Author: Alana Levin, Investment Partner, Variant Fund; Translation: @Jinse Finance xz

The core viewpoint of this Crypto Trends Report is: the growth of the crypto industry can be viewed as an evolutionary trilogy consisting of three composite S-curves: asset creation, asset accumulation, and asset utilization.

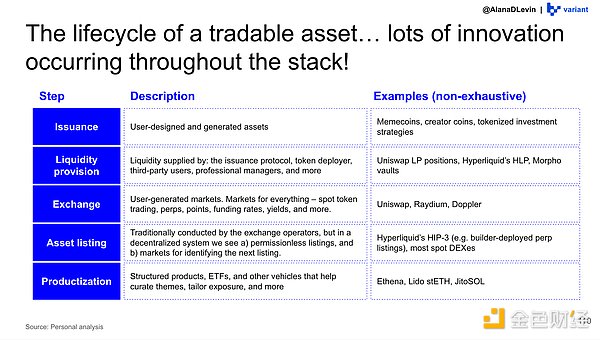

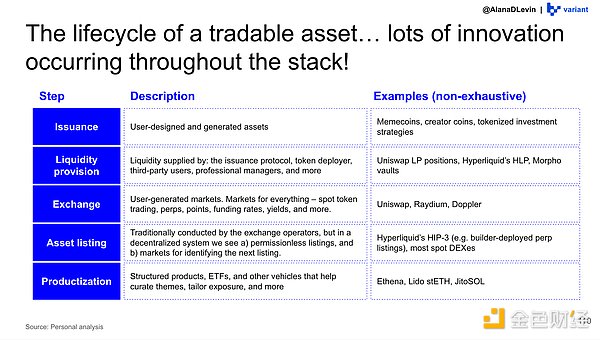

Phase One is the Creation Phase: the tokenization process of value. This phase began with the birth of Bitcoin in 2009 and has since encompassed diverse categories such as Layer 1 monetary assets, project tokens, stablecoins, content tokens, memes, NFTs, and tokenized equity. Between 2024 and 2025, the industry crossed the steepest growth section of the S-curve—in just a few years, the number of tradable tokens surged from approximately 20,000 to millions. Although there is still ample room for innovation (such as tokenized lending, on-chain structured products, and the on-chaining of real-world assets), the most disruptive breakthrough from zero to one has been largely completed.

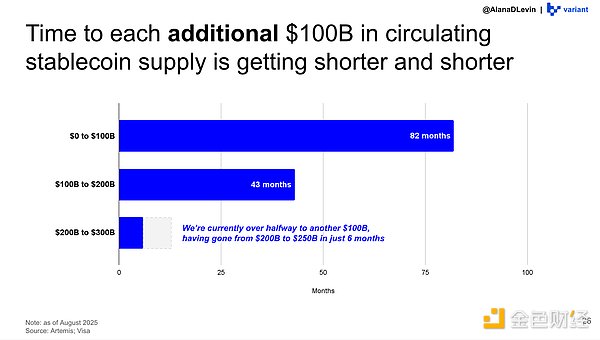

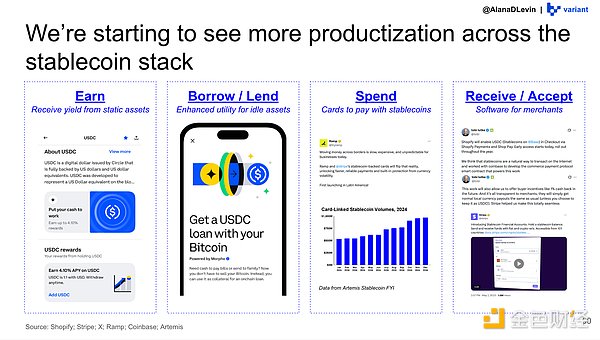

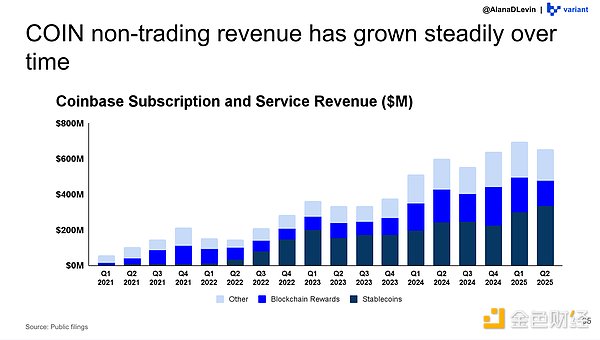

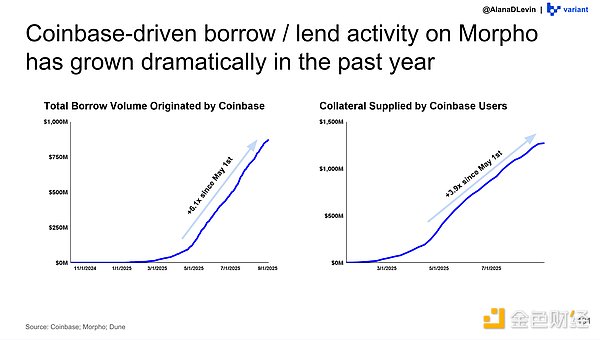

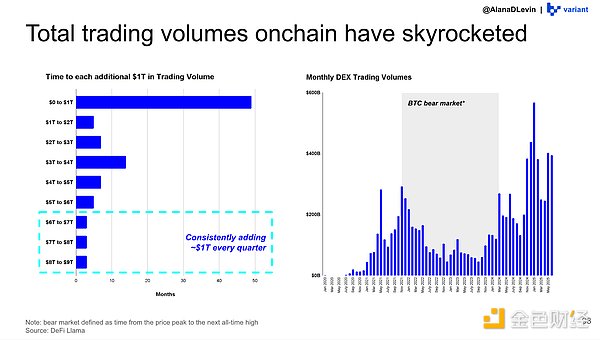

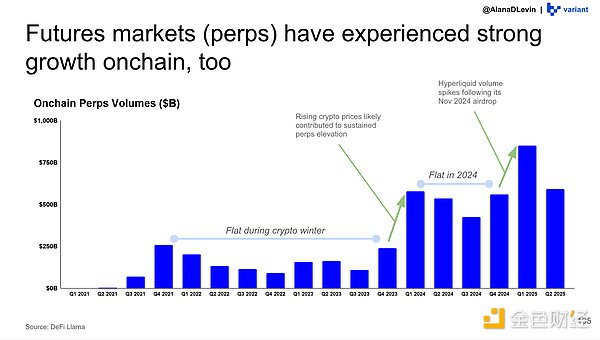

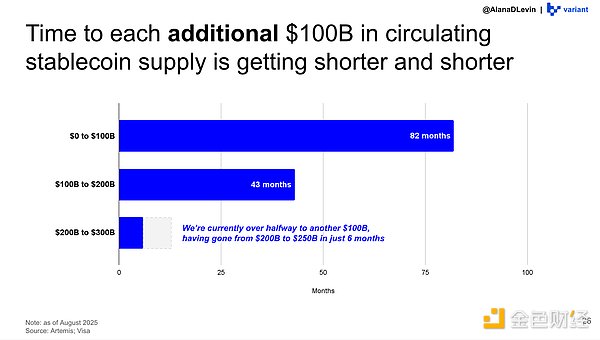

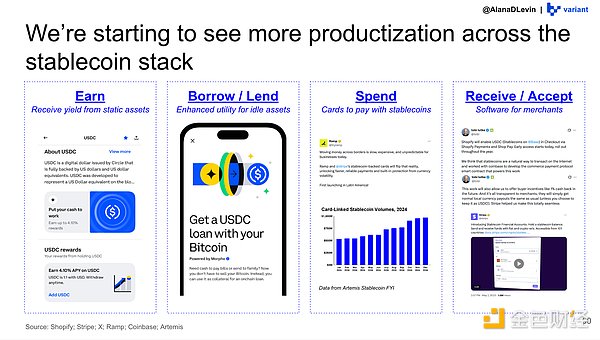

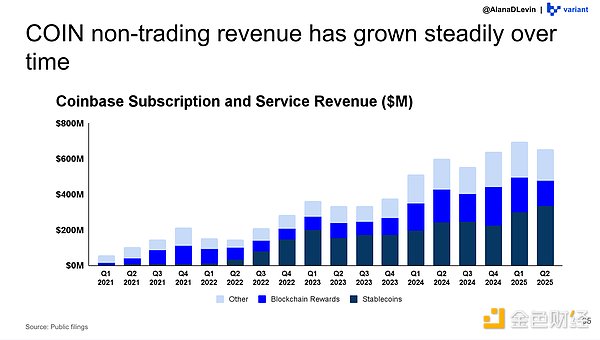

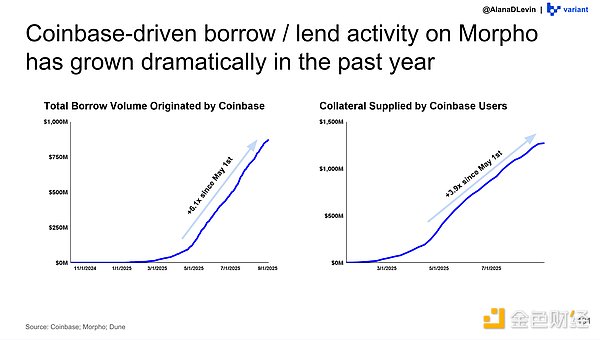

**Phase Two: Accumulation Period** The more diverse and valuable the asset classes, the stronger the demand for holding them. This provides a tailwind for several sub-sectors within the industry: custody products, exchanges, and security solutions. Different custody solutions serve different user groups: stablecoin-supporting applications may use embedded wallets like Turnkey, institutional investors often use qualified custodians, while active on-chain users may use super-application wallets like Phantom. The growing demand for buying, selling, and holding crypto assets has also catalyzed the expansion of distribution channels. Several established exchanges (such as Coinbase) have seen a surge in trading volume, traditional fintech companies (such as Robinhood) have doubled down on crypto channels, and emerging platforms (such as Axiom) have experienced explosive growth. Asset management companies are offering crypto asset allocations in retirement accounts, publicly traded companies are beginning to include Bitcoin and stablecoins on their balance sheets, and even some sovereign wealth funds are starting to accumulate such assets. We are just beginning to climb the steepest part of the S-curve in this phase. Phase Three is the Utilization Phase: Enabling Assets to Create Value. Once people hold assets, they begin to use them. Crypto assets are by far the most composable, accessible, and programmable financial assets. Numerous exciting and mature use cases are emerging: stablecoin payments, supplying and borrowing funds in lending protocols like Morpho, providing liquidity for on-chain exchanges, and network staking. However, we are still in a very early stage regarding the diverse ways in which tokenized assets can and will be used—the S-curve climb is just beginning. I believe that the design space for expanding and enhancing asset utility will be one of the biggest and most exciting blue ocean opportunities in the coming years. This report is divided into five main sections: Macro Trends, Stablecoins, Centralized Exchanges, On-Chain Activity, and Future Outlook. Each section employs a triple-converged S-curve framework to help understand the current major trends and opportunities in the crypto industry. Below are our summary of the main trends in the current crypto space: 1. Macro Trends Mainstream crypto assets continue to expand in scale. Even with the continuous growth of the total crypto market capitalization, the market capitalization concentration of the top ten assets remains remarkably stable. New assets struggle to break into the top five. Many top assets exhibit a genuine Lindy effect and imitation potential. Stablecoins have experienced explosive growth, exhibiting three S-curves: new issuance (asset creation) is progressing at a record pace, funding channels (asset accumulation) are becoming increasingly diversified, and stablecoin application scenarios (asset utilization) continue to expand. This category possesses a powerful network effect—the greater the circulation, the higher the utility value. Similarly, the more entities holding stablecoins, the stronger their ability to build products and services around these assets. Stablecoins have already shown productization benefits in areas such as payments, yield products (e.g., lending protocols), and exchanges. However, we believe there is still ample room for innovation in the triple S-curve.

3、Centralized Exchanges

Centralized exchanges are the most significant beneficiaries of the "accumulation" S-curve.

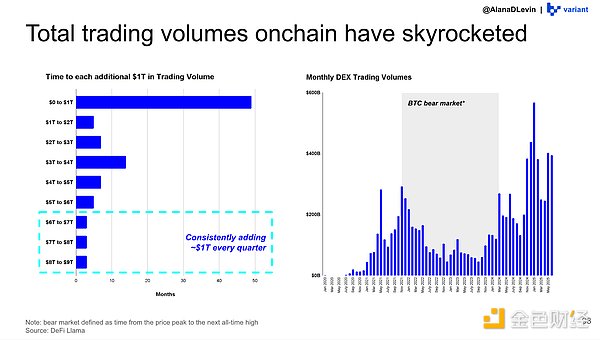

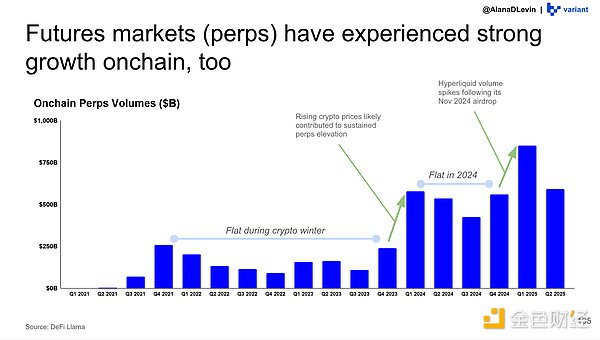

4、On-chain Activities

Want to explore novel applications of crypto assets?

5、Future Outlook

Development based on cryptographic infrastructure can transform products into platforms. This section uses the growth of the prediction market as an example to demonstrate a typical paradigm of cryptographic technology empowering new economic models, and summarizes the entrepreneurial opportunities that Variant is focusing on (not an exhaustive list).

Weatherly

Weatherly