Author: Alex O’Donnell, CoinTelegraph; Compiler: Baishui, Golden Finance

VanEck said in a statement that the company plans to launch a private digital asset fund in June, targeting tokenized Web3 projects built on the Avalanche blockchain network.

The VanEck PurposeBuilt Fund is open only to qualified investors and aims to invest in liquidity tokens and venture capital projects in the Web3 field, including games, financial services, payments and artificial intelligence.

VanEck said that idle funds will be deployed in Avalanche’s real world asset (RWA) products, including tokenized money market funds.

The fund will be managed by the team of VanEck’s Digital Asset Alpha Fund (DAAF), which managed more than $100 million in net assets as of May 21.

“The next wave of value growth in cryptocurrencies will come from real businesses, not more infrastructure,” said Pranav Kanade, portfolio manager at DAAF, in a statement.

Risk-weighted assets (RWAs) are one of the fastest-growing sectors in the cryptocurrency space. Source: RWA.xyz

Thematic Crypto Funds

VanEck’s PurposeBuilt fund is the latest in a series of funds launched by the asset manager and its competitors to provide investment opportunities in projects and companies in the fast-growing Web3 space.

On May 14, VanEck launched a new actively managed exchange-traded fund (ETF) that invests in stocks and financial instruments to provide investment opportunities in the digital economy.

In April, VanEck launched another ETF that invests in a passive index of companies operating in the cryptocurrency space.

VanEck and other asset managers are applying to the U.S. Securities and Exchange Commission (SEC) for approval to list up to 70 cryptocurrency ETFs.

The wave of ETF applications is a response to U.S. President Donald Trump's relaxed stance on cryptocurrency regulation after taking office in January this year.

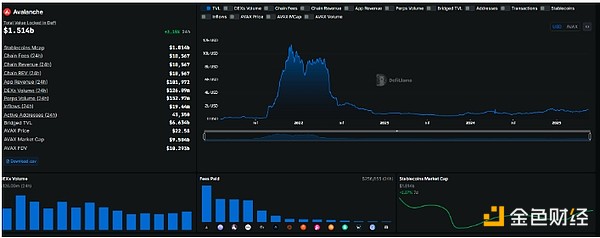

Avalanche TVL as of May 21. Source: DefiLlama

Avalanche Risk-Only Assets (RWA) Ecosystem

Avalanche has become a hub for real-world assets (RWA) and other crypto projects targeting institutional investors.

Its interconnected networks, called subnets, allow institutions to run Ethereum-like smart contracts in a controlled environment. On May 16, Solv Protocol launched a yield-generating Bitcoin token on the Avalanche blockchain, targeting institutional investors.

As of May 21, Avalanche’s total locked value (TVL) was approximately $1.5 billion, according to DefiLlama.

“We are seeing the market shift away from speculative hype and toward real utility and sustainable token economies,” said John Nahas, chief business officer at Ava Labs, in a statement.

Catherine

Catherine