US Court Accepts CZ's Guilty Plea, Forbids Travel To UAE

CZ has argued that his surrender should be proof that he does not pose a flight risk.

Alex

Alex

Author: Fu Shaoqing, SatoshiLab, Wanwudao BTC Studio

Not only the VC coin and meme coin phenomenon has aroused more thinking among people, but many well-known people in the industry have also raised similar questions and are trying to find solutions. For example, in the Twitter space activity where He Yi answered the question about girlfriend coins, Jason (Chen Jian) asked whether the tokens launched on Binance have a mechanism to solve the problem that the project team sells the coins on the exchange and then lies flat. There is also the "A Crazy Idea for Token Issuance" recently published by CZ, which is trying to find a solution to related problems.

I think all teams that are really working hard on projects hope that the market will reward real contributors, rather than letting Ponzi schemes, scammers, speculators, etc. take away the dividends of this industry and disrupt the development of this industry.

Because VC coins and meme coins have good case analysis functions, this article will analyze these two phenomena.

VC coins did not come out of thin air. There are historical reasons for their emergence. Although VC coins do not look perfect now, they played a relatively important role at the beginning, and important projects in the industry have the participation of VC.

2017 was a key year for the outbreak of the initial coin offering (ICO) in the blockchain field. According to statistics, the amount of financing raised by ICO that year exceeded 5 billion US dollars. In addition to the classic ICO projects introduced below, the author also participated in the ICO of some small projects and fully felt the madness at that time. It is not an exaggeration to describe it as a riot of demons. At that time, as long as a project's token was to conduct an ICO, someone would stand up for it, and the white paper was well written. When it was thrown into some groups, it would be immediately snatched up. People were crazy and irrational at that time. To exaggerate, even if you throw a pile of shit into the group, it will be snapped up. If you don't believe me, search for the Token situation of MLGB (Malego Coin). (This also reflects the powerful power of ICO)

As for the reasons for the outbreak, I summarized them as follows through exchanges with DeepSeek and Chatgpt, as well as my own understanding:

(1) The maturity of coin issuance technology: In particular, the launch of Ethereum has enabled developers to easily create smart contracts and decentralized applications (DApps), which has promoted the rise of ICO.

(2) There are several other reasons: market needs, the concept of decentralization has just gained popularity, giving people good expectations, and low threshold investment.

During this period, several classic cases

(1) Ethereum: Although Ethereum's ICO was conducted in 2014, in 2017, Ethereum's smart contract platform was widely used in the ICO of many new projects. At the same time, this project was also conducted through ICO. Overall, this project is still very good and has now grown into the second largest project in the Crypto world.

(2) EOS: EOS raised nearly $4.3 billion through a year-long, phased ICO in 2017, becoming one of the largest ICOs of the year. This project has almost disappeared now, partly because it did not follow the right technical path, and partly because it did not have enough control over market demand.

(3) TRON: TRON also raised a large amount of funds through its ICO in 2017. During the period, it was widely criticized for swapping coins with other projects and plagiarizing them. However, it has developed rapidly in the future and attracted a lot of attention. From this point of view, compared with those projects that have run away, isn’t Sun Ge doing quite well? He has a very accurate grasp of market demand, for example, the income of Tron’s stablecoin. Tron is in sharp contrast to EOS in terms of technical implementation and control of market demand. The development achievements of Tron are still quite good. If HSR (Hshare, nicknamed "red braised pork"), who exchanged coins at the beginning, had kept the share of Tron, the income would be higher than his own project.

(4) Filecoin: Filecoin successfully raised more than US$250 million in 2017. Its concept of distributed storage has attracted widespread attention. The founding team, Juan Benite and others, is a luxurious team. This project cannot be said to be successful or failed, but whether the project can develop healthily is a question.

The author personally feels that there are more non-classic cases and they have a greater impact, which is also a major historical reason for the emergence of VC coins.

Problems Exposed

(1) Lack of supervision: Due to the rapid development of the ICO market, many projects lack supervision or have no supervision at all, resulting in high risks for investors. There are many scams and Ponzi schemes, and almost 99% of the projects are exaggerated and fraudulent.

(2) Market bubble: A large number of projects raised huge amounts of funds in a short period of time (these funds were not well managed), but many of them lacked actual value or described scenarios that were completely unrealizable, which made even projects that did not intend to defraud money run away or fail.

(3) Insufficient investor education and difficulty in judgment: Many ordinary investors lack knowledge of blockchain and cryptocurrency and are easily misled, leading to wrong investment decisions. In other words, investors have no way to measure projects or monitor their progress afterwards.

Through the above description, we can see the chaos after ICO. At this time, venture capital (VC) first stepped forward to solve the problem. VC provided more reliable support for the project through its own reputation and resources, helping to reduce the many problems caused by early ICO. At the same time, an additional effect was to help the majority of users to do a layer of screening.

The role of VC

(1) Replace the grassroots financing defects of ICO

Reduce the risk of fraud: VC filters "air projects" through "strict due diligence" (team background, technical feasibility, economic model) to avoid the rampant white paper fraud in the ICO era.

Standardize fund management: adopt phased capital injection (according to milestones) and token lock-up period clauses to prevent the team from cashing out and running away.

Long-term value binding: VC usually holds project equity or long-term lock-up tokens, which is deeply bound to project development and reduces short-term speculation.

(2)Empowering the project ecosystem

Resource import: Connect projects with key resources such as exchanges, developer communities, and compliance consultants (such as Coinbase Ventures to help projects list their tokens).

Strategic guidance: Assist in designing token economic models (such as token release mechanisms) and governance structures to avoid economic system collapse.

Reputation endorsement: The brand effect of well-known VCs (such as a16z, Paradigm) can enhance the market's trust in the project.

(3) Promote industry compliance

VCs push projects to proactively comply with securities laws (such as the U.S. Howey Test) and adopt compliant financing frameworks such as SAFT (Simple Agreement for Future Tokens) to reduce legal risks.

VC involvement is the most direct solution to the problems of the early ICO model. Overall, VCs play a vital role in the success of Web3 projects. Through funding, resources, reputation and strategic guidance, they help projects overcome many challenges faced by early ICOs, and indirectly help the public complete preliminary screening.

The emergence of new things is to solve some old problems, but when this new thing develops to a certain stage, it also begins to present a series of problems. VC coins are such a case. In the later period, it showed many limitations

Mainly reflected in:

(1) Conflict of interest

VC is an investment institution that makes profits through investment. It may promote the excessive tokenization of projects (such as high unlocking pressure) or give priority to serving its own investment portfolio (such as exchanges and VCs supporting "parent-child" projects).

(2) Inability to solve subsequent project development problems.

(3) Conspiring with project parties to deceive retail investors (some project parties and VCs do this, and big-name VCs are relatively better).

VC institutions only complete the early stages of investment and profit exit. On the one hand, they have no obligation for the later development of the project, and on the other hand, they have no ability or willingness to do so. (Would it be better if VCs were restricted to long unlocking periods?)

The main problem with VC coins is that the project party’s coins lack the motivation to continue to build after listing. VCs and project parties will cash out and run away after listing the coins. This phenomenon makes retail investors hate VC coins, but the fundamental reason is that the projects are not effectively supervised and managed, especially the matching of funds and results.

The Inscription and Fairlanunch that broke out in 2023, and the pumpfun model of memecoin that broke out in 2024, both revealed some phenomena and exposed some problems.

In 2023, two significant trends emerged in the blockchain field: the outbreak of inscriptions technology and the popularization of the Fair Launch model. Both phenomena stem from reflections on early financing models (such as ICO and VC monopoly). In the field of inscriptions, most VCs generally reflect that they have no chance to participate in the primary market, and even in the secondary market, they dare not invest too much. This reflects the pursuit of decentralization and fairness by users and the community.

Inscriptions first broke out on the Bitcoin blockchain, represented by BRC20, and produced important inscriptions such as ORDI and SATS. There are some reasons for the outbreak of inscriptions: the need for innovation in the Bitcoin ecosystem; users' need for anti-censorship and decentralization; low threshold and wealth effect; resistance to VC coins; the attraction of fair launch.

Inscriptions also cause some problems:

Pseudo-fairness, In fact, many participating addresses may also be disguised by a few institutions or large investors;

Liquidity Problem, The use of inscriptions on the Bitcoin mainnet has large transaction costs and time costs;

Value loss, The huge handling fees generated by creating inscriptions are taken away by miners (anchored assets are lost), and the closed loop of the Token ecosystem is not enabled;

Application scenario problem, Inscriptions do not solve the problem of sustainable development of a Token, and these inscriptions have no "useful" application scenarios.

Meme originated relatively early and was a cultural phenomenon in the early days. The real world regards the concept of NFT proposed by Hal Finney in 1993 as the earliest origin. Counterparty, founded in 2014, promoted the emergence of NFT. Based on its creation, Rare Pepes made the popular meme Sad Frog into an NFT application. Meme is translated as meme, which is equivalent to an emoticon package, a sentence, or even a video or animated picture.

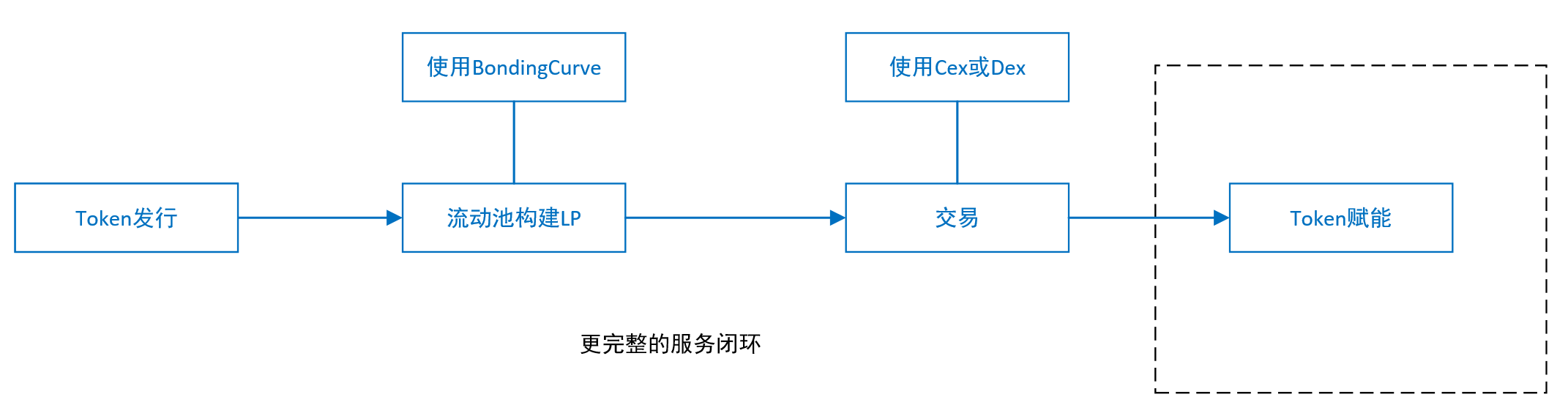

Since Meme has emerged in the field of NFT, and with the maturity of some technologies, memecoin has begun to form. In 2024, the Pump.fun platform based on the Solana chain rose rapidly and became the core position for the issuance of memecoin. The platform uses a simple and complete token service process (ICO+LP+DEX) and a speculation mechanism to make memecoin have a greater impact in 2024. The author believes that the important contribution of Pumpfun is that the platform combines three separate services into a complete closed loop: Token issuance, liquidity pool construction, and decentralized exchange Dex.

The proportion of early Pumpfun tokens on Dex (known as the graduation rate in the industry) is very small, only 2%-3%, which also shows that the early entertainment function is higher than the trading function, which is also in line with the characteristics of meme. But later, during the peak period, the graduation rate of Token often reached more than 20%, and it became a pure hype machine.

An analytical data on Twitter also well illustrates the problem of the memecoin model. (The reliability of this data has not been confirmed by the author)

Pumpfun's total revenue is close to 600 million US dollars, so that US President Trump and his family have also issued their own tokens, which shows the outbreak and climax of memecoin. From the analysis above by Dune, memecoin is also going through a cycle from birth to growth to explosion.

Main problems of memecoin

(1) Systemic fraud and trust collapse: According to Dune data, about 85% of the tokens on Pump.fun are scams, and the average cash-out time for founders is only 2 hours.

(2) False propaganda is rampant: project parties forge KOL platforms and forge transaction volumes (through order-brushing robots). For example, the token MOON claims to be endorsed by Musk, but it is actually a fake PS.

(3) Distortion of market ecology: liquidity siphon effect, memecoin occupies a large amount of on-chain resources, squeezing the development space of normal projects (such as Solana's on-chain DeFi protocol TVL fell by 30%). These led to the expulsion of real users, and ordinary investors gradually withdrew from the market because they could not fight against bots and insider trading. Some project teams even had the idea of using the investment funds they obtained to manipulate a memecoin and run away with arbitrage.

Memecoin has developed from its early entertainment function to PVP (Player versus Player) in the middle and late stages, and later developed into PVB (Player versus Bot), becoming a tool for a few experts to harvest retail investors. It is a serious problem that memecoin has not had effective value injection. If this problem is not solved, memecoin will eventually decline.

By reviewing the development history of Web3 projects, we understand the historical reasons and advantages and disadvantages of the emergence of VC coins, and also briefly analyze inscriptions and the memecoin phenomenon promoted by pumpfun. They are all products of the development of this industry. Through these analyses, we can see that there are still some key problems in the development of web3 projects.

Note: Do VC coins and meme coins reveal all the problems? Or do they reveal the main problems at present?

Based on the previous content, we have summarized the problems of current Web3 projects:

1. The project must have continuous construction motivation. No one can get too much money too early. Token holders and subsequent construction should receive continuous rewards, rather than being hit and deceived.

2. Eliminate or reduce PVP, which is largely fairer and reduces the manipulation of the dealer, so the real fair launch is more valued, but after going on dex, the competition is still fast, because the value of the pool is fixed, and those who get it early get more.

How to solve the above problems:

1. Project management issues: Don't let the project party or VC get a large amount of funds too early, or use funds under supervision, or allocate funds to teams that make contributions and construction.

2. Sustainable external value injection:This can solve the PVP problem and reward medium- and long-term Token holders and builders. Continuous external value injection can provide financial support to the project parties that really want to build, and can also allow Token holders to have medium- and long-term growth expectations, and can also reduce the problem of premature cashing out.

This simple conclusion is not easy to describe the problem clearly. For project management issues, it is necessary to analyze the stakeholders in a project ecosystem, and it is also necessary to dynamically analyze possible problems from different stages of the project (issuance, circulation, governance).

1. Different stakeholders

The most relevant part of the Web3 project is its economic model design. The stakeholders in the project generally include project teams, investors, foundations, users and communities, miners, exchanges, market makers or other participants in the project ecosystem. An economic model is needed to plan the token allocation and contribution incentives for different stakeholders at various stages. The economic model generally includes the token ratio allocated to stakeholders, the token release rules, the incentive method, etc. The specific ratio and release rules will be determined according to the actual situation of each project and the contribution of each stakeholder, and there is no fixed value. There is also a group of bystanders outside the project (speculators, wool-pulling studios, scammers, etc.).

Among different interest groups, we must prevent a certain interest group within the ecosystem from taking too much benefit, such as in the VC coin project, the project team and investors took most of the value of the token, and there was no sustained construction motivation in the later stage. We must also prevent improper benefits from being taken by external groups, such as speculators in memecoin.

2. Analyze the problem from multiple links such as issuance, circulation, and governance

(1) Token issuance

There are many ways to issue digital currency. In addition to the mining issuance based on the PoW method, there are also ICO, STO, IBO and other methods, as well as various gifting and airdrop methods like Ripple. Regardless of the method used, the main purpose of issuing digital currency is twofold: one is to raise funds; the other is to send digital currency to users so that more people can use it.

(2) Token circulation and management

Compared to the early days of the Web3 project, there are already many ways to issue tokens, allowing a large number of digital currencies to enter the circulation field. In the circulation of tokens, due to insufficient demand and limited means of managing token liquidity, many problems have arisen in the circulation field of tokens. Many token management purposes are achieved by providing various applications. For example, token trading functions, token staking, entry thresholds for members (number of tokens or NFTs held), and consumption in applications (gas fees for public chains, registration fees and renewal fees for ENS, etc.)

Tokens released prematurely by the project, that is, the part between the red line and the green line, need to use the liquidity lock function to prevent a certain interested party from taking them away in advance. These locked tokens and the progress of the project during the construction period involve management issues.

3. Project governance issues

In Web3 projects, the most direct control is achieved through the design of consensus mechanisms and economic models. Use the tokens in the economic model to control the supply and consumption of resources. The design of the economic model plays a very important role in the Web3 project, but the scope of this role is limited. When the economic model cannot complete this part of the function, other methods are needed to supplement the areas that the economic model cannot reach. The community governance mechanism is a functional supplement to the areas where the economic model is not good at.

Because of the decentralized characteristics of the blockchain world and the network foundation that relies on programming to run rules, community organizations such as DAO and DAC have emerged, which can be compared with the traditional companies and corporate governance with centralized structures in the real world.

This part of the management combines the DAO and foundation models to better manage funds and ecology, while also providing sufficient flexibility and open transparency. The management members of the DAO must meet certain conditions and must include the main stakeholders and third-party institutions as soon as possible. If the exchange that lists the currency is regarded as a third party, can the suggestion proposed by Jason be adopted in this case, and the exchange has certain rights and functions of supervision and notarization? In fact, Binance played this role in the market maker crash of GoPlus and Myshell.

Can this management structure also better implement the model proposed by CZ in "A Crazy Idea for Token Issuance"? We take the management concept in CZ's article as an example for analysis, as shown in the figure below:

(1) Initially, 10% of the tokens were unlocked and sold on the market. The proceeds will be used for the project team to develop products/platforms, marketing, salaries, etc. (This design is very good, but who will do the management and supervision? This part of the work should be handed over to the project's DAO organization. Wouldn't it be better to use the treasury and third-party supervision?)

(2) Judgment of several conditions that must be met for each future unlocking(This design is for the subsequent continuous work and the management of token liquidity after the initial period. If it is handed over to the DAO for management, the effect will be better.)

(3) The project team has the right to postpone or reduce the size of each unlocking. If they don't want to sell more, they don't have to do so. But each time they can sell (unlock) at most 5%, and then they have to wait at least 6 months for the price to double again. (This design must be done by a third-party organization such as DAO, changing the team's right to do it to the DAO's right to decide to do it. Because the project team is also an important member of the DAO, it should not have too many side effects)

(4) The project team has no right to shorten or increase the size of the next unlock. The tokens should be locked by a smart contract whose keys are controlled by a third party. This avoids new tokens from flooding the market when prices are low. This also incentivizes project teams to build for the long term. (This design further illustrates the need for a third-party organization, which will be more controllable and manageable than smart contracts. In fact, CZ has already subconsciously proposed the concept of DAO)

Of course, this is just a case study. Real project governance also includes many aspects. I believe that web3 will gradually improve and broaden the implementation of this solution as it develops to this day, and will continue to correct problems and find better specific methods in practice.

If it does not cooperate with technology and application innovation, the current various projects in the industry will not last long if they rely on the shouting model. In the end, the problems of VC coins and meme coins reappeared. In fact, pumpfun provides a framework for reference. Its explosion and subsequent demise are due to the lack of an important link: Token empowerment (also known as value capture and value injection). As shown in the figure below,

Based on the above figure, we can see that after the VC coin is listed on the exchange, the project party will obtain a relatively rich return and will no longer have the motivation for later construction. Because the later construction not only has greater risks, but also does not have enough returns, lying flat is the best choice. But there are some teams with ideals and capabilities that will continue to build, and the number of such teams is relatively small. Pumpfun's memecoin model itself does not have the subsequent Token empowerment, so they are all in a race to run fast. Why can memecoins like Dogecoin continue to rise? The author believes that there are many reasons, and there will be opportunities to elaborate in depth in the future. How can we have long-term value injection? What are the ways of empowerment? Reviewing previous Web3 project cases, such as how DeFi protocols capture value through liquidity mining, how NFT projects inject external value through royalty mechanisms, or how DAOs accumulate value through community contributions. With the maturity of web3 technology, more "application scenarios" can be generated, so that more and more points of combination can generate value.

Value capture and external value injection are the two pillars of the Web3 economic model, the former focuses on retention and the latter focuses on introduction. More popular terms such as "value accumulation" and "flywheel effect" can better reflect the dynamic combination of the two, while "token empowerment" and "positive externalities" are approached from the perspective of functional design.

The core challenge is to balance short-term incentives with long-term value and avoid falling into "paper models" and Ponzi cycles.

The previous content analyzed the problems of VC coins and meme coins that the industry is currently paying more attention to. Will solving these problems promote the outbreak of the next bull market? Let's first review the two bull markets in 2017 and 2021.

Note: The following content is based on information found online, with reference to exchanges with DeepSeek and Chatgpt, and on the other hand, the author personally experienced the bull markets in 2017 and 2021, and our team is currently developing related products for the Bitcoin ecosystem, so some of my own feelings and judgments are added to the article.

The bull market in the blockchain field in 2017 was the result of multiple factors, including technological breakthroughs and ecological development, as well as external macro-environmental factors. According to professional analysis and classic literature in the industry, the reasons are summarized as follows:

(1) ICO (Initial Coin Offering) craze

Ethereum's ERC-20 standard lowered the threshold for issuing coins, and a large number of projects raised funds through ICO (raising more than US$5 billion throughout the year).

(2) Bitcoin fork and expansion controversy

The Bitcoin community’s disagreement over the expansion plan (SegWit vs. large blocks) led to the fork. The Bitcoin Cash (BCH) fork in August 2017 triggered market attention to the scarcity and technological evolution of Bitcoin. The price of BTC rose from $1,000 at the beginning of the year to a record high of $19,783 in December.

(3) The rise of Ethereum’s smart contract ecosystem

Smart contracts and DApp development tools are mature, attracting an influx of developers. The concept of decentralized finance (DeFi) was born, and early DApps such as CryptoKitties triggered user participation.

(4) Global liquidity easing and regulatory gap

The global low interest rate policy in 2017 led to funds seeking high-risk and high-return assets. The regulation of ICOs and cryptocurrencies in various countries has not yet been perfected, and speculative activities lack constraints.

The bull market in 2017 laid the foundation for the industry (such as wallets and exchanges), attracted technical talents and more new users to join, but also exposed ICO fraud, lack of supervision and other problems, prompting the industry to turn to compliance and technological innovation (such as DeFi and NFT) after 2018.

The bull market in the blockchain field in 2021 is the result of the resonance of multiple factors such as industry ecology, macroeconomics, technological innovation and institutional participation. According to professional analysis and classic literature in the industry, the reasons are roughly summarized as follows:

(1) The outbreak and maturity of DeFi (decentralized finance)

The maturity of Ethereum smart contracts and the test launch of Layer 2 expansion solutions (such as Optimism and Arbitrum) have reduced transaction costs and delays. Leading to an explosion of applications: Uniswap V3, Aave, Compound and other DeFi protocols have increased their total locked value (TVL) from 1.8 billion at the beginning of the year to 25 billion at the end of the year, attracting a large amount of funds and developers.

Yield Farming: High annualized yield (APY) attracts retail and institutional arbitrage funds to flow in. At that time, YF (yield finance, known as Uncle in the industry) was once higher than the price of BTC.

(2) NFT (Non-Fungible Token) Breaks the Circle and Goes Mainstream

Beeple's NFT work "Everydays: The First 5000 Days" was auctioned at Christie's for US$69 million. The market value of NFT projects such as CryptoPunks and Bored Ape Yacht Club (BAYC) exceeded US$10 billion. NFT trading platforms such as Opensea have emerged.

(3) Institutional capital enters the market on a large scale

Tesla announced the purchase of $1.5 billion in Bitcoin and accepted BTC payments.

MicroStrategy continues to increase its holdings of Bitcoin (holding 124,000 BTC by the end of 2021).

Canada approved the first Bitcoin ETF (Purpose Bitcoin ETF, February 2021).

Coinbase went public directly on the Nasdaq (valued at US$86 billion).

(4) Global macroeconomics and monetary policy

Liquidity flooding: The Federal Reserve maintained zero interest rates and quantitative easing policies, and funds poured into high-risk assets.

Inflation expectations: The year-on-year increase in the US CPI exceeded 7%, and Bitcoin was regarded by some investors as "digital gold" to hedge against inflation.

(5) Increased acceptance by mainstream society

Payment scenario expansion: PayPal supports users to buy and sell cryptocurrencies, and Visa allows the use of USDC for settlement.

El Salvador lists Bitcoin as legal tender (September 2021).

Celebrity effect: Public figures such as Musk and Snoop Dogg frequently mention cryptocurrencies and NFTs.

(6) Multi-chain ecological competition and innovation

The rise of new public chains: Solana, Avalanche, Polygon and other high-performance chains attract users and developers due to their low fees and high TPS.

Cross-chain technology breakthroughs: Cosmos and Polkadot's cross-chain protocols promote asset interoperability.

(7) Meme coins and community culture

Phenomenal projects: Dogecoin (DOGE) and Shiba Inu Coin (SHIB) skyrocketed due to social media hype (DOGE's annual increase exceeded 12,000%).

Retail investor enthusiasm: Reddit forum WallStreetBets (WSB) and TikTok drove retail investors into the market.

Impact on subsequent markets

The bull market in 2021 promoted the institutionalization, compliance and technological diversification of cryptocurrencies, but also exposed problems such as DeFi hacker attacks and NFT bubbles. Since then, the industry has shifted its focus to:

Regulatory compliance: The U.S. SEC has strengthened its review of stablecoins and securitized tokens.

Sustainable development: Ethereum turns to PoS (merger plan), and Bitcoin mining explores clean energy.

Web3 narrative: Concepts such as the metaverse and DAO (decentralized autonomous organization) have become new focuses.

The following is a forecast analysis of the potential bull market drivers in the cryptocurrency market in 2025. Combining the current industry trends, technological innovation and macroeconomic background, the reasons are roughly summarized based on professional analysis and classic literature in the industry:

(1) Web3 large-scale application and the rise of user sovereignty

Scenario landing: decentralized social networking (such as Nostr, Lens Protocol), on-chain games (AAA-level GameFi), and decentralized identity (DID) have become mainstream, and user data ownership and revenue distribution models have subverted the traditional Internet.

Key events: Giants such as Meta and Google integrate blockchain technology and open up cross-platform migration of user data.

Related technologies: Zero-knowledge proof (ZKP) and fully homomorphic encryption (FHE) are mature, ensuring privacy and compliance.

(2) Deep integration of AI and blockchain

Decentralized AI network: Blockchain-based computing power markets (such as Render Network) and AI model training data rights confirmation (such as Ocean Protocol) solve the monopoly problem of centralized AI.

Autonomous agent economy: AI-driven DAO (such as AutoGPT) automatically executes on-chain transactions and governance, improves efficiency and creates a new economic model.

(3) Global central bank digital currency (CBDC) and stablecoin interoperability

Policy promotion: CBDCs of major economies are launched (such as digital euro and digital dollar), forming a hybrid payment network with compliant stablecoins (such as USDC and EUROe).

Cross-chain settlement: The Bank for International Settlements (BIS) takes the lead in establishing a CBDC interoperability agreement, and cryptocurrencies become a key component of cross-border payment channels.

(4) Bitcoin Ecosystem Revival and Layer 2 Innovation

Bitcoin Layer 2 Explosion: Lightning Network capacity continues to hit new highs and the TaprootAssets protocol is created, the RGB protocol supports the issuance of assets on the Bitcoin chain, and the Stacks ecosystem introduces smart contract functions.

Institutional Custody Upgrade: BlackRock and Fidelity launch Bitcoin ETF options and mortgage lending services, releasing Bitcoin's financial instrument attributes.

(5) Clarity of regulatory framework and full entry of institutions

Global compliance: The United States and Europe passed the "Markets in Crypto-Assets Act" (MiCA)-like regulations to clarify the classification of tokens and the exchange license system.

Traditional financial integration: JPMorgan Chase and Goldman Sachs launched crypto derivatives and structured products, and the proportion of pension funds allocated to cryptocurrencies exceeded 2%.

(6) Geopolitical conflict and de-dollarization narrative

Safe-haven demand: As geopolitical risks such as the Russia-Ukraine conflict and the situation in the Taiwan Strait escalate, cryptocurrencies have become neutral settlement tools.

Diversification of reserve assets: The BRICS countries jointly issued blockchain-based trade settlement tokens, and some national government bonds were denominated in Bitcoin.

(7) Meme Culture 3.0 and Community DAO

Next Generation Meme Coin: Meme projects that combine AI Generated Content (AIGC) and dynamic NFTs (such as the AI-driven "Immortal Dog" character), where the community decides the direction of IP development through DAO voting.

Fan Economy Chain Reform: Top stars such as Taylor Swift and BTS issue fan tokens to unlock exclusive content and participate in revenue sharing.

Note: In order not to leave out relevant possibilities, the above analysis data is retained.

Through the summary of the bull market in 2017 and 2021, as well as the analysis of the possibility of 2025, we can roughly refer to the figure below to make some judgments.

For the model:

The inscriptions in 2023 and the pumpfun phenomenon in 2024 are some possible bull market outbreaks. If the problems of the inscriptions and pumpfun themselves can be solved, a more complete model will be generated, which may lead to the outbreak of the bull market in some areas. The high probability is still related to issuing assets and trading assets.

Regarding the field:

It is roughly generated in two fields: (1) Pure Web3 field; (2) The field of integration of AI and web3.

Specific analysis:

Regarding (1) Large-scale application of Web3 and the rise of user sovereignty, I personally think that the infrastructure is not perfect enough, and the wealth effect is not that strong. It is difficult to become the main factor or field of the bull market alone, or it will not become the main factor of this bull market.

Regarding (2) Deep integration of AI and web3, almost everyone has experienced the power of AI. Will this field produce supporting factors for the bull market? It is indeed difficult to judge..., I personally tend to think it is a bit early. But it is hard to say in this field. Rapidly emerging phenomena such as DeepSeek and Manus are not new in the field of AI. What will happen to DeFi empowered by AI?

For (4) Bitcoin ecosystem revival and Layer 2 innovation, Bitcoin has performed well in the bull markets of 2017 and 2021. The current market value of Bitcoin accounts for 60% of the crypto market, and the wealth effect is strong enough. If there is a good model + good technical implementation in this field, the probability of a bull market will be very high.

For (7) Meme culture 3.0 and community DAO, if meme culture solves the PVP problem and has continuous external value injection, is it possible to become a driving factor for the bull market? Judging from the wealth effect, it is quite difficult.

Other (3), (5), (6) should accelerate changes and have a icing on the cake effect on the bull market, but the direct factors that generate the bull market alone are not strong enough.

If there is a bull market in 2025, the most likely ones are:

Bitcoin ecology and Layer 2 innovation, new models based on new asset issuance and trading

The combination of AI and Web3, AI-enabled trading models

In addition to the judgment of the field and model, as for when the bull market will break out, it also depends on the external environment factors.

The above judgment is purely personal thinking and does not constitute any investment advice.

CZ has argued that his surrender should be proof that he does not pose a flight risk.

Alex

AlexNetflix has recently revealed its latest cinematic offering, "Bitconned," a riveting exposé on a cybercrime saga entwined with cryptocurrency scams. The film delves into the intricacies of a dark digital underworld, emphasising the need for vigilance and awareness in the face of evolving threats.

Joy

JoyGoogle has introduced Gemini, a suite of artificial intelligence tools designed for both consumers and businesses.

Aaron

AaronIt's crucial to note that 50% of the token allocation is available at genesis, with the remaining 50% unlocking gradually over 12 months, vesting from the Token Generation Date.

Brian

BrianFrom December 11, 2023, TOPPAN Holdings, Inc. and Dentsu Group, Inc. are teaming up with ODK Solutions, Inc., Sony Corporation, and several other entities to introduce a groundbreaking innovation - the Web3.0 Wallet. This digital asset storage solution incorporates photorealistic avatars to revolutionise user interaction.

Joy

JoySolana Labs' co-founder, Anatoly Yakovenko, addressed the less-than-impressive sales of the company's smartphone, Saga, in an interview with Unchained Crypto on Dec 5.

Aaron

AaronSotheby’s digital art division revealed plans to auction pieces from the BitcoinShrooms collection, a project crafted by artist Shroomtoshi. The collection, minted on-chain in October, is hailed as the "first-ever Ordinals collection," according to both the BitcoinShroom website and its associated account.

Joy

JoyBinance's CZ, facing money laundering charges, confronts an unplanned stay in the U.S. until sentencing.

Hui Xin

Hui XinThere have been no details regarding the other specifics of the airdrop, though scammers have already posted multiple phishing links in response to the Twitter post.

Brian

BrianTokens that have previously been delisted in the US are also available for trading in the EU.

Alex

Alex