capable of supporting almost any application a developer could imagine.

The Birth of Ethereum

Vitalik’s Ethereum white paper proposed a radical vision: a blockchain with a Turing-complete programming language that, in theory, could solve any computational problem given enough time and memory. At its core was the concept of “smart contracts”: self-executing agreements whose terms were written directly into the code.

The response was swift and enthusiastic.

Within a few weeks, a group of programmers, including Gavin Wood, Joseph Lubin, and Charles Hoskinson, gathered around Vitalik’s vision. In January 2014, they announced the birth of Ethereum.

To raise funds for development, the team held an initial coin offering (ICO) in July 2014, exchanging Ether (ETH) tokens for Bitcoin. The offering raised about 31,000 Bitcoins, worth about $18 million at the time—a huge sum that demonstrated great confidence in the project’s potential.

At the same time, Vitalik was awarded the $100,000 Thiel Scholarship, established by PayPal co-founder Peter Thiel to support young entrepreneurs willing to drop out of school or skip college to pursue their ideas. This financial support enabled Vitalik to devote himself to Ethereum full-time.

After a lot of development and testing, Ethereum was officially launched on July 30, 2015. The first version was called "Frontier", which was basic but fully functional and provided developers with a platform to start building decentralized applications.

Ethereum's design introduced several key innovations:

An account-based model, rather than Bitcoin's UTXO (unspent transaction output) system

Smart contracts, which support complex self-executing agreements

Gas mechanism, which is used to measure and limit computational work

The Ethereum Virtual Machine (EVM), a Turing-complete execution environment

These features make Ethereum more flexible than Bitcoin and open the door to applications that go beyond simple value transfer. Developers can now create token systems, financial derivatives, decentralized autonomous organizations (DAOs), identity systems, and more on a single blockchain platform.

However, the launch of Ethereum was not without challenges. In 2016, a decentralized venture capital fund project called The DAO was hacked due to a code vulnerability, and hackers stole millions of dollars worth of Ethereum, bringing an existential crisis to the young platform.

The community faced a difficult choice: modify the blockchain to recover the stolen funds, violating the principle of immutability, or accept the loss to maintain the philosophical integrity of the system?

Vitalik advocated a "soft fork" to restore the funds. This position sparked controversy, split the community, and ultimately led to a "hard fork" of the blockchain. The result was two independent chains: Ethereum (the modified chain, which recovered the stolen funds) and Ethereum Classic (the original unchanged chain).

This decision showed the pragmatic side of Vitalik's leadership: a willingness to prioritize the protection of users rather than strictly following ideological principles. This pragmatism has been reflected in his subsequent approach to the development of Ethereum.

Technical Vision and Evolution

Ethereum has always embraced continuous evolution. Refusing to stick to traditional architecture is both Ethereum's greatest strength and its greatest challenge.

The platform's price chart tells a story of wild swings - from a few cents at launch to nearly $4,900 in November 2021, to a drop below $1,000 during the crypto winter of 2022, and now stabilizing at $2,605. For a decade, these swings have tested the resolve of ETH supporters, who have endured promised upgrades, delayed timelines, and technological transitions.

For Ethereum believers, the journey has been an emotional roller coaster. Early supporters envisioned rapid scaling solutions, but they required great patience in the face of years-long development cycles. Some gave up at the bottom, while the most loyal members of the community - the "ETH maximalists" - maintained their faith through multiple market cycles.

What many critics overlook is that Ethereum's seemingly slow development pace is actually by design. Vitalik has been at the forefront of community development.

As a truly community-driven protocol, every major upgrade requires extensive research, multiple implementations, community debate, and rigorous testing. This governance model prioritizes security and consensus over speed—a necessity when handling hundreds of billions of dollars in value.

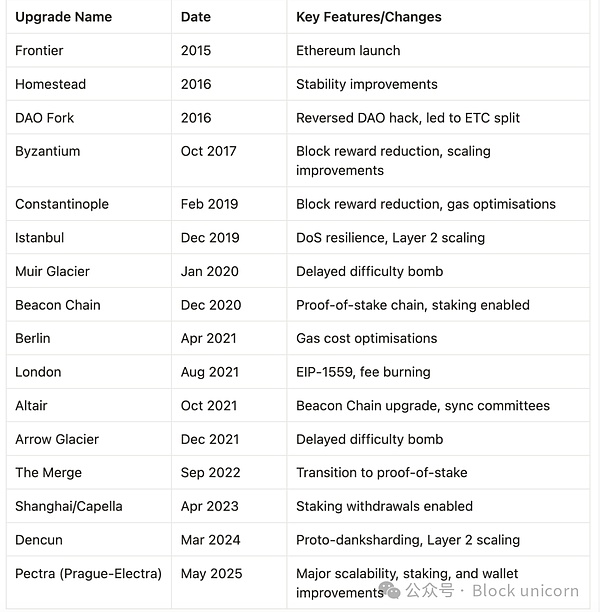

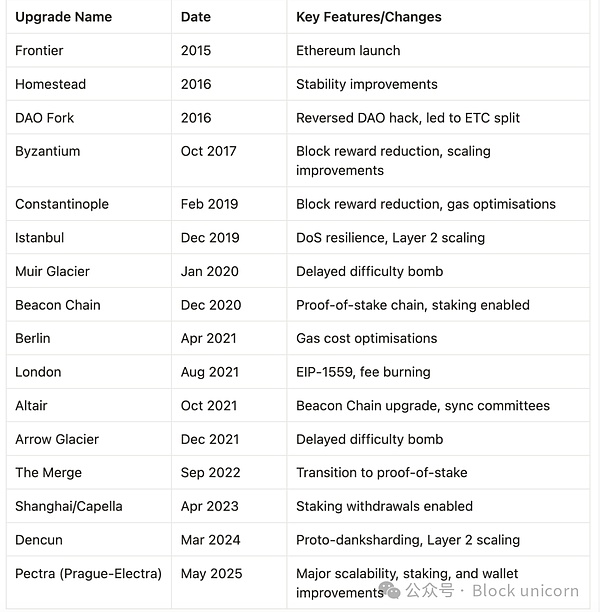

Ethereum's ten-year journey has spanned several important milestones.

Vitalik’s roadmap for the future development of Ethereum revolves around several key stages, named in a playful way:

The Merge: Completing the transition to Proof of Stake (PoS)

The Surge: Implementing sharding to improve scalability

The Verge: Introducing Verkle trees to improve efficiency

The Purge: Reducing Storage Requirements

The Splurge: Enhancing Quantum Resistance

The recent Pectra upgrade (May 2025) advances this roadmap by improving wallet functionality and validator economics, but the true North Star remains Vitalik’s vision: a blockchain that serves as a global neutral infrastructure for coordination and value exchange.

For validators, the upgrade increased the maximum stake limit from 32 ETH to a staggering 2048 ETH, significantly reducing operating costs for institutional stakers. These improvements have driven ETH out of its recent price slump, climbing from around $1,615 in mid-April to over $2,600 today, an increase of more than 60%.

However, just a few days before Pectra went online, Vitalik published a seemingly contradictory vision in his blog post "Simplifying L1", arguing that Ethereum must become "almost as simple as Bitcoin" within five years.

He proposed replacing the Ethereum virtual machine with RISC-V (an open source instruction set architecture), saying it could bring "100x performance improvement" while making the system more developer-friendly.

This apparent contradiction—implementing a complex Pectra upgrade while advocating for radical simplification—embodies Buterin’s pragmatic approach: planning for a more elegant future architecture while making necessary improvements to the current system.

Philanthropist and Philosopher

In addition to his technical contributions, Vitalik has often emerged as a philanthropist, using his cryptocurrency wealth to support a variety of scientific, medical, and humanitarian causes.

In May 2021, he made headlines by donating $1.14 billion worth of Shiba Inu cryptocurrency (SHIB) to the Indian Crypto Covid Relief Fund to help fight the COVID-19 pandemic. The donation caused a sharp drop in the coin’s price, but provided substantial aid at a critical time.

His other notable donations include:

$665 million to the Future of Life Institute, focused on reducing existential risks including artificial intelligence

$763,970 worth of Ethereum to the Machine Intelligence Institute

$2.4 million in Ethereum to the SENS Research Foundation for research into rejuvenation and life extension

$336 million in Dogelon Mars tokens to the Methuselah Foundation for longevity research

$9.4 million in USDC to the University of Maryland for research into germicidal UV light to prevent future outbreaks

In 2022 During the outbreak of the Russo-Ukrainian war in 2016, Vitalik supported relief efforts through cryptocurrency donations and public affiliations, including participation in initiatives such as the Ukraine DAO.

Vitalik’s personal philosophy is centered on decentralization, egalitarian principles, and the potential of technology to create positive social change. His thinking has evolved over time, moving from what he describes as “anarcho-capitalist thinking” to more “Georgian thinking” about public goods and common resources.

Recently, Vitalik has expressed concerns that artificial intelligence could pose an existential risk to humanity. In a November 2023 blog post, “My Techno-Optimism,” he argued that AI is “fundamentally different” from other inventions, such as guns, airplanes and social media, because it could develop a new form of “thinking” that could even be antagonistic to humans.

“If a superintelligent AI decided to turn against us, it could wipe out all of humanity and end the human race completely,” Vitalik wrote. “Even Mars might not be safe.”

In response to these concerns, he advocates a philosophy he calls “d/acc,” which focuses on defensive, decentralized, democratic, and differentiated technology development. This approach seeks to advance beneficial technologies while mitigating the risks of potentially harmful ones.

Our Take

Vitalik Buterin’s story reveals the contradictory forces shaping the blockchain revolution. His journey is both deeply technical and philosophical, challenging traditional narratives about tech founders and their creations.

Unlike the typical Silicon Valley founder-CEO, Vitalik rejects the trappings of traditional corporate leadership. He leads not through organizational authority, but through the persuasiveness of his ideas, which he publicly publishes in blog posts and technical papers.

However, this leadership style also brings tensions. Critics such as Cardano founder Charles Hoskinson argue that Ethereum’s governance remains too dependent on Vitalik’s direction. “Everybody is counting on him to set the roadmap,” Hoskinson noted at a recent conference. “If you remove him from the equation now, what will the next hard fork look like?”

This criticism touches on a fundamental challenge for decentralized projects: how to balance visionary leadership with truly distributed governance. Ethereum’s success stems in part from Vitalik’s technical insights and roadmap, but its long-term resilience will need to transcend reliance on any single individual.

Ethereum’s current transformation—from the immediate technical improvements of the Pectra upgrade to Vitalik’s longer-term vision of radical simplification—is less an isolated change than a fundamental recalibration of its approach. The market’s recent positive reaction suggests that investors believe in this dual strategy of immediate enhancements and long-term architectural innovation.

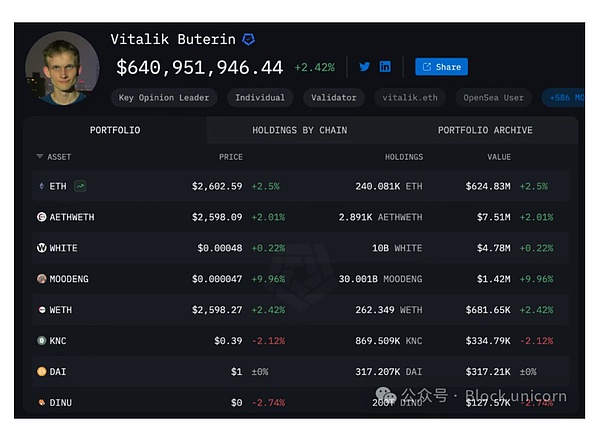

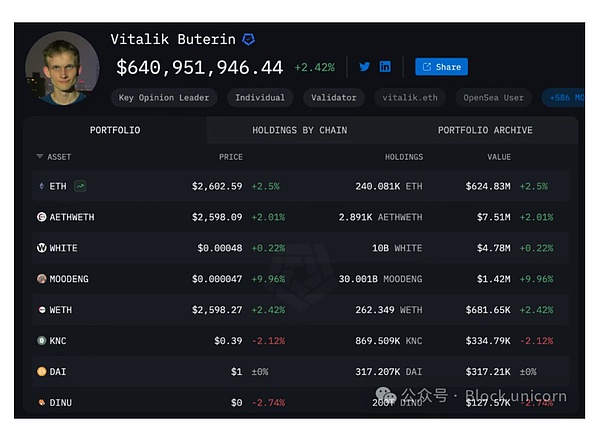

The conflict between Vitalik’s personal wealth and his philosophical commitment presents another paradox. Although his net worth exceeds $1 billion, he lives modestly, dresses simply, and focuses on intellectual rather than material pursuits. Yet, as one of Ethereum’s largest token holders, he benefits financially from the platform’s growth — a potential conflict with the fair, decentralized system he promotes.

His approach to these contradictions is instructive. Rather than pretending that these contradictions don’t exist, Vitalik openly acknowledges them and examines the trade-offs of different paths forward. This intellectual honesty stands in stark contrast to much of the hyperbolic marketing and tribalism in crypto.

In a space dominated by extremism and absolute thinking, Vitalik offers a different model: one that is open to intellectual exploration, willing to revise one’s views, and committed to building technology that serves human values rather than simply upending the existing system. Whether this approach can withstand market pressures and competing visions remains an open question — and that will likely define the next chapter in Ethereum and Vitalik’s story.

Aaron

Aaron